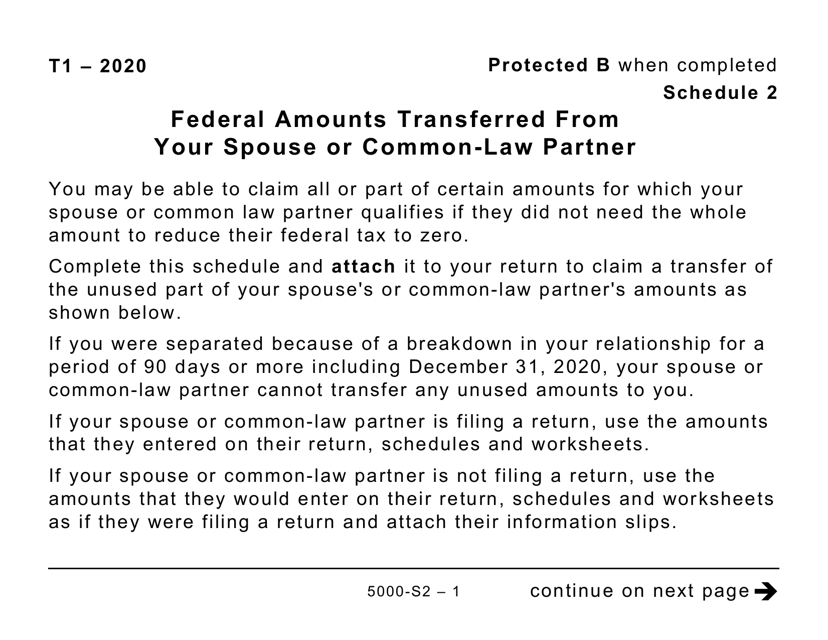

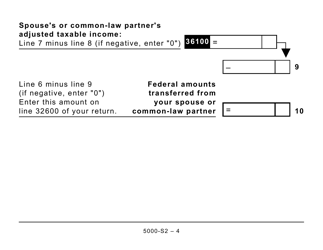

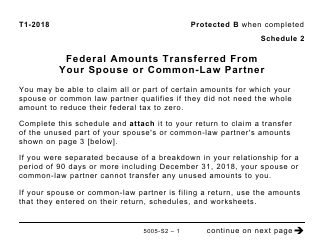

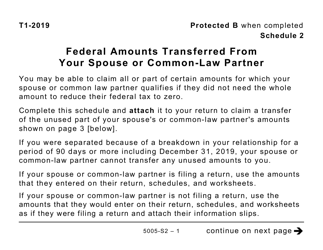

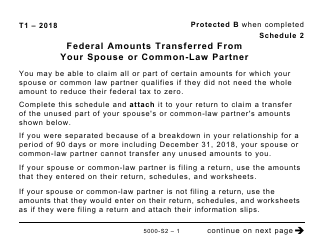

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Large Print - Canada

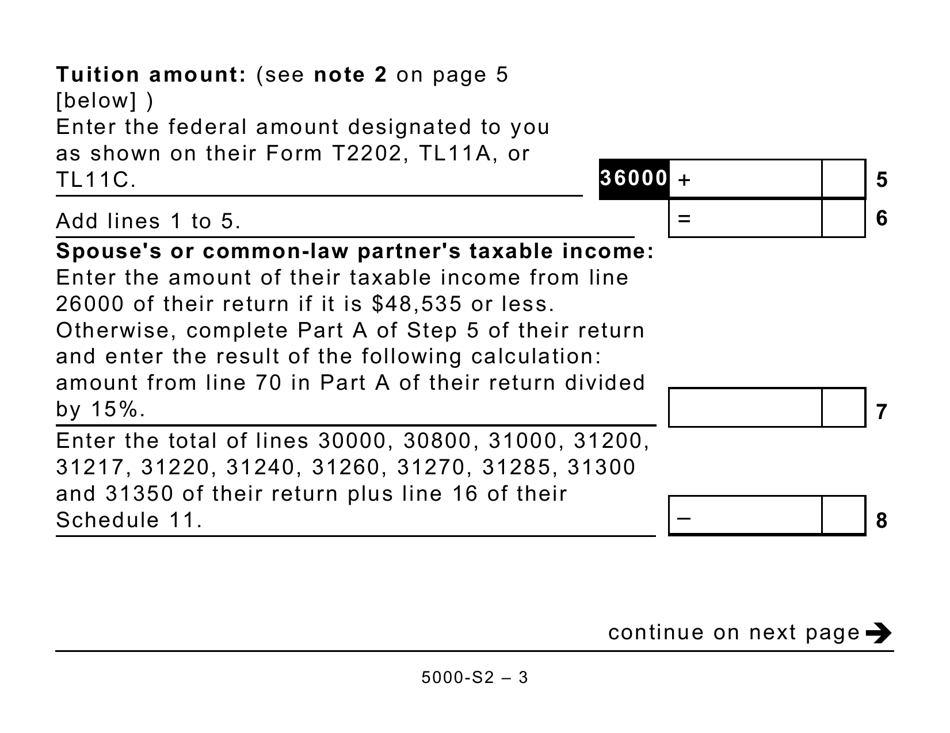

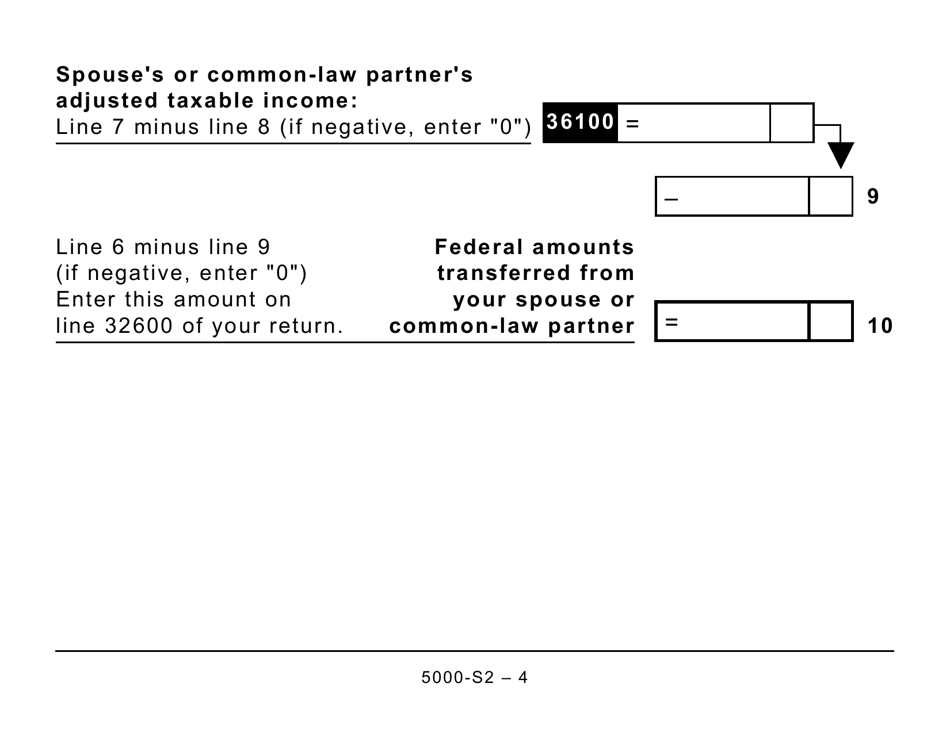

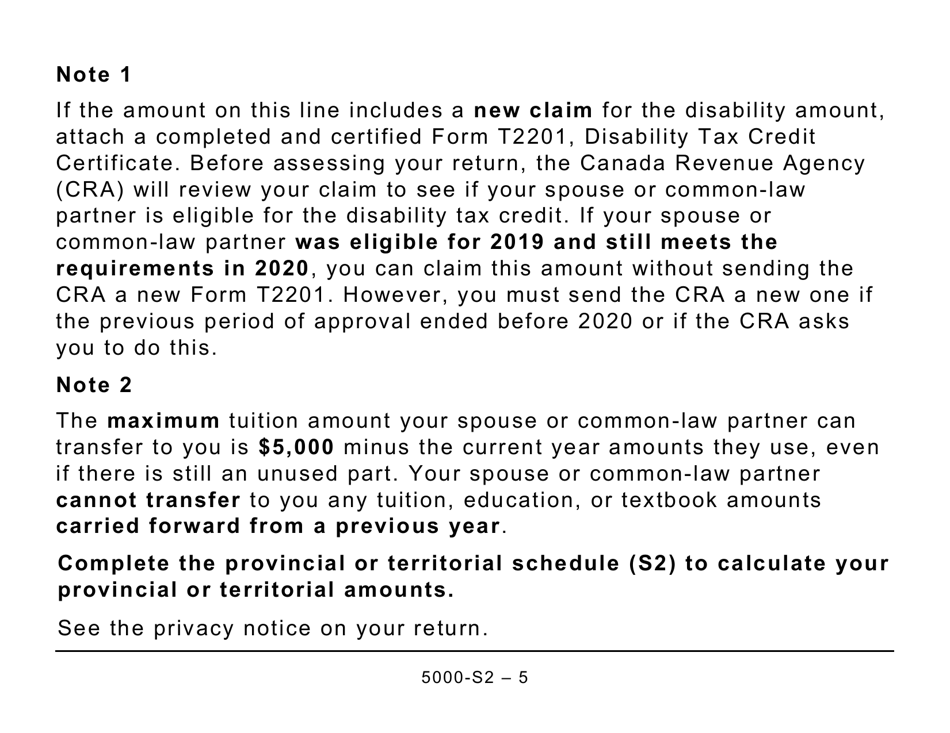

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Large Print - Canada is used to report any federal amounts transferred from your spouse or common-law partner for tax purposes. It allows you to transfer certain credits, deductions, and expenses between you and your spouse or common-law partner to reduce your overall tax liability.

FAQ

Q: What is Form 5000-S2?

A: Form 5000-S2 is a schedule in Canada used to report federal amounts transferred from your spouse or common-law partner.

Q: What is the purpose of Schedule 2?

A: The purpose of Schedule 2 is to report amounts transferred from your spouse or common-law partner that can be used to reduce your federal taxes.

Q: Why is it called Large Print?

A: The Large Print version of Form 5000-S2 is designed to be easier to read for individuals with visual impairments.

Q: Who needs to file Schedule 2?

A: Schedule 2 is required to be filed by individuals who have transferred federal amounts from their spouse or common-law partner.

