This version of the form is not currently in use and is provided for reference only. Download this version of

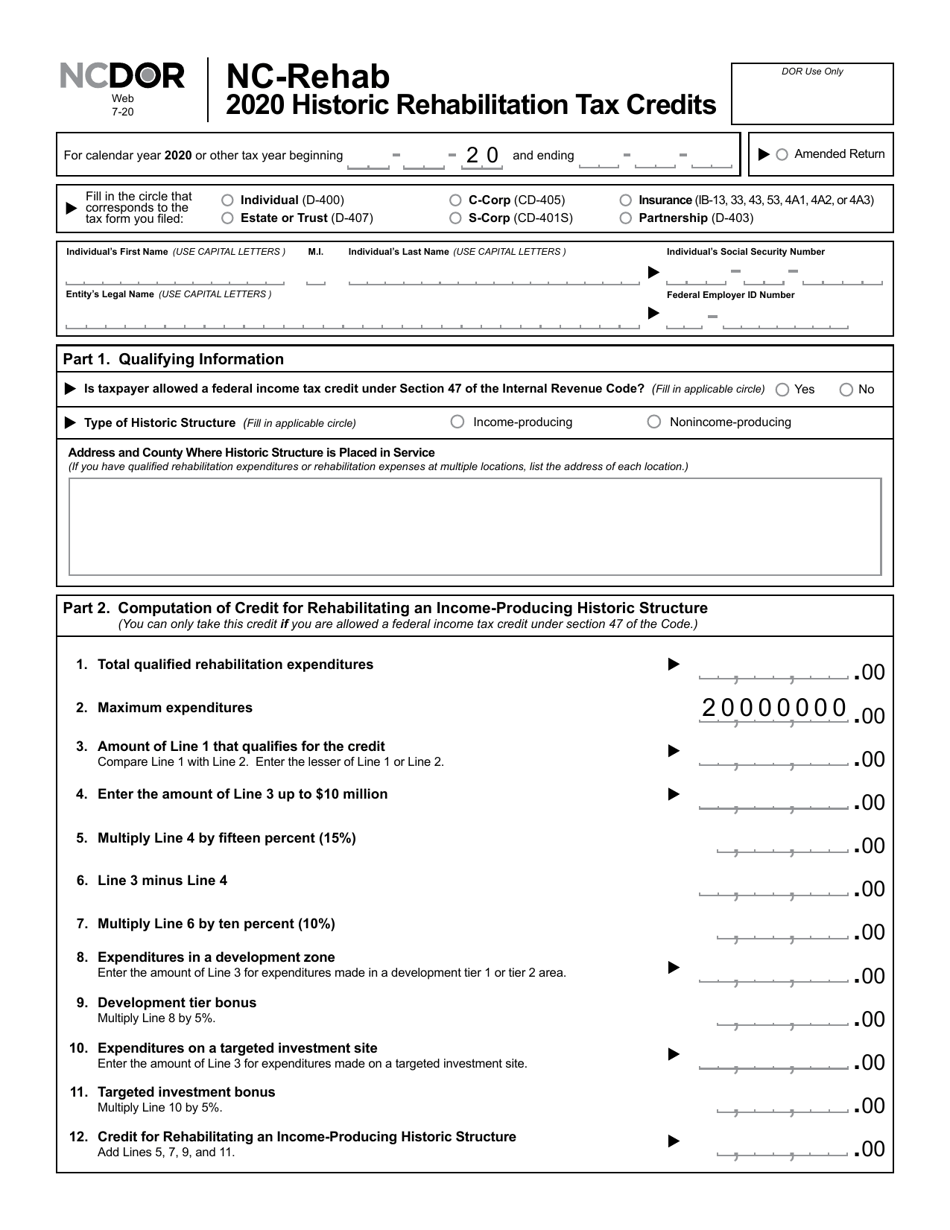

Form NC-REHAB

for the current year.

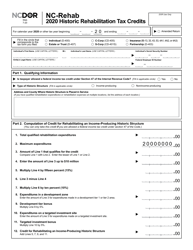

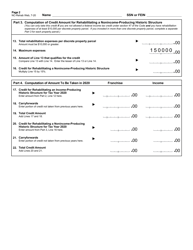

Form NC-REHAB Historic Rehabilitation Tax Credits - North Carolina

What Is Form NC-REHAB?

