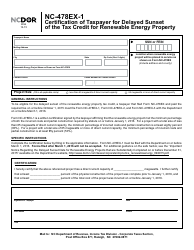

This version of the form is not currently in use and is provided for reference only. Download this version of

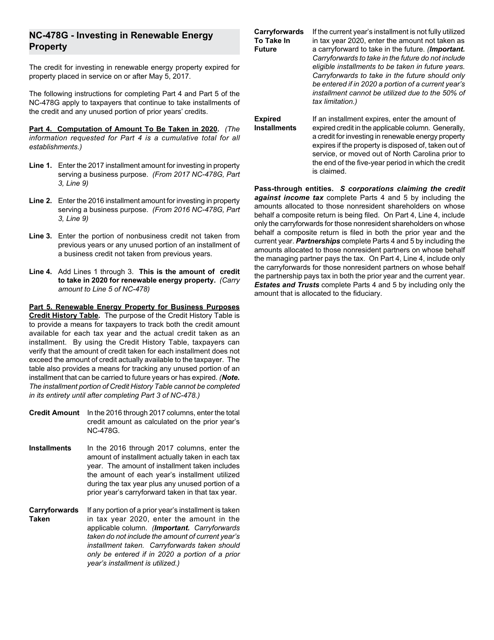

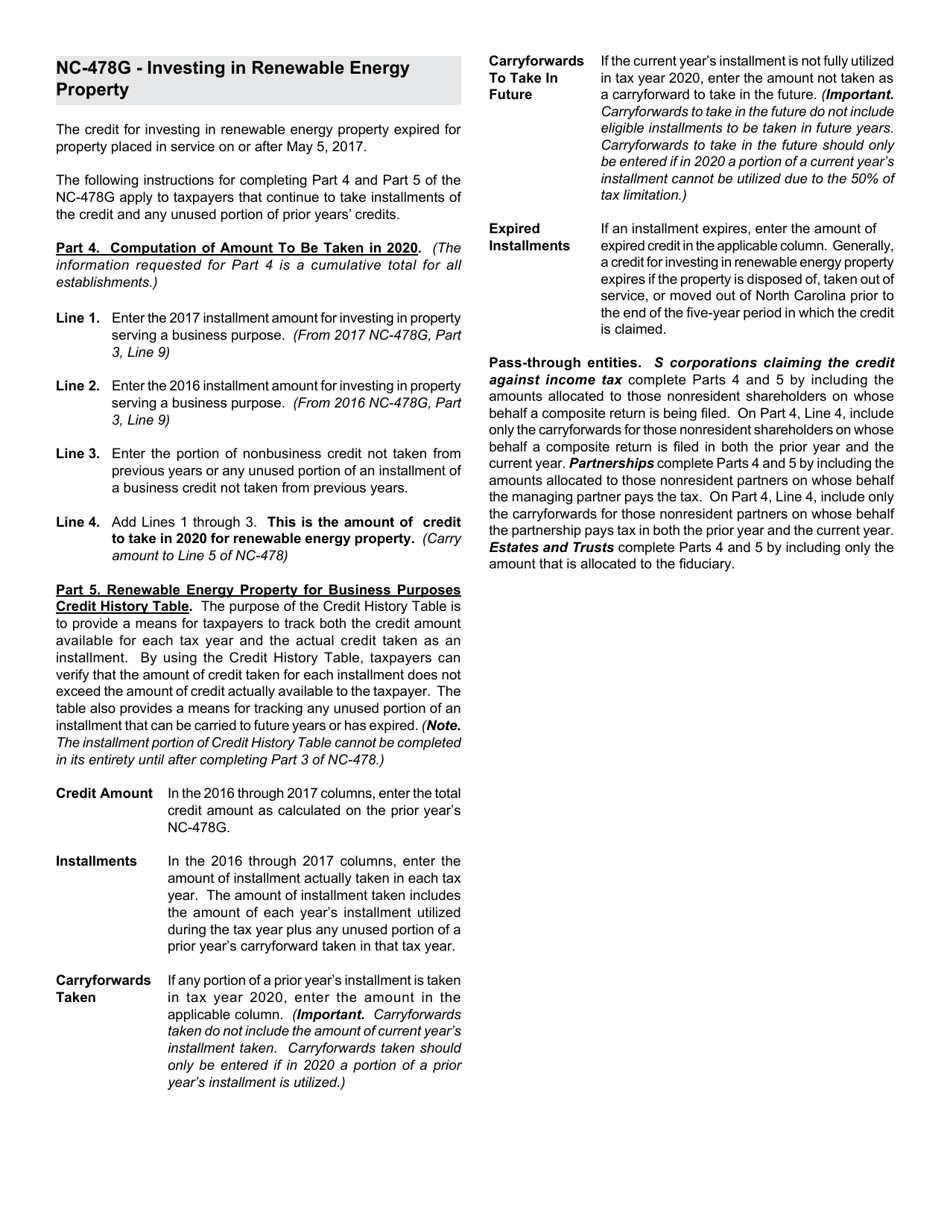

Instructions for Form NC-478G

for the current year.

Instructions for Form NC-478G Tax Credit for Investing in Renewable Energy Property - North Carolina

This document contains official instructions for Form NC-478G , Tax Credit for Investing in Renewable Energy Property - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form NC-478G is available for download through this link.

FAQ

Q: What is Form NC-478G?

A: Form NC-478G is a tax form used in North Carolina to claim tax credits for investing in renewable energy property.

Q: What is the purpose of Form NC-478G?

A: The purpose of Form NC-478G is to compute and claim tax credits for investments made in renewable energy property in North Carolina.

Q: Who can use Form NC-478G?

A: Individuals, corporations, and other entities who have made investments in renewable energy property in North Carolina may use Form NC-478G.

Q: What types of renewable energy property are eligible for tax credits?

A: Renewable energy property eligible for tax credits may include solar energy property, wind energy property, and other qualifying forms of renewable energy property.

Q: What information do I need to complete Form NC-478G?

A: You will need information about your investments in renewable energy property, such as the cost of the property, the date it was placed in service, and any other relevant documentation.

Q: Are there any limitations or restrictions on the tax credits?

A: Yes, there are limitations and restrictions on the tax credits, including caps on the total amount of credits that can be claimed and requirements for certification and verification of the property.

Q: When is the deadline for filing Form NC-478G?

A: The deadline for filing Form NC-478G is typically the same as the deadline for filing your North Carolina state tax return, which is usually April 15th.

Q: Can I carry forward unused tax credits from Form NC-478G?

A: Yes, unused tax credits from Form NC-478G can generally be carried forward for up to five years to offset future North Carolina state tax liabilities.

Q: Is there a limit to the total amount of tax credits that can be claimed?

A: Yes, there is a limit to the total amount of tax credits that can be claimed for investments in renewable energy property in North Carolina.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.