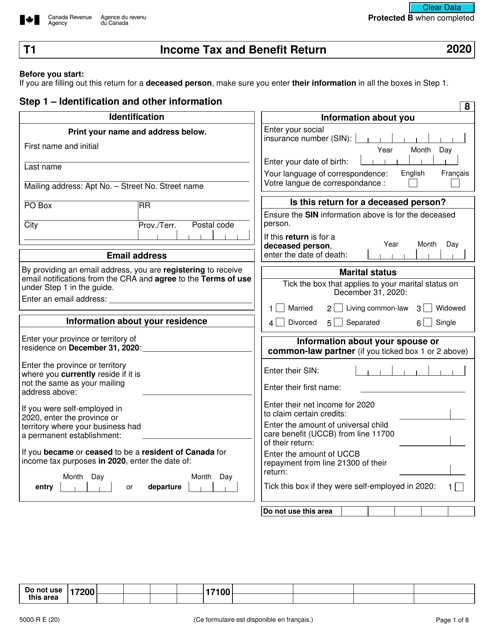

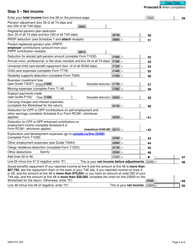

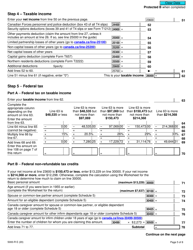

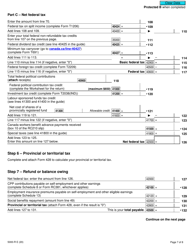

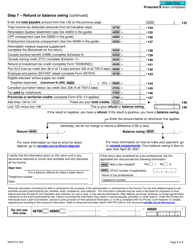

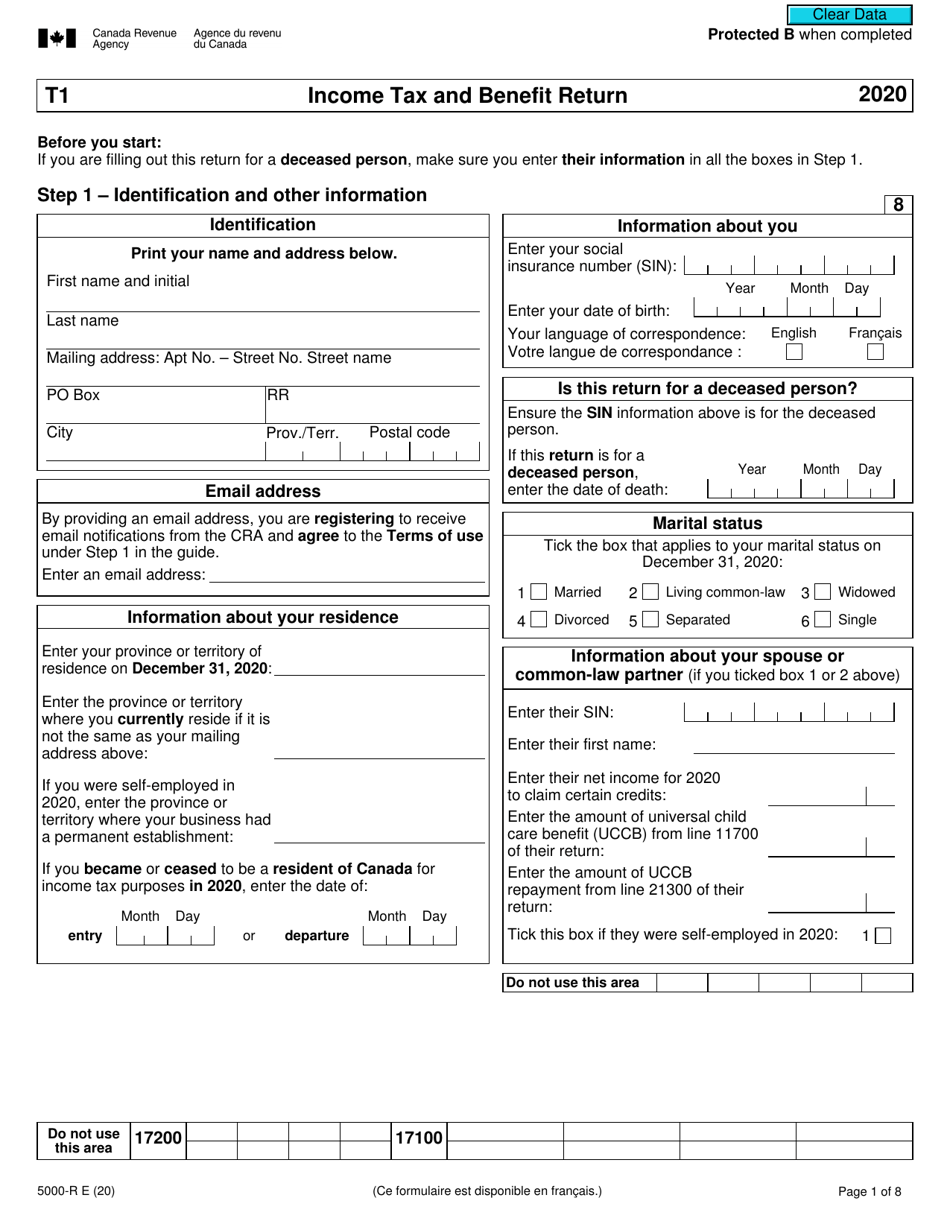

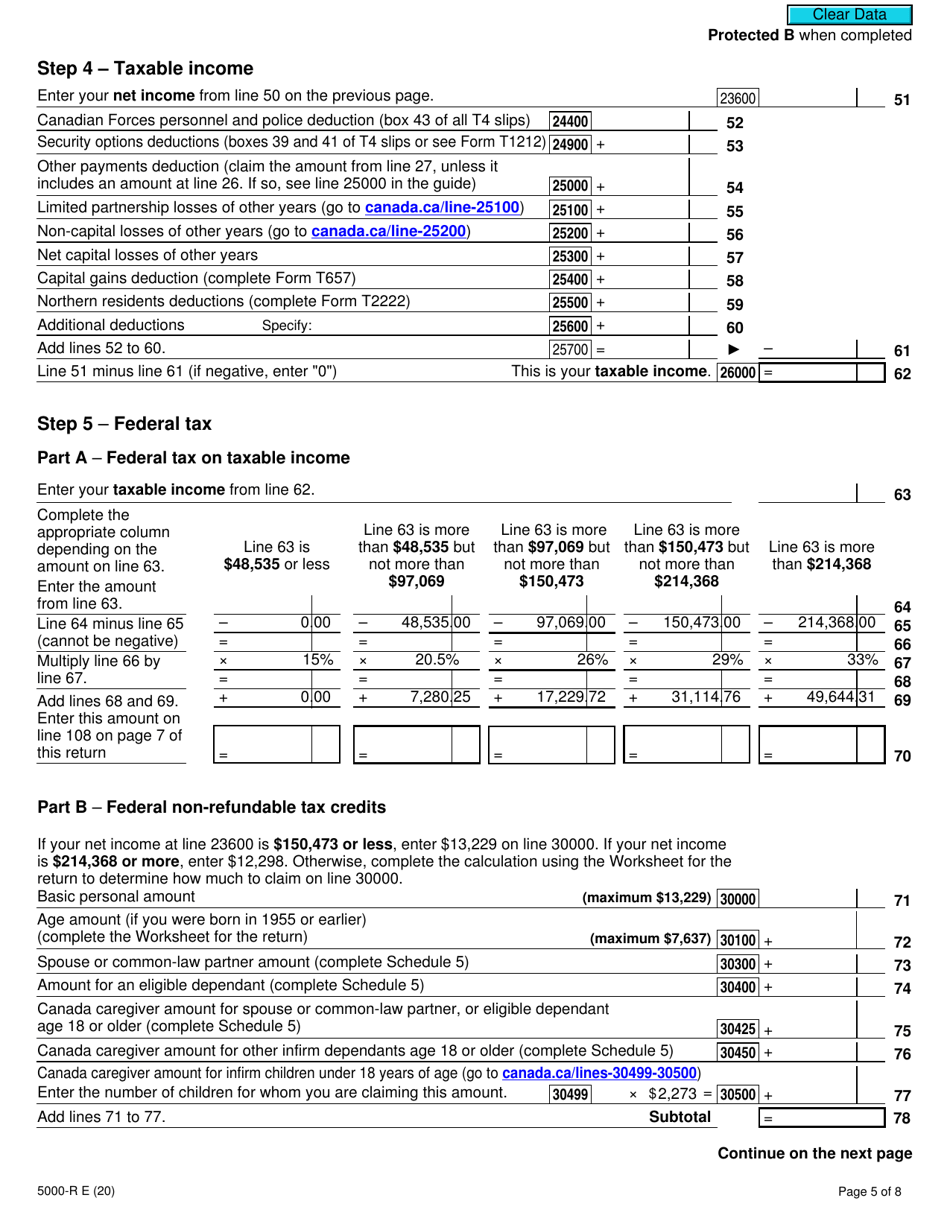

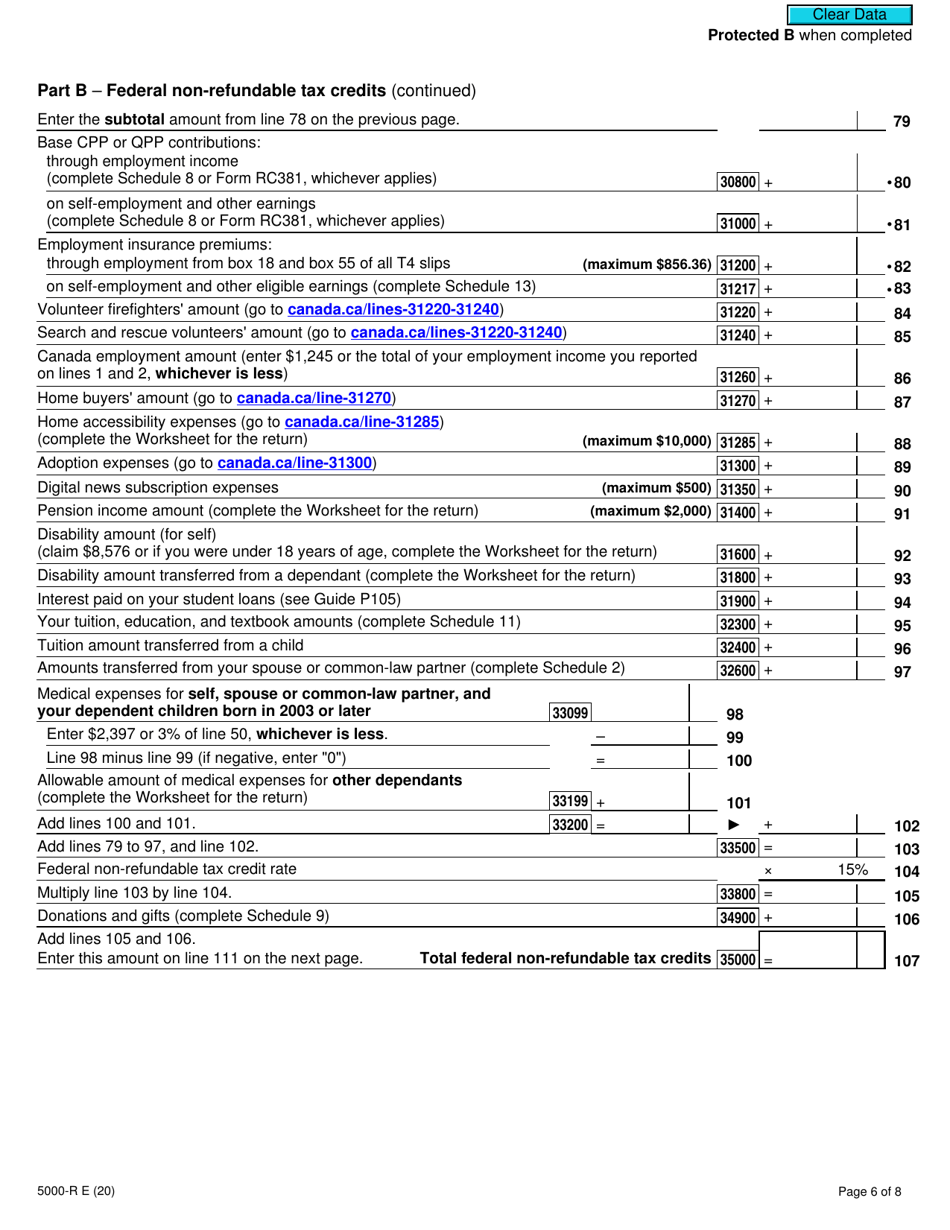

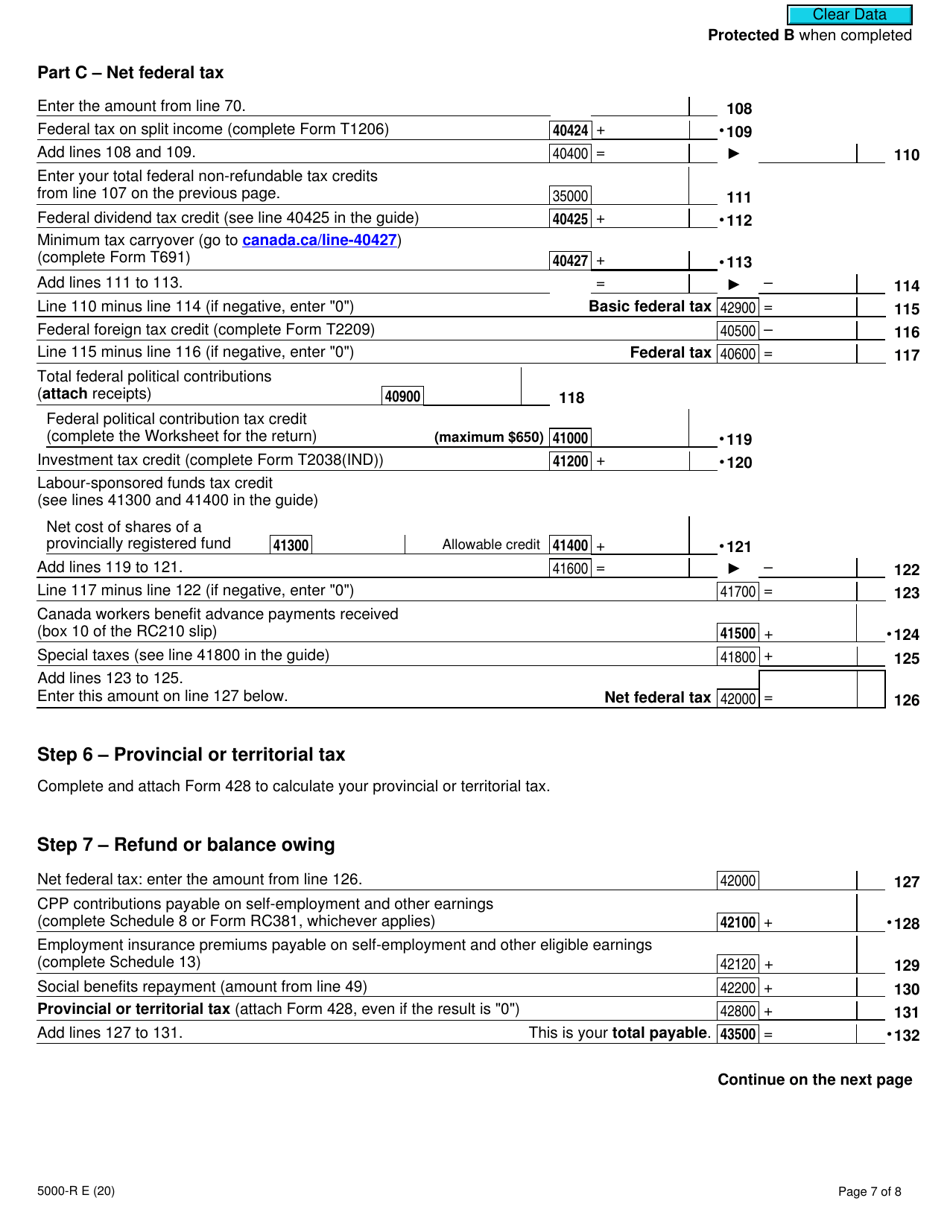

