This version of the form is not currently in use and is provided for reference only. Download this version of

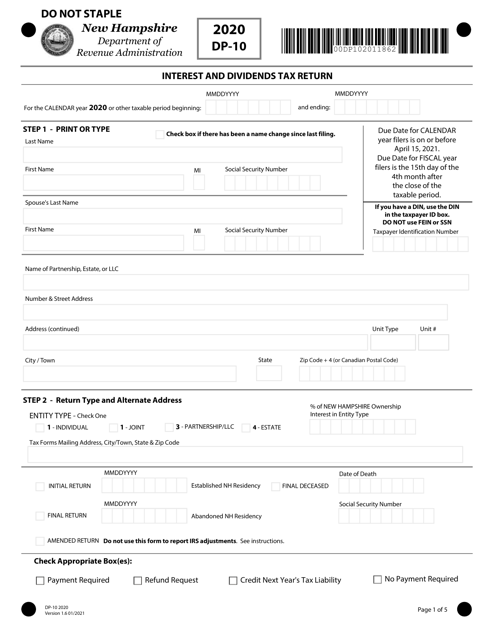

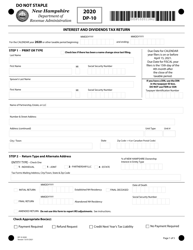

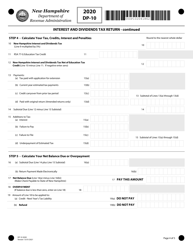

