This version of the form is not currently in use and is provided for reference only. Download this version of

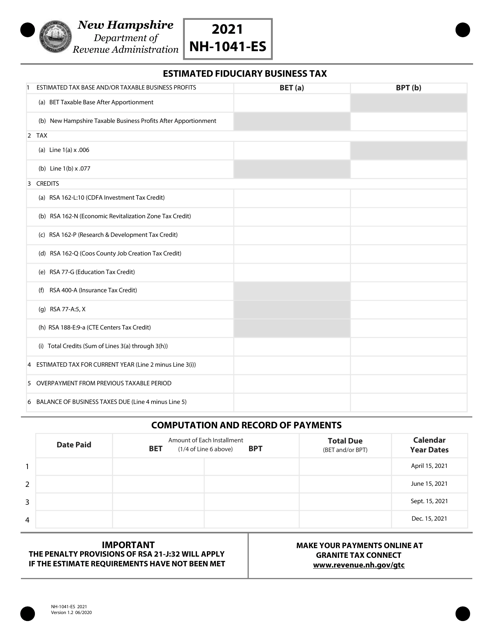

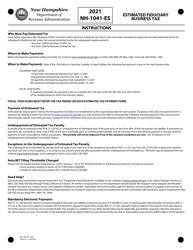

Form NH-1041-ES

for the current year.

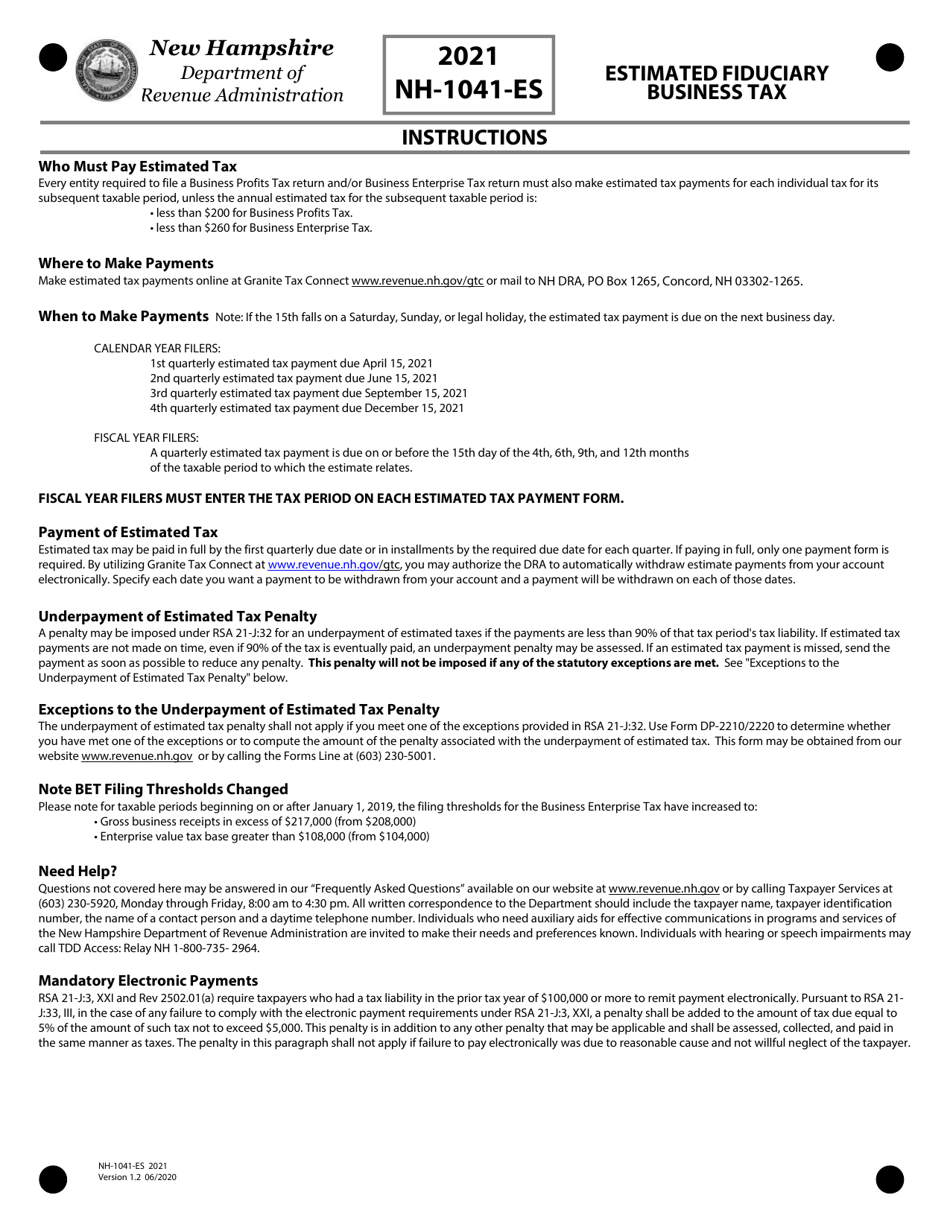

Form NH-1041-ES Estimated Fiduciary Business Tax - New Hampshire

What Is Form NH-1041-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NH-1041-ES?

