This version of the form is not currently in use and is provided for reference only. Download this version of

Form CD-405

for the current year.

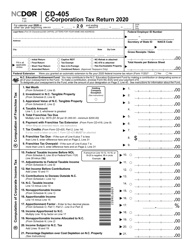

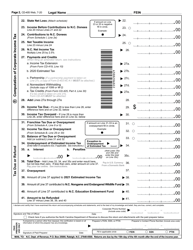

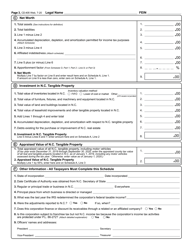

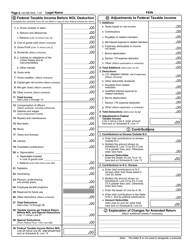

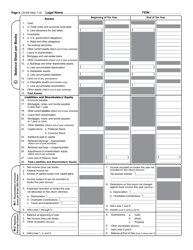

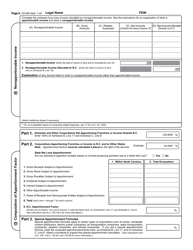

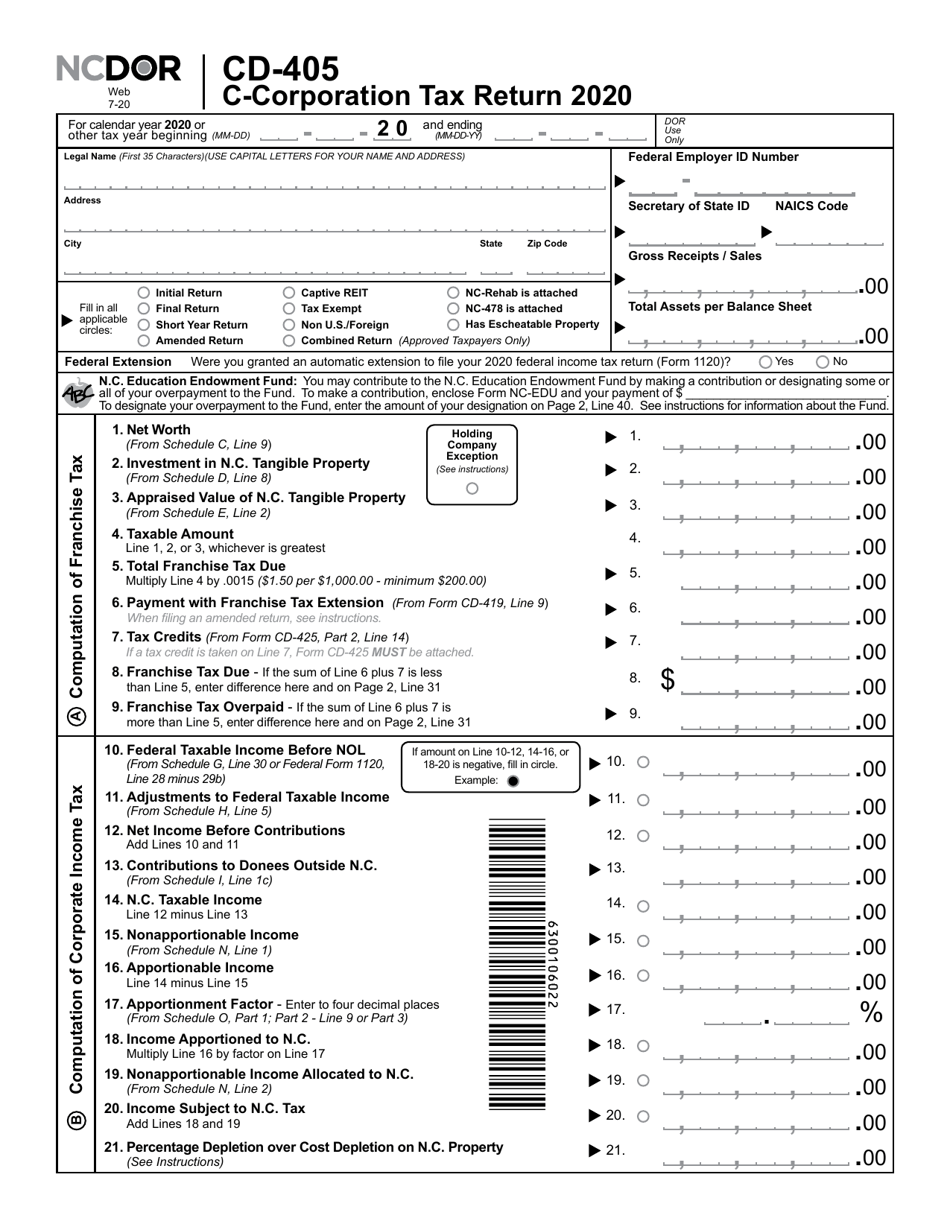

Form CD-405 C-Corporation Tax Return - North Carolina

What Is Form CD-405?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-405?