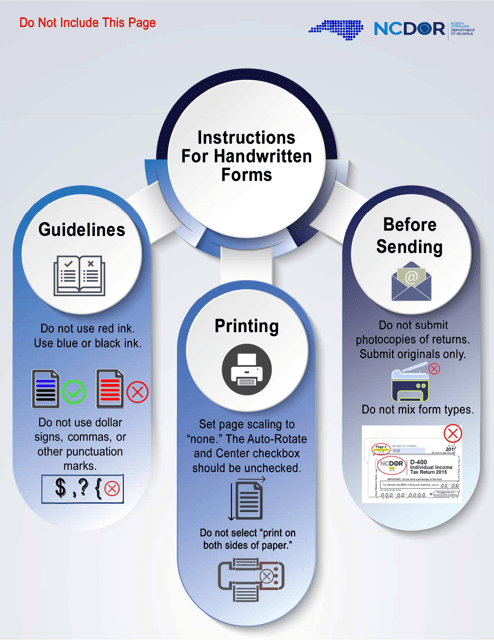

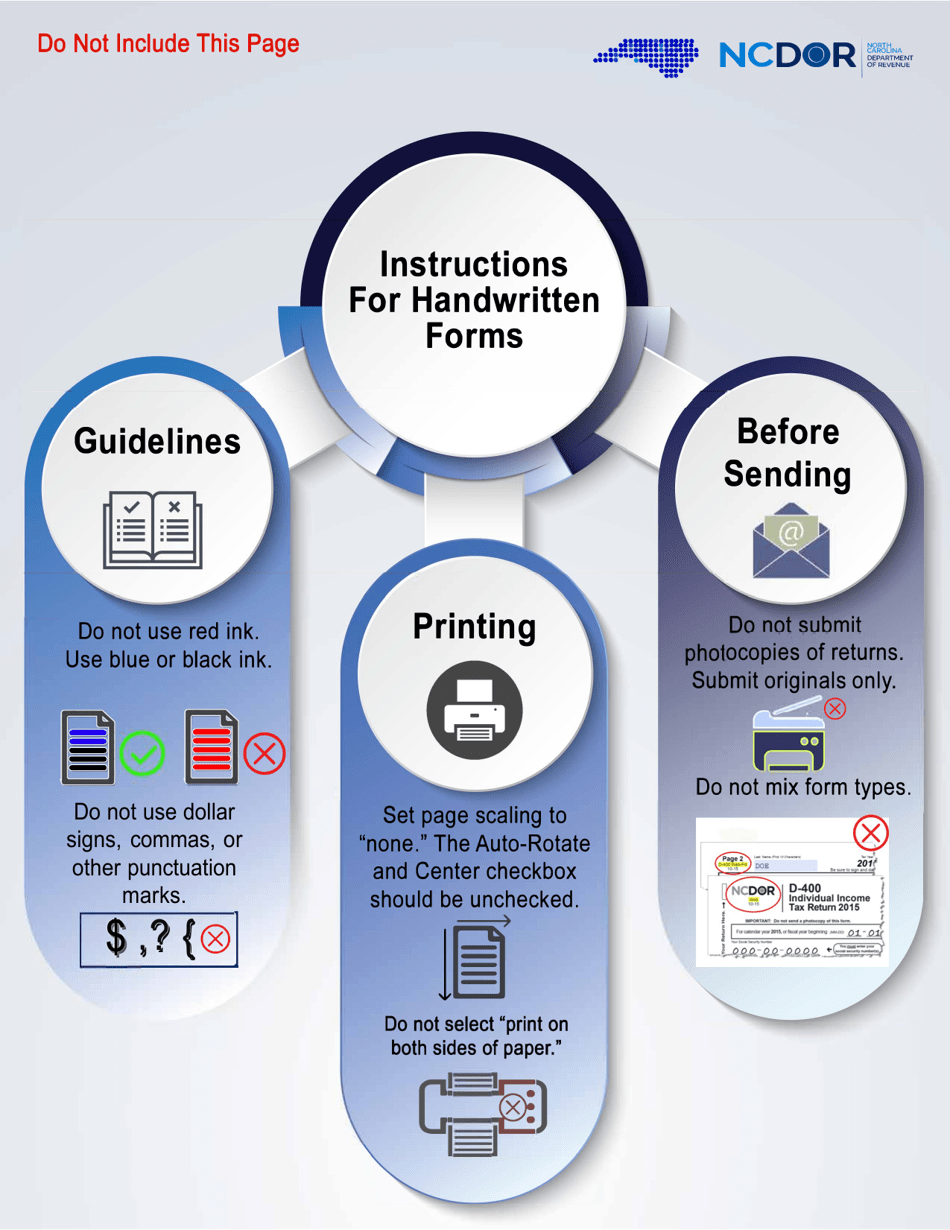

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-REHAB?

A: Form NC-REHAB is a tax form used in North Carolina for claiming Historic RehabilitationTax Credits.

Q: What are Historic Rehabilitation Tax Credits?

A: Historic Rehabilitation Tax Credits are incentives provided by the government to encourage the preservation and restoration of historic properties.

Q: Who is eligible to claim Historic Rehabilitation Tax Credits in North Carolina?

A: Individuals or businesses who have invested in the rehabilitation of qualified historic properties in North Carolina are eligible to claim Historic Rehabilitation Tax Credits.

Q: What is the purpose of Form NC-REHAB?

A: The purpose of Form NC-REHAB is to report and claim the amount of Historic Rehabilitation Tax Credits that an individual or business is eligible for.

