This version of the form is not currently in use and is provided for reference only. Download this version of

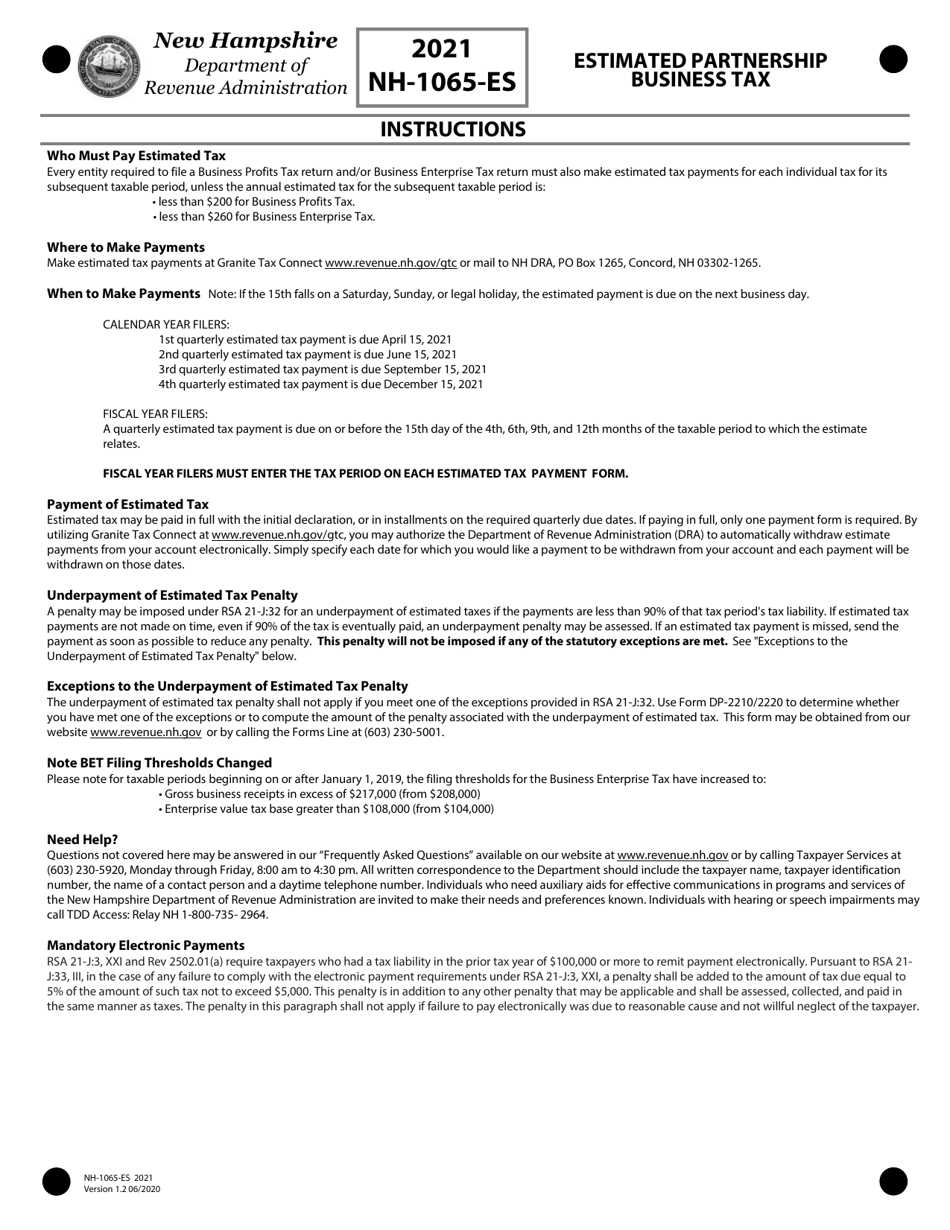

Form NH-1065-ES

for the current year.

