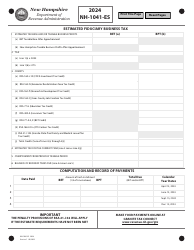

This version of the form is not currently in use and is provided for reference only. Download this version of

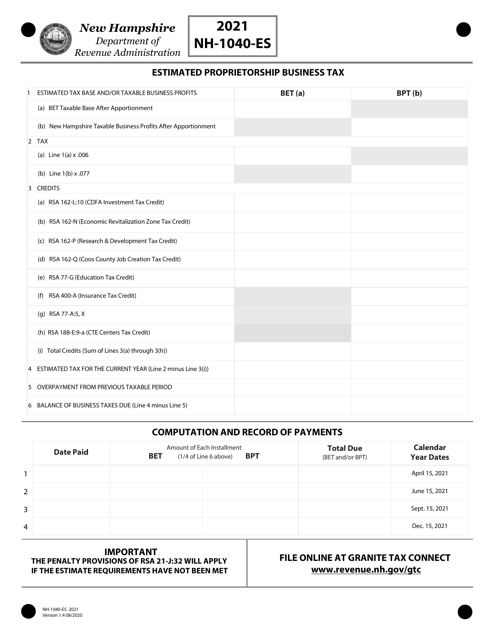

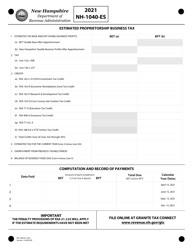

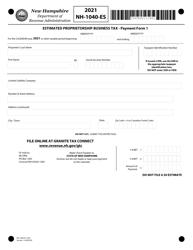

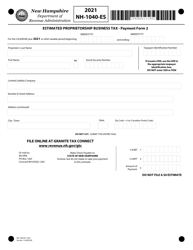

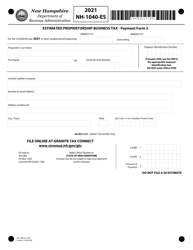

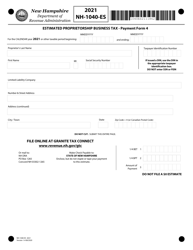

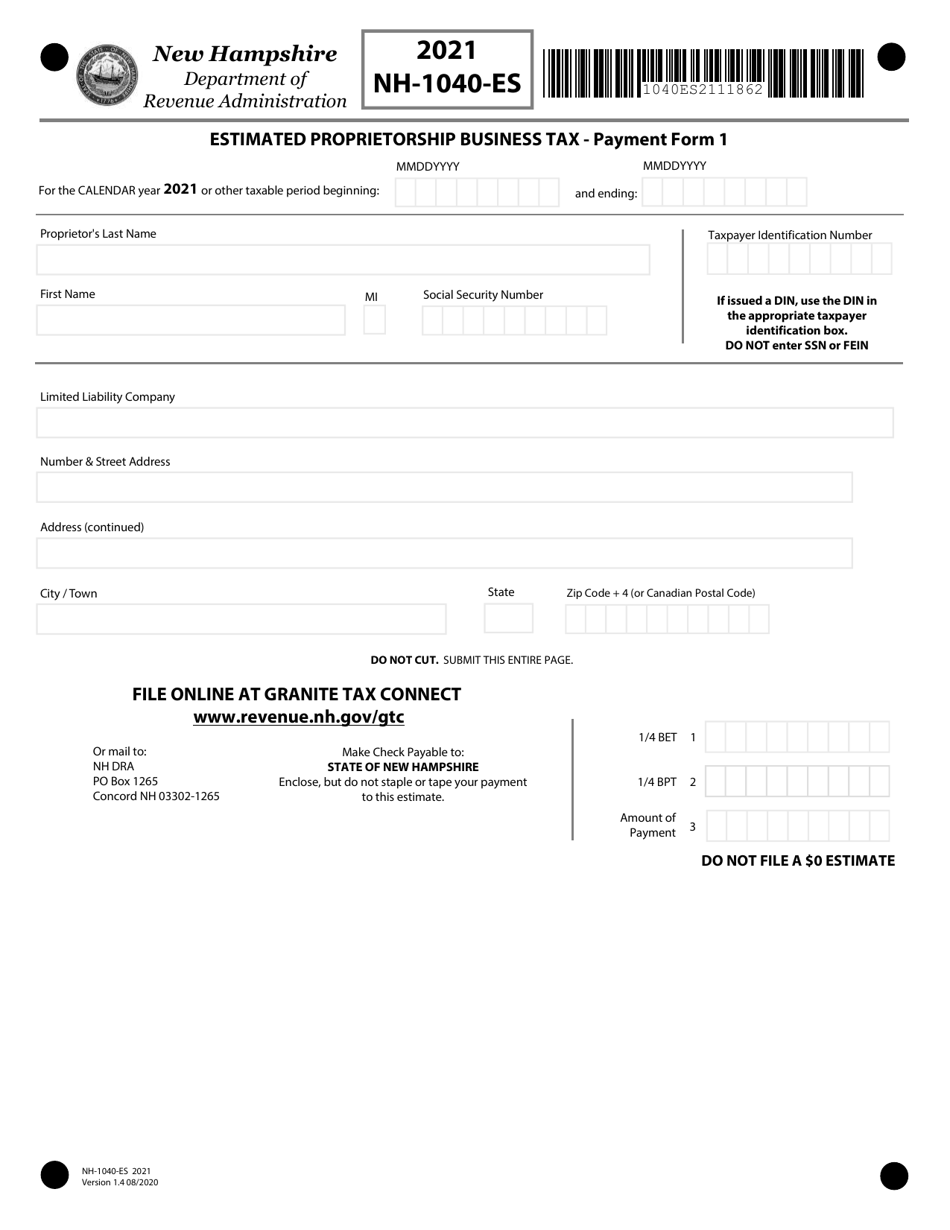

Form NH-1040-ES

for the current year.

