This version of the form is not currently in use and is provided for reference only. Download this version of

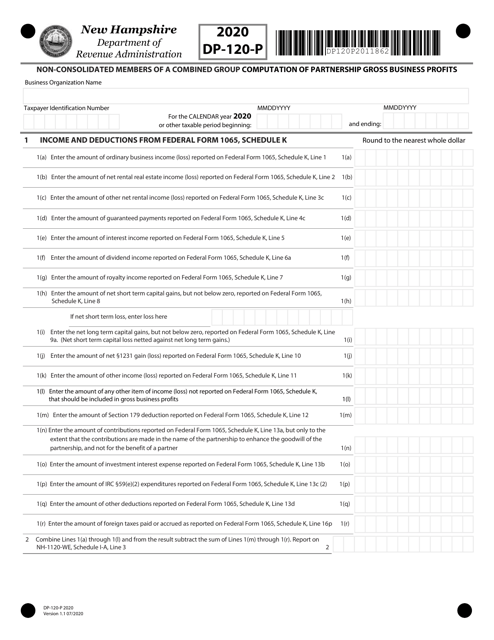

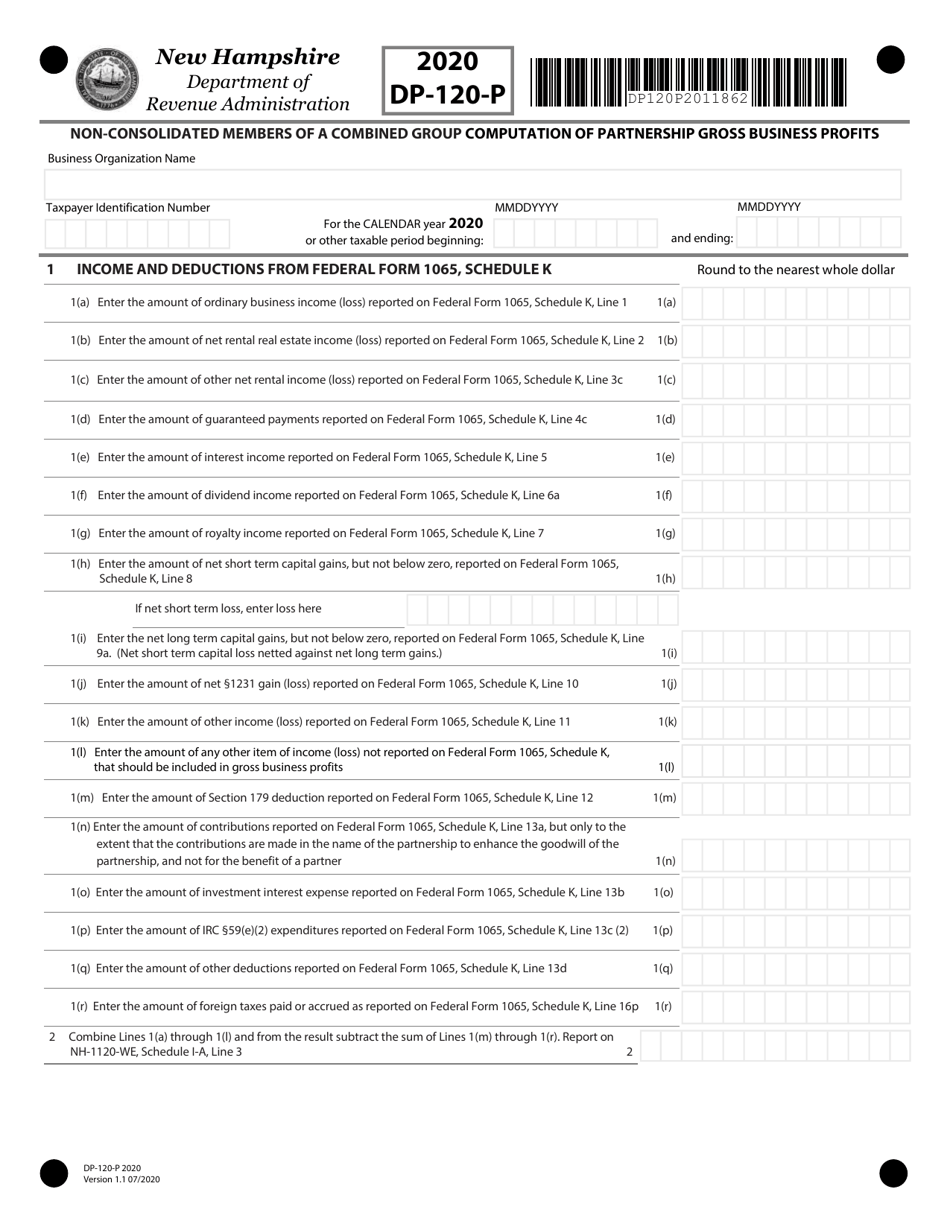

Form DP-120-P

for the current year.

Form DP-120-P Non-consolidated Members of a Combined Group Computation of Partnership Gross Business Profits - New Hampshire

What Is Form DP-120-P?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-120-P?

A: Form DP-120-P is a form used to compute the partnership gross business profits for non-consolidated members of a combined group in New Hampshire.

Q: Who needs to file Form DP-120-P?

A: Non-consolidated members of a combined group in New Hampshire need to file Form DP-120-P.

Q: What is the purpose of Form DP-120-P?

A: The purpose of Form DP-120-P is to calculate the partnership gross business profits for non-consolidated members of a combined group.

Q: Do I need to attach any supporting documents with Form DP-120-P?

A: It is recommended to review the instructions provided with Form DP-120-P to determine if any supporting documents need to be attached.

Q: What if I made an error on my filed Form DP-120-P?

A: If an error was made on a filed Form DP-120-P, you may need to file an amended return. Please consult with the New Hampshire Department of Revenue Administration for guidance.

Q: Is Form DP-120-P used for individual partners or the partnership as a whole?

A: Form DP-120-P is used for non-consolidated members of a combined group, not for individual partners or the partnership as a whole.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-120-P by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.