This version of the form is not currently in use and is provided for reference only. Download this version of

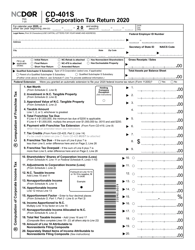

Form CD-401S

for the current year.

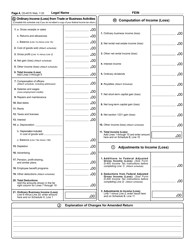

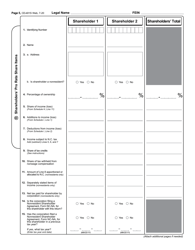

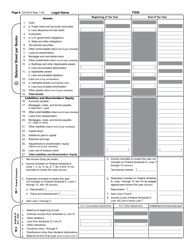

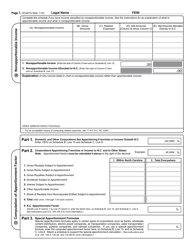

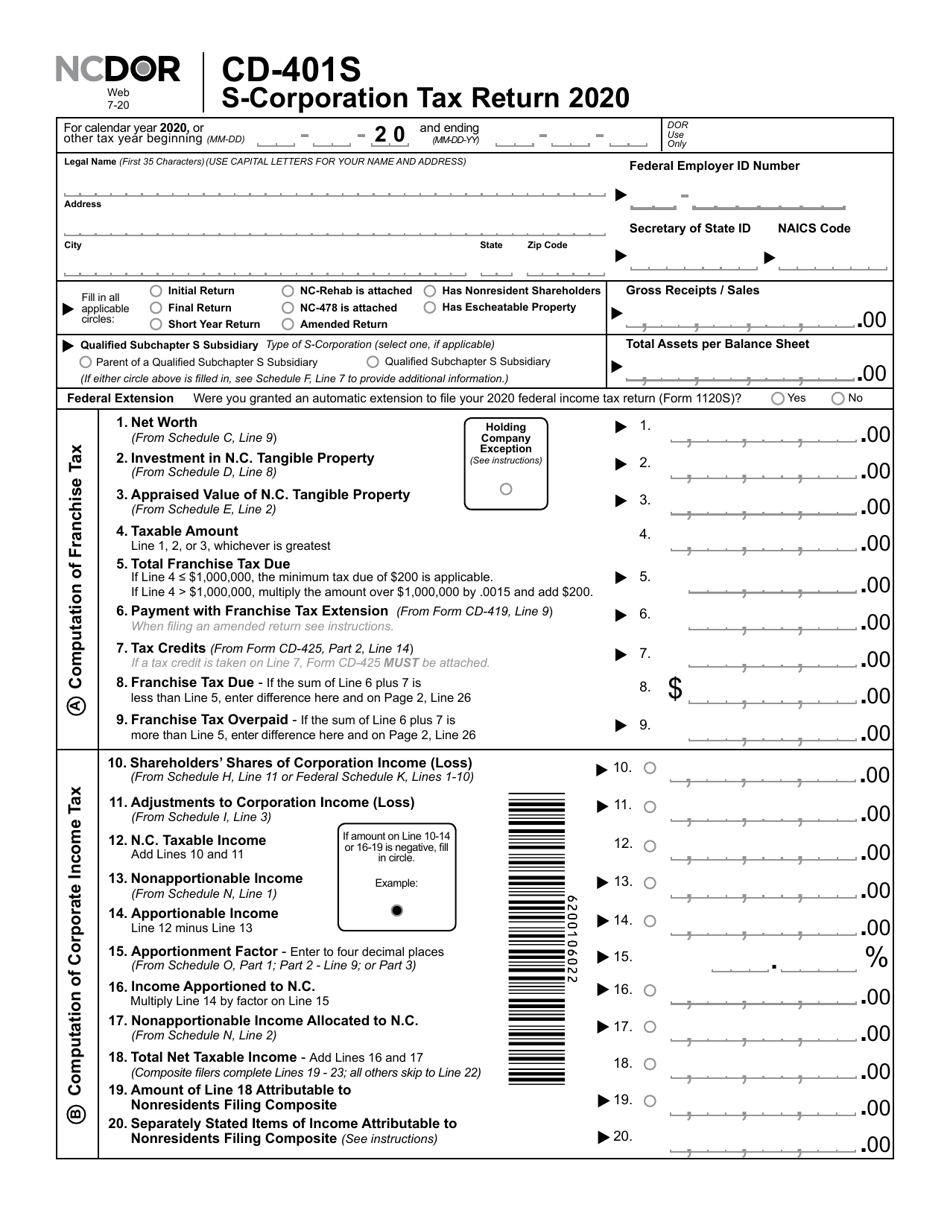