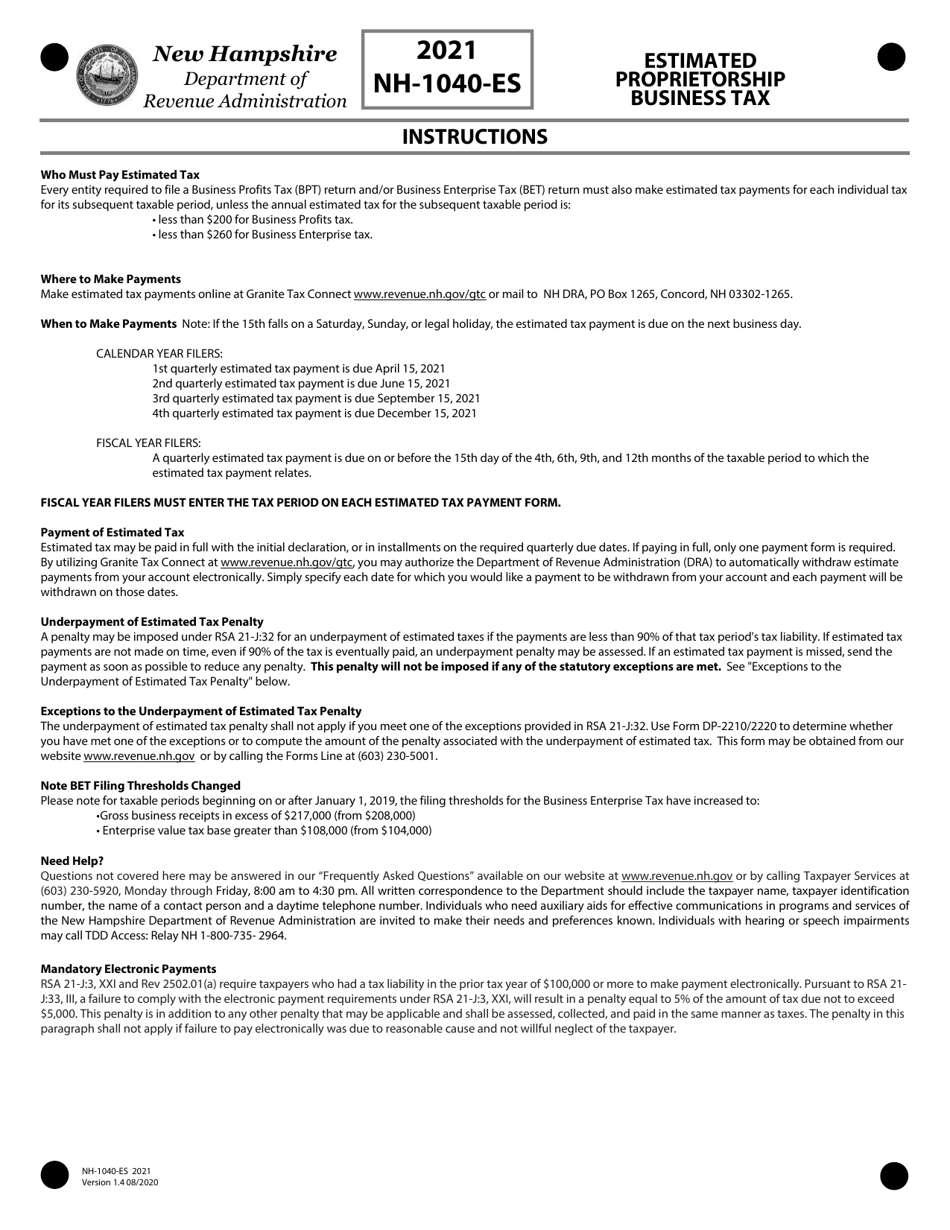

Form NH-1040-ES Proprietorship or Jointly Owned Property Business Profits Tax Estimates - New Hampshire

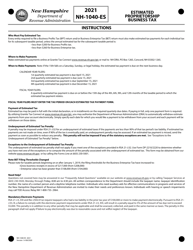

What Is Form NH-1040-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NH-1040-ES?

