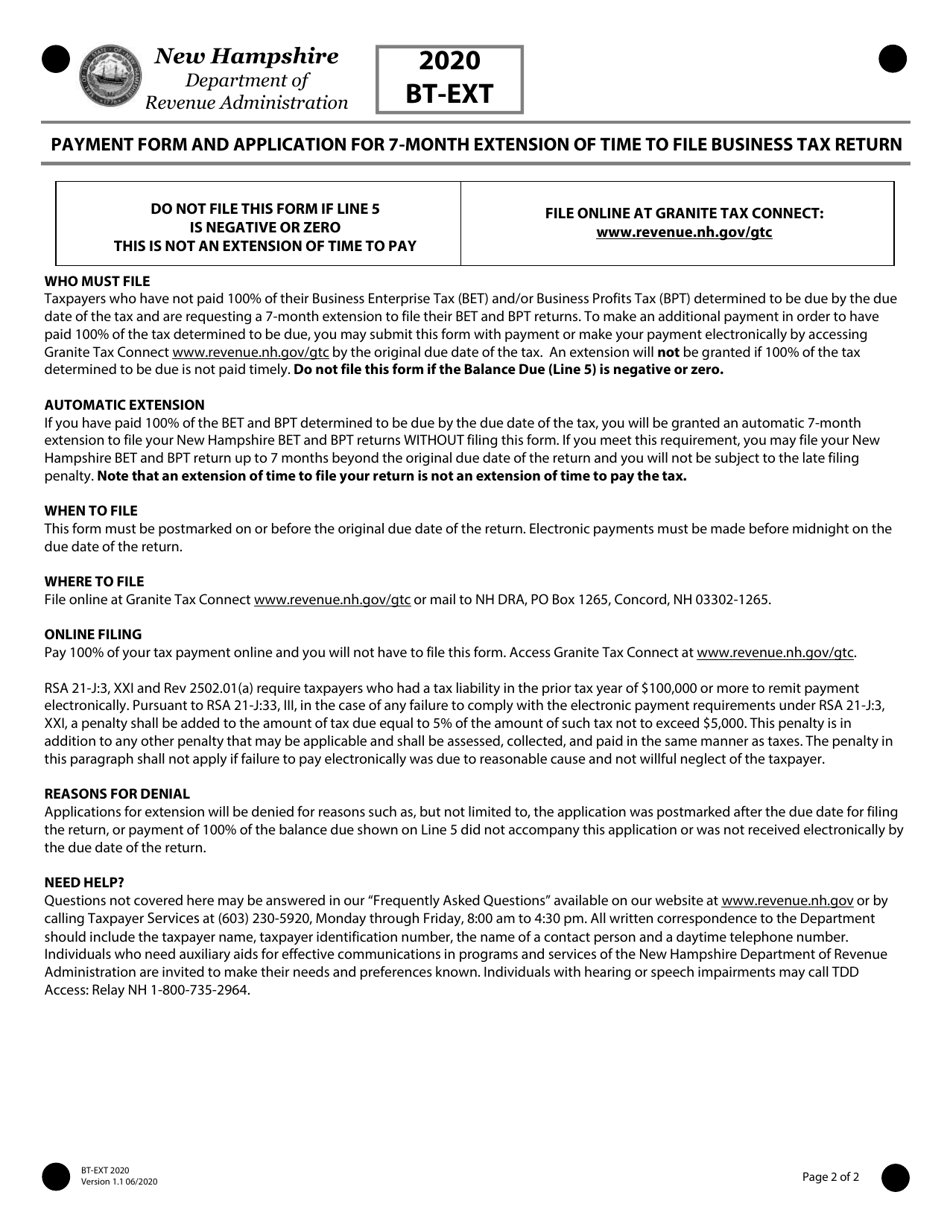

This version of the form is not currently in use and is provided for reference only. Download this version of

Form BT-EXT

for the current year.

