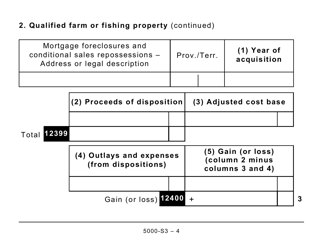

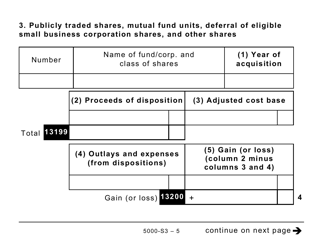

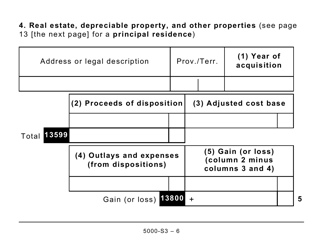

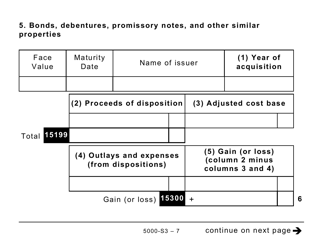

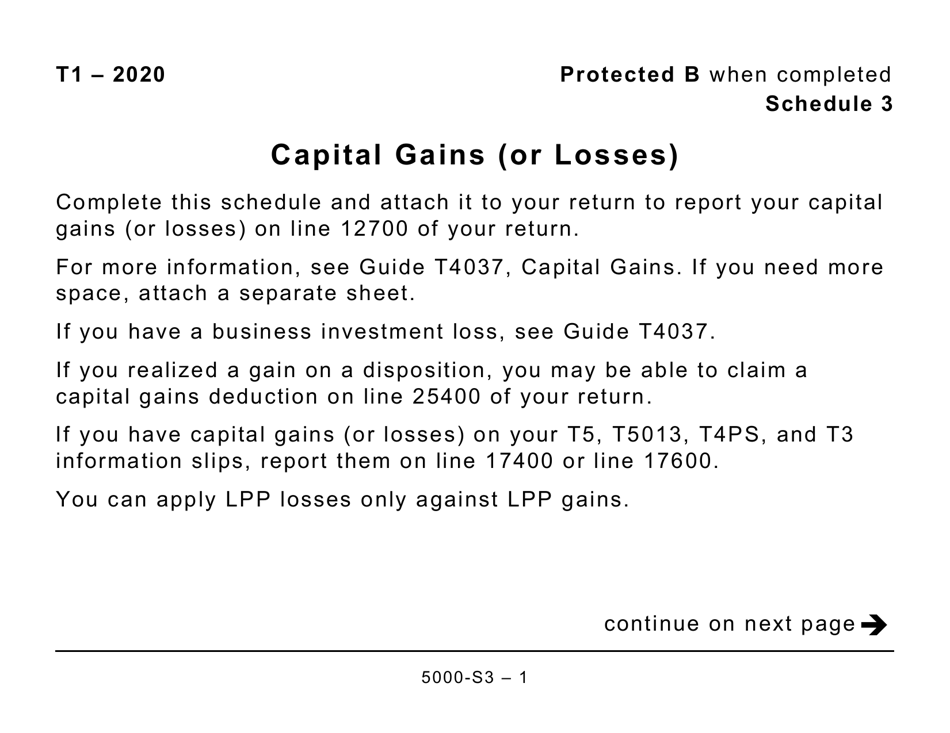

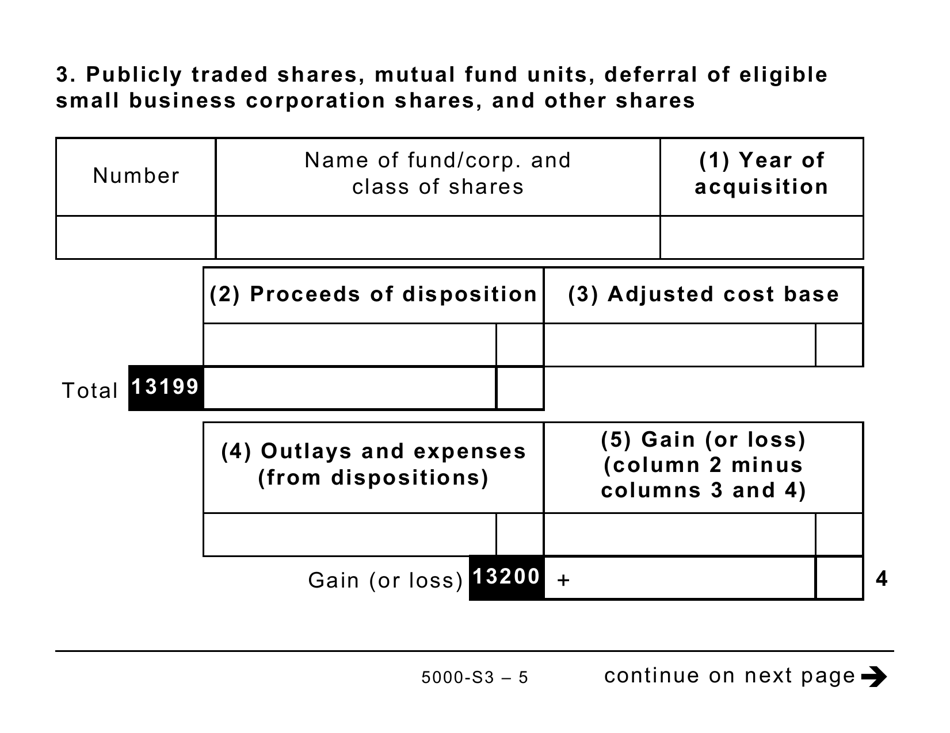

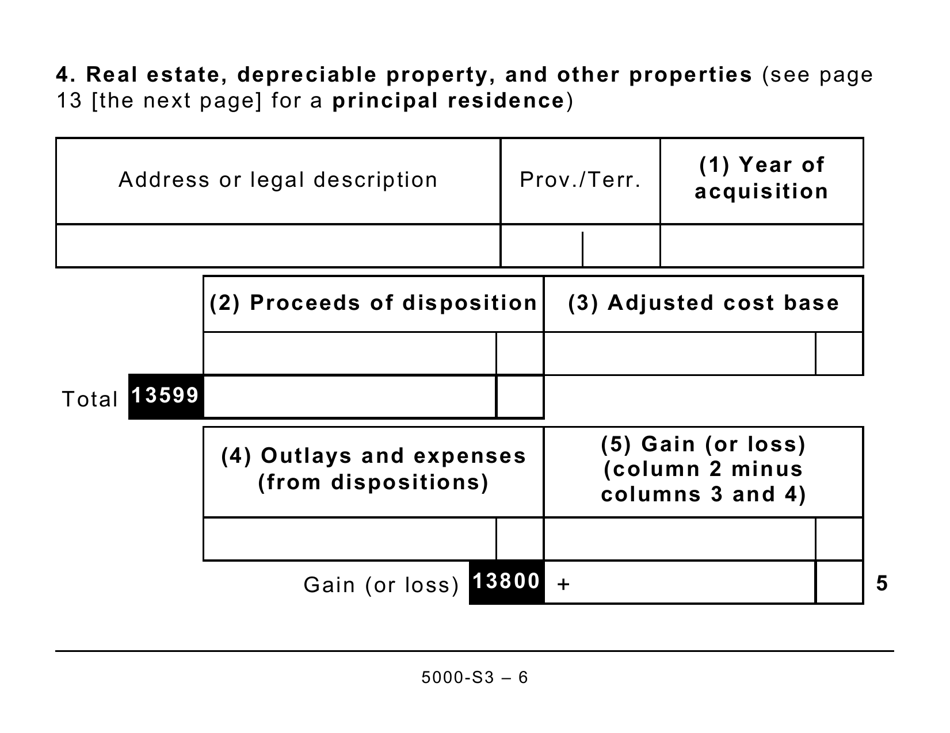

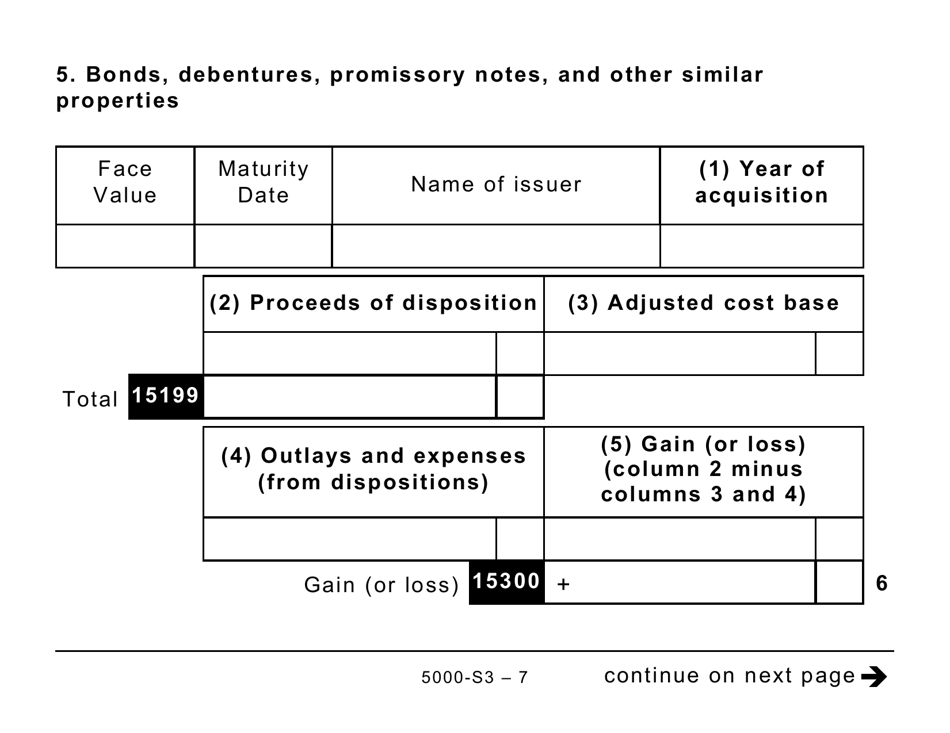

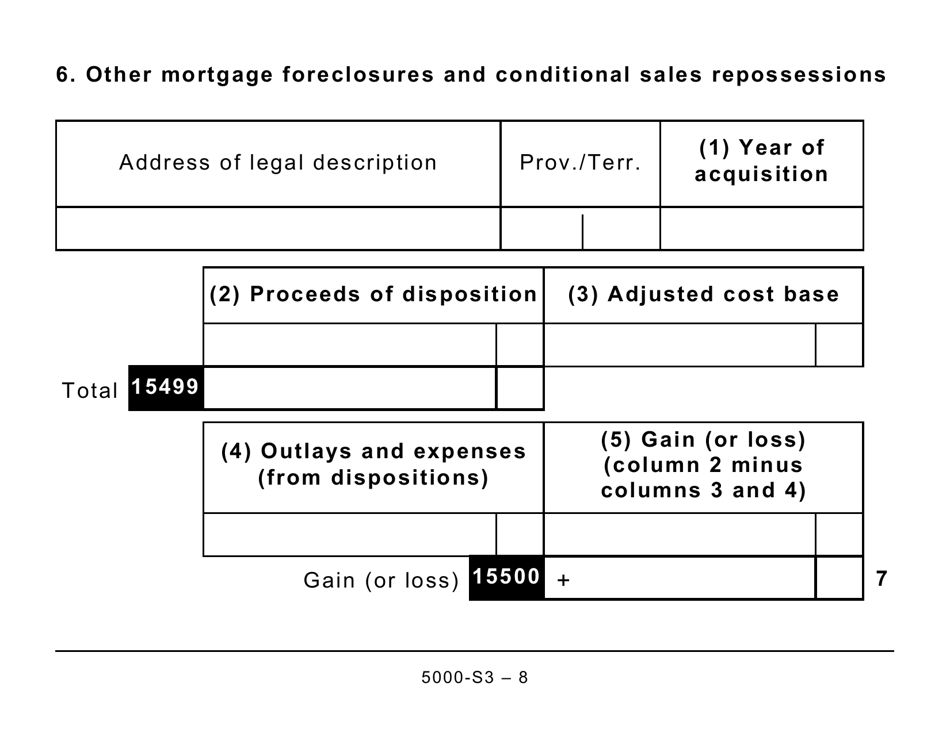