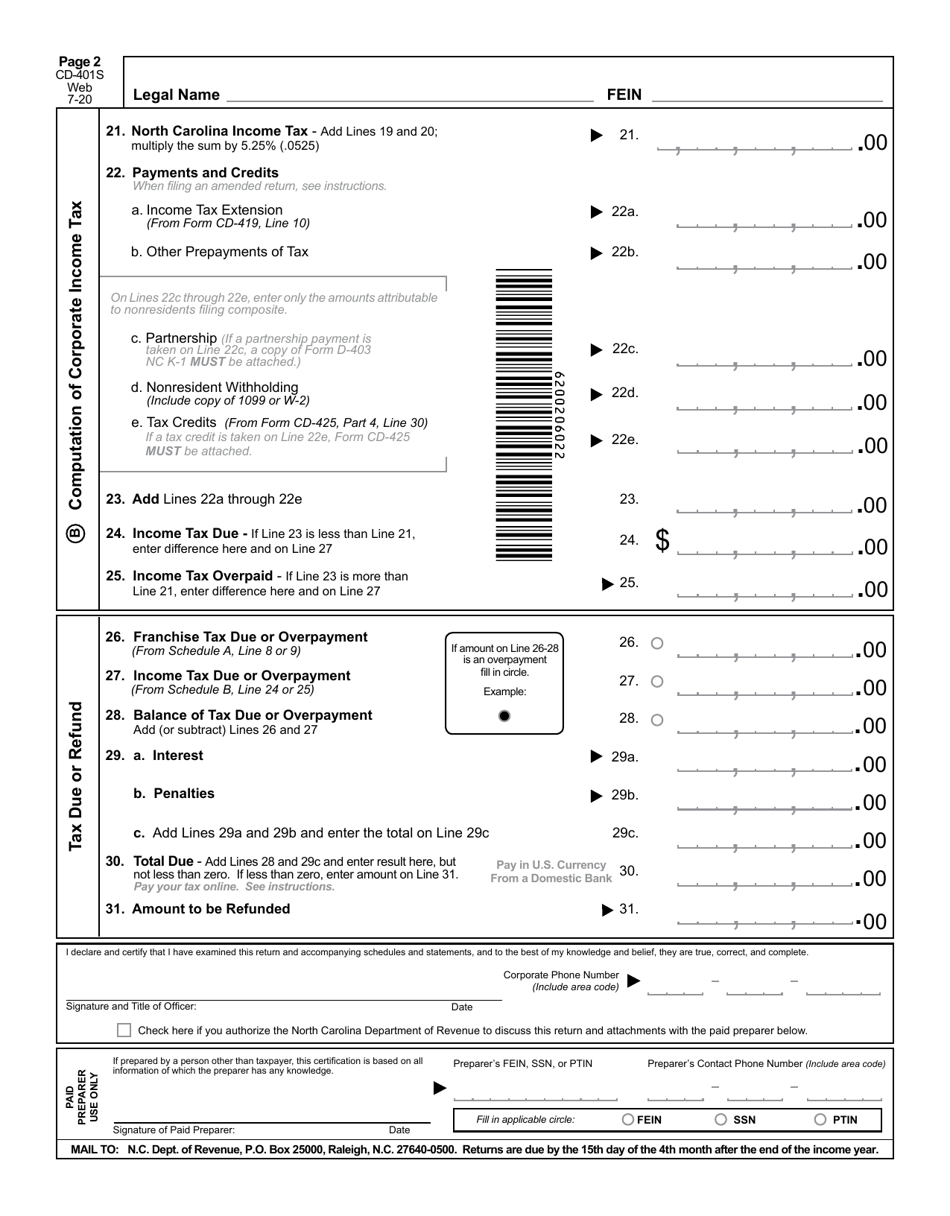

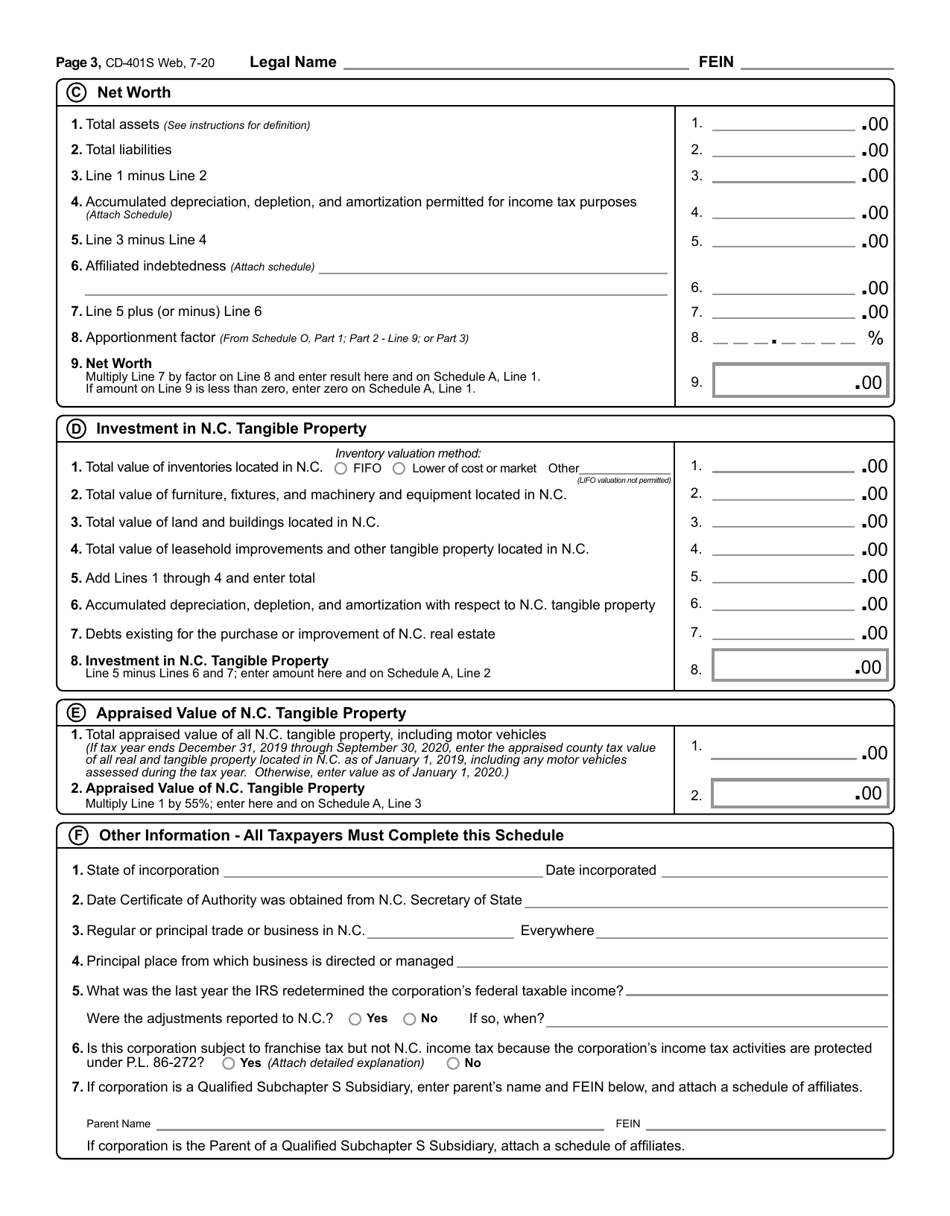

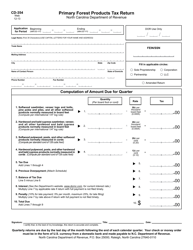

Form CD-401S S-Corporation Tax Return - North Carolina

What Is Form CD-401S?