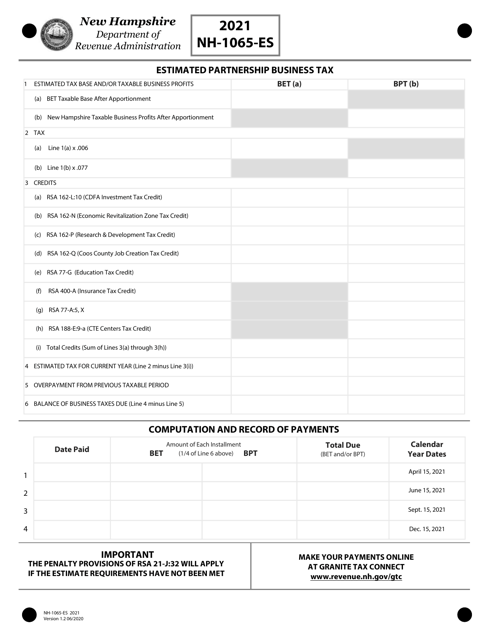

Form NH-1065-ES Estimated Partnership Business Tax - New Hampshire

What Is Form NH-1065-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

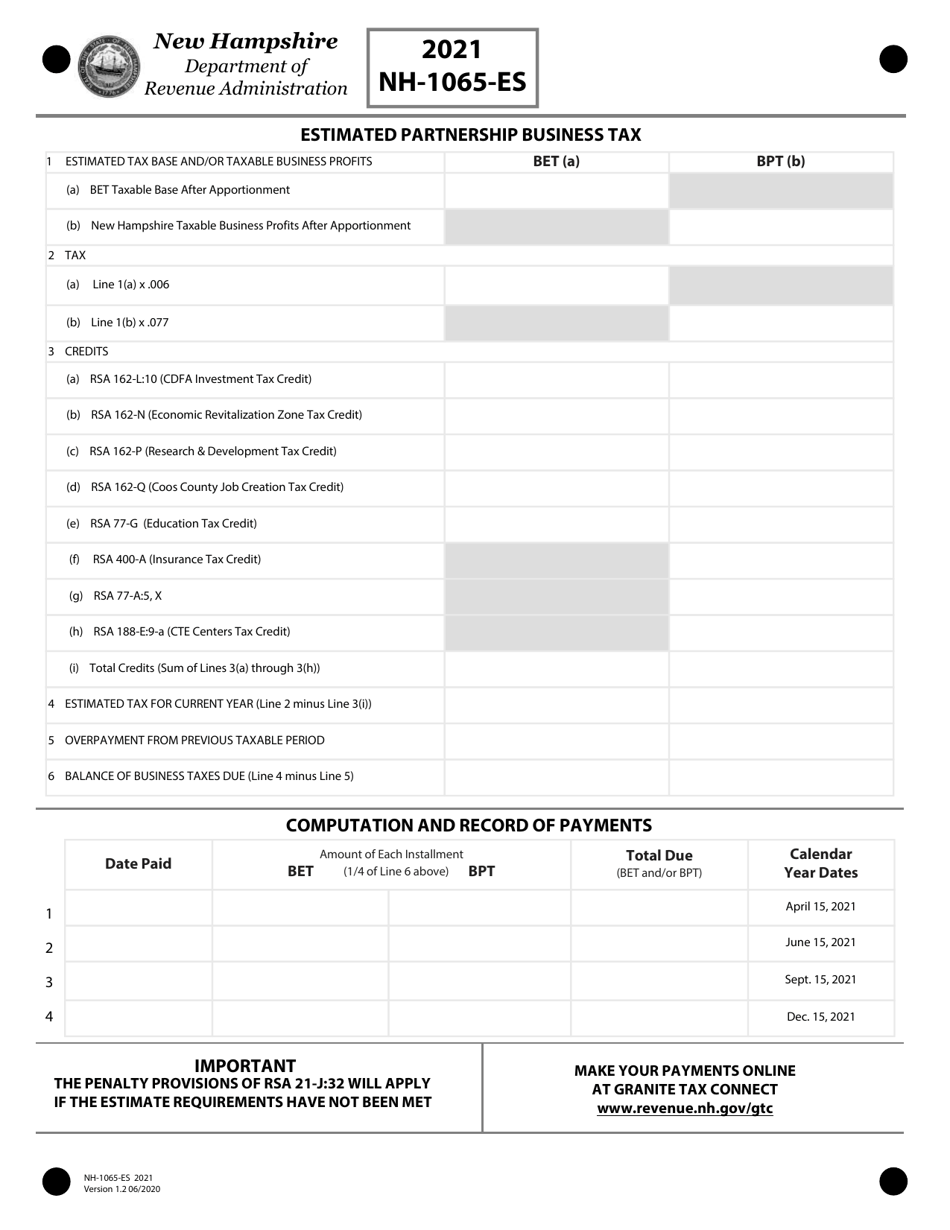

Q: What is NH-1065-ES?