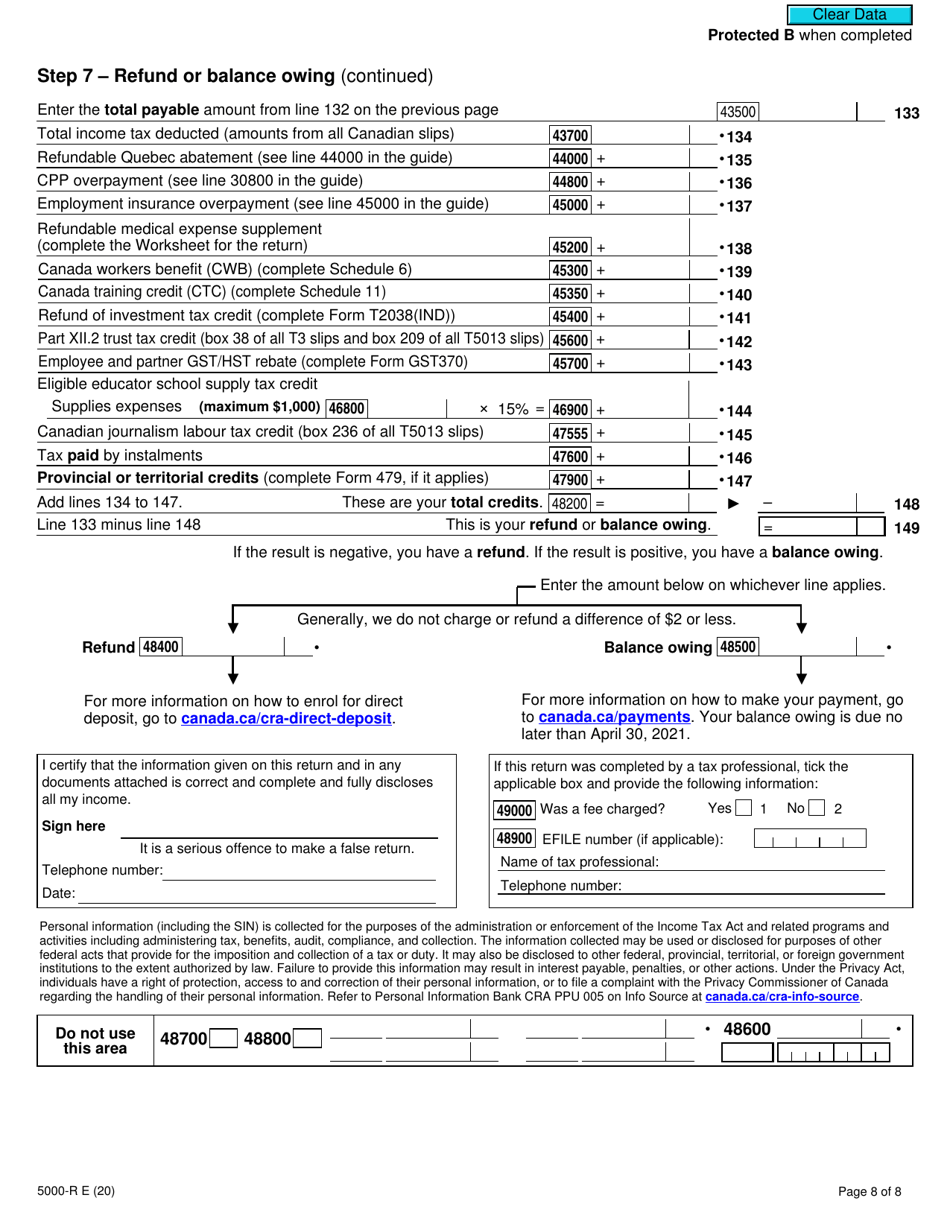

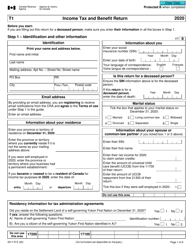

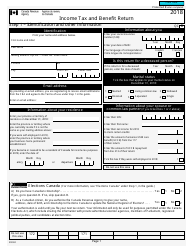

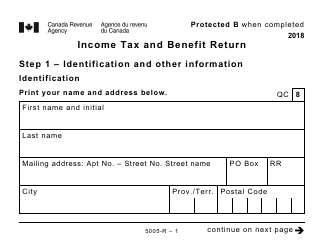

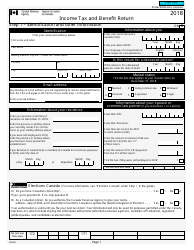

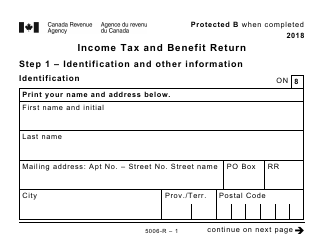

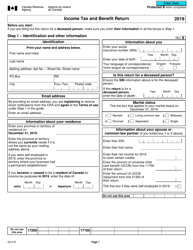

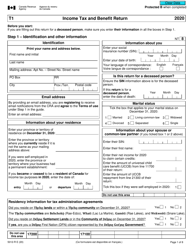

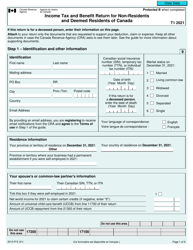

