This version of the form is not currently in use and is provided for reference only. Download this version of

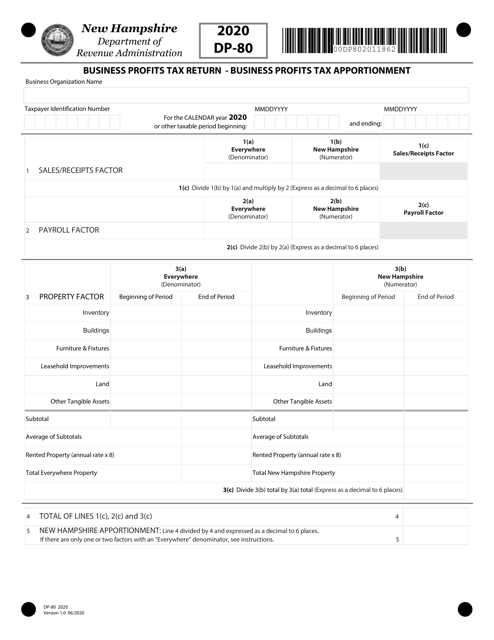

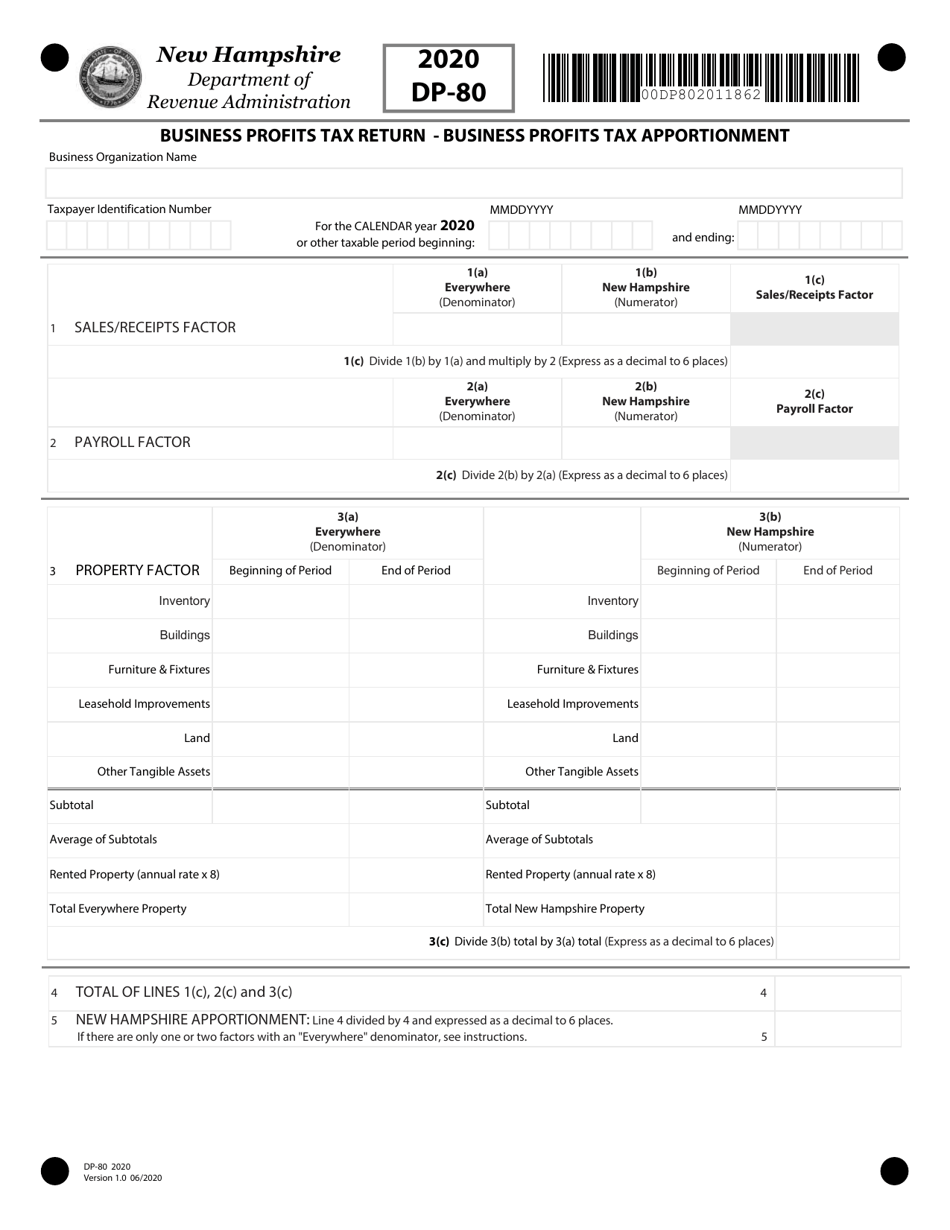

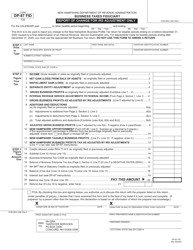

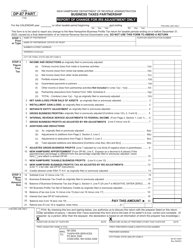

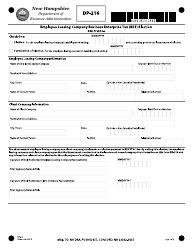

Form DP-80

for the current year.

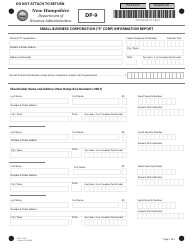

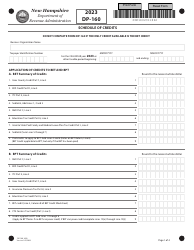

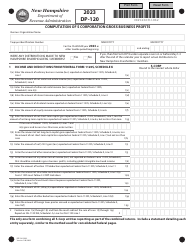

Form DP-80 Business Profits Tax Return - Business Profits Tax Apportionment - New Hampshire

What Is Form DP-80?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-80?

A: Form DP-80 is the Business Profits Tax Return for New Hampshire.

Q: What is the purpose of Form DP-80?

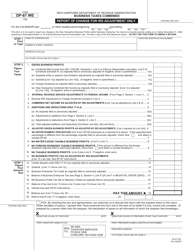

A: Form DP-80 is used to report and calculate the Business Profits Tax in New Hampshire.

Q: What is the Business Profits Tax in New Hampshire?

A: The Business Profits Tax is a tax imposed on the net income derived from business activity in New Hampshire.

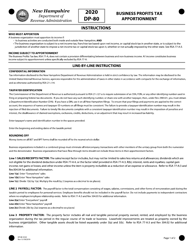

Q: What is Business Profits Tax apportionment?

A: Business Profits Tax apportionment is the process of allocating and distributing the taxable income among different states or jurisdictions.

Q: Why is Business Profits Tax apportionment necessary?

A: Business Profits Tax apportionment is necessary because businesses often operate in more than one state and their income should be fairly divided among those states.

Q: Who needs to file Form DP-80?

A: Any business that derives income from business activity in New Hampshire is required to file Form DP-80.

Q: When is Form DP-80 due?

A: Form DP-80 is due on or before the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing of Form DP-80?

A: Yes, there are penalties for late filing of Form DP-80. The penalty is 2% of the tax due for each month or part of a month that the return is filed late, up to a maximum of 25%.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-80 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.