A: Form CD-405 is the C-Corporation Tax Return for businesses operating in North Carolina.

Q: Who should file Form CD-405?

A: C-Corporations operating in North Carolina should file Form CD-405.

Q: What is the purpose of Form CD-405?

A: The purpose of Form CD-405 is to report and calculate the tax liability of C-Corporations in North Carolina.

Q: What information is required on Form CD-405?

A: Form CD-405 requires information about the corporation's income, deductions, and credits.

Q: When is Form CD-405 due?

A: Form CD-405 is due on the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any extensions available for filing Form CD-405?

A: Yes, extensions are available. The extension request must be filed by the original due date of the return.

Q: Is e-filing available for Form CD-405?

A: Yes, e-filing is available for Form CD-405.

Q: Are there any penalties for late filing of Form CD-405?

A: Yes, there are penalties for late filing, which may include interest charges and additional fines.

Q: What should I do if I need help with Form CD-405?

A: If you need assistance with Form CD-405, you can contact the North Carolina Department of Revenue for guidance.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

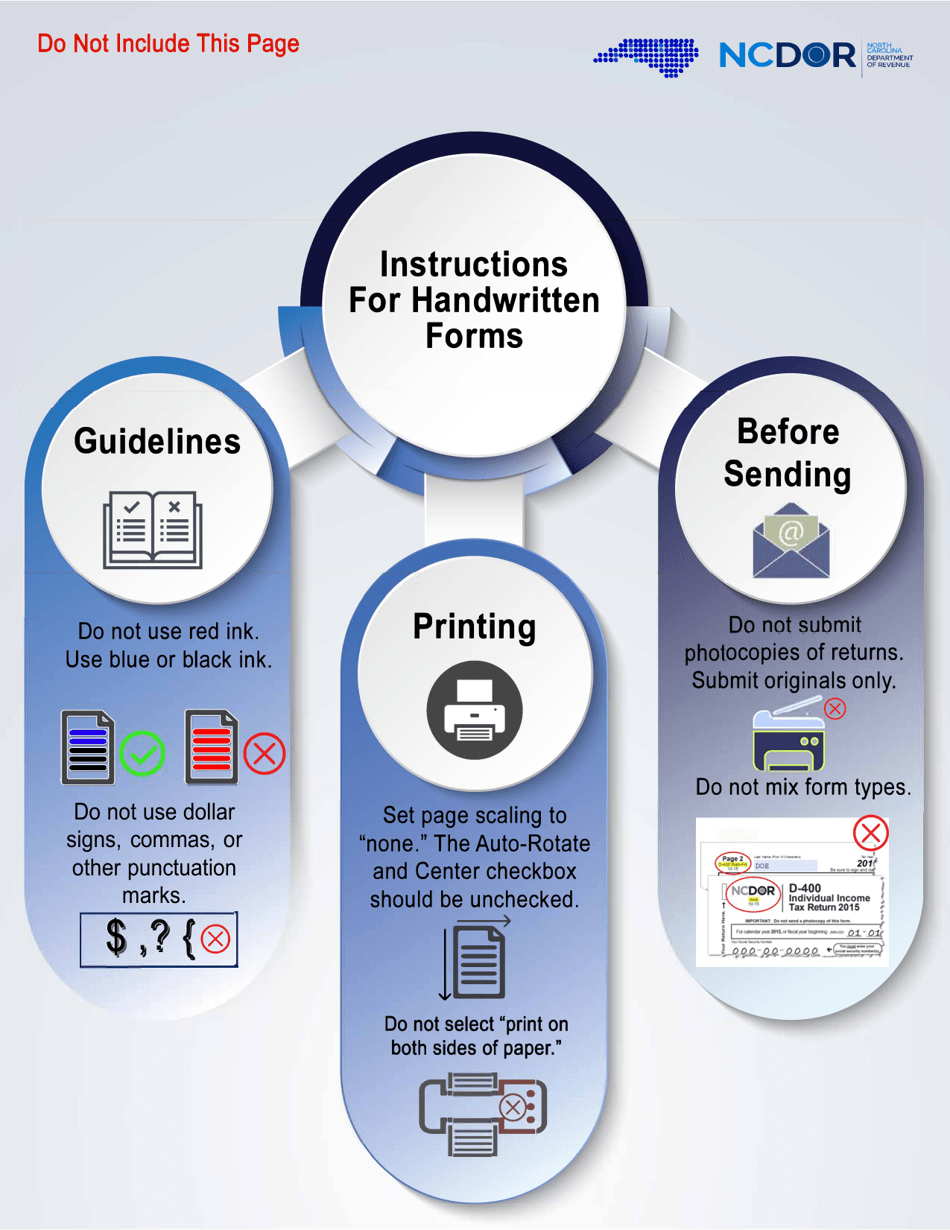

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-405 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.