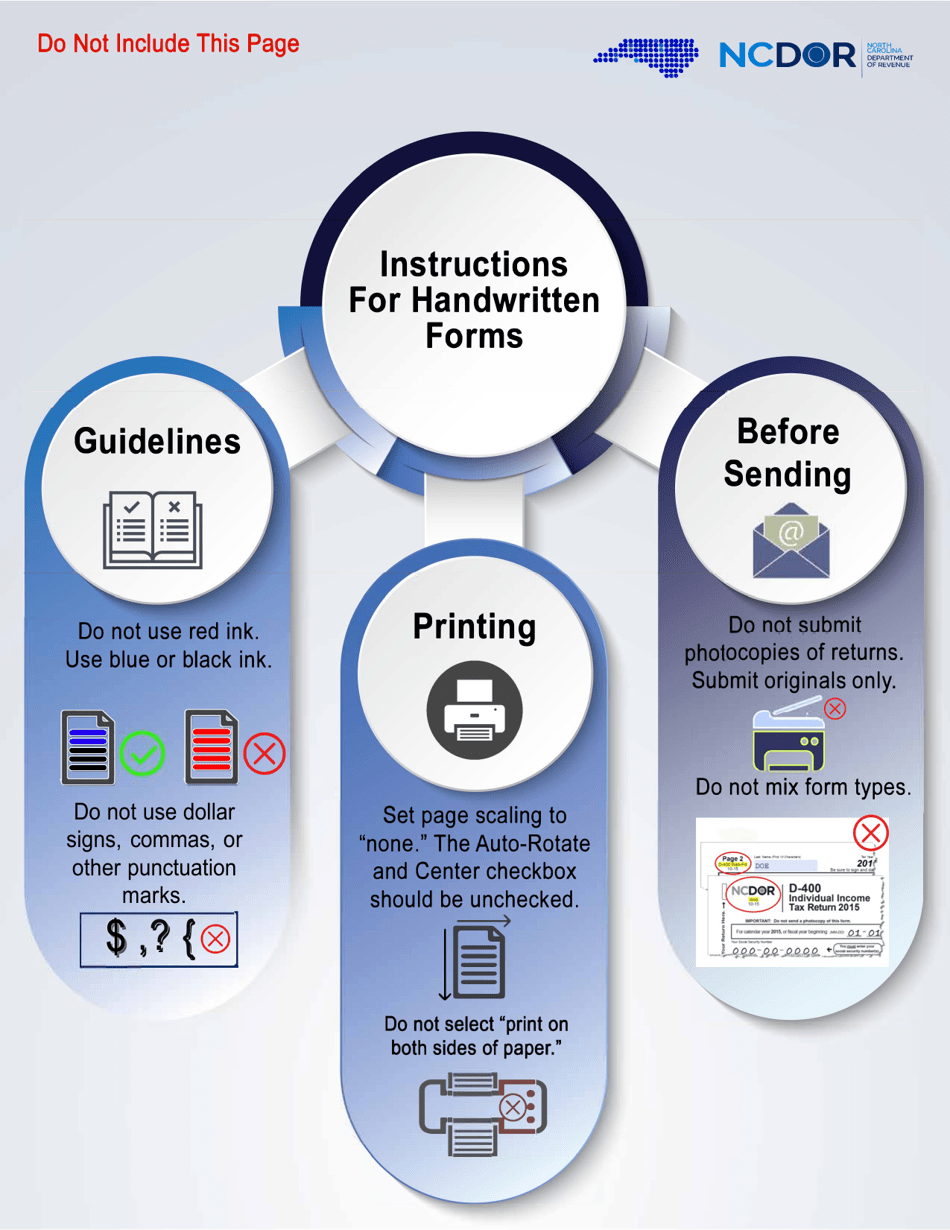

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-401S?

A: Form CD-401S is the S-Corporation Tax Return for North Carolina.

Q: Who needs to file Form CD-401S?

A: S-Corporations operating in North Carolina need to file Form CD-401S.

Q: When is the due date for filing Form CD-401S?

A: The due date for filing Form CD-401S is on or before the 15th day of the 3rd month following the close of the tax year.

