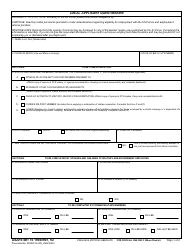

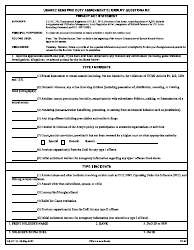

W-9 Questionaire - New Jersey

W-9 Questionaire is a legal document that was released by the New Jersey Department of Law and Public Safety - Office of The Attorney General - a government authority operating within New Jersey.

FAQ

Q: What is a W-9?

A: A W-9 is a tax form used to request taxpayer identification information.

Q: Why do I need to fill out a W-9?

A: You may need to fill out a W-9 if you are performing work or providing services and the person or company paying you needs your taxpayer information for reporting purposes.

Q: Who should fill out a W-9?

A: Any individual or business that is requested to do so by another party.

Q: What information is required on a W-9?

A: A W-9 requires your name, address, taxpayer identification number (such as a Social Security Number or Employer Identification Number), and certification of your taxpayer status.

Q: Do I need to file a W-9 with my tax return?

A: No, you do not need to file a W-9 with your tax return. It is a separate form used for information reporting purposes.

Q: What is the purpose of a W-9?

A: The purpose of a W-9 is to provide the payer with the necessary taxpayer identification information to accurately report payments made.

Q: What happens if I don't fill out a W-9?

A: If you fail to fill out a W-9 when required, the payer may be required to withhold a percentage of your payments for tax purposes.

Q: Can I refuse to fill out a W-9?

A: You have the right to refuse to fill out a W-9, but the payer may be required to withhold a percentage of your payments if you do so.

Q: Is a W-9 only used in New Jersey?

A: No, a W-9 is used across the United States for tax reporting purposes.

Form Details:

- The latest edition currently provided by the New Jersey Department of Law and Public Safety - Office of The Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Law and Public Safety - Office of The Attorney General.