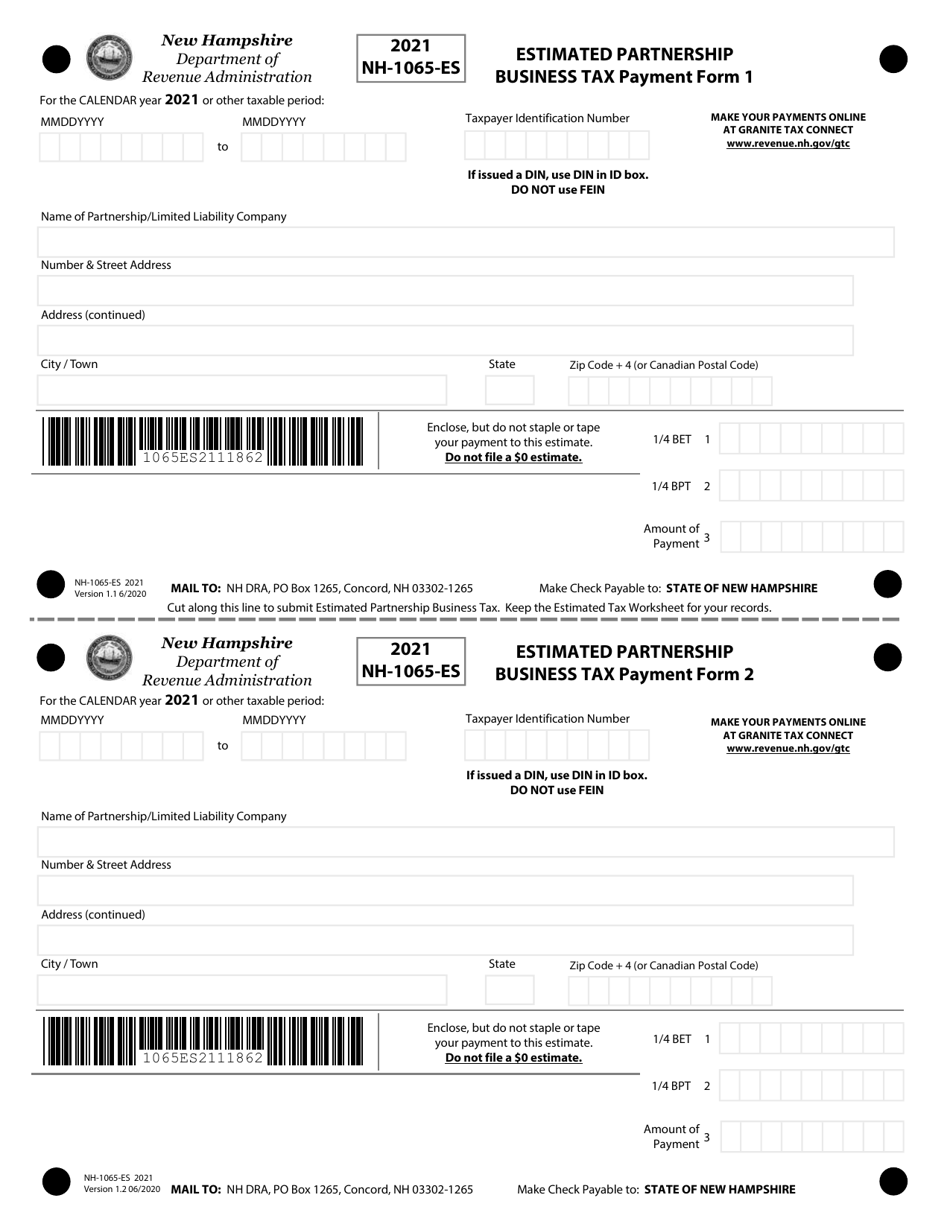

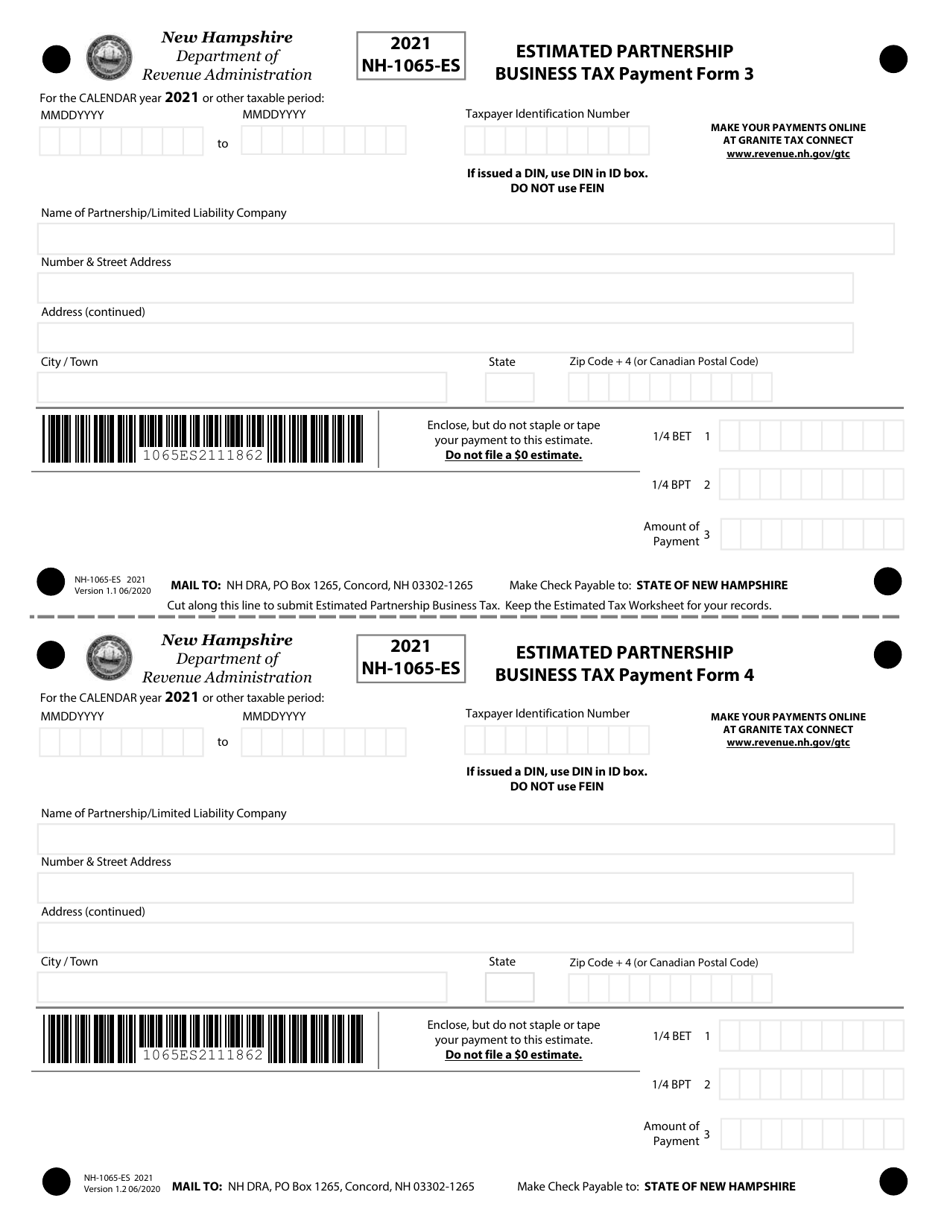

A: NH-1065-ES is a form used to make estimated tax payments for partnership businesses in New Hampshire.

Q: Who needs to file NH-1065-ES?

A: Partnership businesses in New Hampshire that are required to make estimated tax payments need to file NH-1065-ES.

Q: What are estimated tax payments?

A: Estimated tax payments are required periodic payments made by businesses to cover their tax liability for the current tax year.

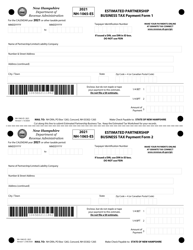

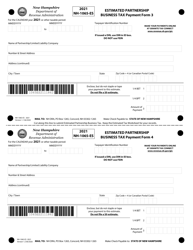

Q: When are NH-1065-ES payments due?

A: NH-1065-ES payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: How do I calculate the amount of NH-1065-ES payment?

A: To calculate the amount of NH-1065-ES payment, you should estimate your partnership's income and apply the appropriate tax rate.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.