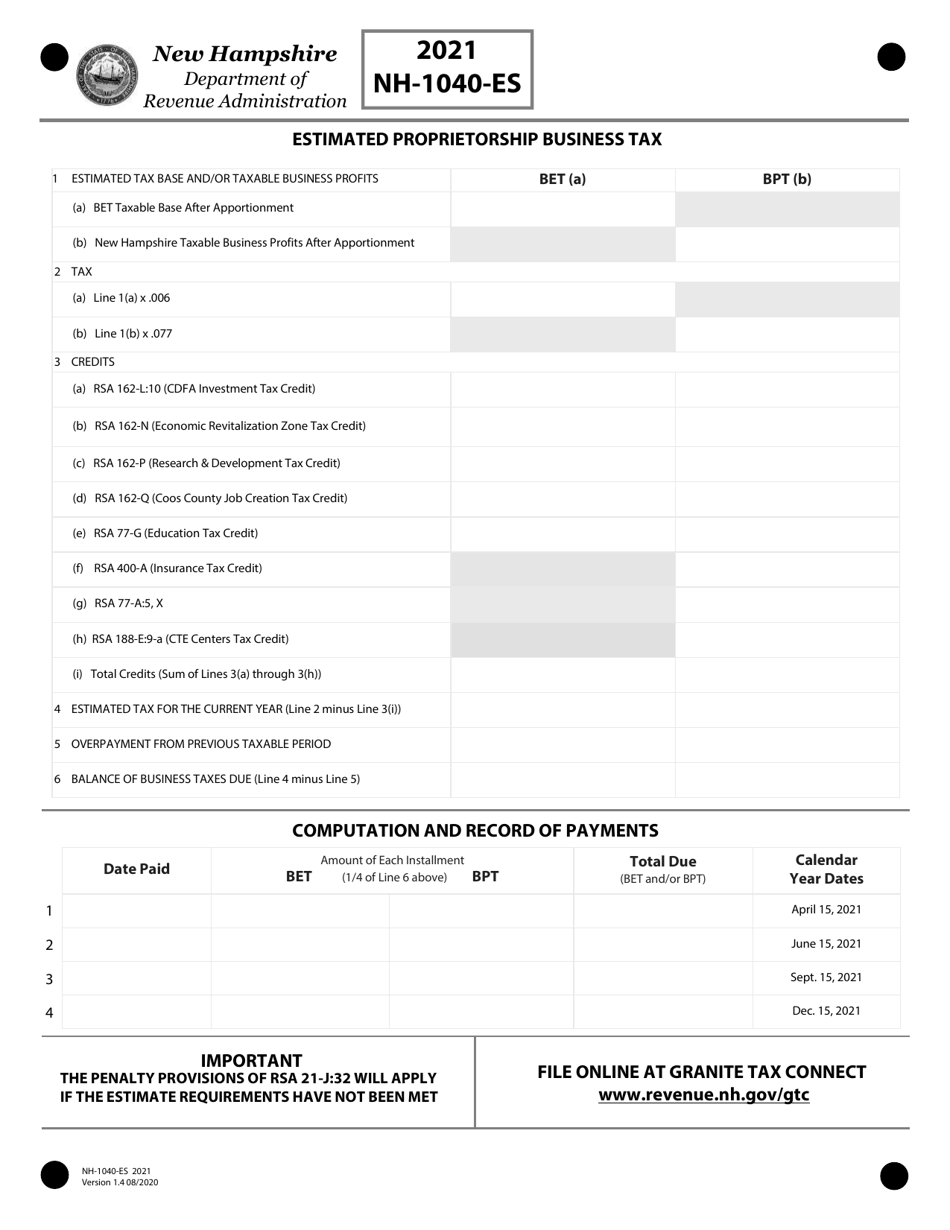

A: NH-1040-ES is a tax form for estimating and paying quarterly business profits tax for proprietors or individuals with jointly owned property businesses in New Hampshire.

Q: Who needs to file NH-1040-ES?

A: Individuals who operate proprietorships or jointly owned property businesses in New Hampshire and are required to pay business profits tax.

Q: What is the purpose of NH-1040-ES?

A: The purpose of NH-1040-ES is to help individuals estimate and pay their quarterly business profits tax to the state of New Hampshire.