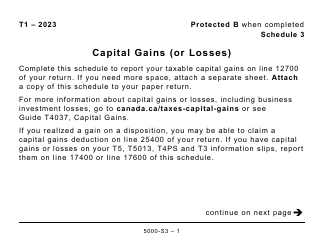

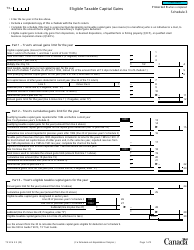

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Large Print - Canada

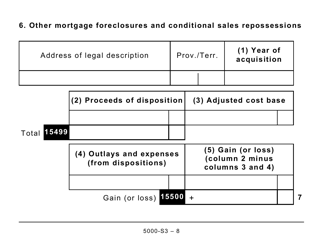

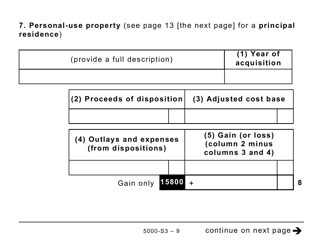

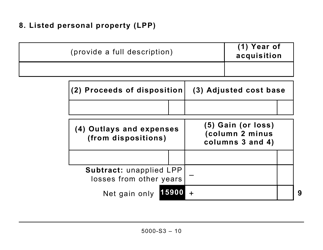

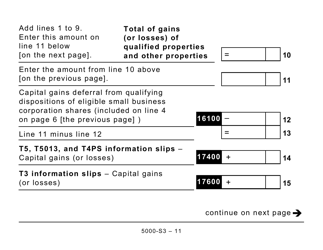

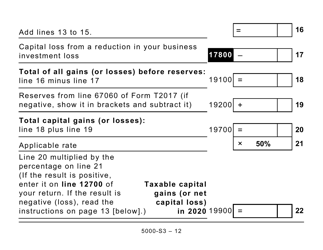

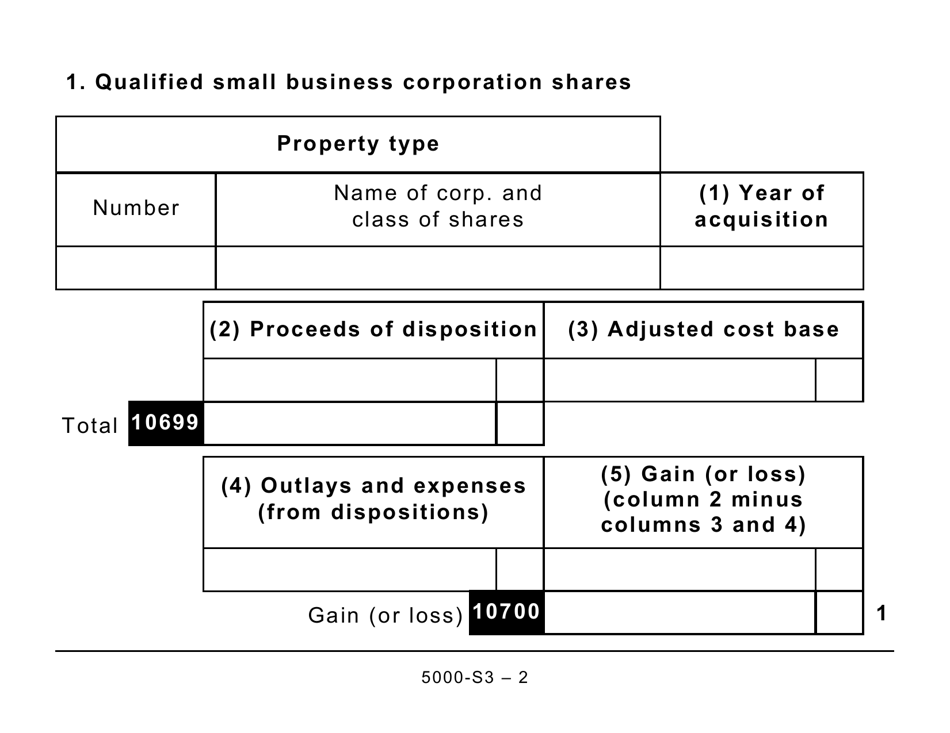

