This version of the form is not currently in use and is provided for reference only. Download this version of

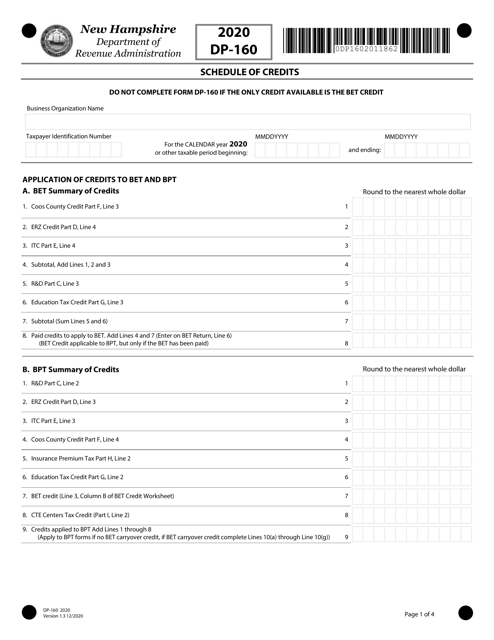

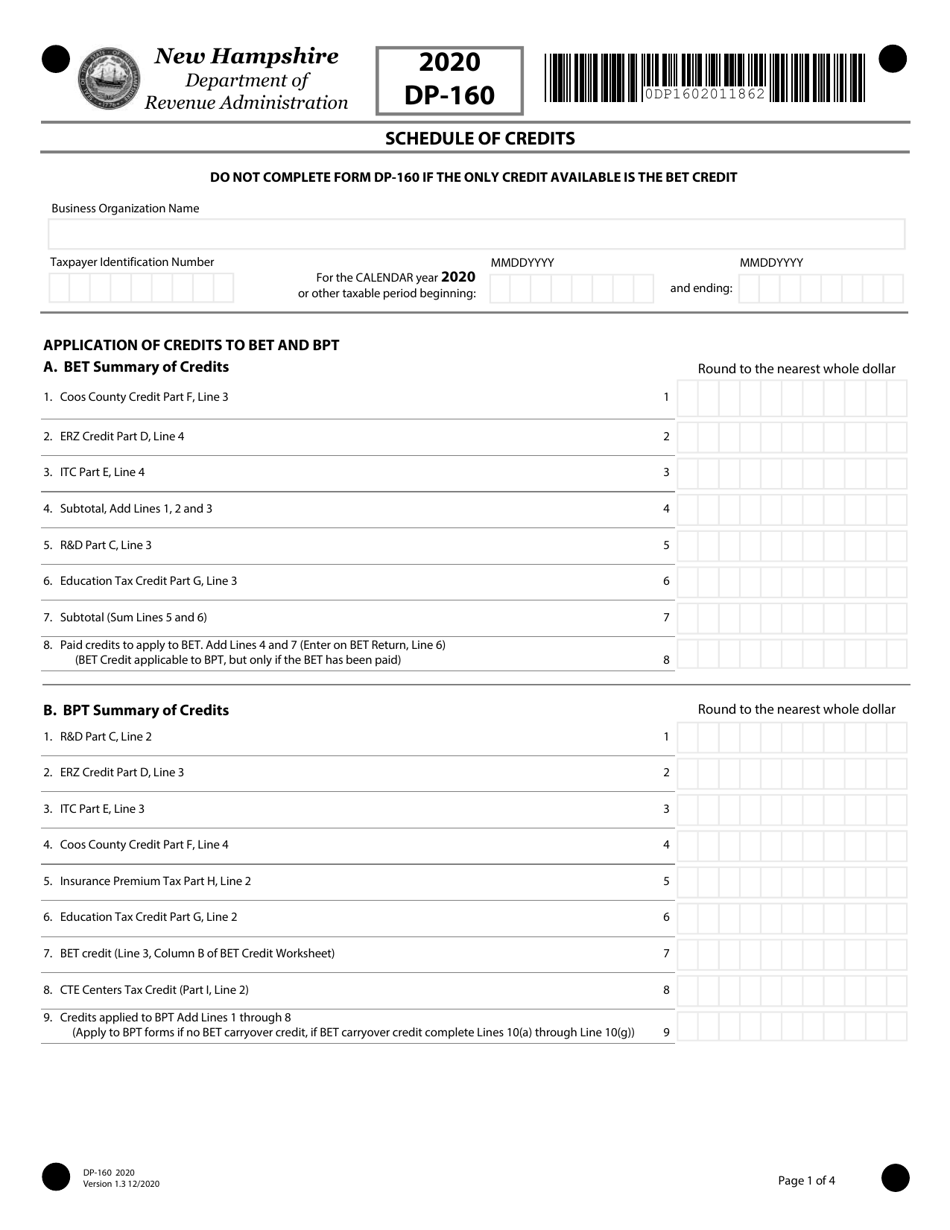

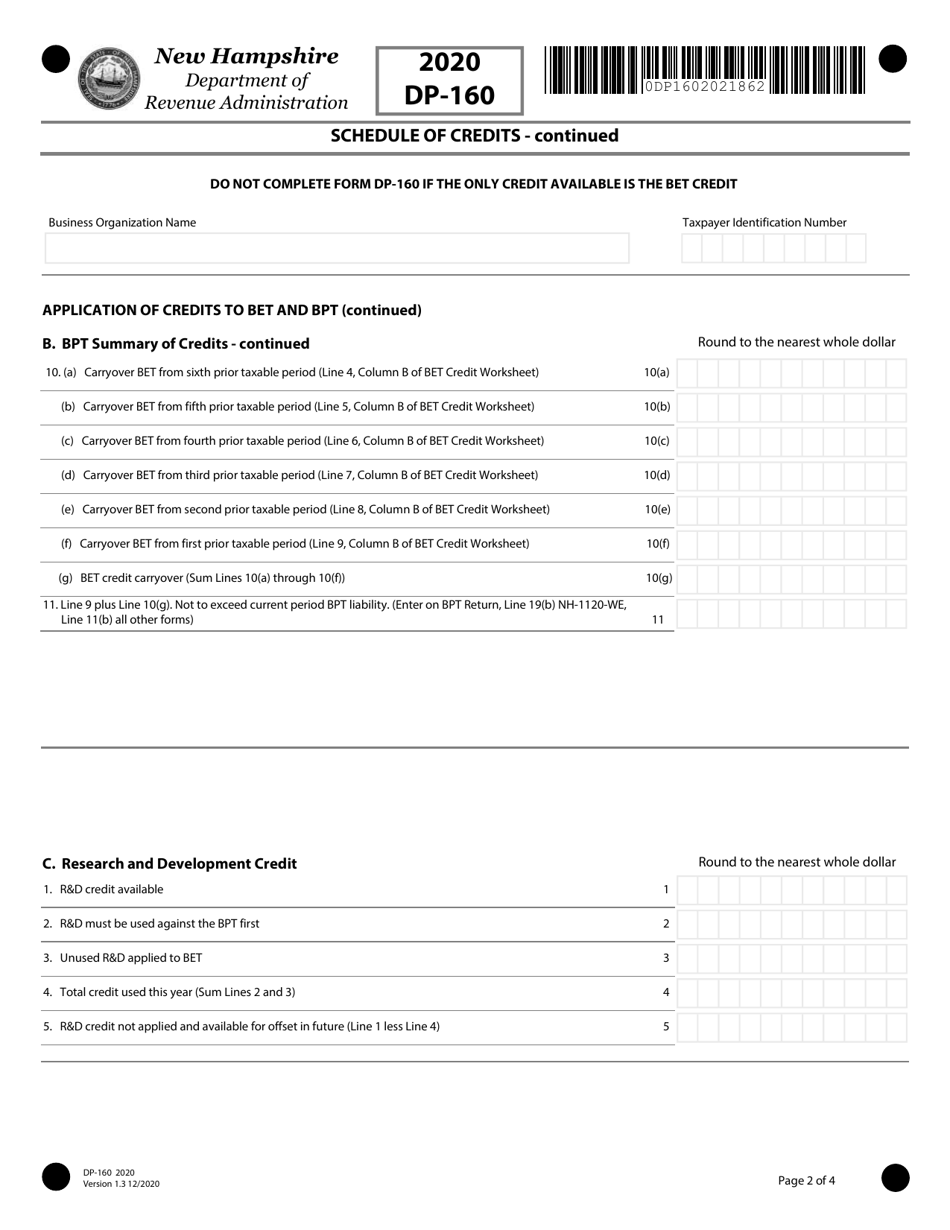

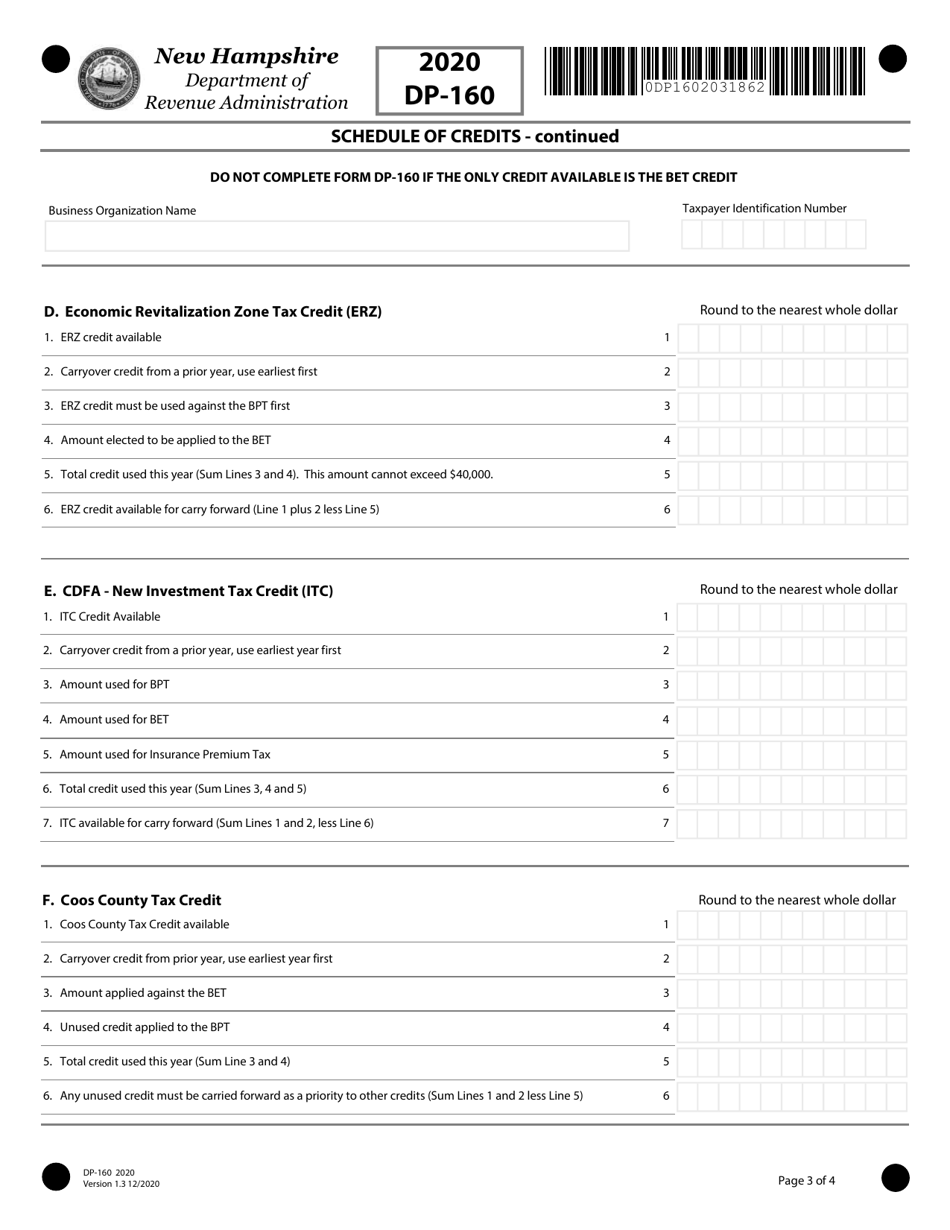

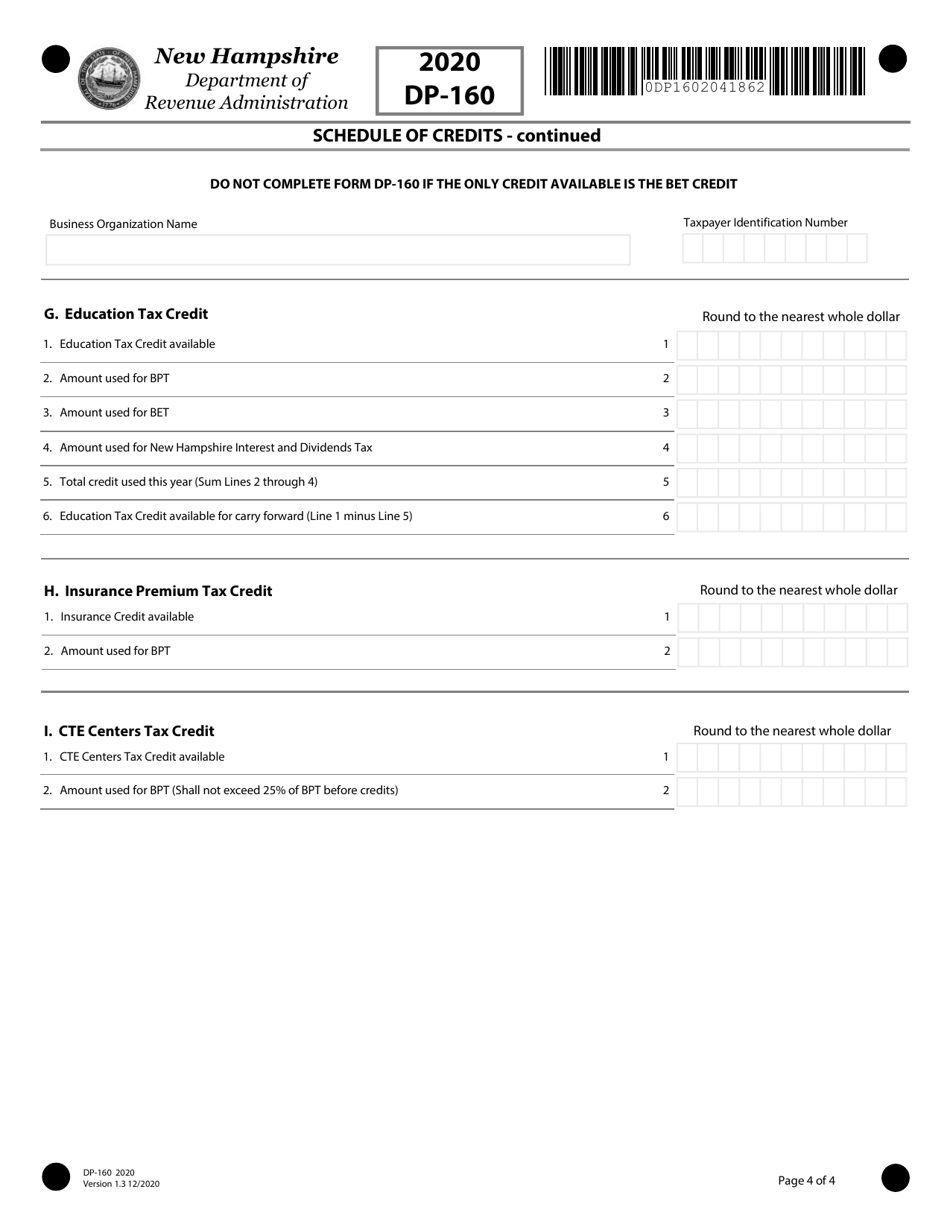

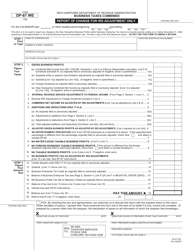

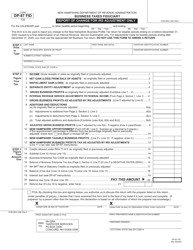

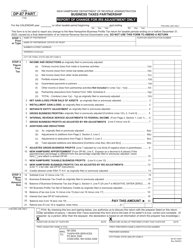

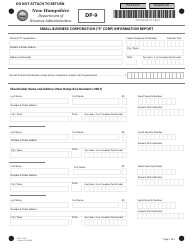

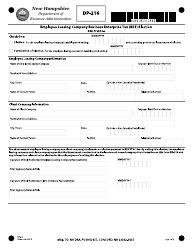

Form DP-160

for the current year.

