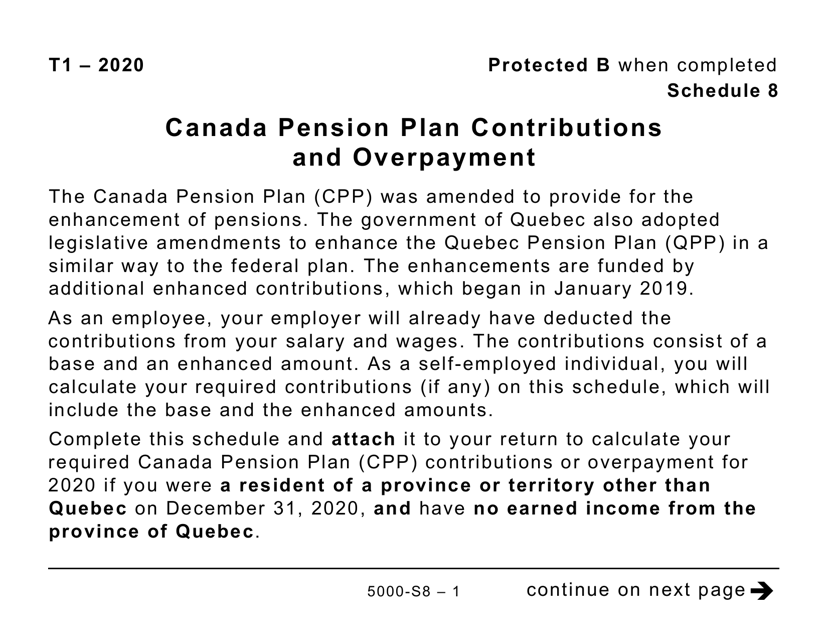

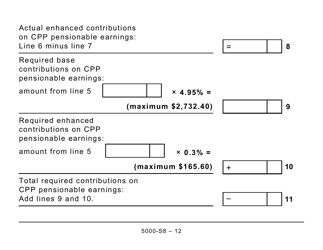

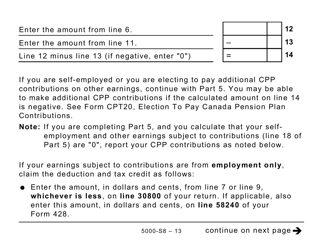

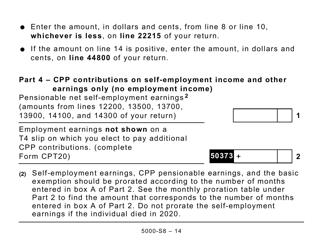

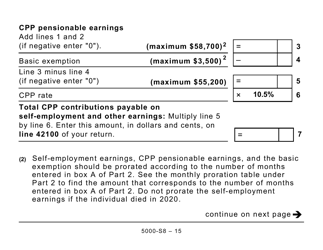

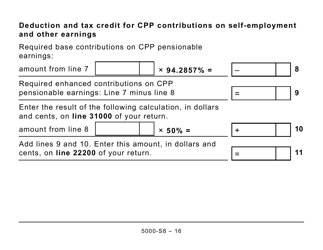

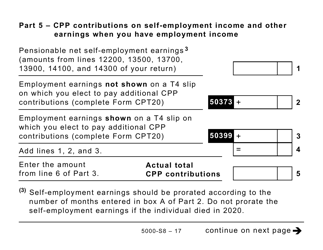