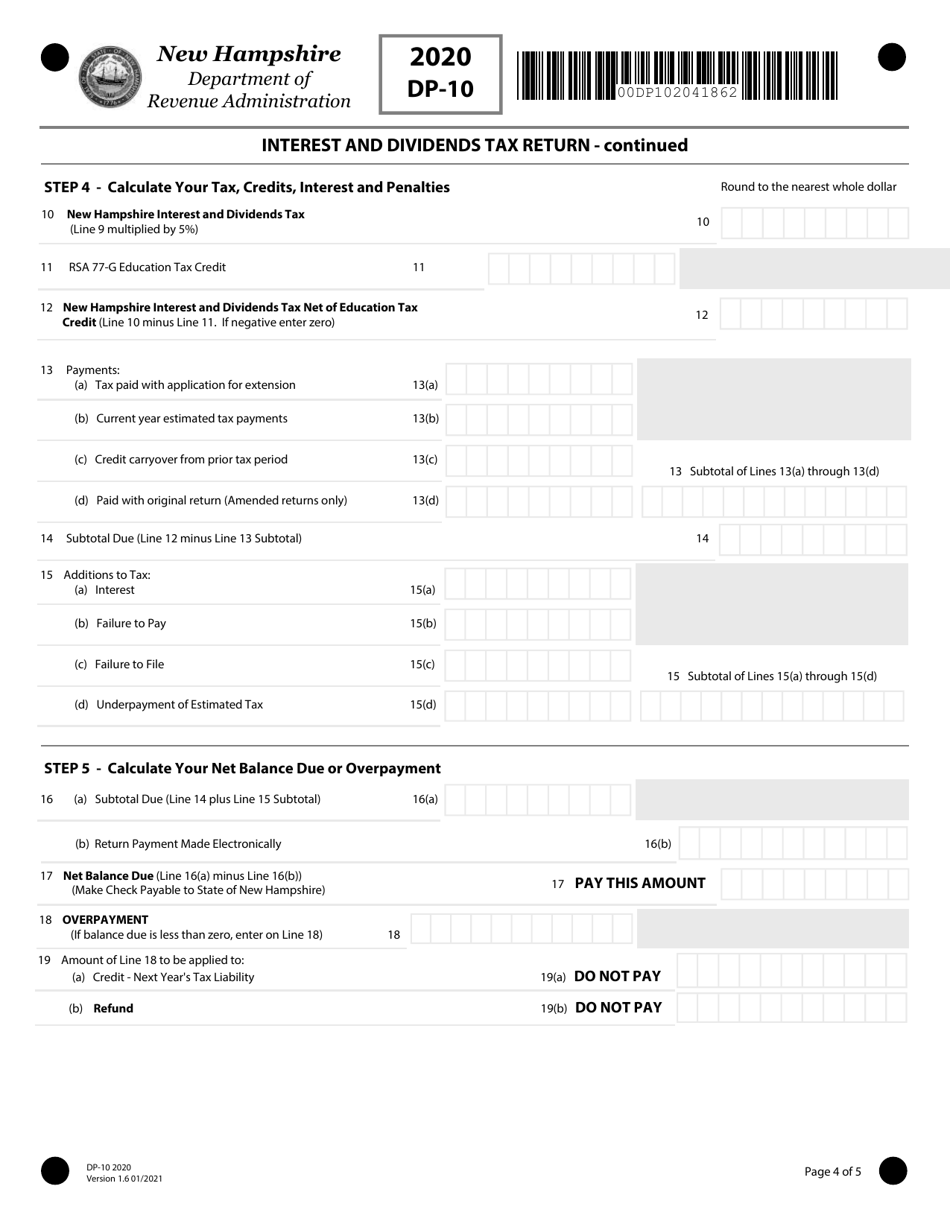

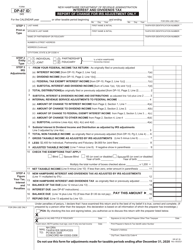

Form DP-10

for the current year.

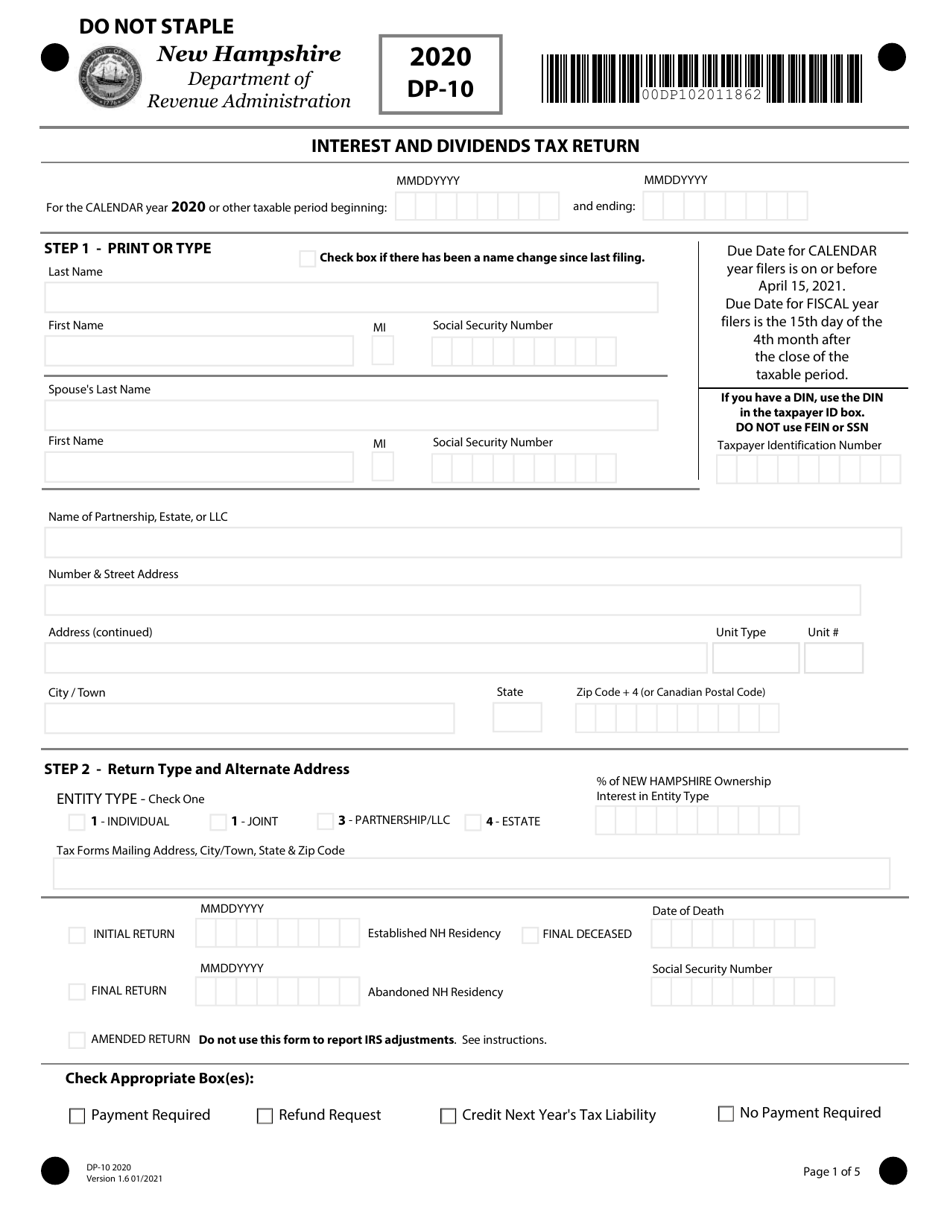

Form DP-10 Interest and Dividends Tax Return - New Hampshire

What Is Form DP-10?

