This version of the form is not currently in use and is provided for reference only. Download this version of

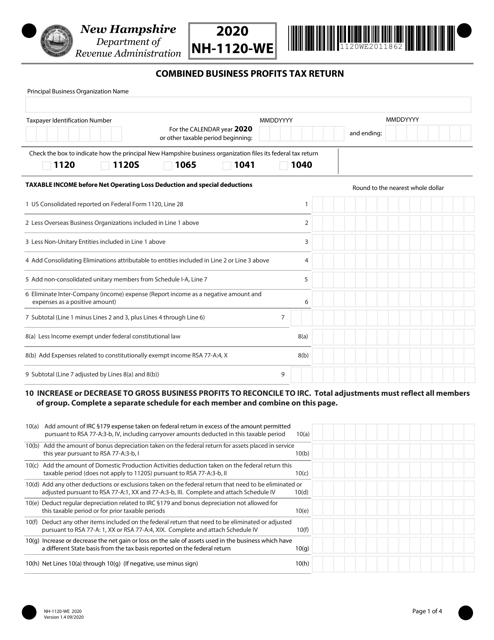

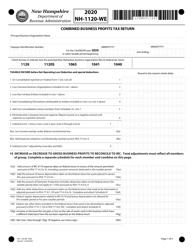

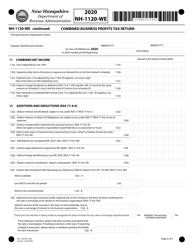

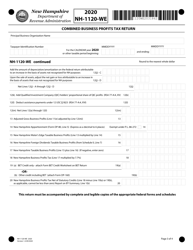

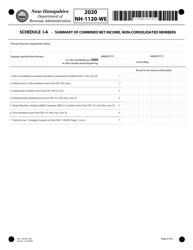

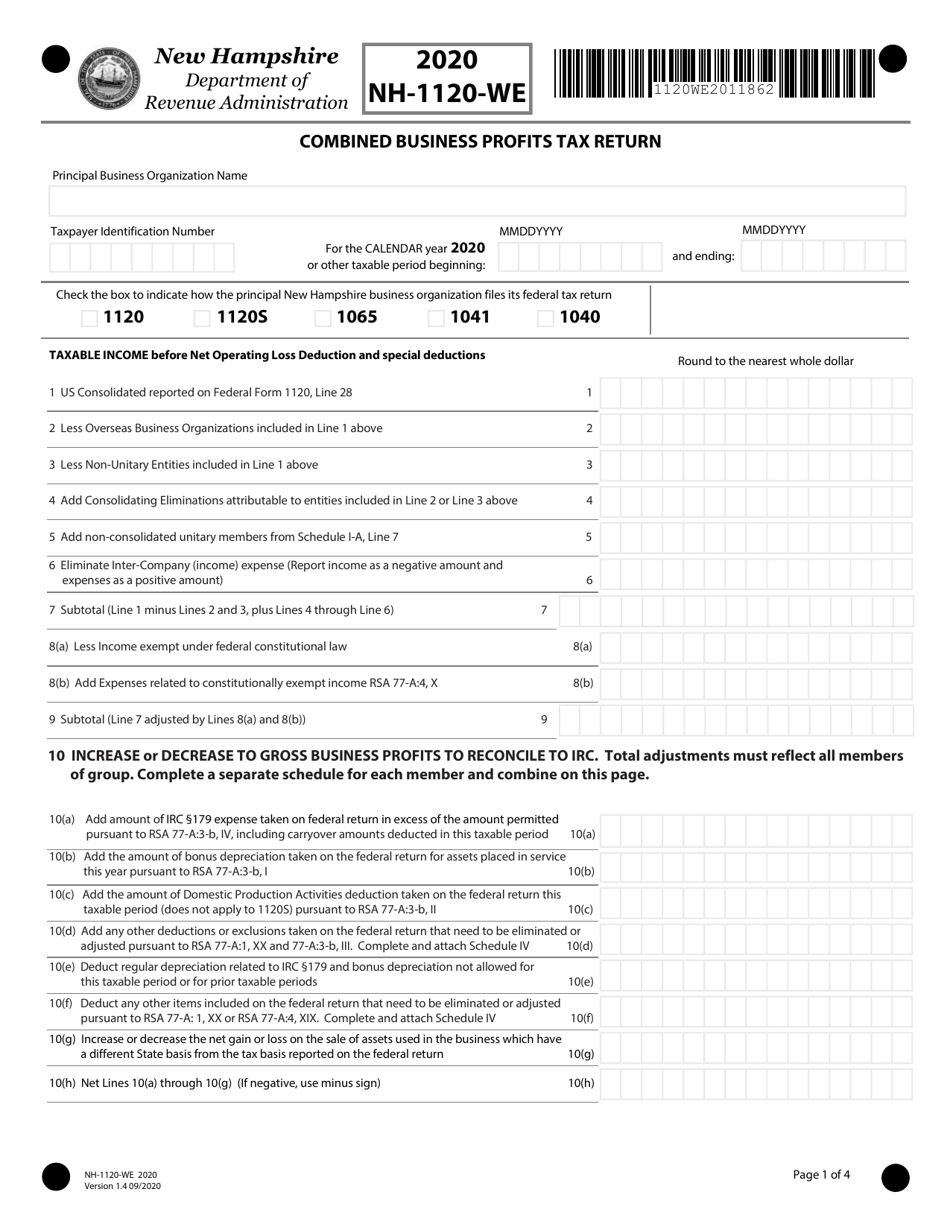

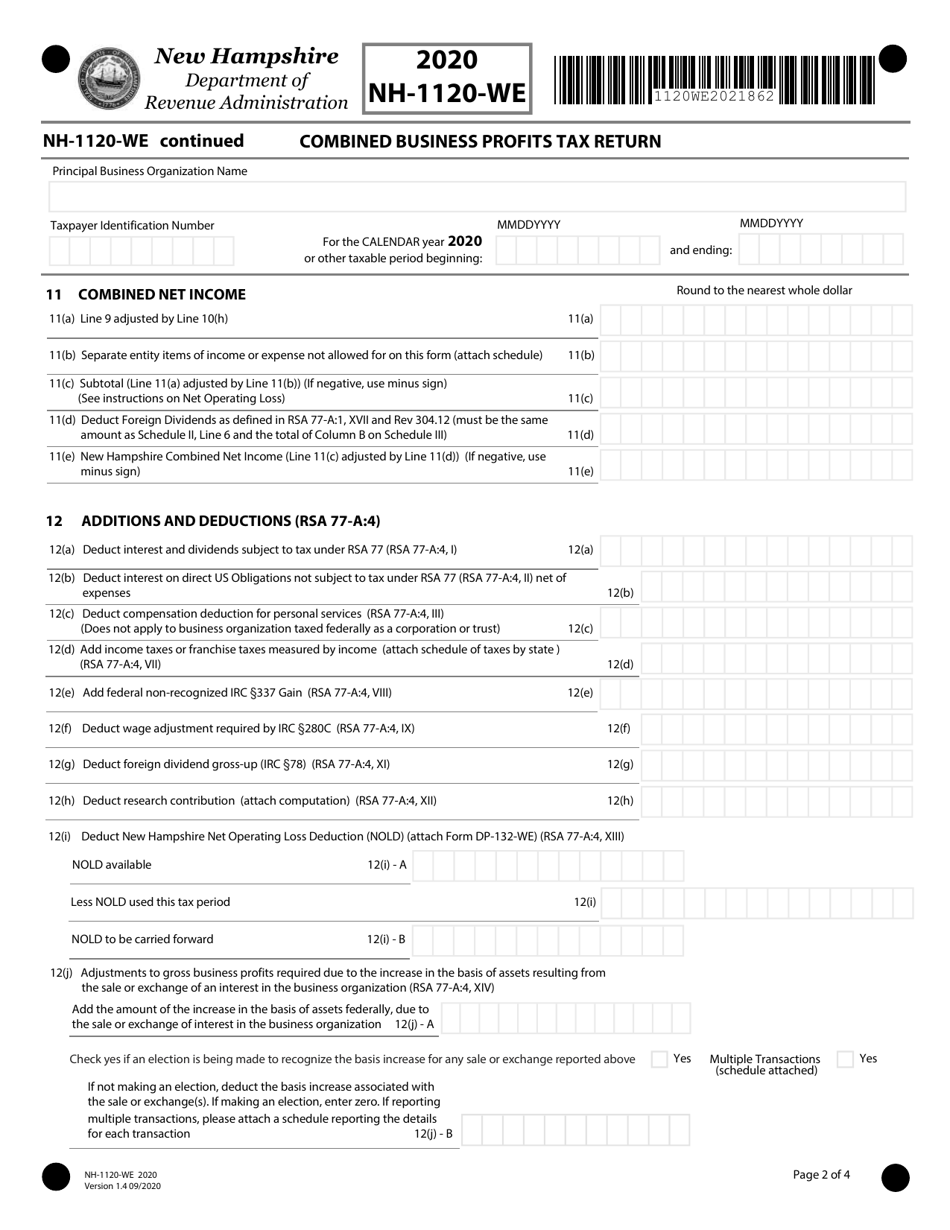