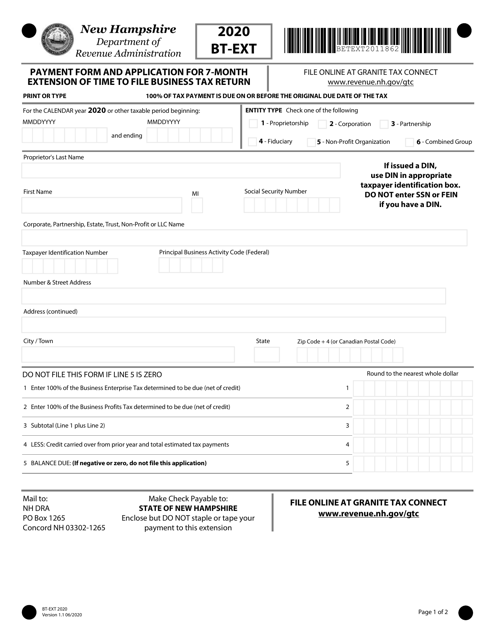

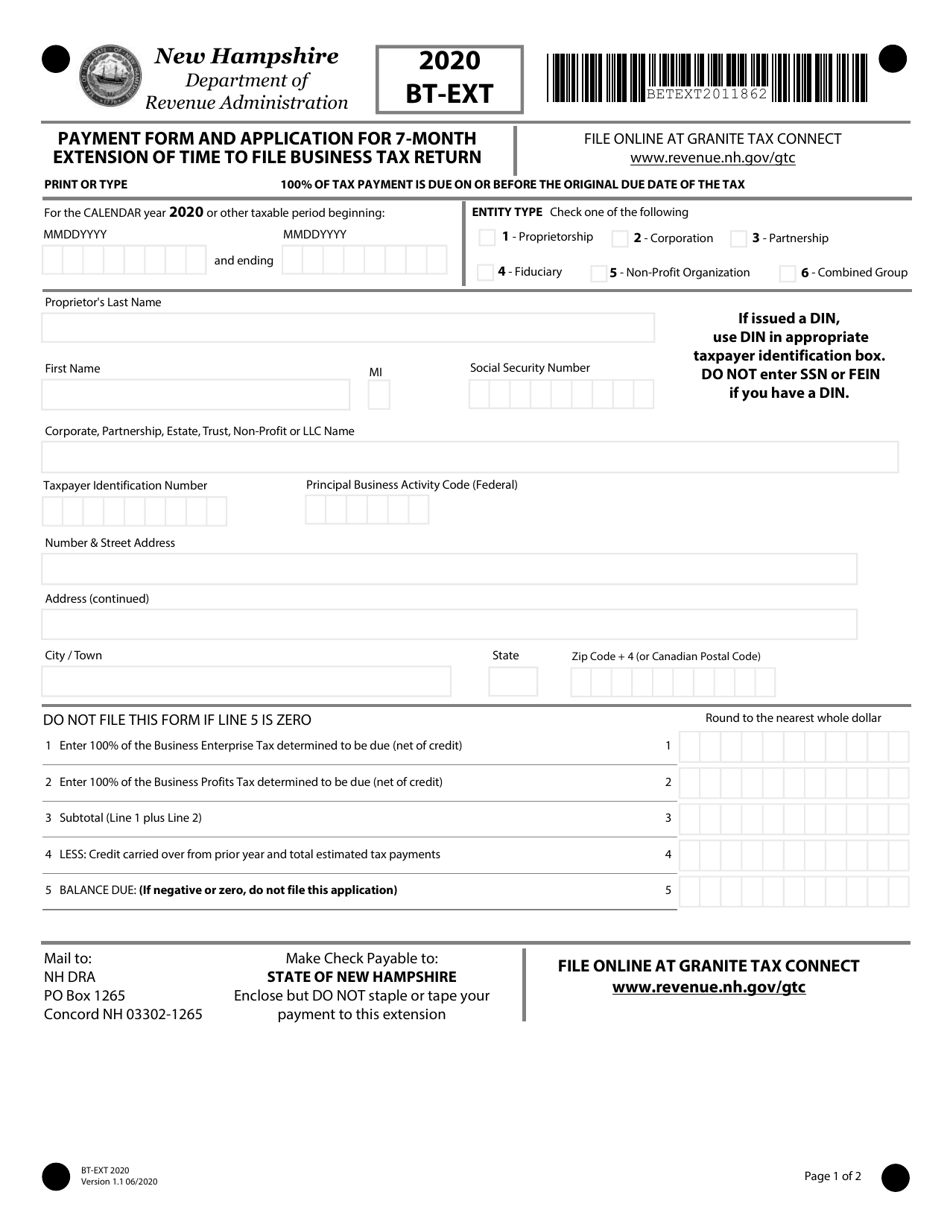

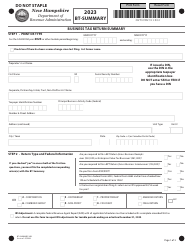

Form BT-EXT Payment Form and Application for 7-month Extension of Time to File Business Tax Return - New Hampshire

What Is Form BT-EXT?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

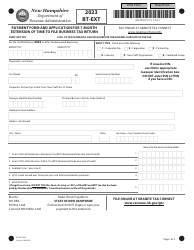

Q: What is Form BT-EXT?

A: Form BT-EXT is a payment form and application for a 7-month extension of time to file a business tax return in New Hampshire.

Q: Who needs to use Form BT-EXT?

A: Businesses in New Hampshire that need additional time to file their tax returns and make payments may need to use Form BT-EXT.

Q: What is the purpose of Form BT-EXT?

A: The purpose of Form BT-EXT is to request an extension of time to file a business tax return in New Hampshire and make the necessary payment.

Q: How long is the extension granted by Form BT-EXT?

A: Form BT-EXT allows for a 7-month extension of time to file a business tax return in New Hampshire.

Q: What information is required on Form BT-EXT?

A: Form BT-EXT requires information such as the business name, address, identification number, estimated tax liability, and the amount of payment being made.

Q: Are there any fees associated with filing Form BT-EXT?

A: No, there are no fees associated with filing Form BT-EXT.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-EXT by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.