This version of the form is not currently in use and is provided for reference only. Download this version of

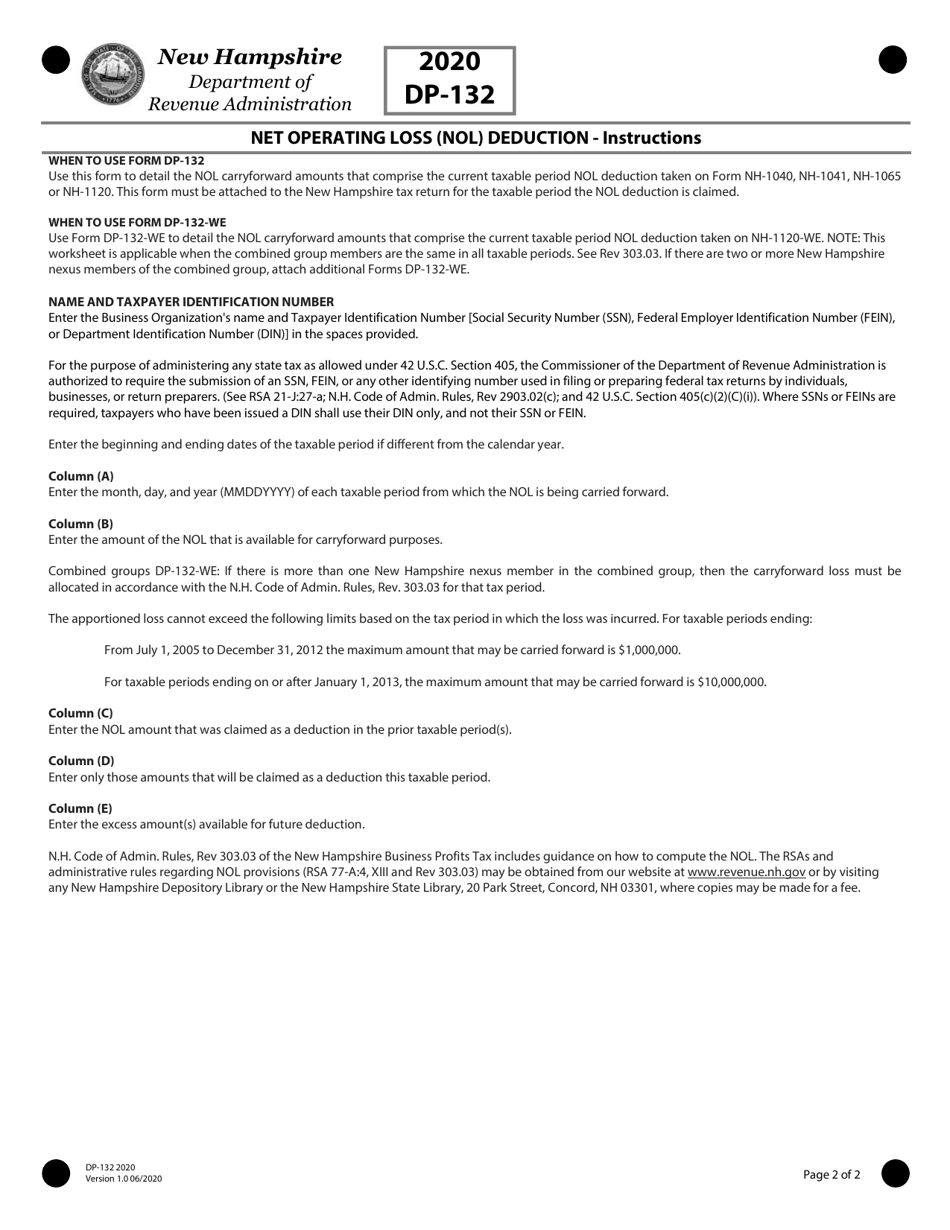

Form DP-132

for the current year.

