This version of the form is not currently in use and is provided for reference only. Download this version of

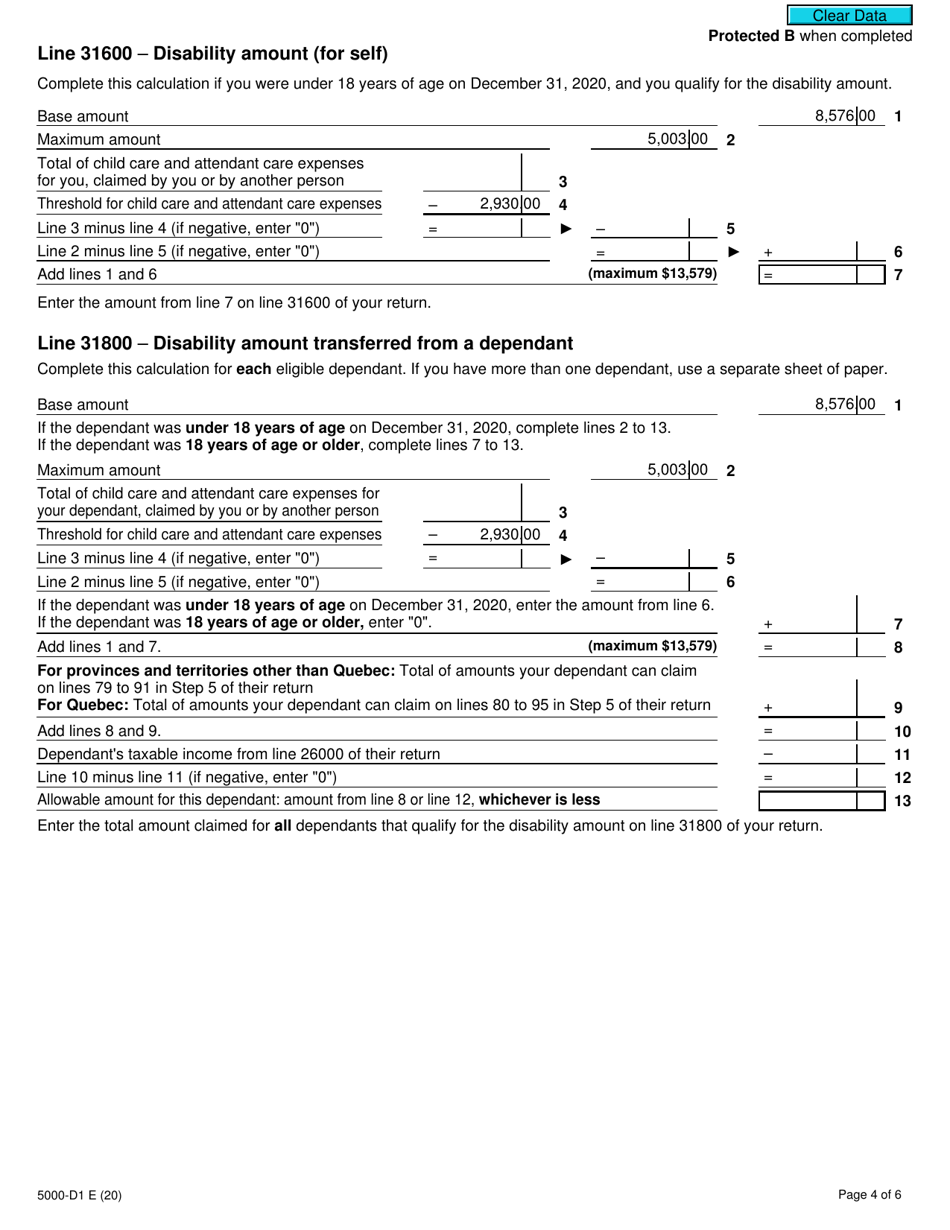

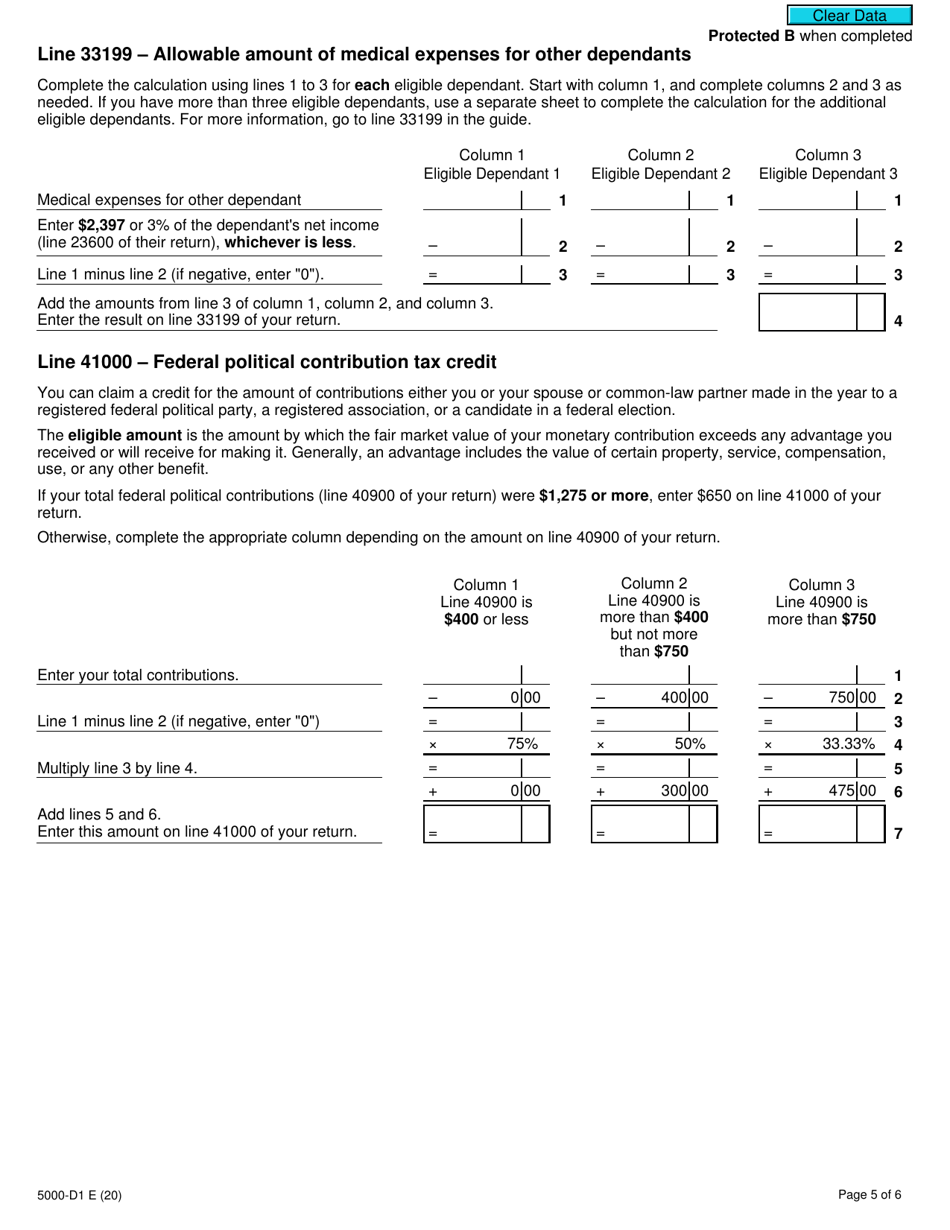