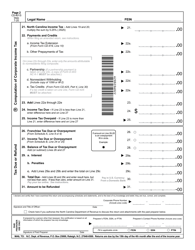

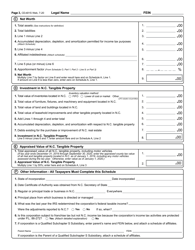

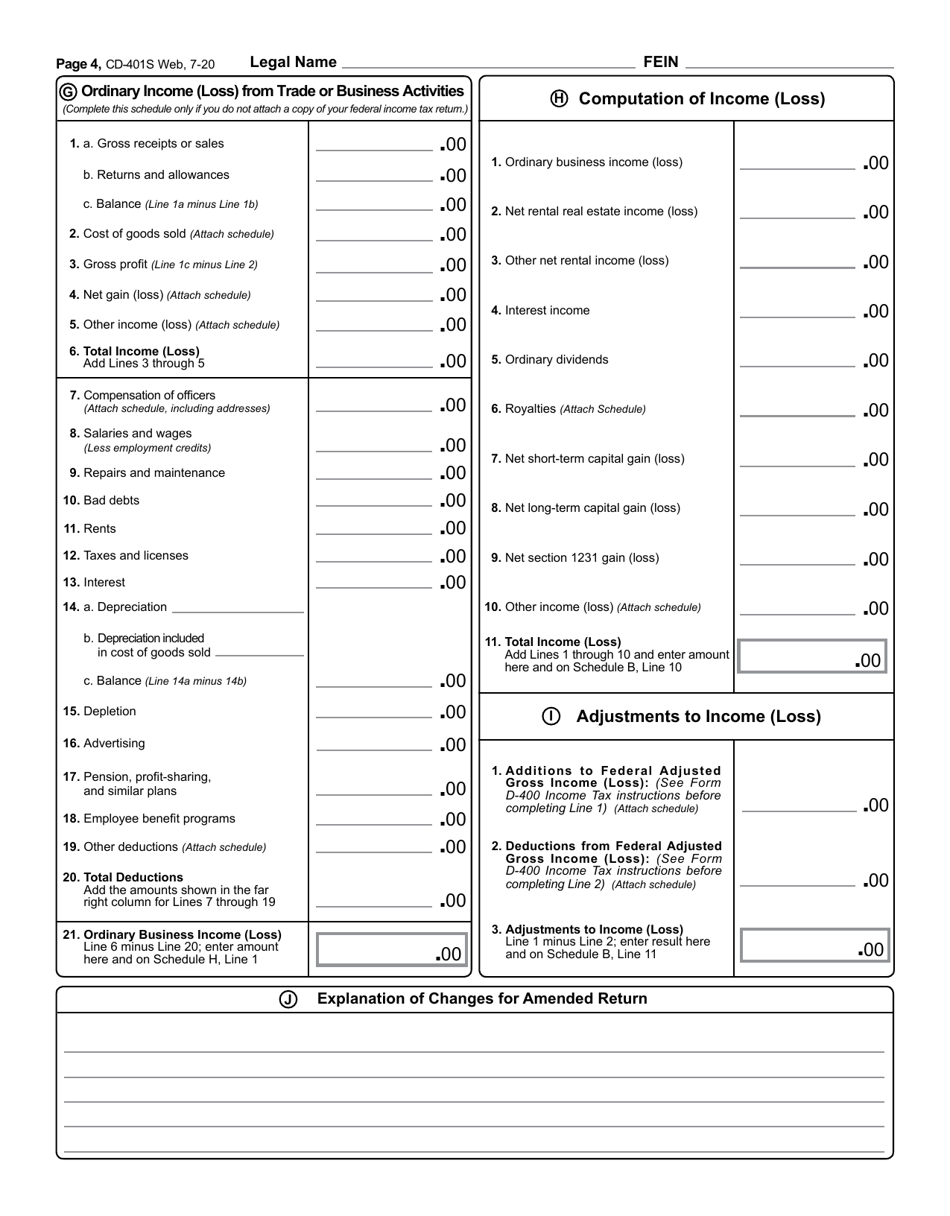

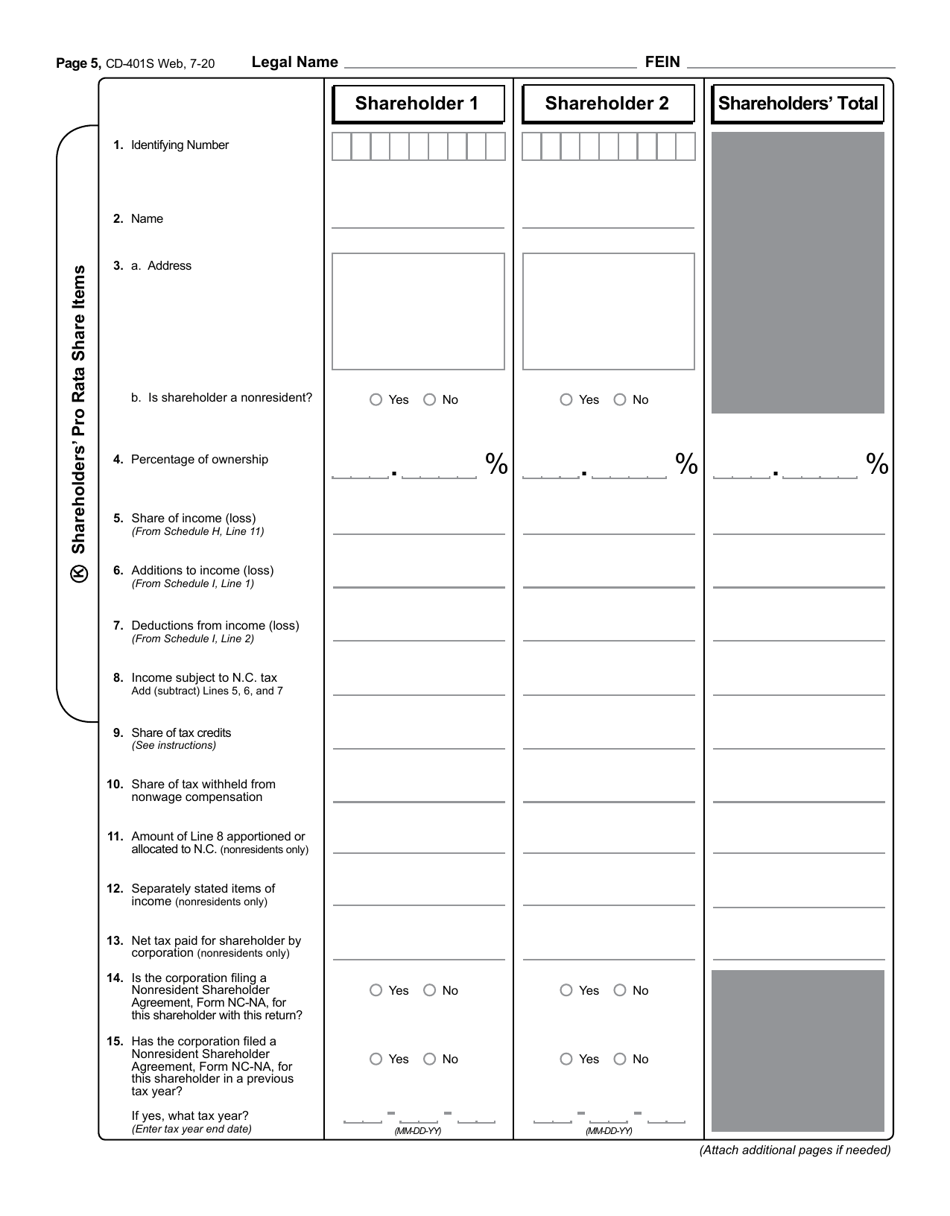

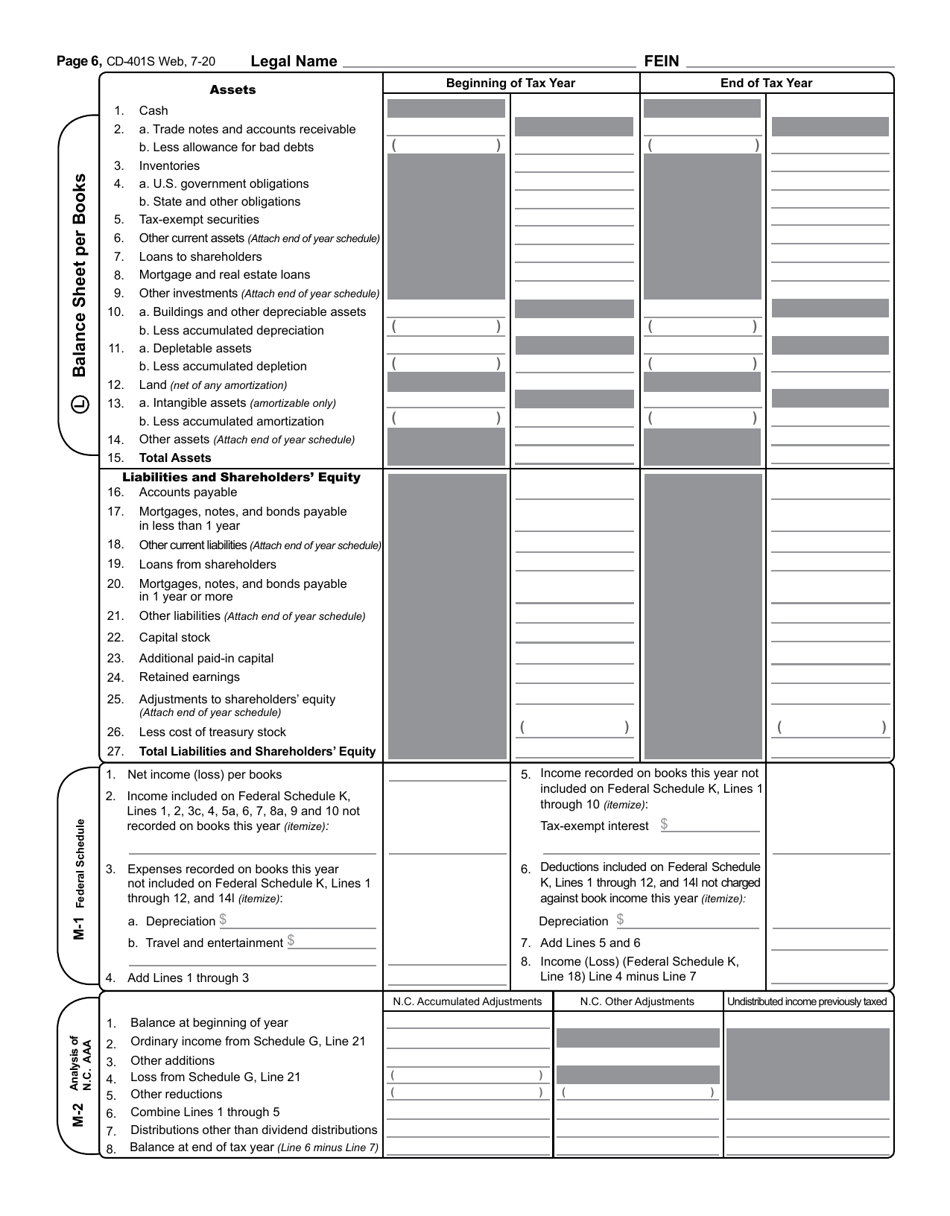

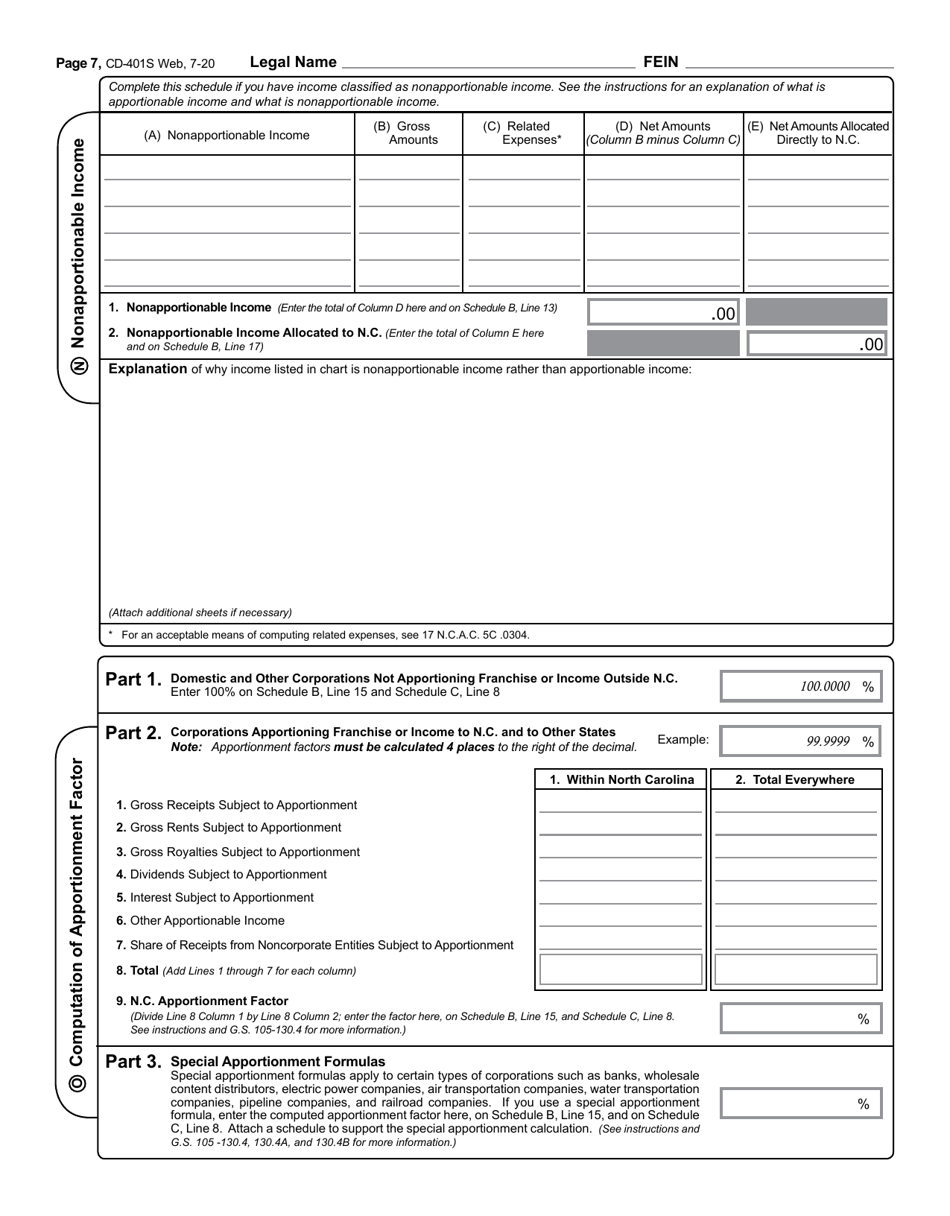

Q: What information is required to complete Form CD-401S?