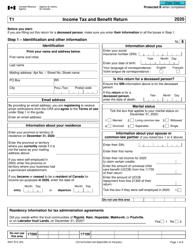

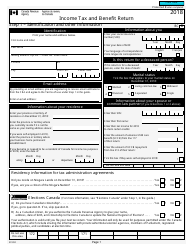

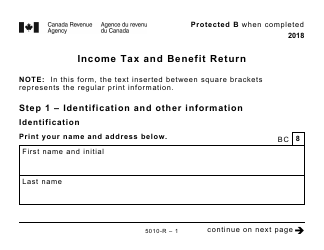

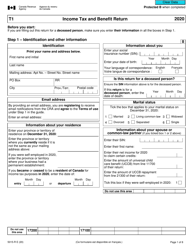

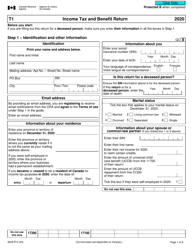

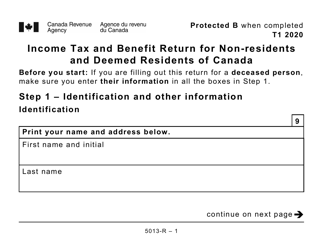

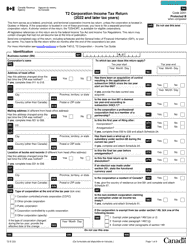

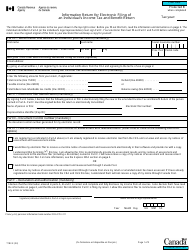

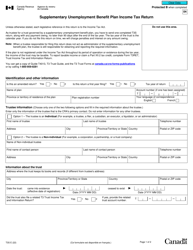