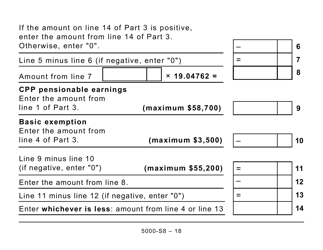

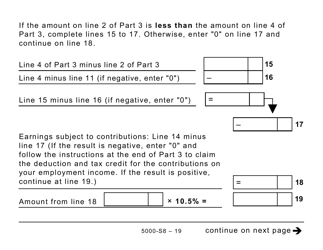

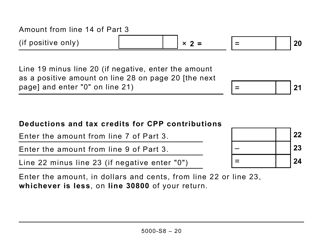

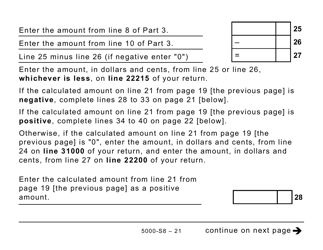

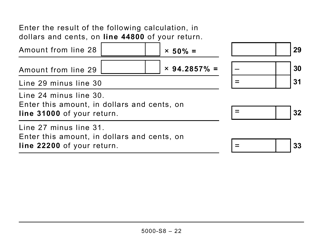

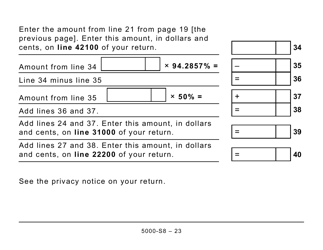

