This version of the form is not currently in use and is provided for reference only. Download this version of

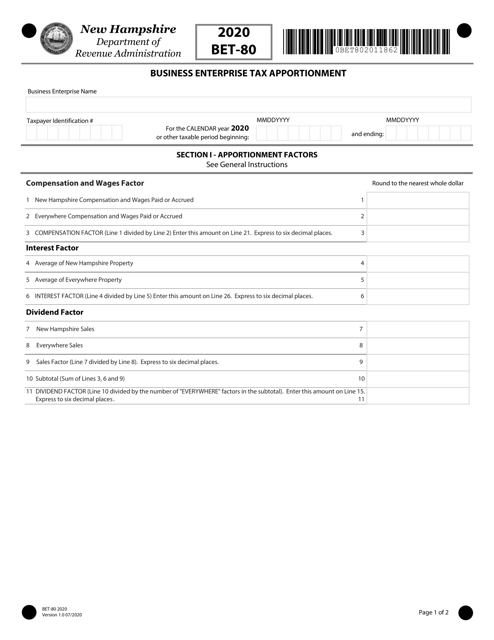

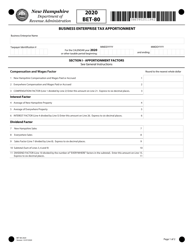

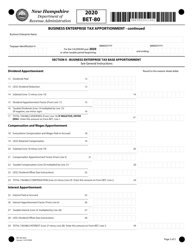

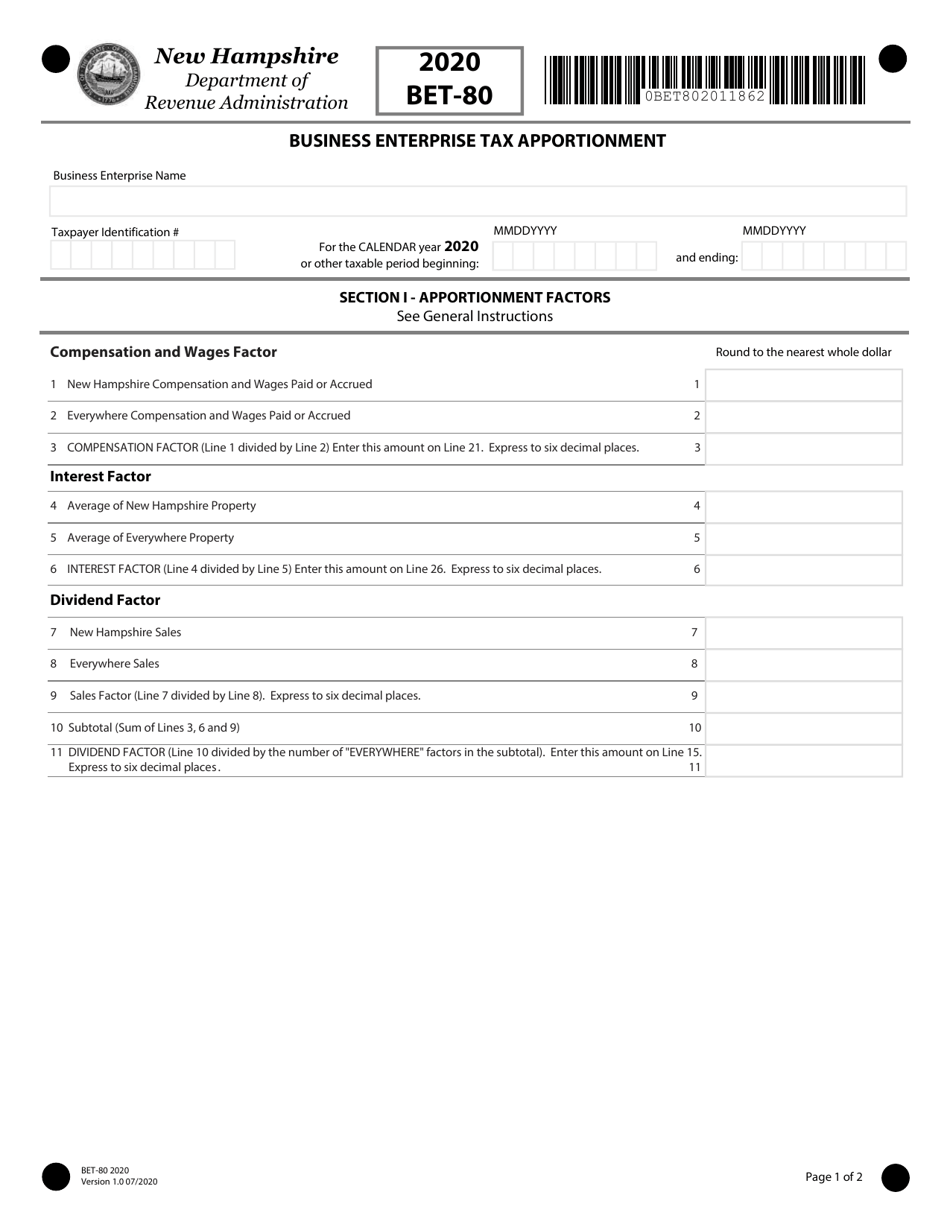

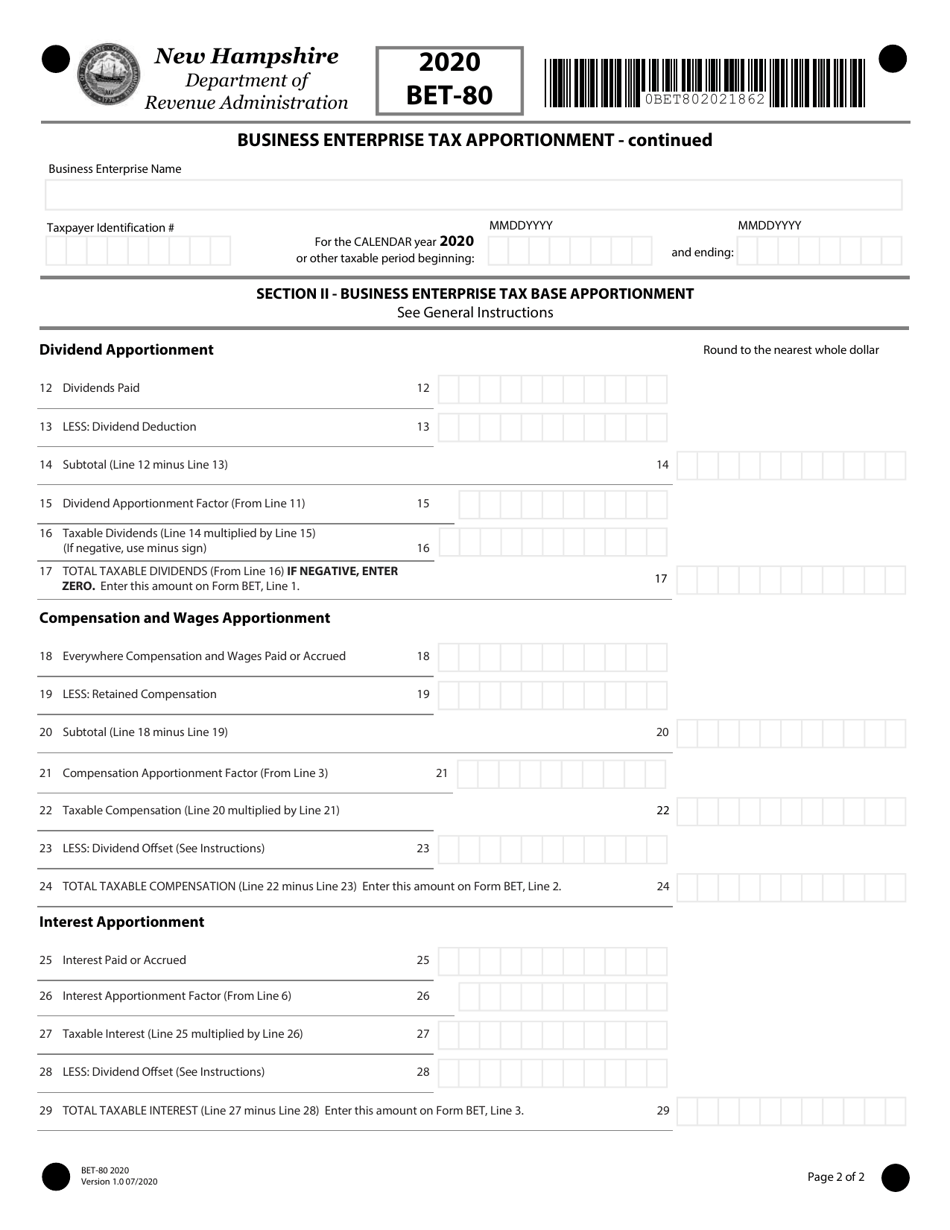

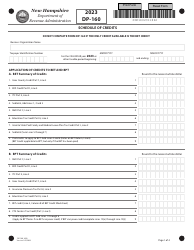

Form BET-80

for the current year.

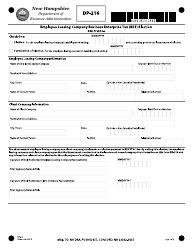

Form BET-80 Business Enterprise Tax Apportionment - New Hampshire

What Is Form BET-80?

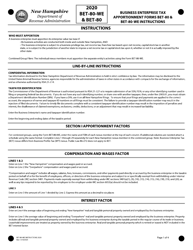

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is BET-80?

A: BET-80 is a form used for apportioning the Business Enterprise Tax in the state of New Hampshire.

Q: What is the Business Enterprise Tax (BET)?

A: The Business Enterprise Tax is a tax imposed on certain business entities in New Hampshire.

Q: Who needs to file BET-80?

A: Businesses subject to the Business Enterprise Tax in New Hampshire need to file BET-80.

Q: What is apportionment?

A: Apportionment refers to the division or allocation of the Business Enterprise Tax based on certain factors such as sales, property, and payroll.

Q: Why is apportionment necessary for the Business Enterprise Tax?

A: Apportionment is necessary to ensure that businesses are taxed fairly based on their activity in New Hampshire.

Q: What information is required on the BET-80 form?

A: The BET-80 form requires information about the business's apportionment factors such as sales, property, and payroll in New Hampshire.

Q: When is the BET-80 form due?

A: The due date for filing the BET-80 form varies depending on the taxpayer's fiscal year. It is generally due on or before the 15th day of the third month following the close of the fiscal year.

Q: Are there any penalties for late filing of BET-80?

A: Yes, there may be penalties for late filing of the BET-80 form. It is important to file the form on time to avoid any potential penalties.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BET-80 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.