Form 5000-R Income Tax and Benefit Return (For Nb, Ns, Nu and Pe Only) - Canada

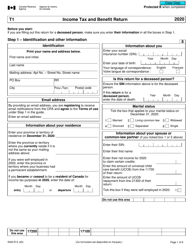

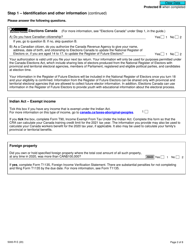

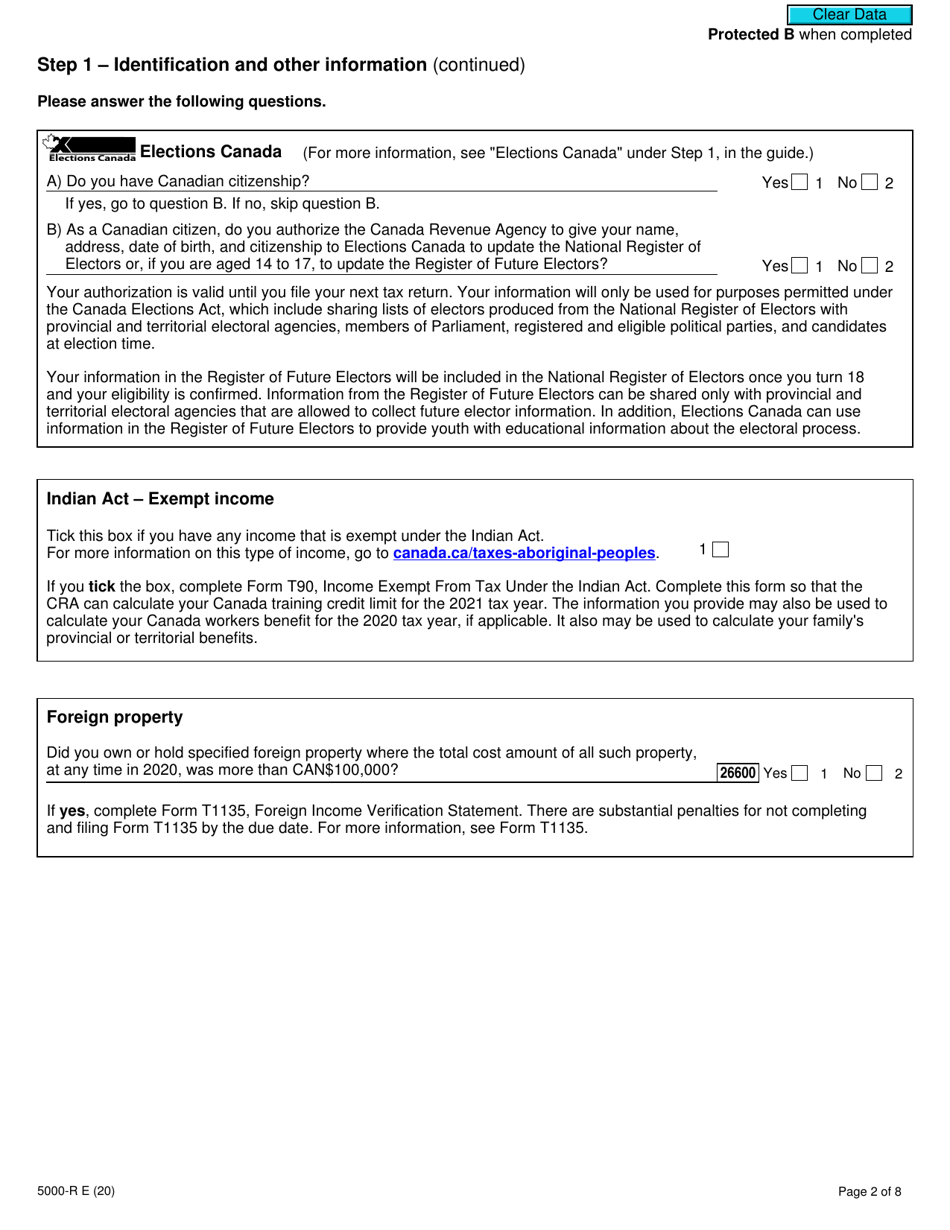

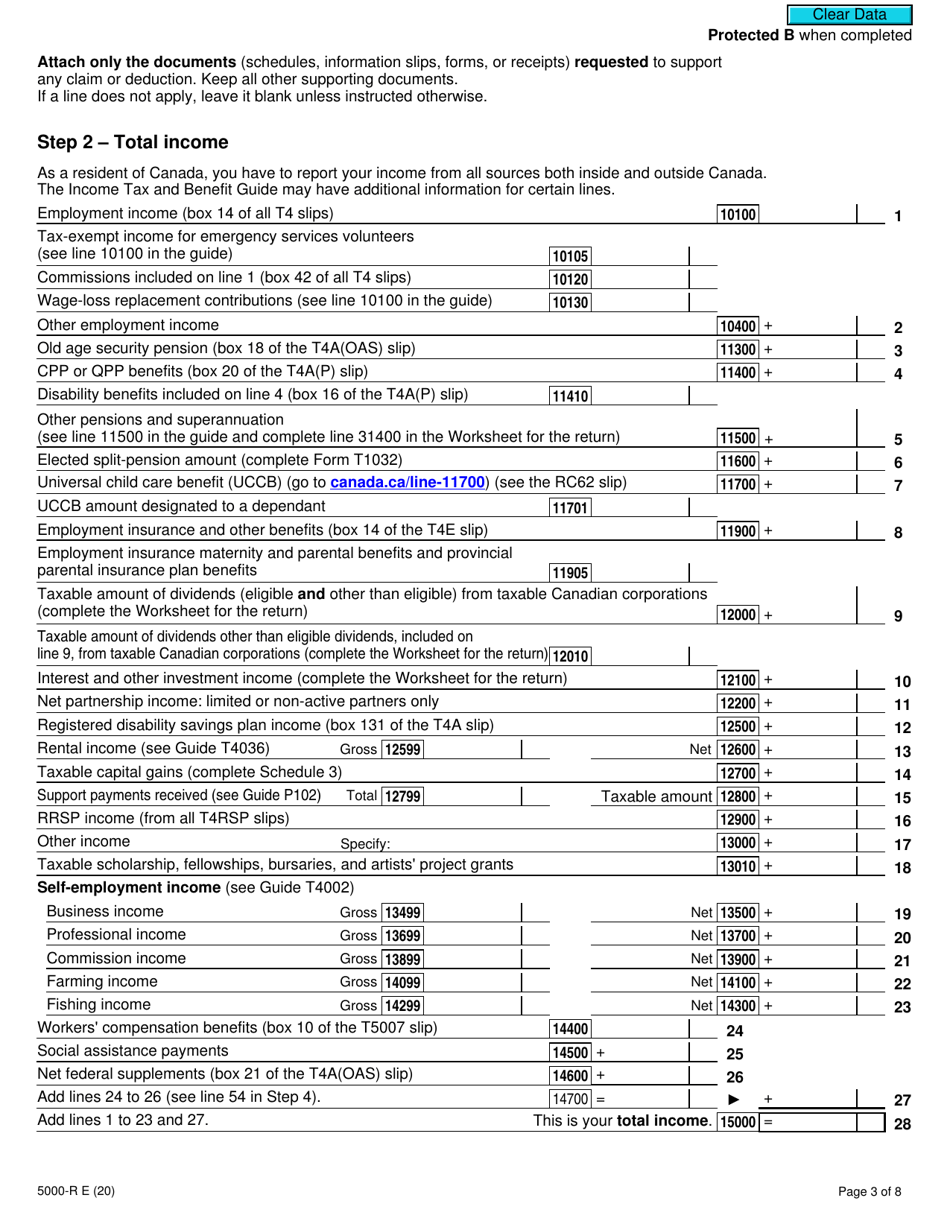

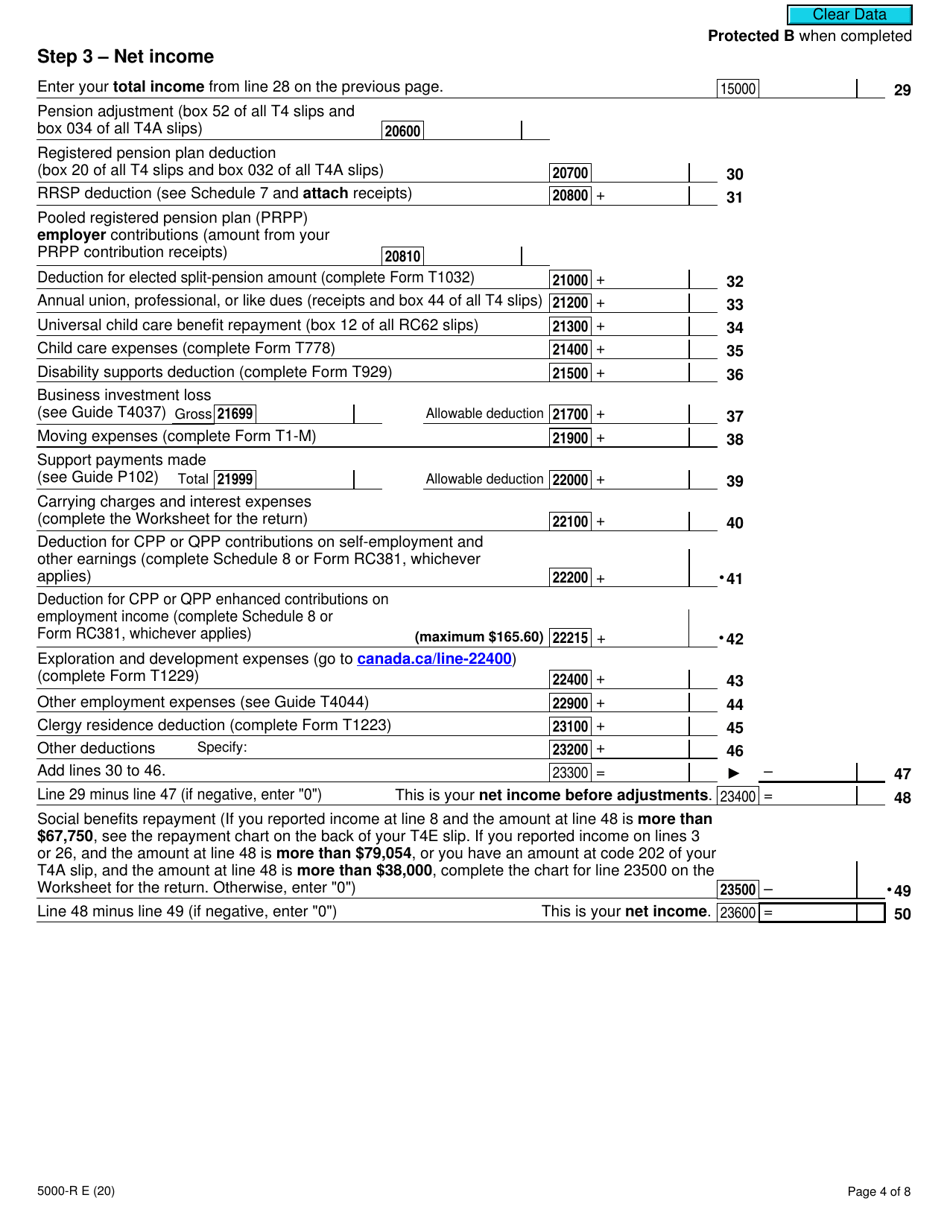

Form 5000-R Income Tax and Benefit Return (For Nb, Ns, Nu and Pe Only) is a tax