This version of the form is not currently in use and is provided for reference only. Download this version of

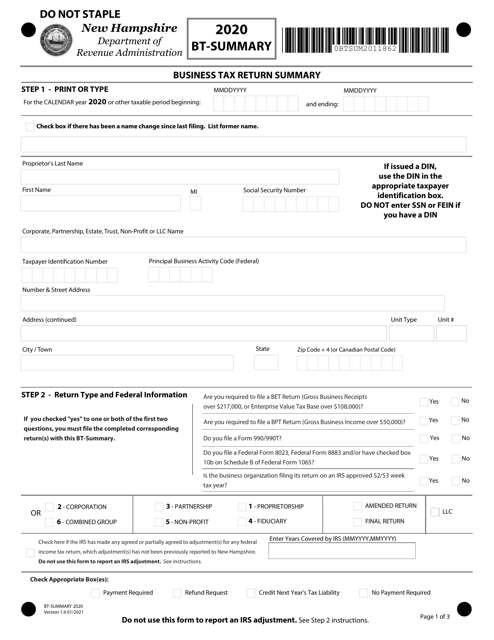

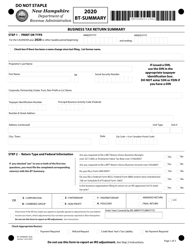

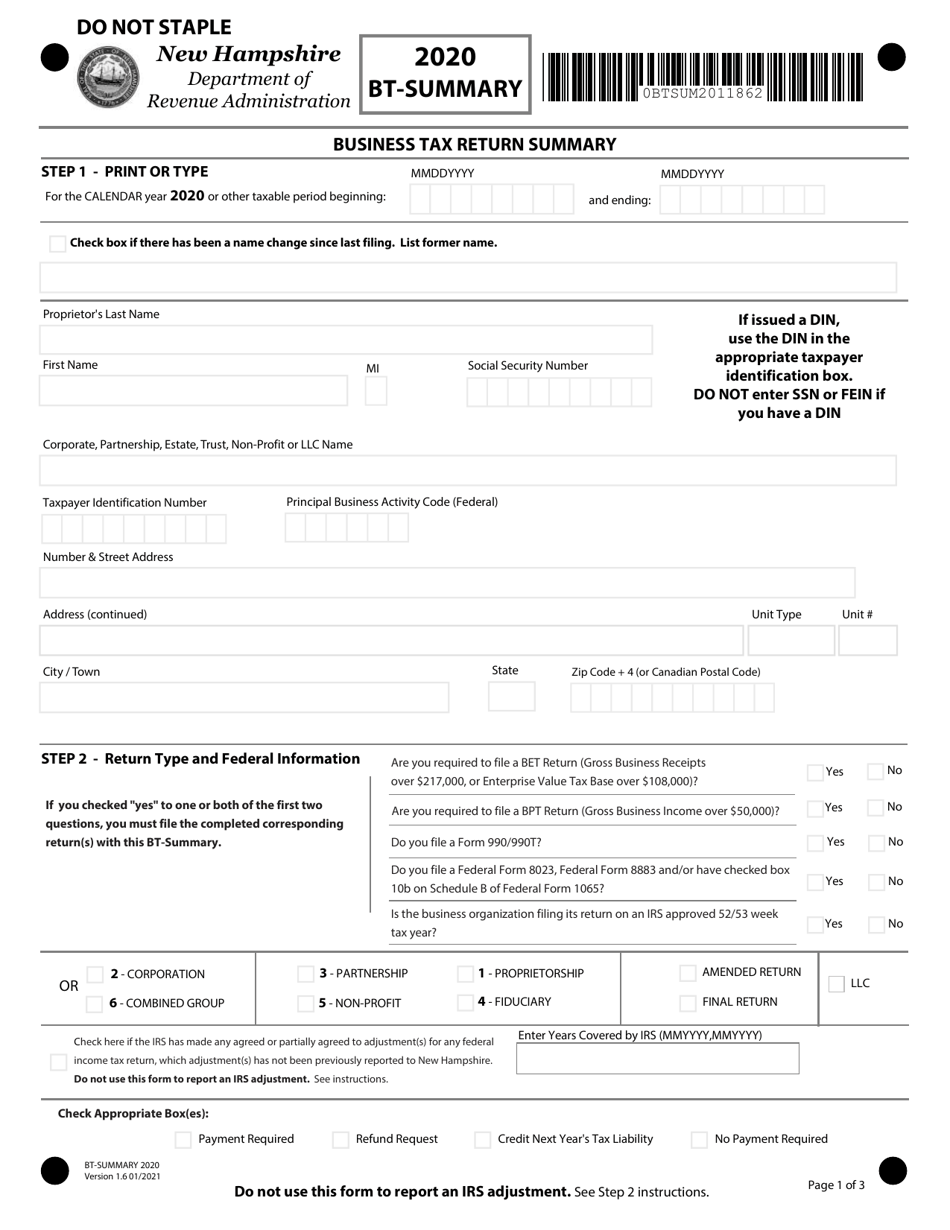

Form BT-SUMMARY

for the current year.

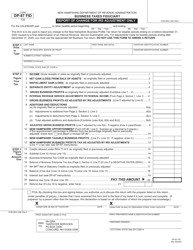

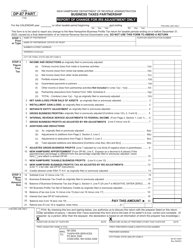

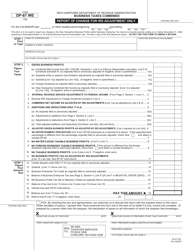

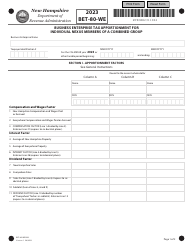

Form BT-SUMMARY Business Tax Return Summary - New Hampshire

What Is Form BT-SUMMARY?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a BT-SUMMARY?

A: BT-SUMMARY stands for Business Tax Return Summary.

Q: What is the purpose of a Business Tax Return Summary?

A: The purpose of a Business Tax Return Summary is to provide a concise overview of a business' tax return.

Q: Is the BT-SUMMARY specific to New Hampshire?

A: Yes, the BT-SUMMARY is specific to the state of New Hampshire.