A: NH-1041-ES is a form used to estimate and pay fiduciary business tax in New Hampshire.

Q: Who needs to file NH-1041-ES?

A: Fiduciaries who have income from a business conducted in New Hampshire and are required to pay fiduciary business tax are required to file NH-1041-ES.

Q: What is fiduciary business tax?

A: Fiduciary business tax is a tax imposed on the income earned by trusts, estates, and other fiduciary entities in New Hampshire.

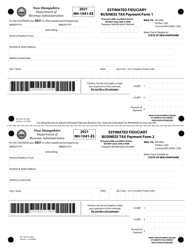

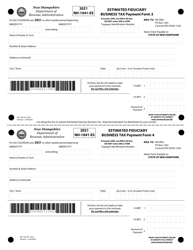

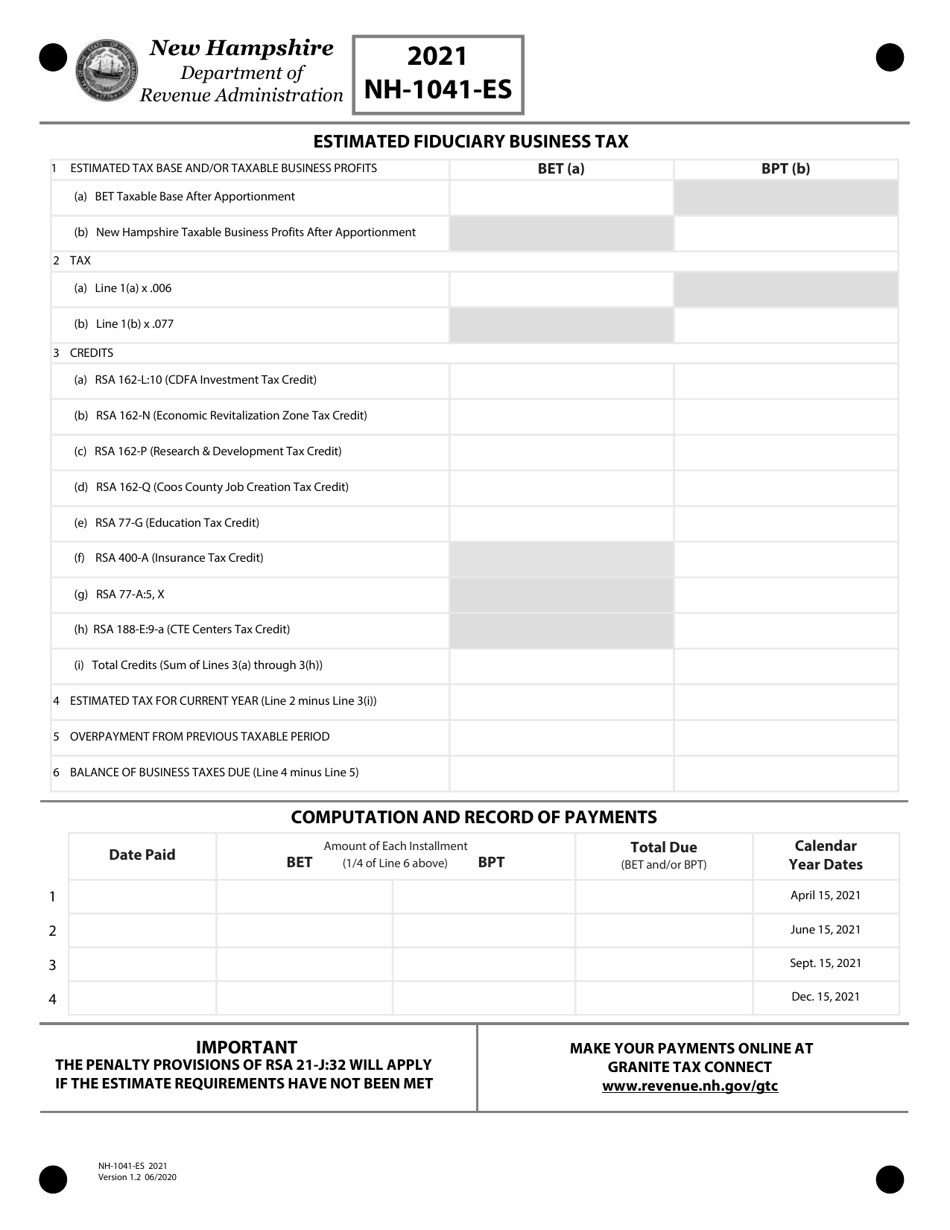

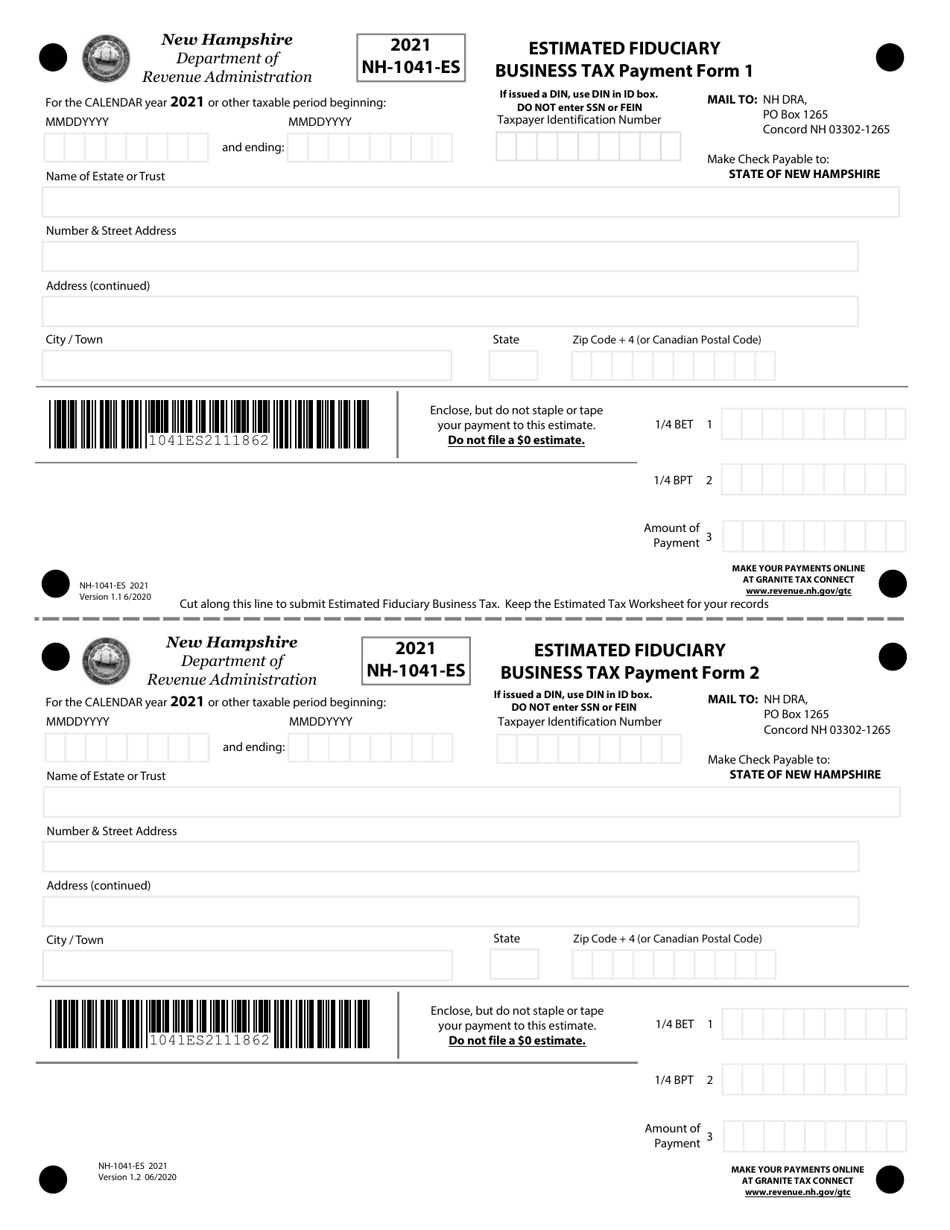

Q: How often do I need to file NH-1041-ES?

A: NH-1041-ES needs to be filed quarterly, with estimated tax payments made by April 15th, June 15th, September 15th, and December 15th of each year.

Q: Is NH-1041-ES the only form I need to file?

A: No, in addition to NH-1041-ES, fiduciaries may also need to file other forms such as NH-1041, the Fiduciary Tax Return.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1041-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.