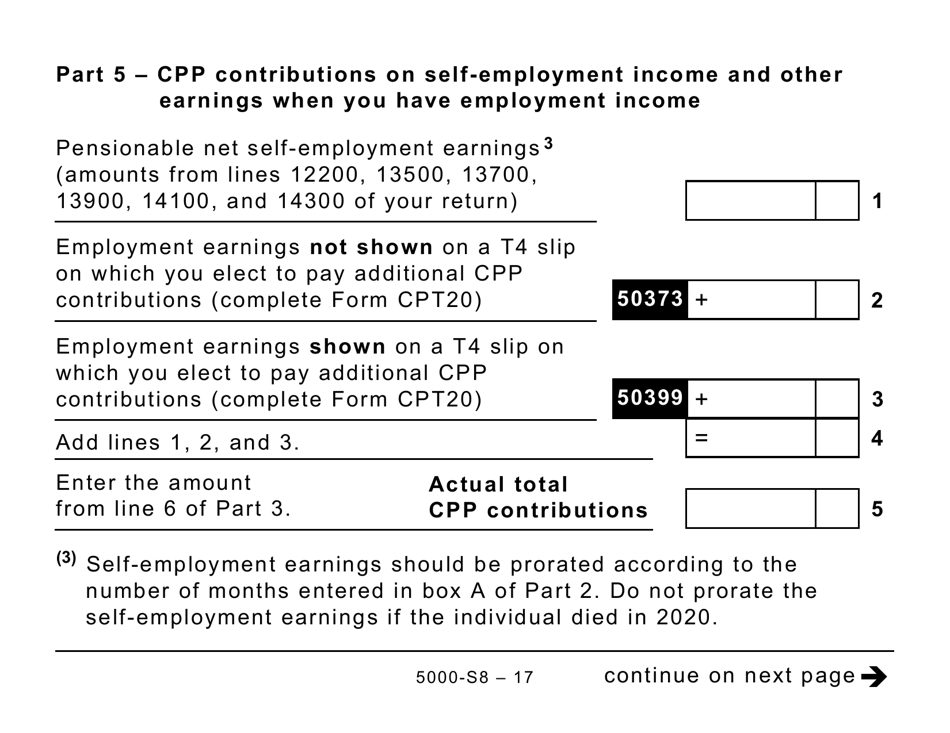

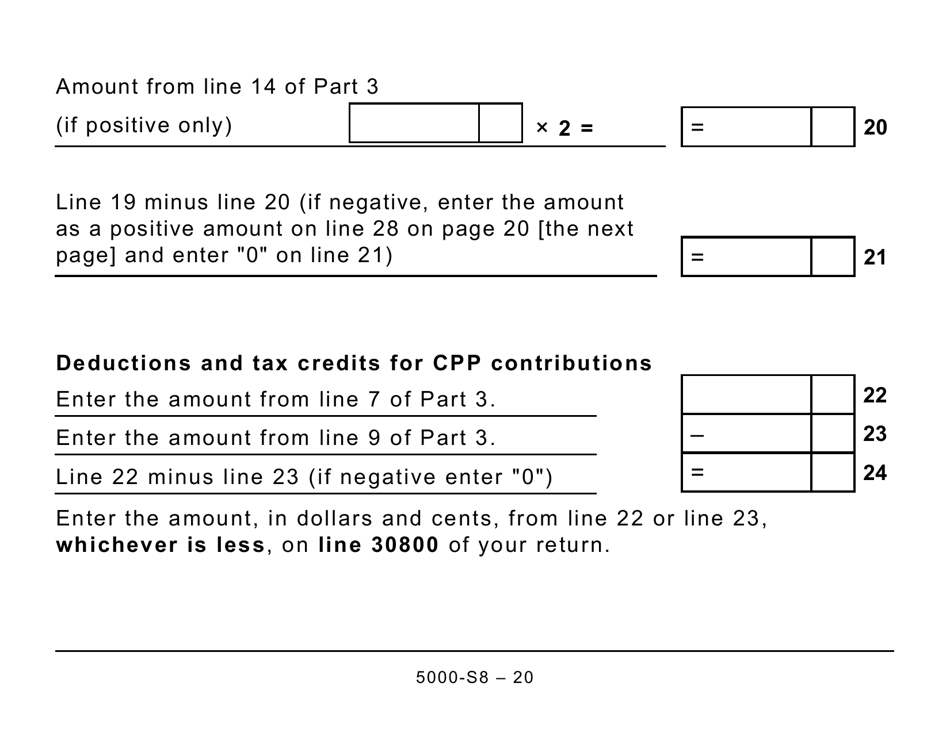

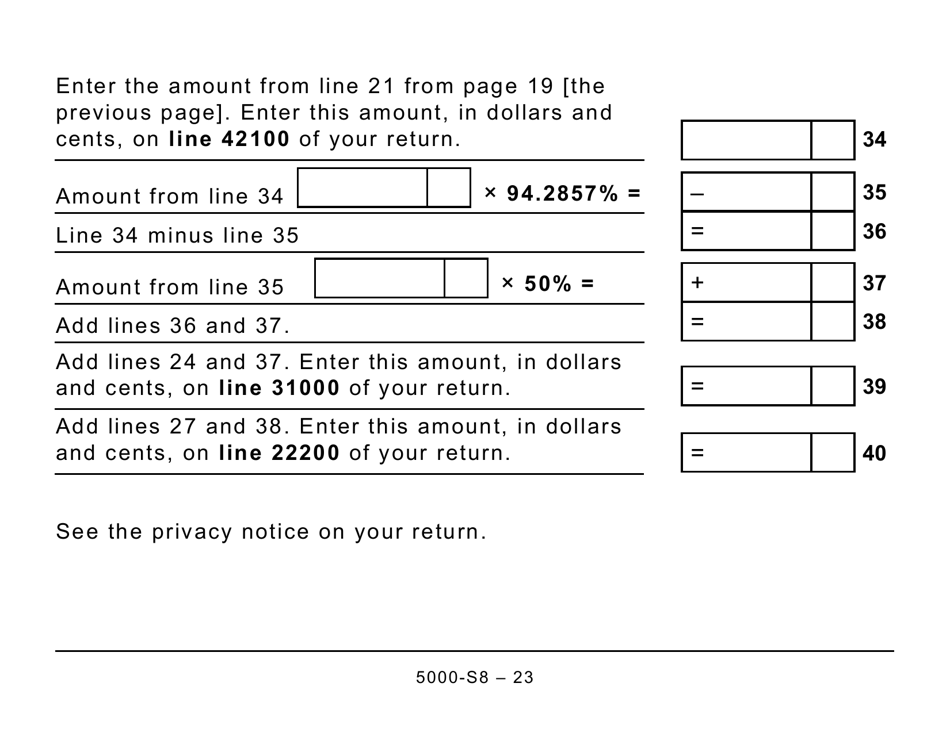

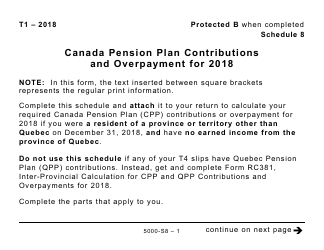

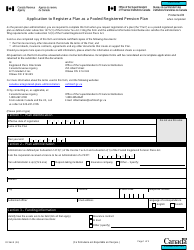

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment (Large Print) - Canada