form specific to residents of New Brunswick, Nova Scotia, Nunavut, and Prince Edward Island in Canada. It is used to report income and claim any eligible tax credits and deductions for the tax year.

The Form 5000-R Income Tax and Benefit Return (For Nb, Ns, Nu and Pe Only) in Canada is filed by individuals who are residents of New Brunswick (NB), Nova Scotia (NS), Nunavut (NU), and Prince Edward Island (PE).

FAQ

Q: What is Form 5000-R?

A: Form 5000-R is an Income Tax and Benefit Return form.

Q: Who can use Form 5000-R?

A: Form 5000-R can be used by residents of New Brunswick, Nova Scotia, Nunavut, and Prince Edward Island.

Q: What is the purpose of Form 5000-R?

A: Form 5000-R is used to report your income and claim benefits or credits for the tax year.

Q: When is Form 5000-R due?

A: Form 5000-R is due on or before the tax filing deadline, which is usually April 30th of the following year.

Q: What should I include with Form 5000-R?

A: You should include all relevant documents such as T4 slips, receipts, and supporting documents for deductions or credits.

Q: What happens if I don't file Form 5000-R?

A: If you don't file Form 5000-R, you may face penalties and interest on any taxes owed.

Q: Can I get help with filling out Form 5000-R?

A: Yes, you can seek assistance from the CRA's helpline or consult a tax professional.

Q: What if I made a mistake on Form 5000-R?

A: If you made a mistake, you can request a change by filing an adjustment request or contacting the CRA.