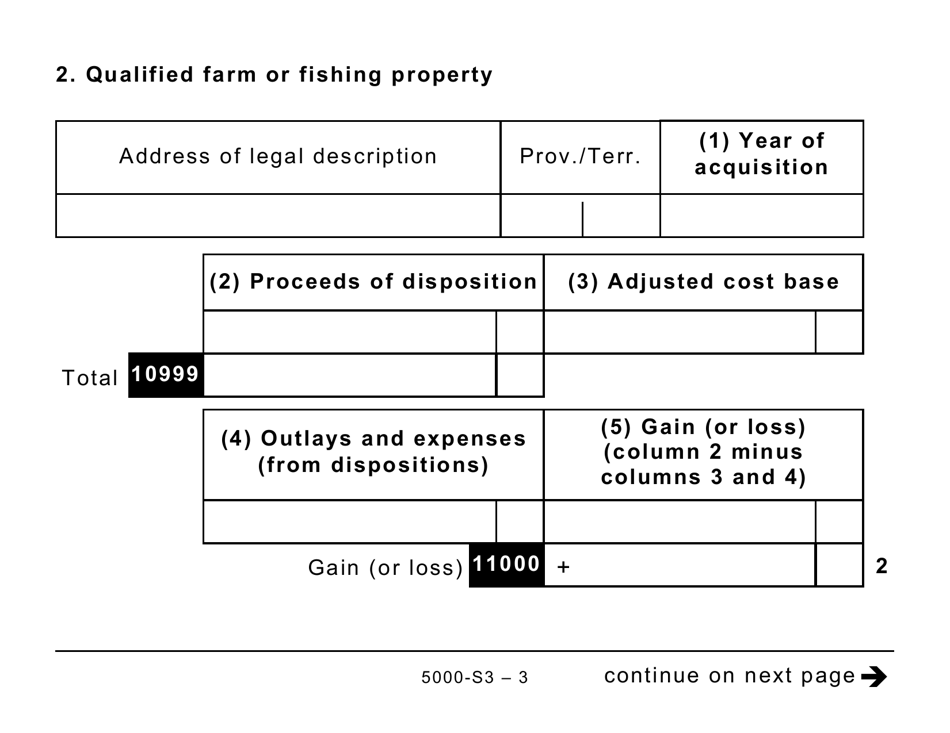

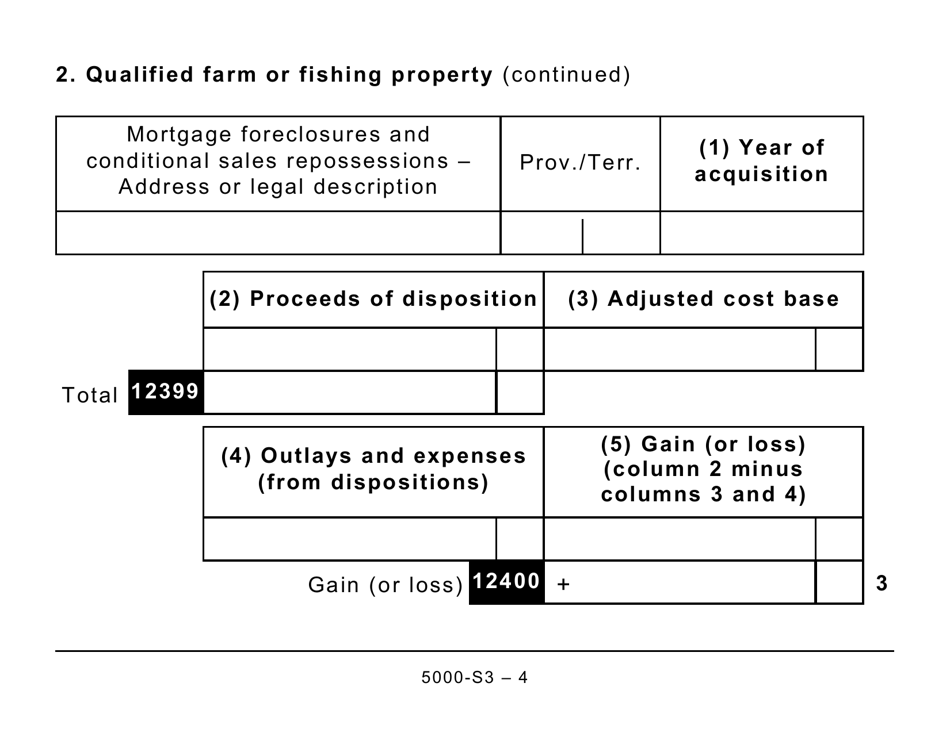

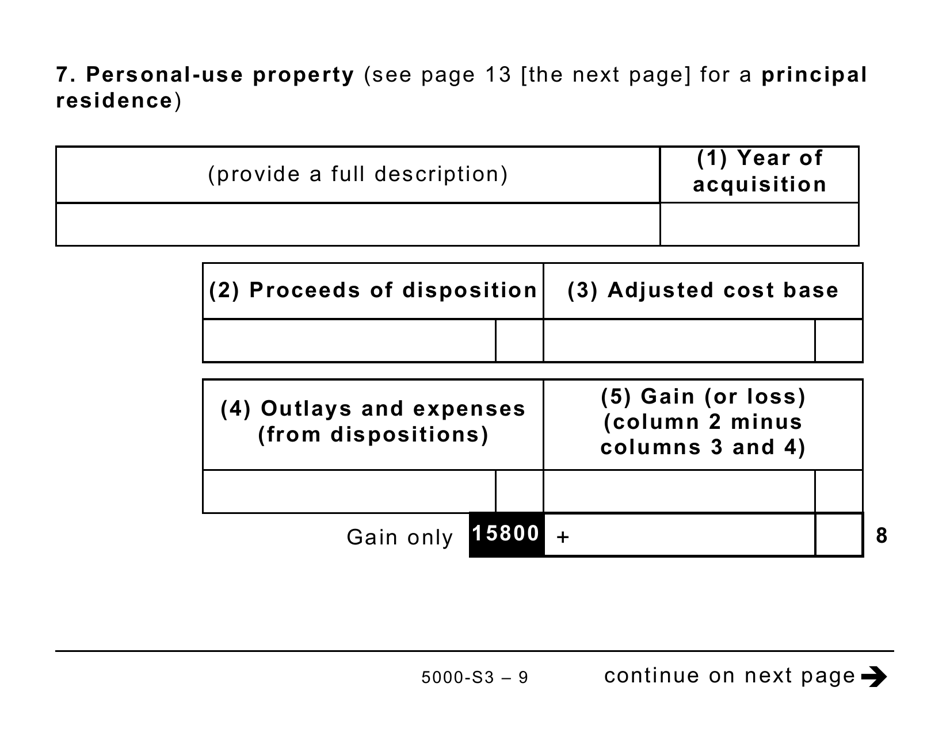

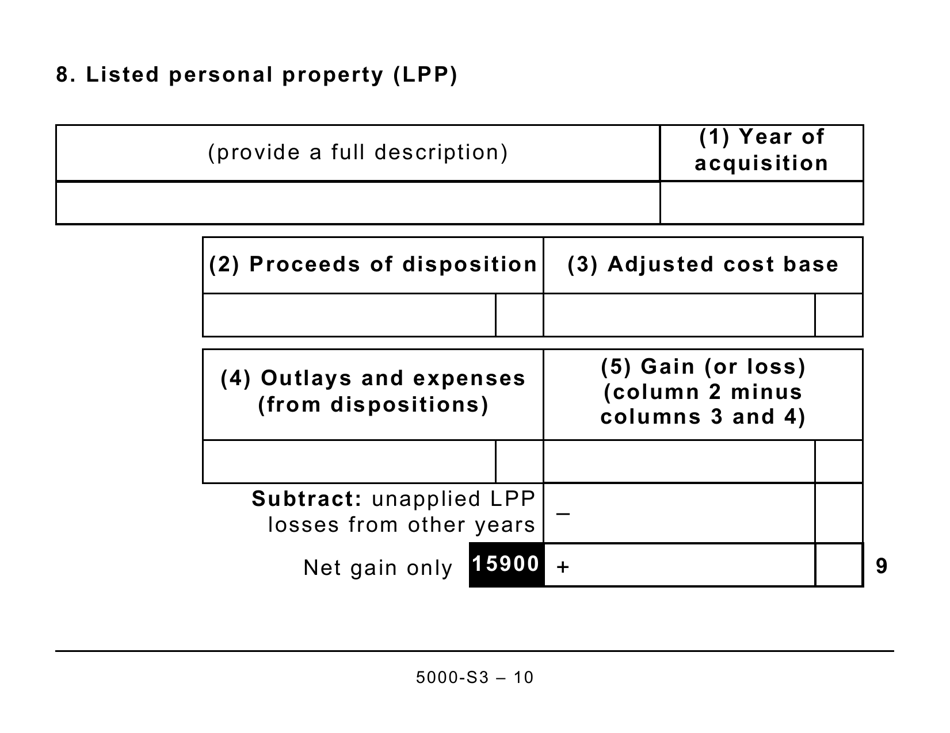

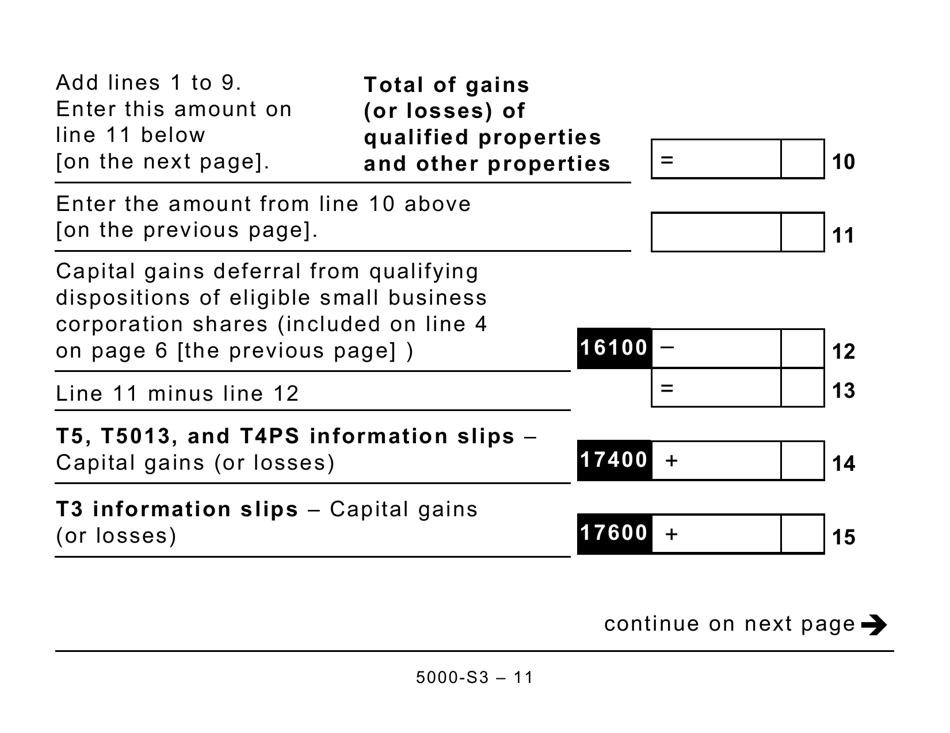

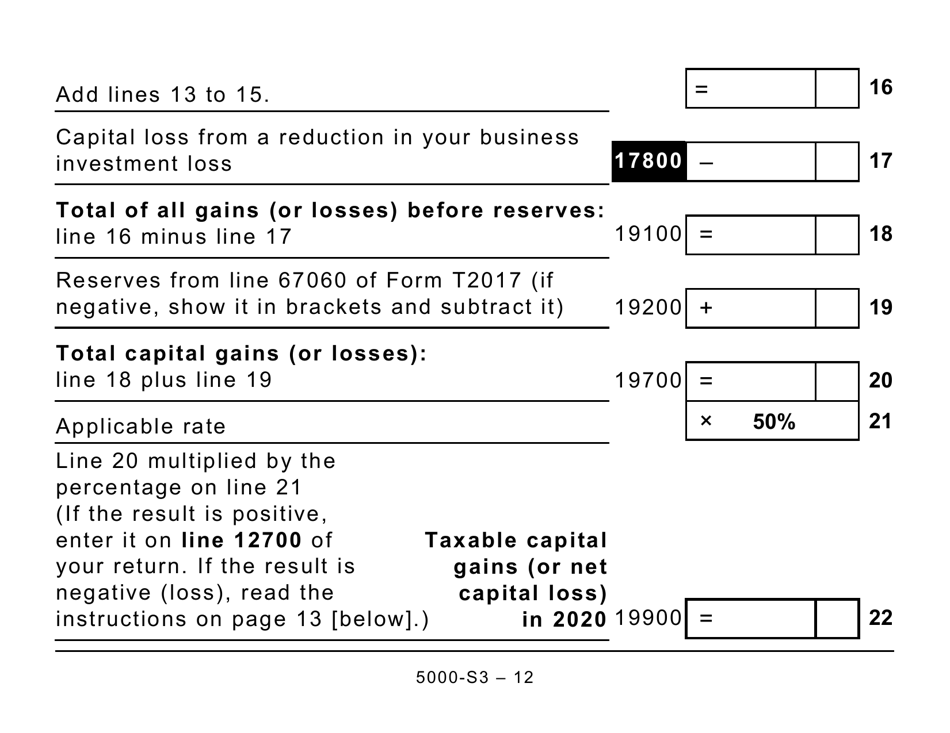

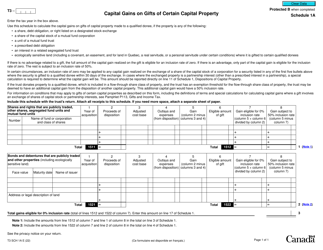

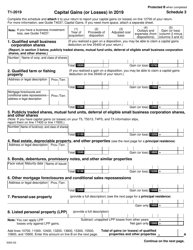

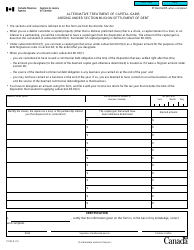

