This version of the form is not currently in use and is provided for reference only. Download this version of

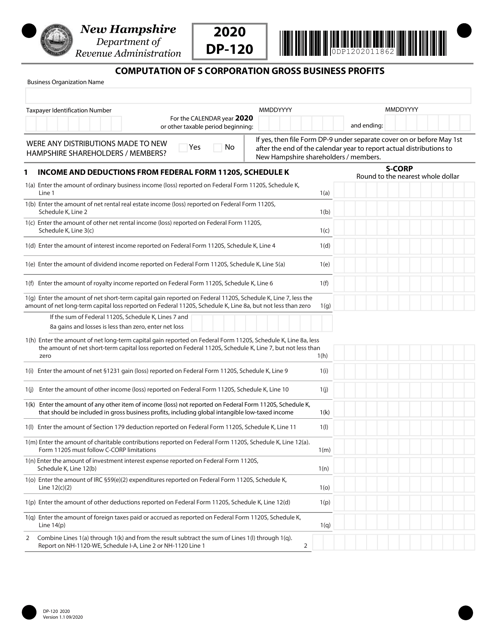

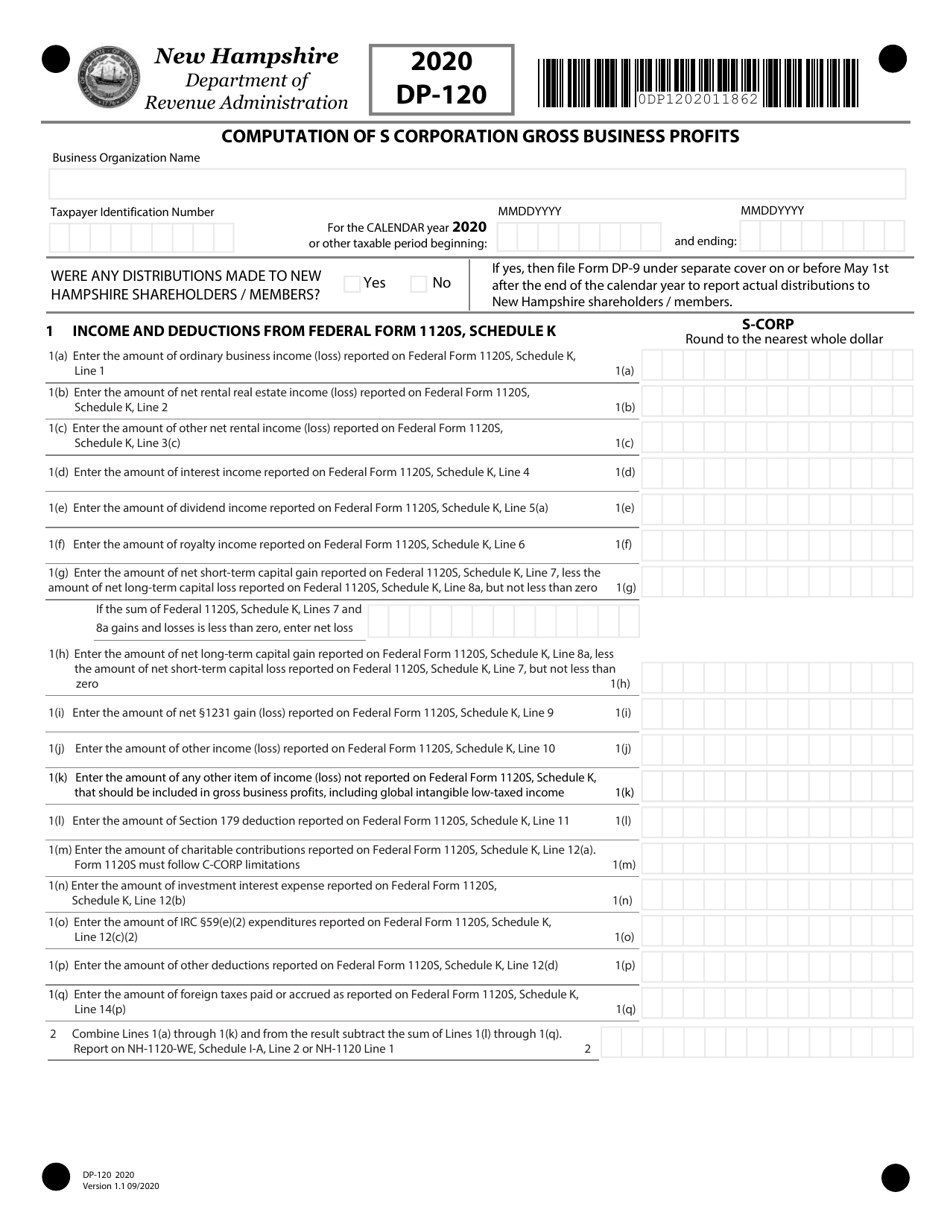

Form DP-120

for the current year.

Form DP-120 Computation of S-Corporation Gross Business Profits - New Hampshire

What Is Form DP-120?

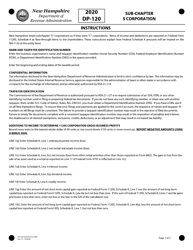

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-120?

A: Form DP-120 is the Computation of S-Corporation Gross Business Profits for New Hampshire.

Q: Who needs to file Form DP-120?

A: S-Corporations in New Hampshire need to file Form DP-120 to compute their gross business profits.

Q: What is the purpose of Form DP-120?

A: The purpose of Form DP-120 is to calculate the gross business profits of S-Corporations in New Hampshire.

Q: When is the deadline to file Form DP-120?

A: The deadline to file Form DP-120 is usually April 15th of the following tax year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form DP-120. It is important to file the form on time to avoid any penalties.

Q: Do I need to include any supporting documents with Form DP-120?

A: You may need to include supporting documents such as schedules and statements to substantiate the figures entered on Form DP-120.

Q: Who should I contact for more information about Form DP-120?

A: For more information about Form DP-120, you can contact the New Hampshire Department of Revenue Administration.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-120 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.