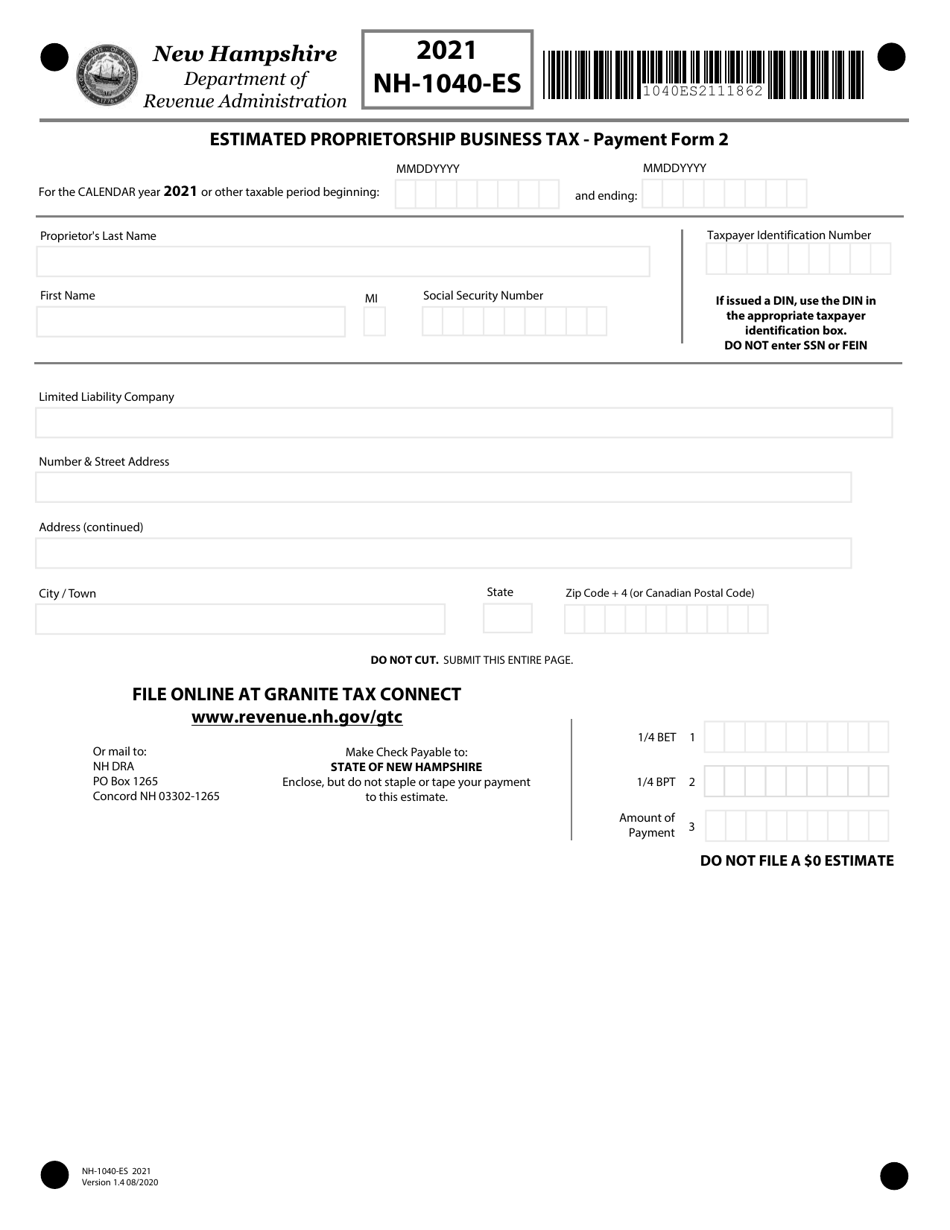

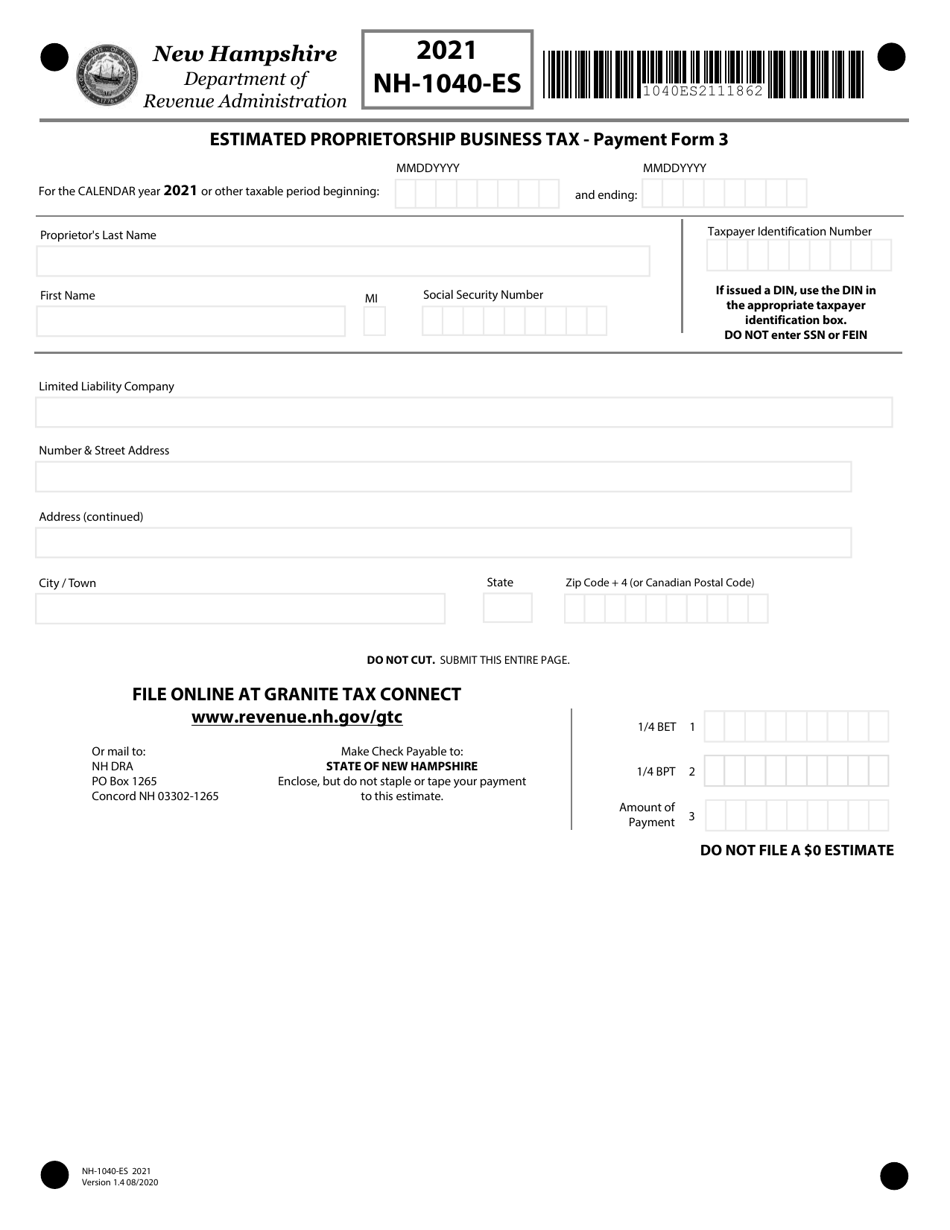

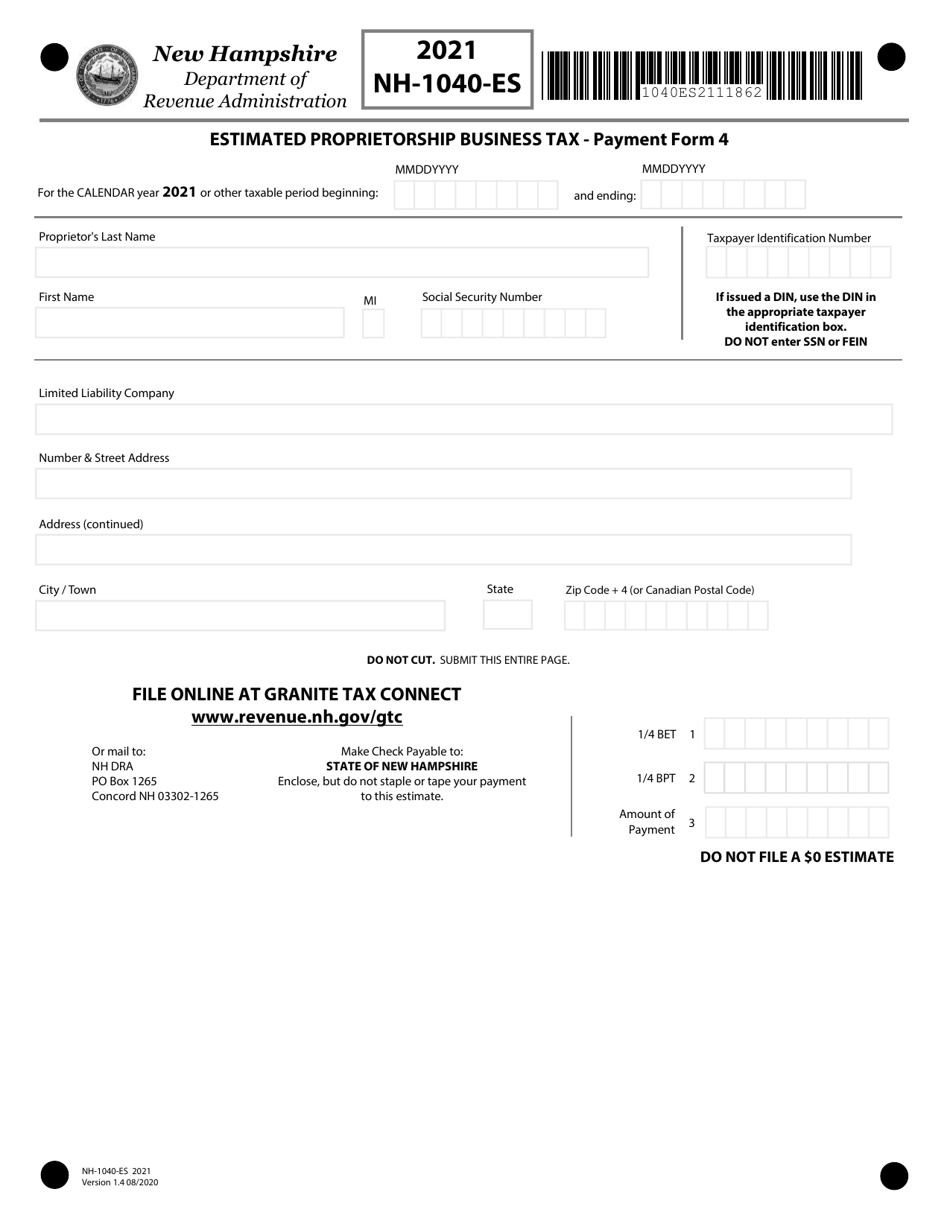

Q: How often do I need to file NH-1040-ES?

A: NH-1040-ES must be filed and paid quarterly, on or before April 15, June 15, September 15, and December 15.

Q: What information is required to complete NH-1040-ES?

A: You will need information about your business income, deductions, tax credits, and other relevant financial details to complete NH-1040-ES.

Q: What happens if I don't file NH-1040-ES?

A: If you are required to file NH-1040-ES and fail to do so, you may be subject to penalties and interest on the unpaid tax amounts.

Q: Can I file NH-1040-ES electronically?

A: No, you cannot file NH-1040-ES electronically. It must be filed by mail using the paper form.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1040-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.