Form 5000-S3 Schedule 3 Capital Gains (or Losses) - Large Print in Canada is used to report any capital gains or losses incurred during the tax year. It provides a detailed breakdown of these gains or losses for tax purposes.

The taxpayer who has capital gains or losses in Canada would file the Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Large Print.

FAQ

Q: What is Schedule 3?

A: Schedule 3 is a form used in Canada to report capital gains or losses.

Q: Do I need to file Schedule 3?

A: You need to file Schedule 3 if you have incurred capital gains or losses during the tax year.

Q: What is considered a capital gain?

A: A capital gain is the profit that you make when you sell an asset, such as stocks or real estate, at a higher price than what you initially paid for it.

Q: What is considered a capital loss?

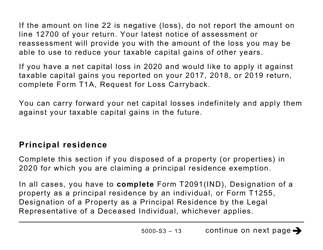

A: A capital loss occurs when you sell an asset for a lower price than what you originally paid for it.

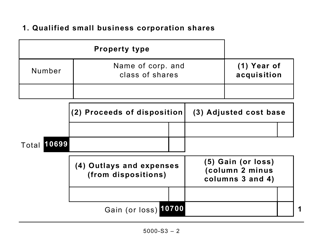

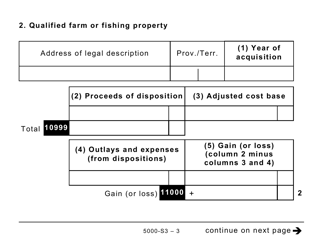

Q: How do I report capital gains or losses on Schedule 3?

A: You report capital gains or losses on Schedule 3 by filling out the appropriate sections and calculations based on the information provided.

Q: Are there any exemptions or deductions for capital gains or losses?

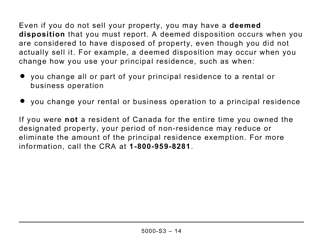

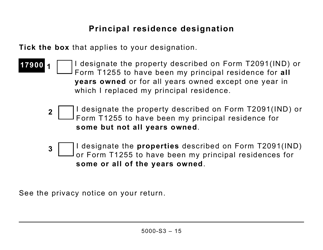

A: Yes, there are certain exemptions and deductions available for capital gains or losses, such as the principal residence exemption for the sale of your main home.

Q: Do I need to include supporting documents with Schedule 3?

A: In most cases, you don't need to include supporting documents with Schedule 3. However, you should keep them on file in case the CRA requests them.

Q: When is the deadline to file Schedule 3?

A: The deadline to file Schedule 3 is usually April 30th of the following year. However, the specific deadline may vary depending on your individual circumstances.