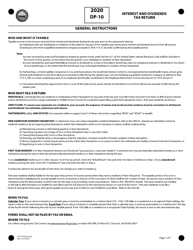

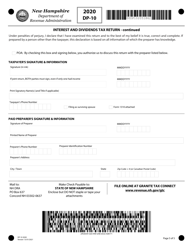

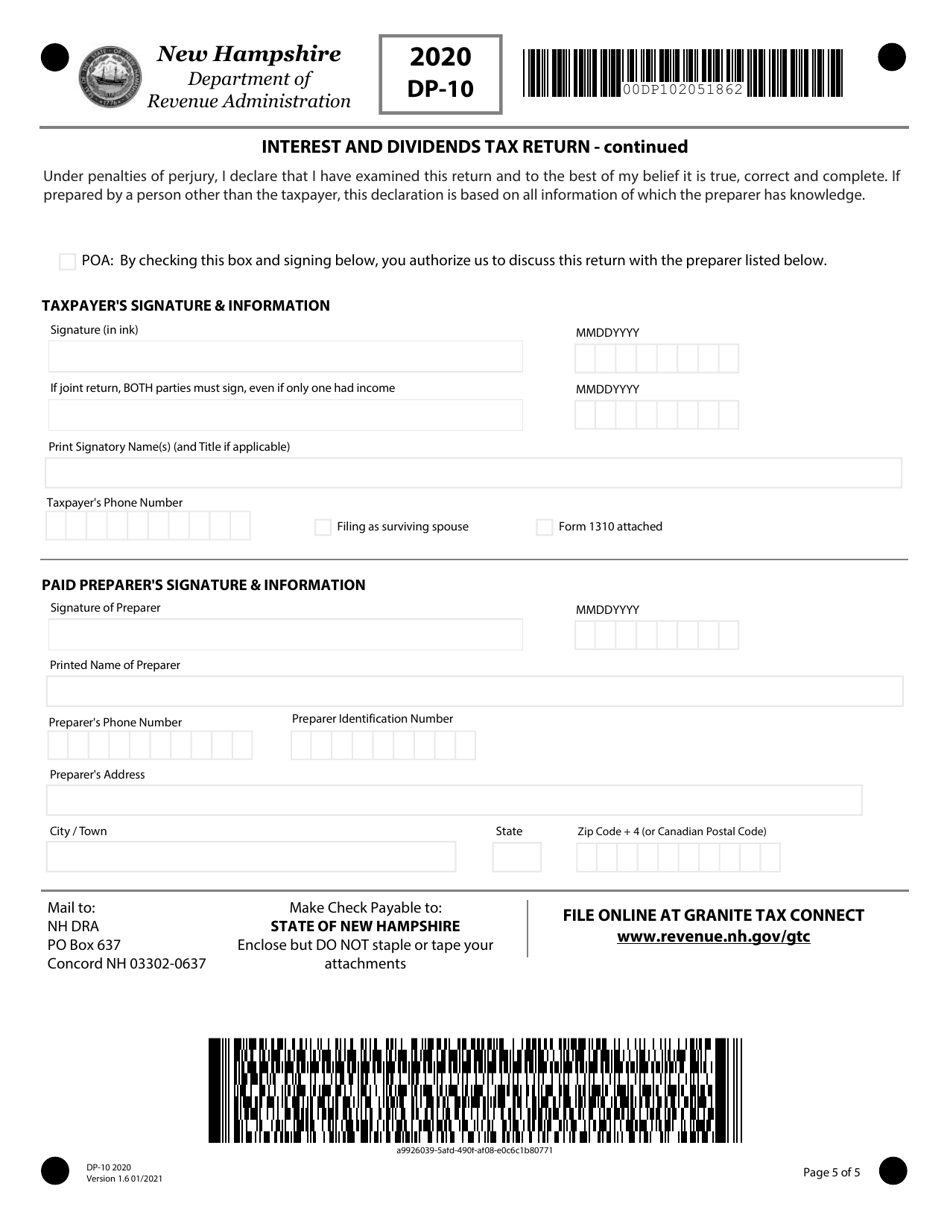

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-10?

A: Form DP-10 is the Interest and Dividends Tax Return for New Hampshire.

Q: Who needs to file Form DP-10?