A: Information required to complete Form CD-401S includes the S-Corporation's income, deductions, credits, and other relevant financial information.

Q: Are there any additional forms or schedules that need to be filed with Form CD-401S?

A: Yes, there may be additional forms or schedules that need to be filed depending on the specific circumstances of the S-Corporation.

Q: Is there an electronic filing option available for Form CD-401S?

A: Yes, S-Corporations can choose to file Form CD-401S electronically.

Q: What are the consequences of not filing Form CD-401S?

A: Failure to file Form CD-401S can result in penalties and interest charges.

Q: Can I request an extension to file Form CD-401S?

A: Yes, you can request an extension to file Form CD-401S. The extension request must be submitted on or before the original due date of the return.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

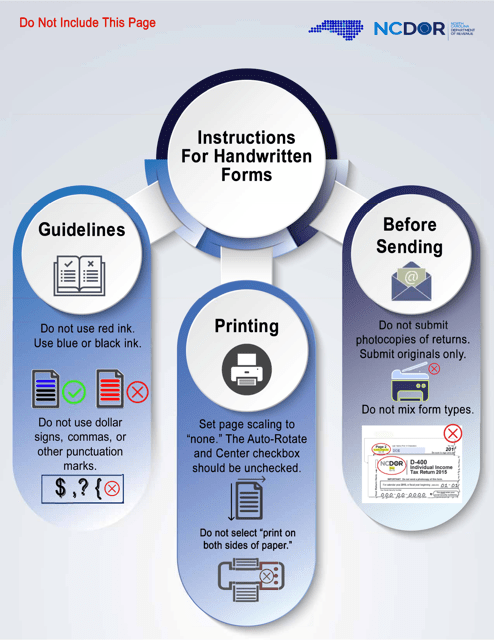

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-401S by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.