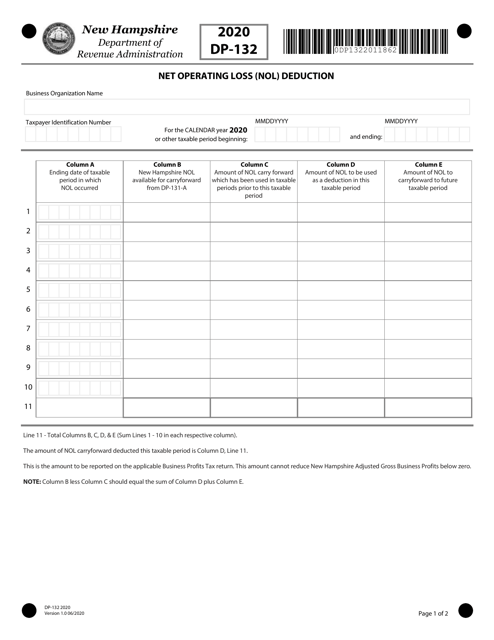

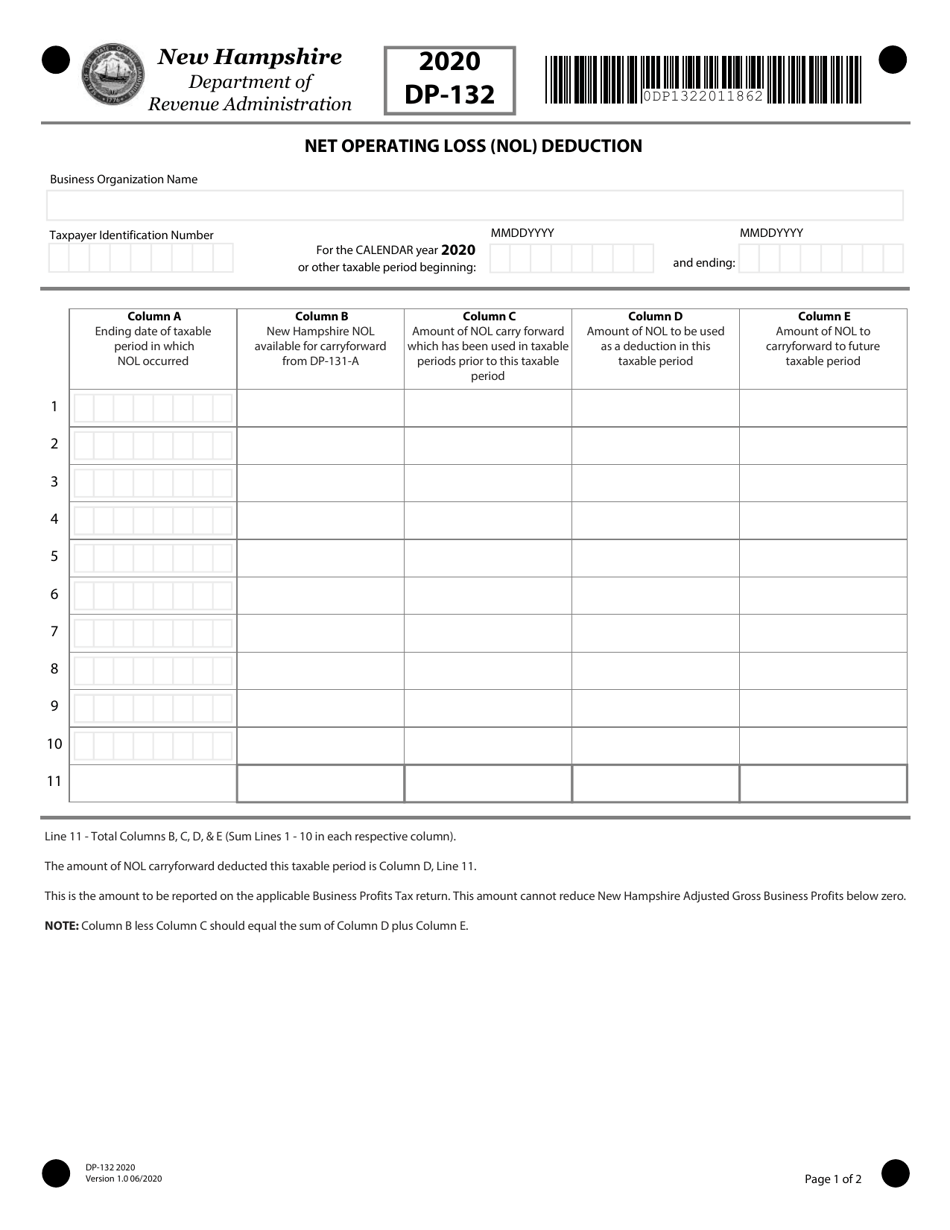

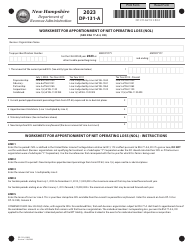

Form DP-132 Net Operating Loss (Nol) Deduction - New Hampshire

What Is Form DP-132?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-132?

A: Form DP-132 is the Net Operating Loss (NOL) Deduction form for taxpayers in New Hampshire.

Q: What is the Net Operating Loss Deduction?

A: The Net Operating Loss Deduction allows taxpayers to deduct losses from one year against income in another year.

Q: Who needs to file Form DP-132?

A: Taxpayers in New Hampshire who have a net operating loss that they want to carry forward or carry back must file Form DP-132.

Q: What can be deducted using Form DP-132?

A: You can deduct the net operating loss from your New Hampshire taxable income.

Q: Is there a time limit for claiming the deduction?

A: Yes, the deduction must be claimed within 7 years from the end of the tax year in which the loss occurred.

Q: Do I need to attach any supporting documents with Form DP-132?

A: Yes, you need to attach a copy of your federal net operating loss carryback or carryforward determination.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-132 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.