Form DP-160 Schedule for Business Enterprise and Business Profits Tax Credits - New Hampshire

What Is Form DP-160?

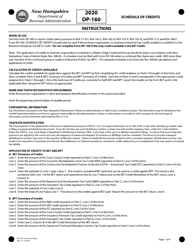

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-160?

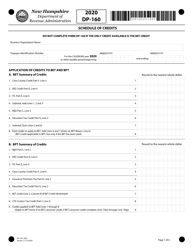

A: Form DP-160 is a schedule for claiming business enterprise and business profits tax credits in New Hampshire.

Q: What is the purpose of Form DP-160?

A: The purpose of Form DP-160 is to allow businesses to claim tax credits for specific activities or investments.

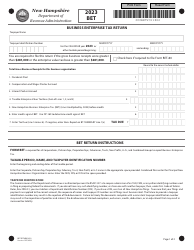

Q: Who needs to file Form DP-160?

A: Businesses in New Hampshire that are eligible for business enterprise and business profits tax credits need to file Form DP-160.

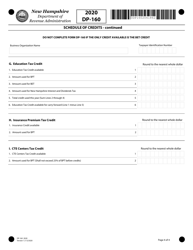

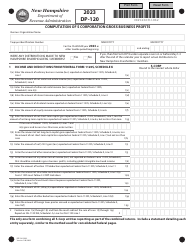

Q: What types of tax credits can be claimed on Form DP-160?

A: Form DP-160 allows for the claiming of various tax credits, such as research and development tax credits and sustainable energy tax credits.

Q: When is the deadline for filing Form DP-160?

A: The deadline for filing Form DP-160 depends on the specific tax year and should be checked with the New Hampshire Department of Revenue Administration.

Q: Is there a fee for filing Form DP-160?

A: No, there is no fee for filing Form DP-160.

Q: Are there any additional requirements for filing Form DP-160?

A: Yes, businesses may need to provide supporting documentation or evidence to claim certain tax credits on Form DP-160.

Q: What should I do if I have questions or need assistance with Form DP-160?

A: If you have questions or need assistance with Form DP-160, you can contact the New Hampshire Department of Revenue Administration for guidance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-160 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.