This version of the form is not currently in use and is provided for reference only. Download this version of

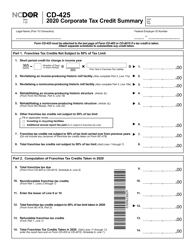

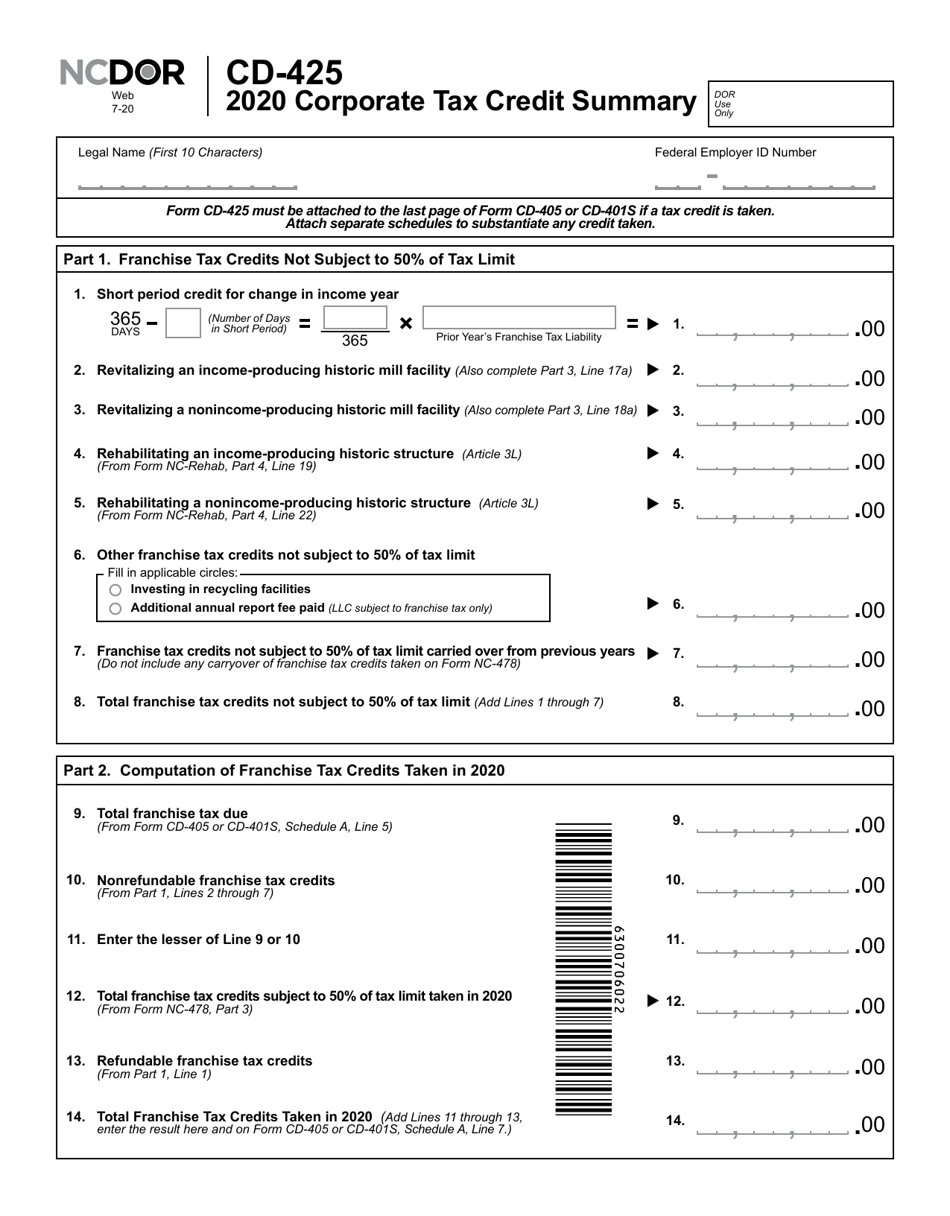

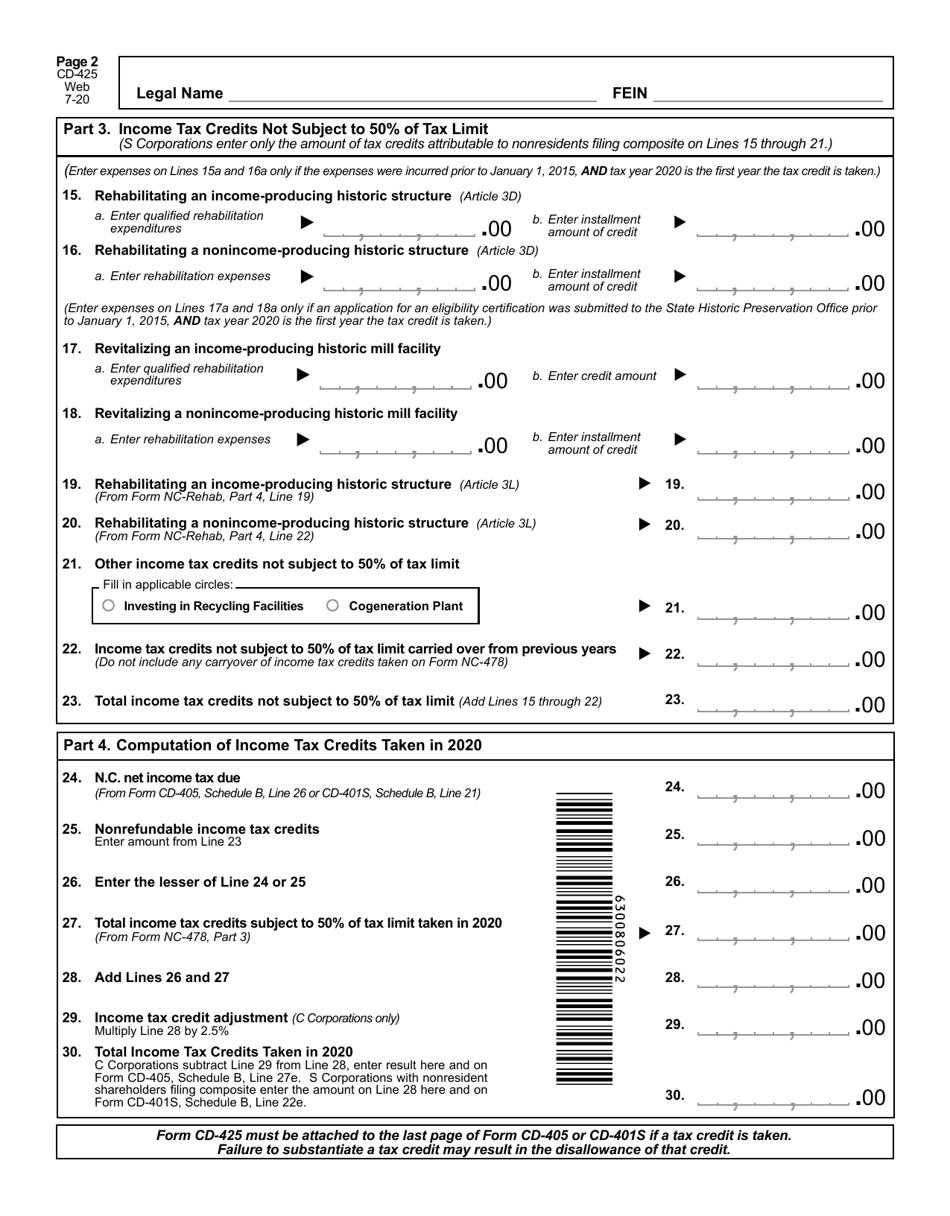

Form CD-425

for the current year.

Form CD-425 Corporate Tax Credit Summary - North Carolina

What Is Form CD-425?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-425?

A: Form CD-425 is a Corporate Tax Credit Summary form used in North Carolina.

Q: Who needs to file Form CD-425?

A: Corporations in North Carolina who have tax credits to report.

Q: What information is required on Form CD-425?

A: Form CD-425 requires the corporation's name, federal employer identification number (FEIN), contact information, credit information, and the amount of tax credit.

Q: When is Form CD-425 due?

A: Form CD-425 is due on the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for filing Form CD-425 late?

A: Yes, there are penalties for late filing of Form CD-425. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-425 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.