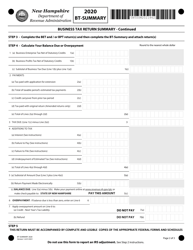

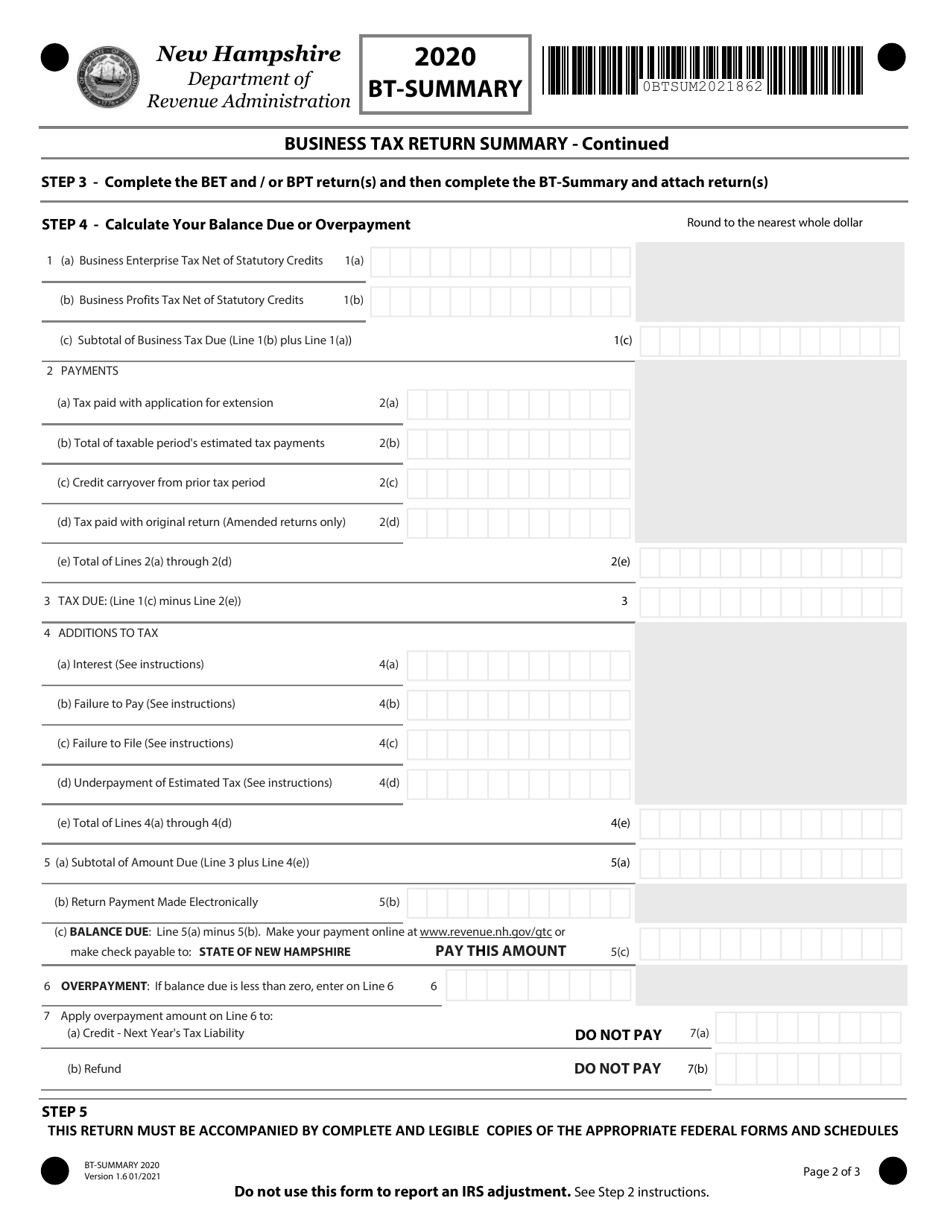

Q: What information does the BT-SUMMARY include?

A: The BT-SUMMARY includes key details such as the business name, tax year, total income, deductions, and the amount of tax owed.

Q: Do all businesses need to file a BT-SUMMARY?

A: No, only businesses that are required to file a tax return in New Hampshire need to submit a BT-SUMMARY.

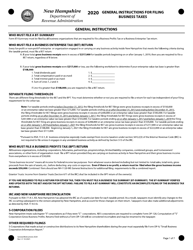

Q: Are there any specific instructions for completing the BT-SUMMARY?

A: Yes, the New Hampshire Department of Revenue Administration provides instructions on how to complete the BT-SUMMARY form.

Q: Does the BT-SUMMARY require any attachments?

A: It depends on the specific requirements of the New Hampshire Department of Revenue Administration. They may require additional documentation to be attached to the BT-SUMMARY.

Q: When is the deadline for submitting the BT-SUMMARY?

A: The deadline for submitting the BT-SUMMARY is typically the same as the deadline for filing the business tax return in New Hampshire. It is important to check the official guidelines for the current year's deadline.

Q: What should I do if I have questions or need assistance with the BT-SUMMARY?

A: If you have questions or need assistance with the BT-SUMMARY, you should contact the New Hampshire Department of Revenue Administration directly.

Q: Are there any penalties for late submission of the BT-SUMMARY?

A: Penalties for late submission of the BT-SUMMARY may apply. It is important to file the form on time to avoid potential penalties.