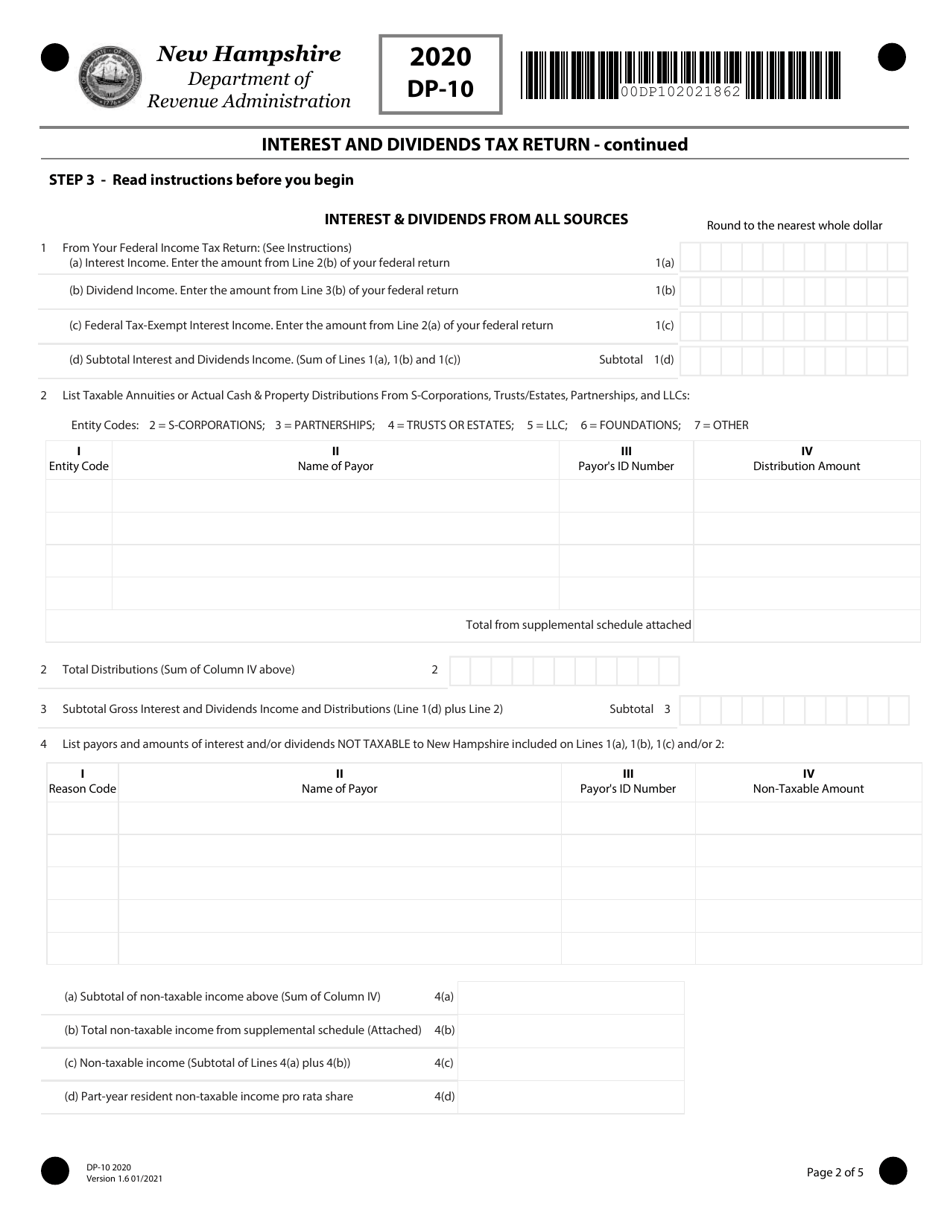

A: Any individual or entity that earned interest and dividends income in New Hampshire needs to file Form DP-10.

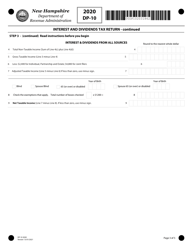

Q: What is the purpose of Form DP-10?

A: Form DP-10 is used to report and calculate the interest and dividends tax owed to New Hampshire.

Q: What income should be reported on Form DP-10?

A: All interest and dividends income earned in New Hampshire should be reported on Form DP-10.

Q: When is the due date for filing Form DP-10?

A: The due date for filing Form DP-10 is April 15th of each year.

Q: Are there any penalties for late filing of Form DP-10?

A: Yes, there are penalties for late filing of Form DP-10. It is important to file the form on time to avoid penalties and interest charges.

Q: Can I file Form DP-10 electronically?

A: Yes, New Hampshire offers the option to file Form DP-10 electronically through the NH-ETC system.

Q: Do I need to attach any supporting documents with Form DP-10?

A: No, you do not need to attach any supporting documents with Form DP-10 unless specifically requested by the New Hampshire Department of Revenue Administration.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-10 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.