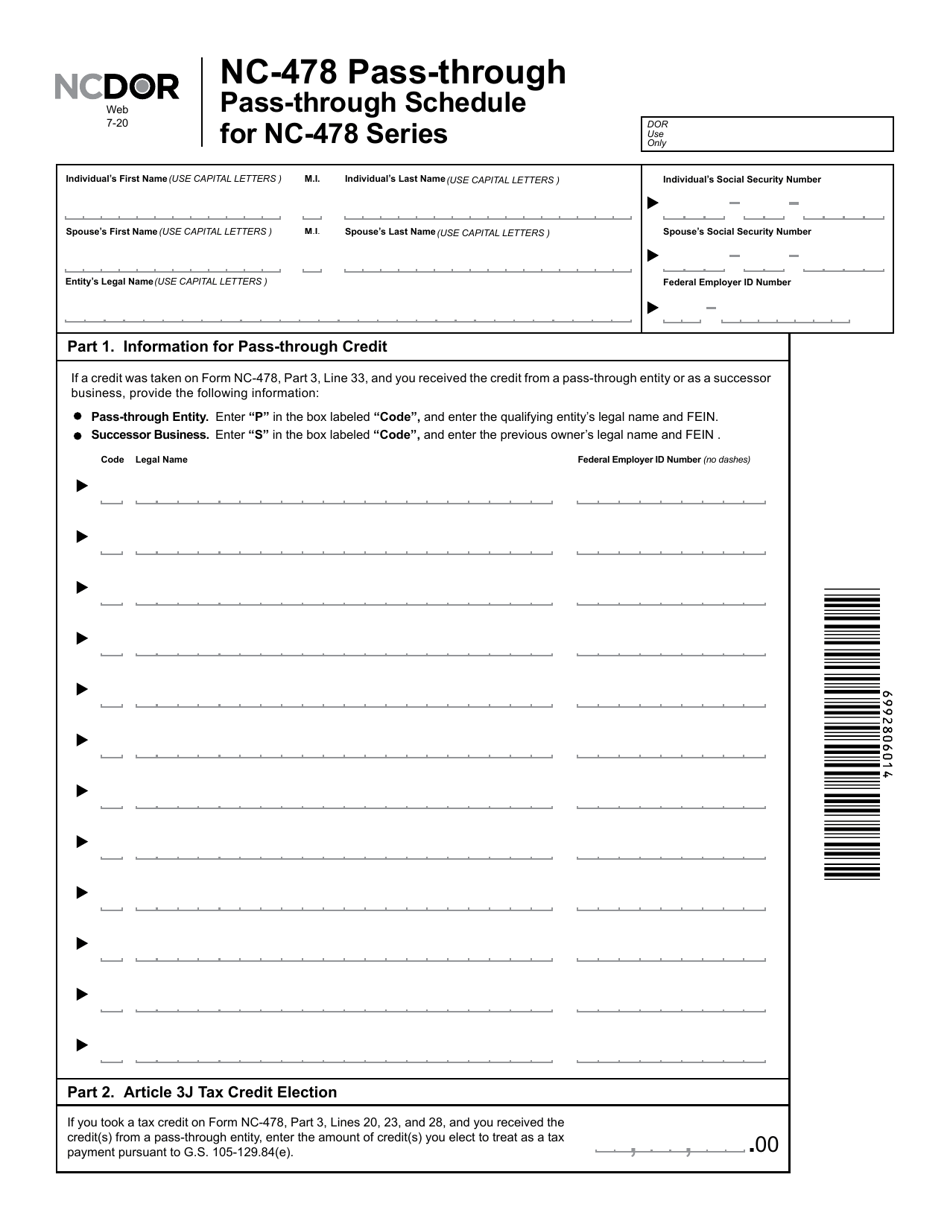

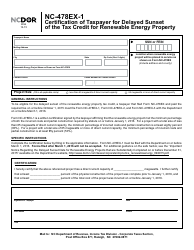

Form NC-478 PASS-THROUGH Pass-Through Schedule for Nc-478 Series - North Carolina

What Is Form NC-478 PASS-THROUGH?

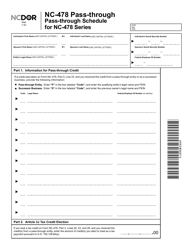

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-478?

A: Form NC-478 is the Pass-Through Schedule for Nc-478 Series in North Carolina.

Q: What is the purpose of Form NC-478?

A: The purpose of Form NC-478 is to report pass-through income for Nc-478 Series in North Carolina.

Q: Who needs to file Form NC-478?

A: Anyone who has pass-through income from Nc-478 Series in North Carolina needs to file Form NC-478.

Q: When is the deadline to file Form NC-478?

A: The deadline to file Form NC-478 is generally April 15th of each year.

Q: Are there any penalties for not filing Form NC-478?

A: Yes, there are penalties for not filing Form NC-478, including monetary fines and potential legal consequences.

Q: Do I need to include any supporting documents with Form NC-478?

A: It depends on your specific circumstances. Check the instructions for Form NC-478 to see if any supporting documents are required.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478 PASS-THROUGH by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.