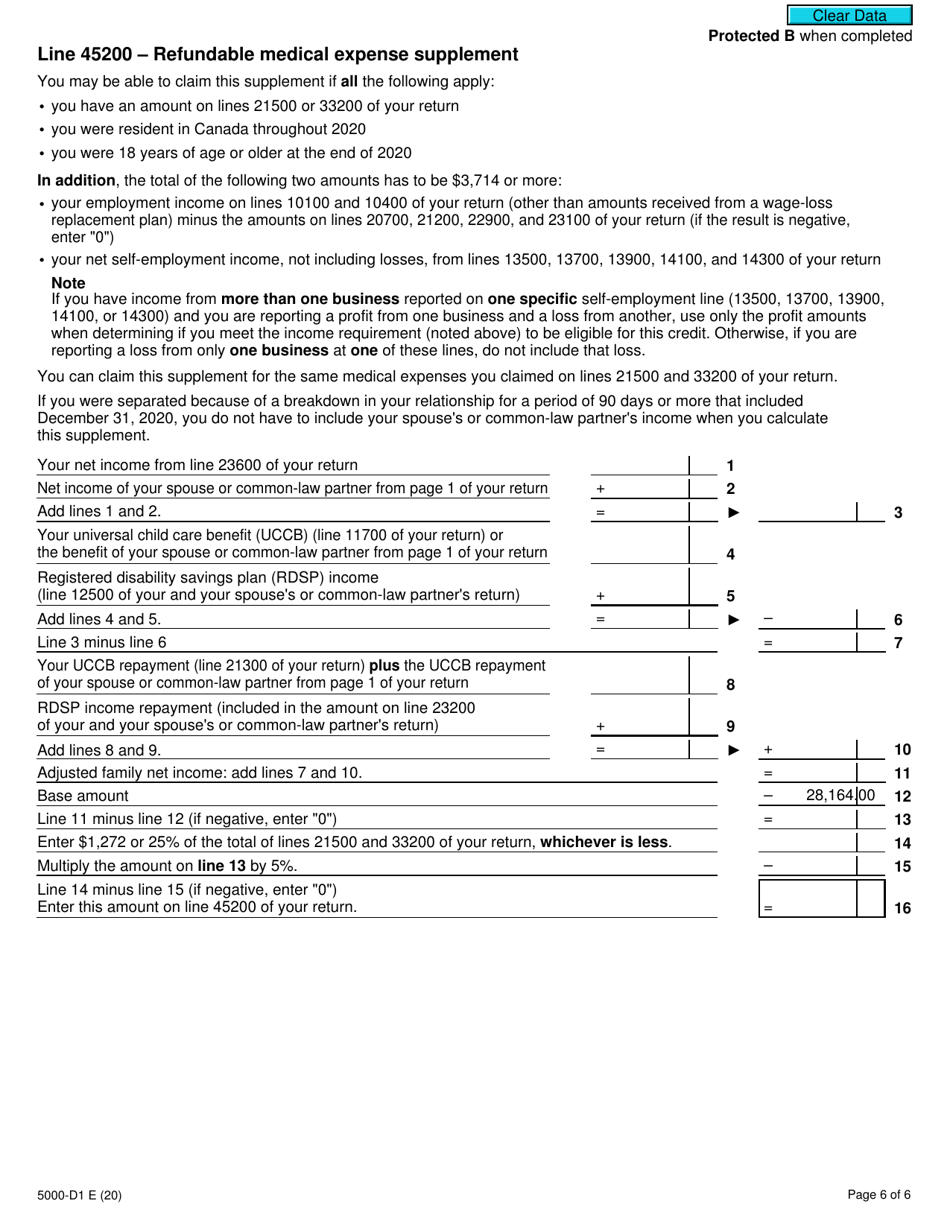

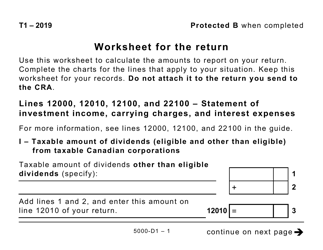

Form 5000-D1

for the current year.