Q: Are there any deadlines for filing Form NC-REHAB?

A: Yes, there are specific deadlines for filing Form NC-REHAB. It is advised to consult the North Carolina Department of Revenue or a tax professional for the current deadlines.

Q: Can I claim Historic Rehabilitation Tax Credits for properties located outside of North Carolina?

A: No, Historic Rehabilitation Tax Credits can only be claimed for qualified historic properties located in North Carolina.

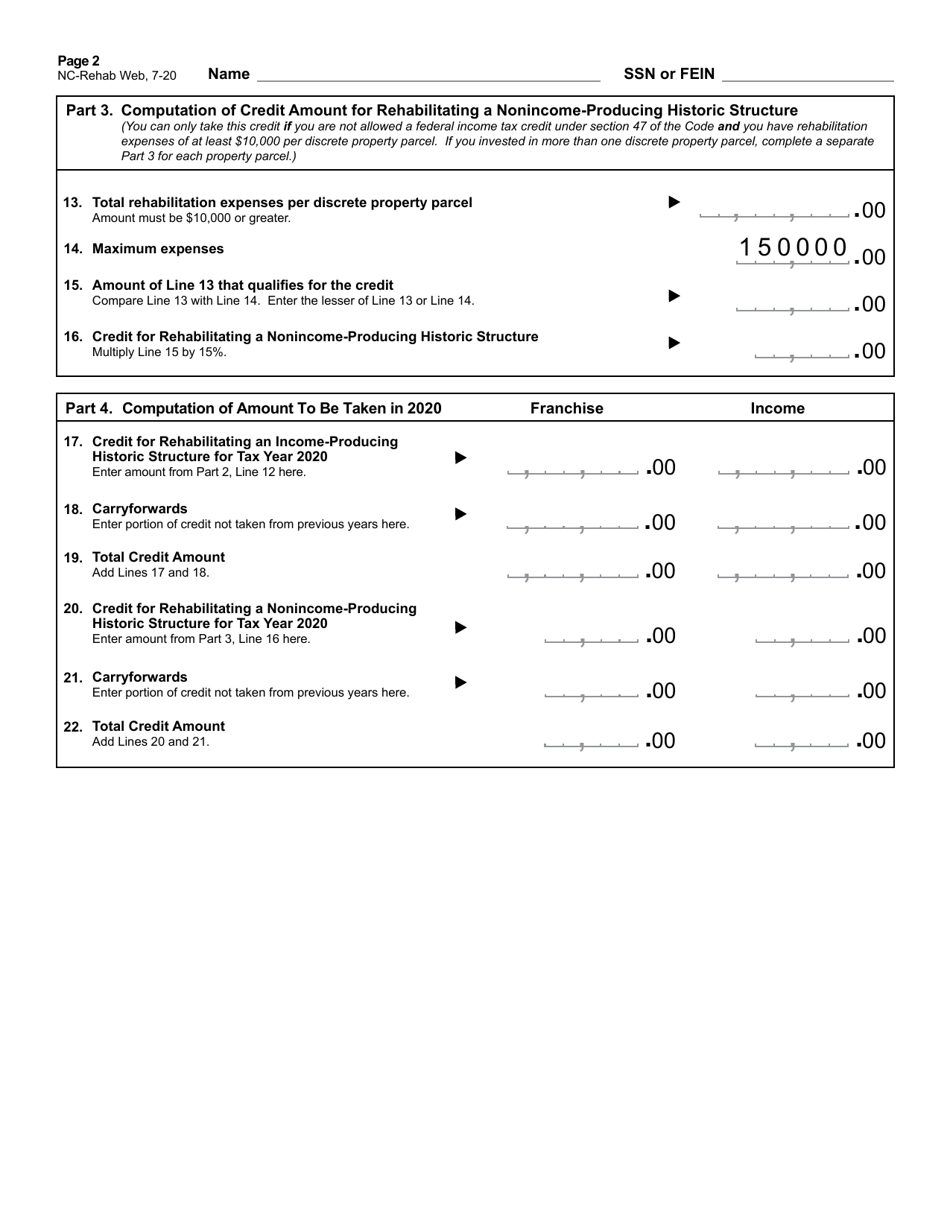

Q: What types of expenses can be claimed for Historic Rehabilitation Tax Credits?

A: Expenses related to the rehabilitation and preservation of historic properties, such as labor, materials, and architectural services, can be claimed for Historic Rehabilitation Tax Credits.

Q: Are there any limitations on the amount of Historic Rehabilitation Tax Credits that can be claimed?

A: Yes, there are limitations on the amount of Historic Rehabilitation Tax Credits that can be claimed based on the total rehabilitation expenses and the value of the property.

Q: Can individuals and businesses claim Historic Rehabilitation Tax Credits in North Carolina?

A: Yes, both individuals and businesses can claim Historic Rehabilitation Tax Credits in North Carolina.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-REHAB by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.