Q: Is the BT-SUMMARY form specific to a certain type of business?

A: No, the BT-SUMMARY form can be used by different types of businesses operating in New Hampshire that are required to file a tax return.

Q: Does the BT-SUMMARY form include personal income information?

A: No, the BT-SUMMARY form only includes information related to the business' income, deductions, and tax liability. Personal income information is not included.

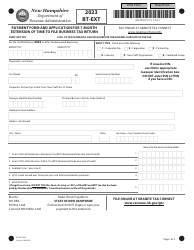

Q: Can I request an extension for filing the BT-SUMMARY?

A: Yes, you can request an extension for filing the BT-SUMMARY. However, it is important to follow the guidelines and procedures provided by the New Hampshire Department of Revenue Administration.

Q: What happens if I make an error on the BT-SUMMARY?

A: If you make an error on the BT-SUMMARY, you may be required to amend or correct the form. It is important to review and double-check your information before submitting the form.

Q: Is the BT-SUMMARY confidential?

A: The BT-SUMMARY, like other tax-related documents, is generally treated as confidential by the New Hampshire Department of Revenue Administration.

Q: Can I use a BT-SUMMARY from a previous tax year?

A: No, you should always use the most current version of the BT-SUMMARY form for the relevant tax year.

Q: Can I get a copy of my submitted BT-SUMMARY?

A: Yes, you can request a copy of your submitted BT-SUMMARY from the New Hampshire Department of Revenue Administration.