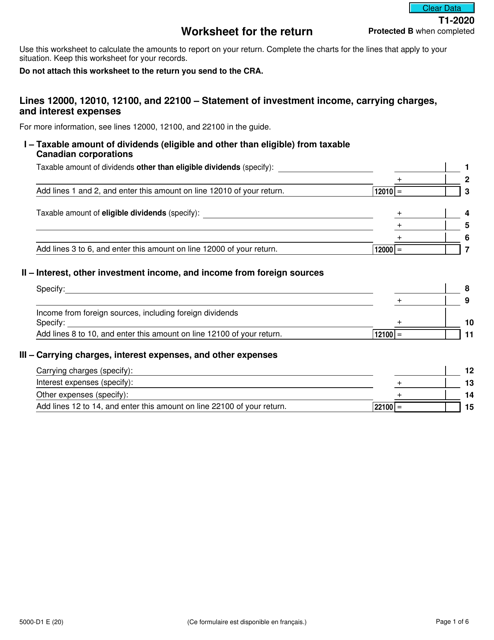

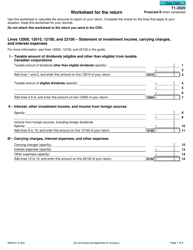

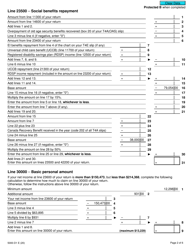

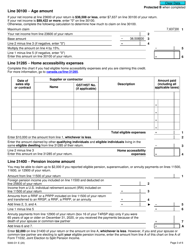

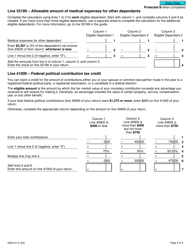

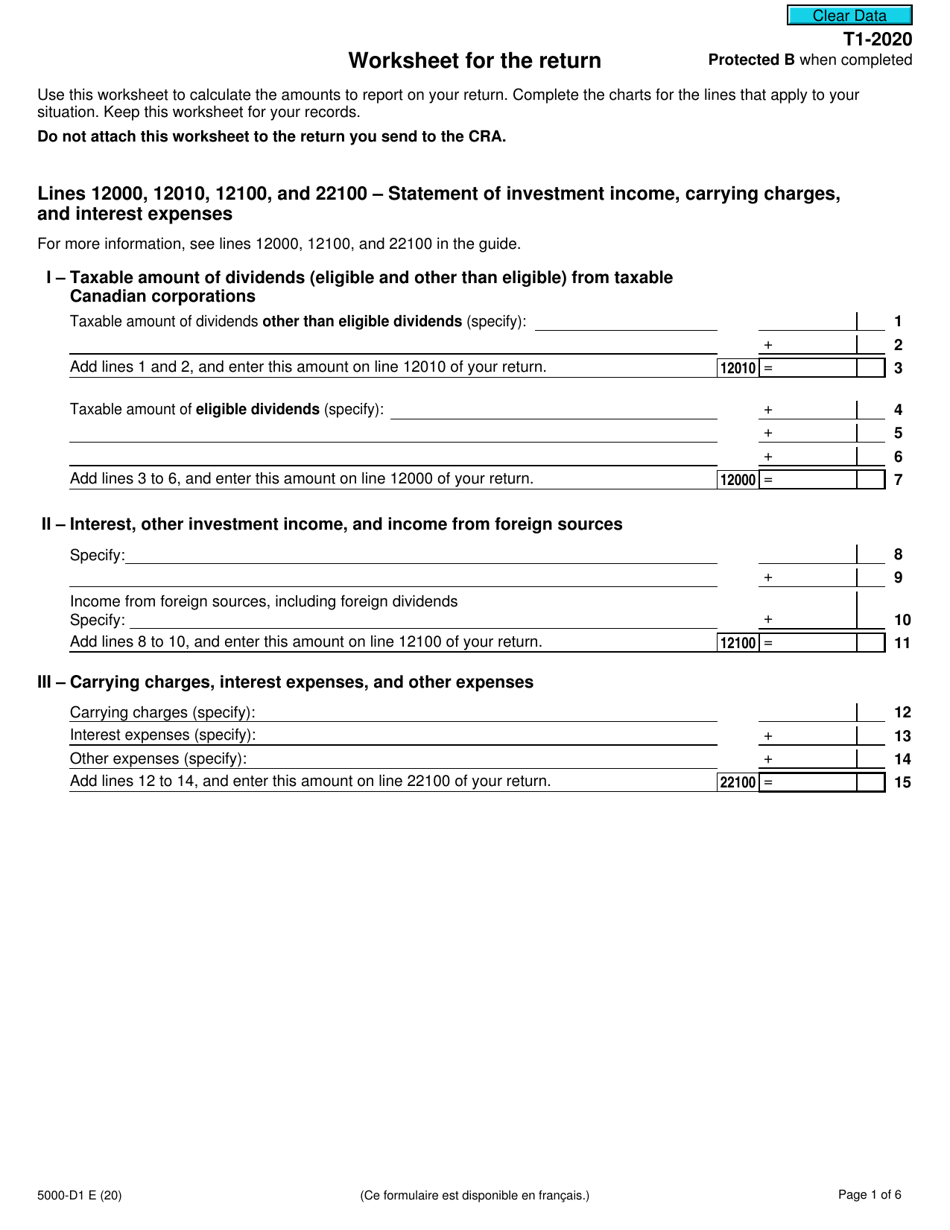

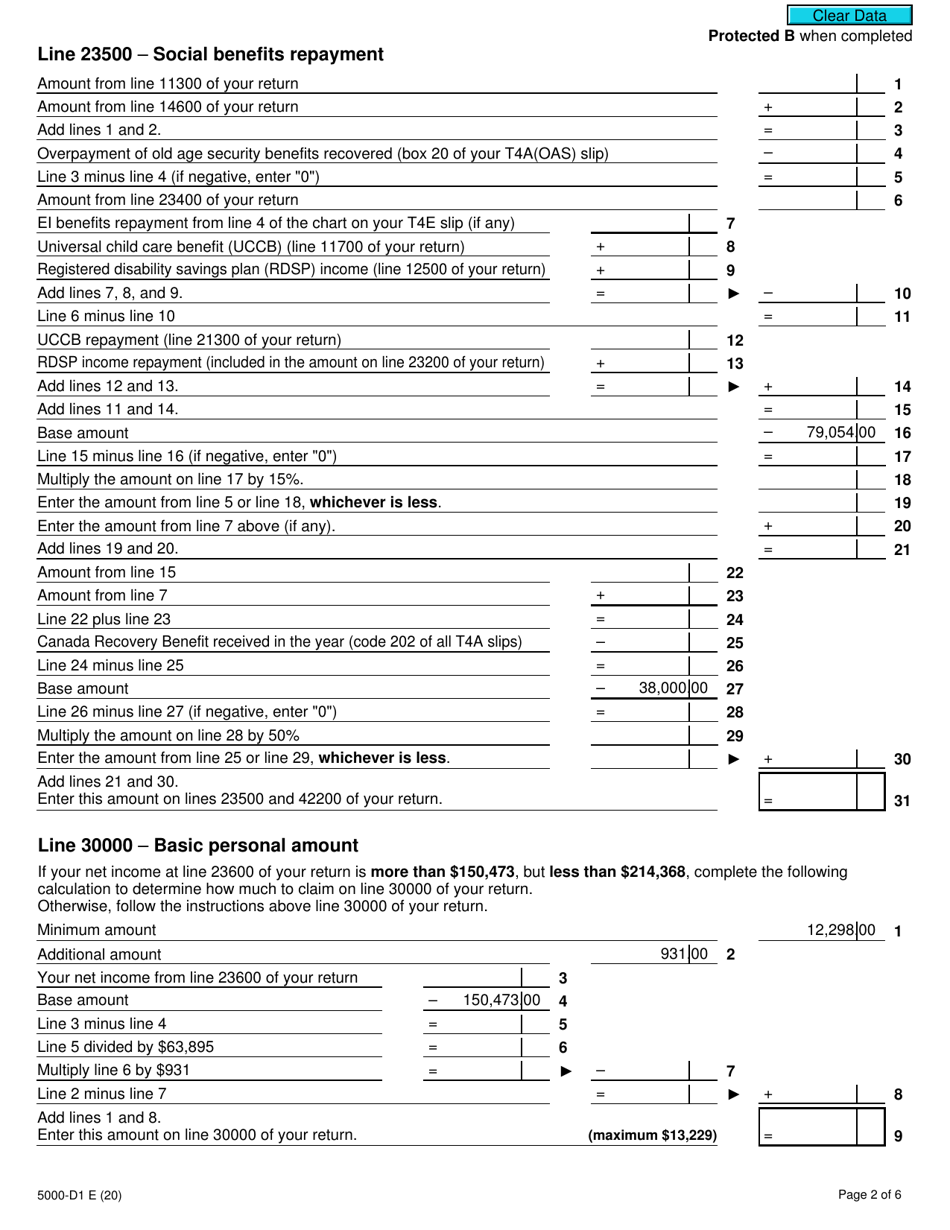

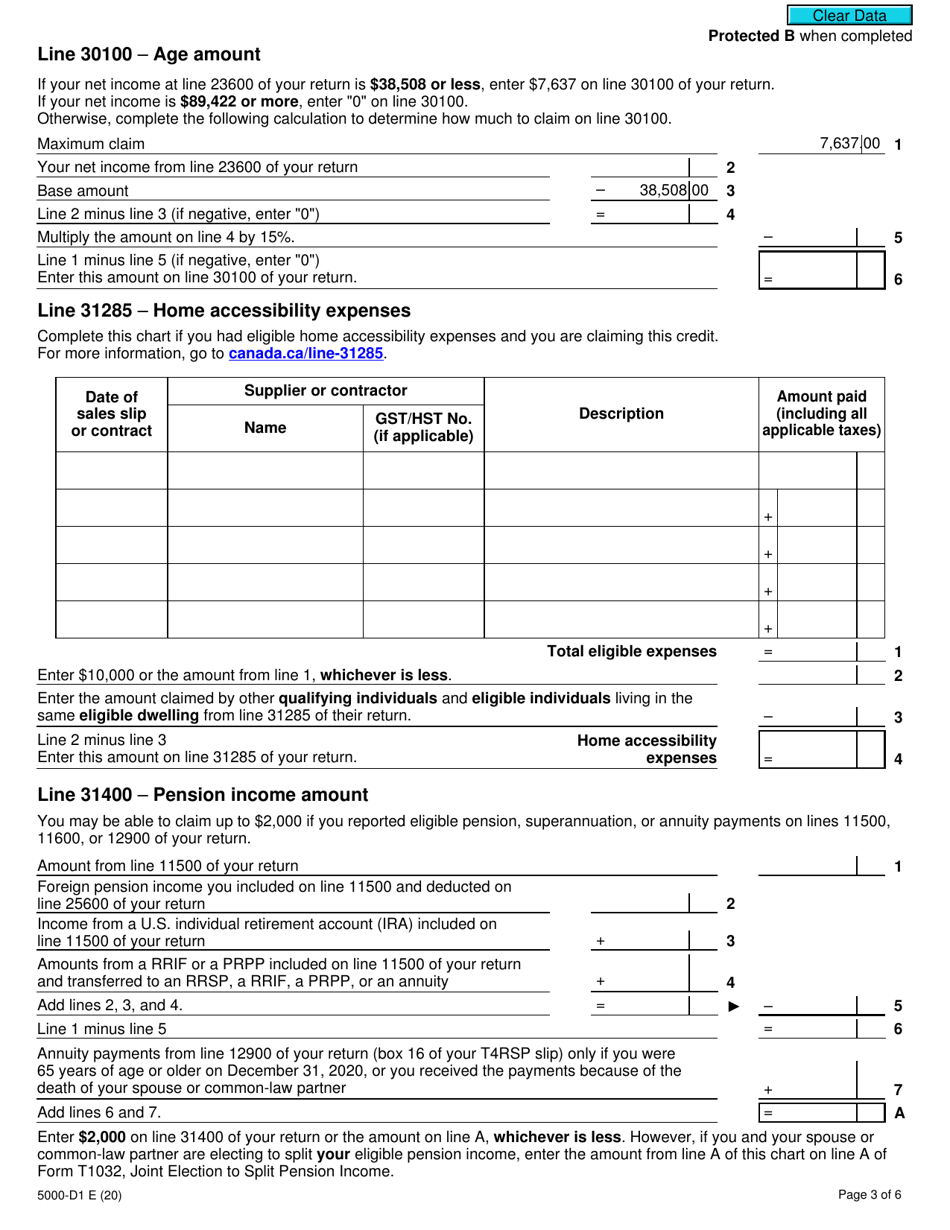

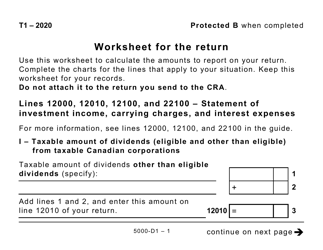

Form 5000-D1 Worksheet for the Return - Canada

FAQ

Q: What is Form 5000-D1?

A: Form 5000-D1 is a worksheet used for filing a return in Canada.

Q: What is the purpose of Form 5000-D1?

A: The purpose of Form 5000-D1 is to help calculate and organize information for filing a return in Canada.

Q: Who needs to use Form 5000-D1?

A: Anyone who is required to file a return in Canada may need to use Form 5000-D1.

Q: How do I fill out Form 5000-D1?

A: You should follow the instructions provided on the form to ensure you fill it out correctly. It may be helpful to consult with a tax professional if you have any questions.

Q: Can I e-file Form 5000-D1?

A: No, Form 5000-D1 cannot be e-filed. It must be completed and submitted by mail or dropped off at a designated CRA office.

Q: What should I do if I make a mistake on Form 5000-D1?

A: If you make a mistake on Form 5000-D1, you should contact the CRA for guidance on how to correct the error.

Q: Can I get an extension to file Form 5000-D1?

A: You may be able to get an extension to file Form 5000-D1, but you must contact the CRA to request an extension and follow their guidelines for filing.

Q: What happens if I don't file Form 5000-D1?

A: If you are required to file Form 5000-D1 and you fail to do so, you may be subject to penalties and interest charges. It is important to fulfill your tax obligations in order to avoid any potential consequences.