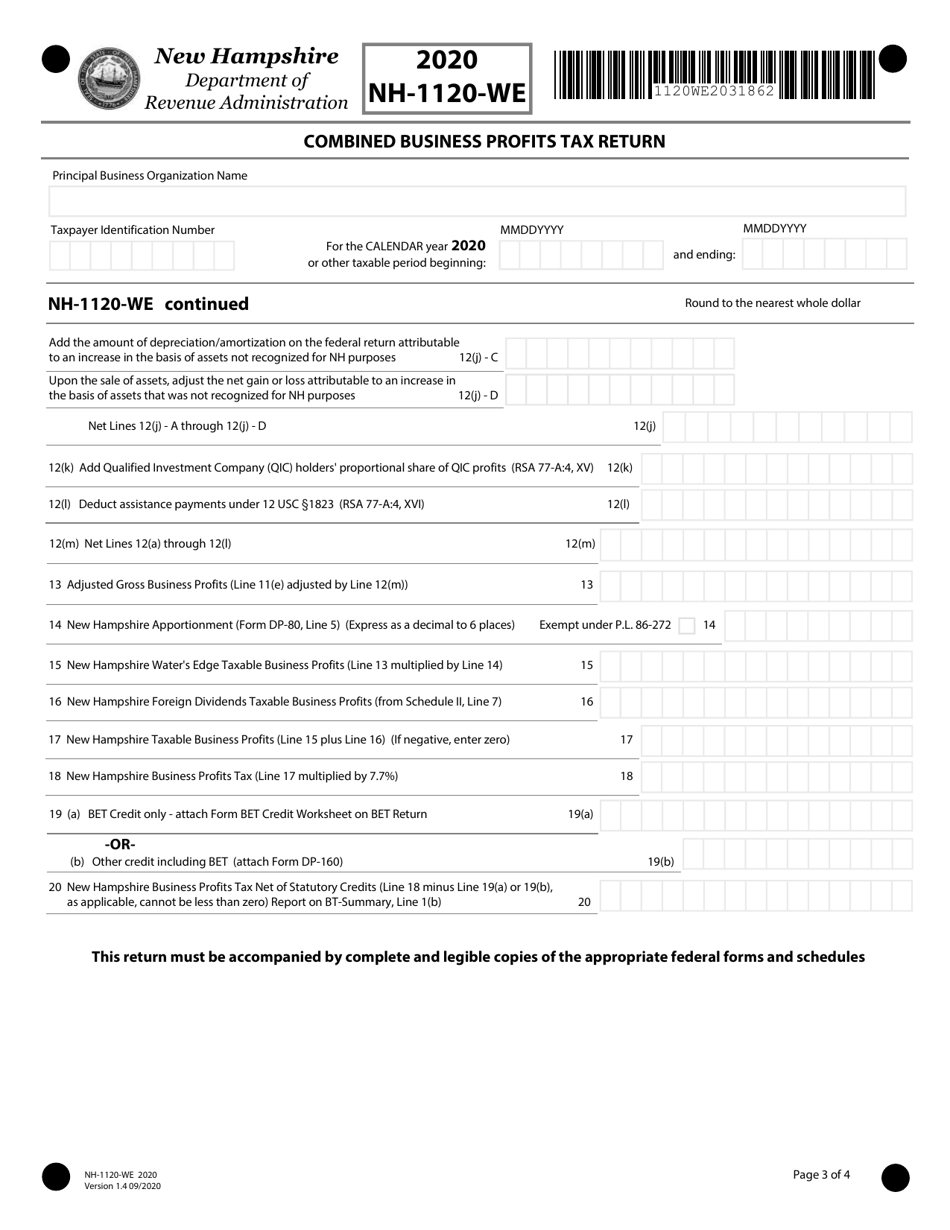

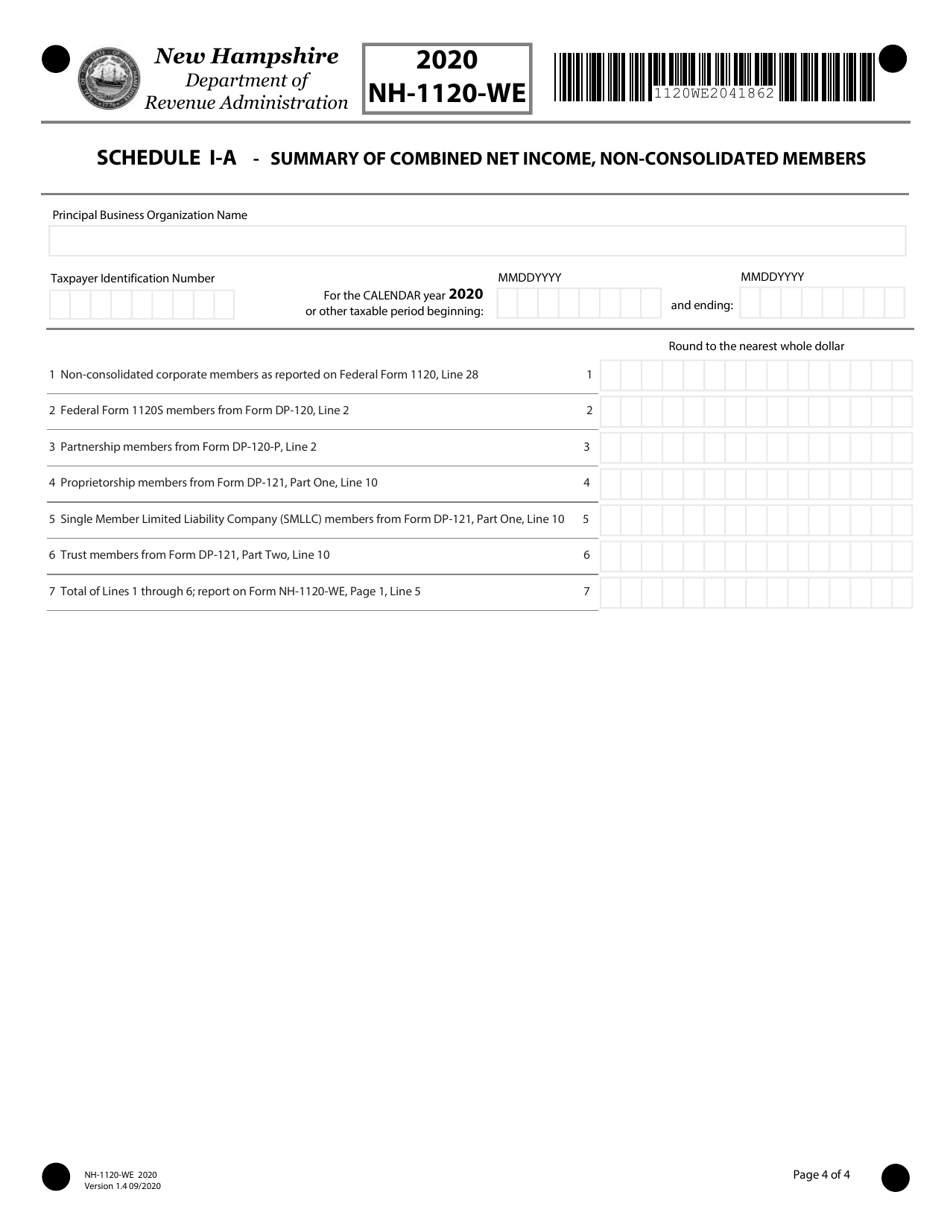

Form NH-1120-WE

for the current year.

Form NH-1120-WE Combined Business Profits Tax Return - New Hampshire

What Is Form NH-1120-WE?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NH-1120-WE?

A: Form NH-1120-WE is the Combined Business Profits Tax Return for businesses in New Hampshire.

Q: Who needs to file Form NH-1120-WE?

A: Any business operating in New Hampshire that has taxable business profits needs to file Form NH-1120-WE.

Q: What is the purpose of Form NH-1120-WE?

A: The purpose of Form NH-1120-WE is to report and pay the business profits tax in New Hampshire.

Q: When is the deadline to file Form NH-1120-WE?

A: The deadline to file Form NH-1120-WE is on or before the 15th day of the 3rd month following the close of the taxable period.

Q: Are there any penalties for late filing of Form NH-1120-WE?

A: Yes, there are penalties for late filing of Form NH-1120-WE. The penalty is $50 per month, up to a maximum of $1,000, for each month or fraction of a month the return is filed late.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1120-WE by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.