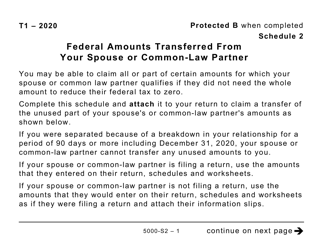

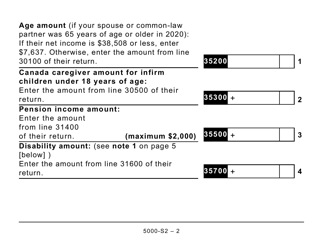

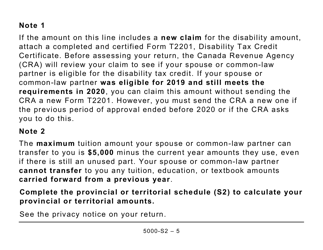

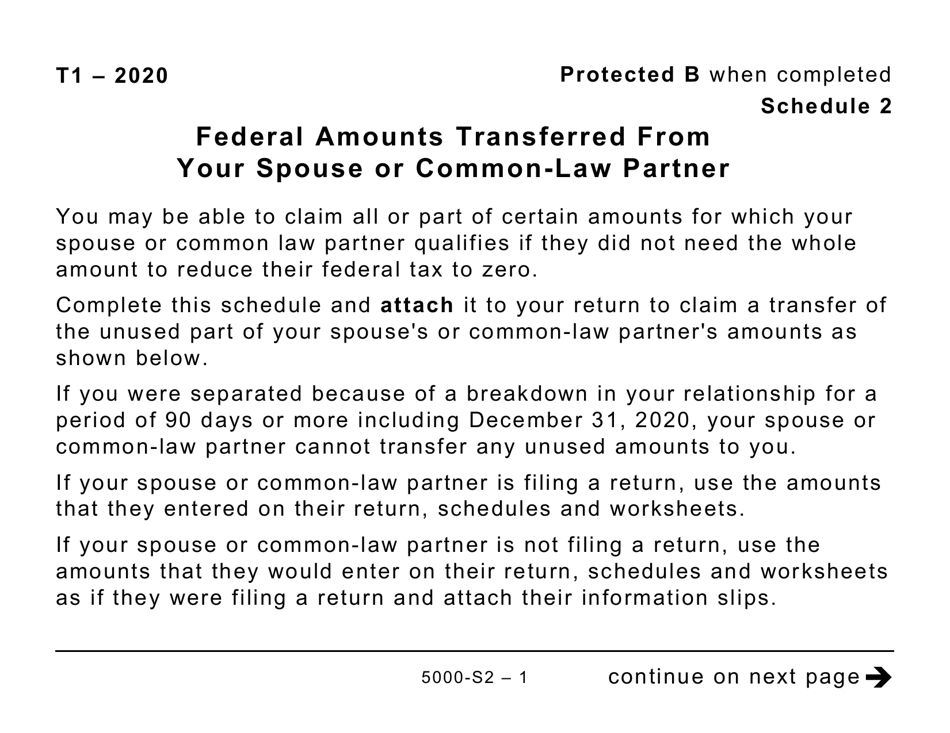

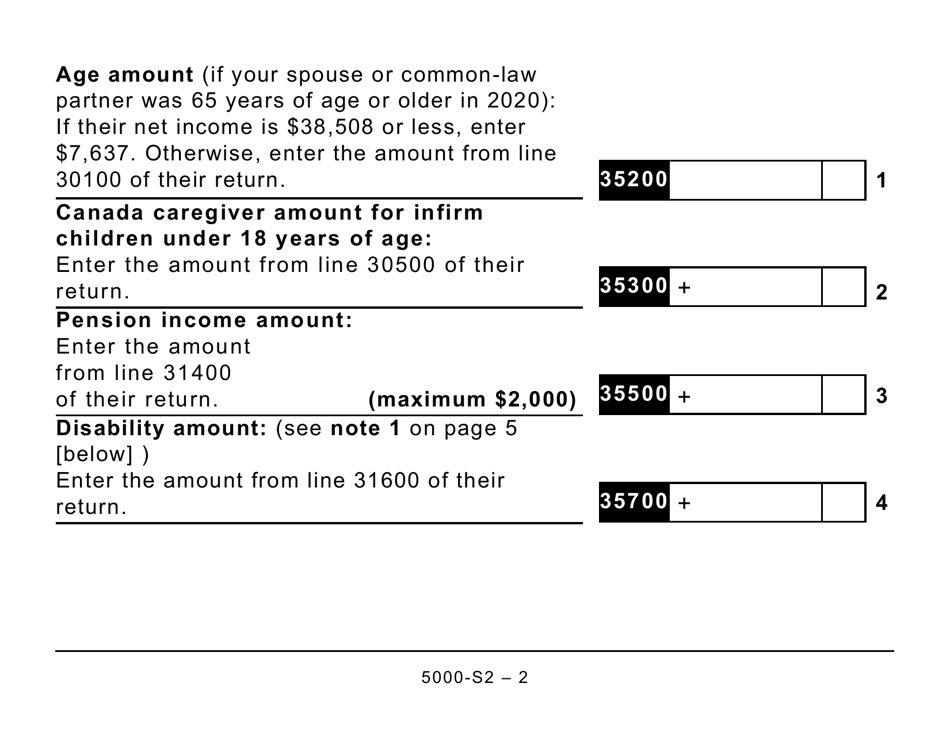

Q: What types of amounts can be transferred?

A: You can transfer certain federal tax credits, deductions, and expenses from your spouse or common-law partner.

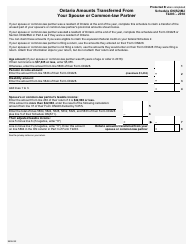

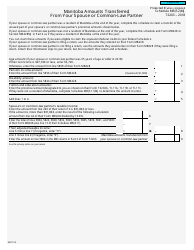

Q: How do I fill out Schedule 2?

A: You need to provide the necessary information about the transferred amounts from your spouse or common-law partner.

Q: Is Schedule 2 only applicable to Canada?

A: Yes, Schedule 2 is specific to Canada and its federal tax system.