Q: What should I do if I am unable to complete the BT-SUMMARY?

A: If you are unable to complete the BT-SUMMARY, you should seek professional assistance or contact the New Hampshire Department of Revenue Administration for guidance.

Q: How long should I keep a copy of the BT-SUMMARY?

A: It is recommended to keep a copy of the BT-SUMMARY and any related tax documents for a minimum of 3 years.

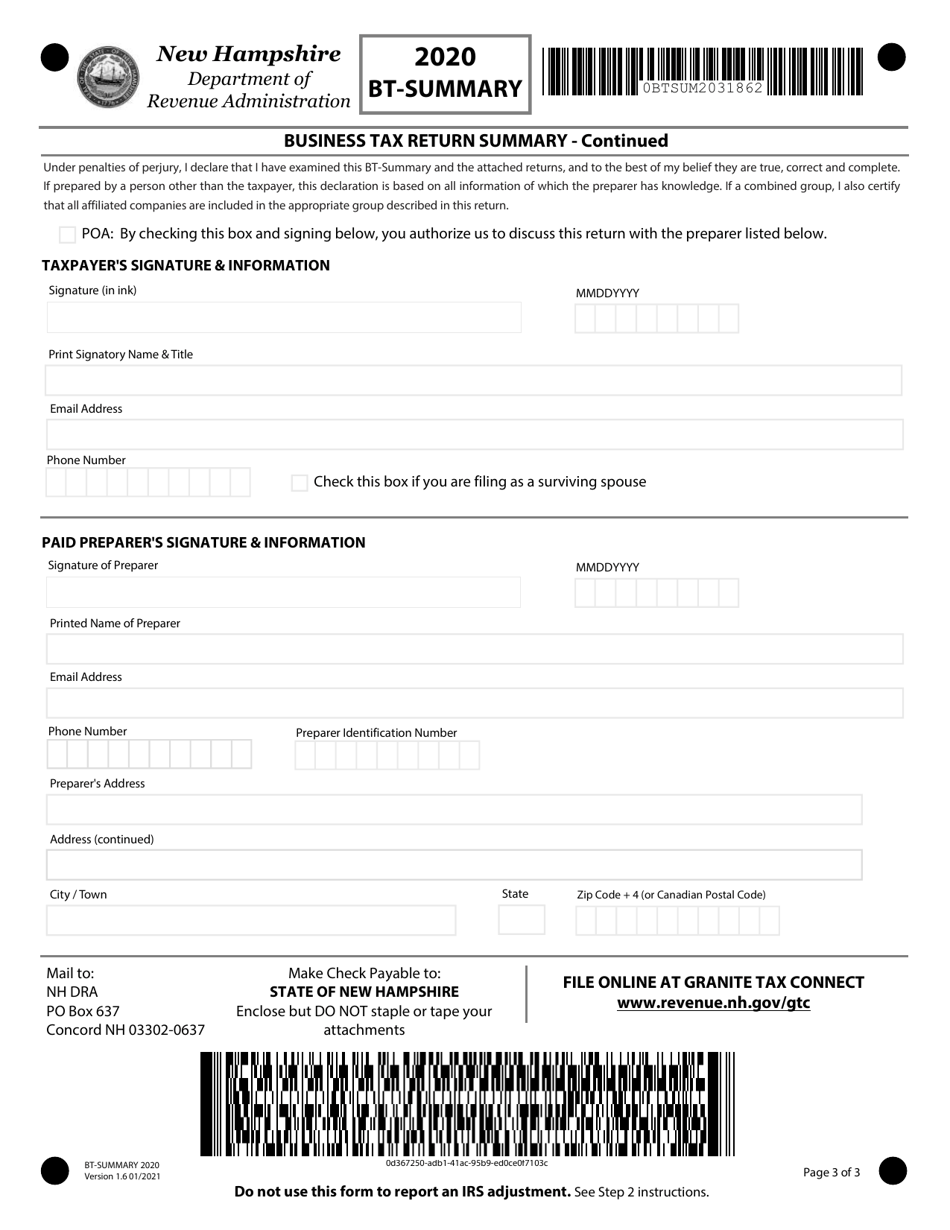

Q: Can I file the BT-SUMMARY by mail?

A: Yes, you can file the BT-SUMMARY by mail, along with any required attachments, to the address provided by the New Hampshire Department of Revenue Administration.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-SUMMARY by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.