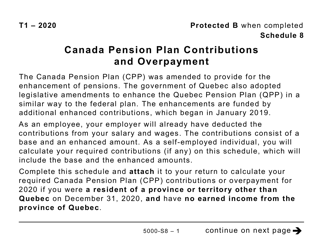

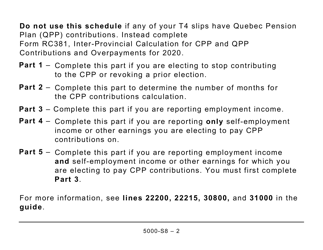

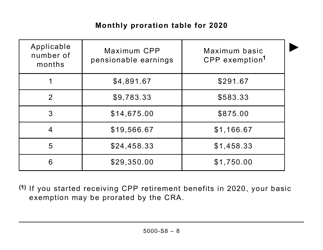

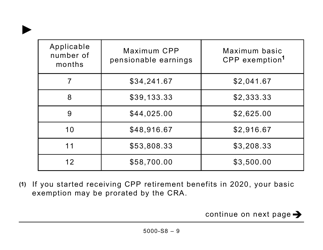

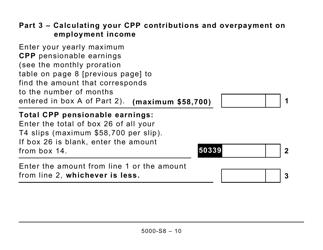

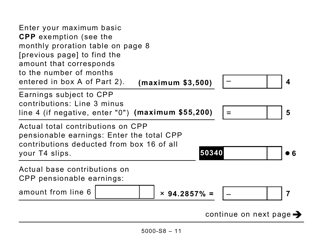

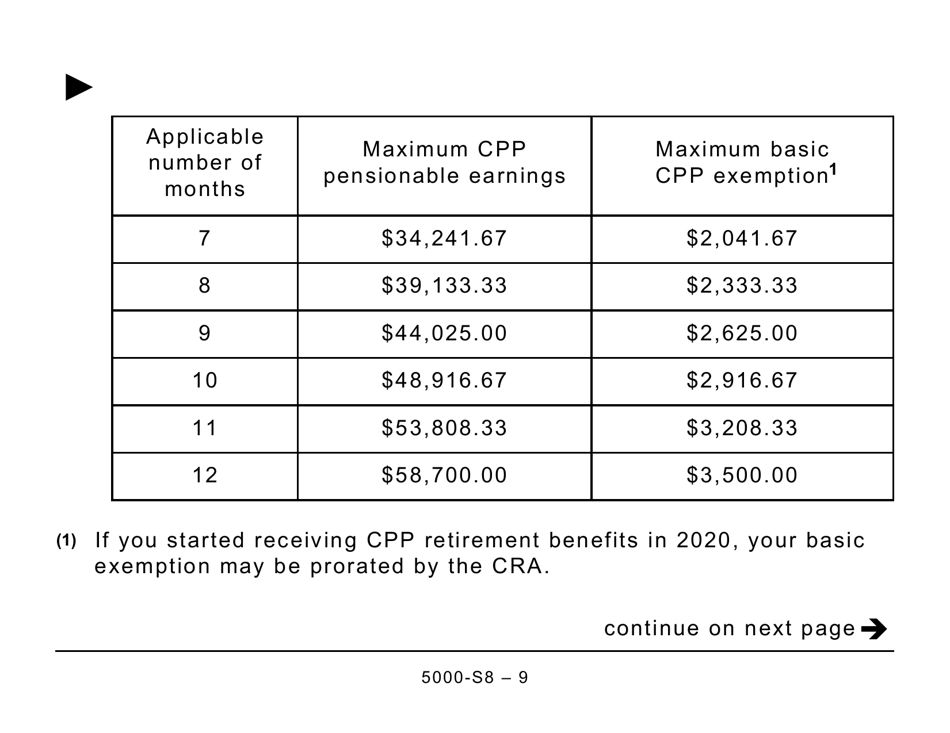

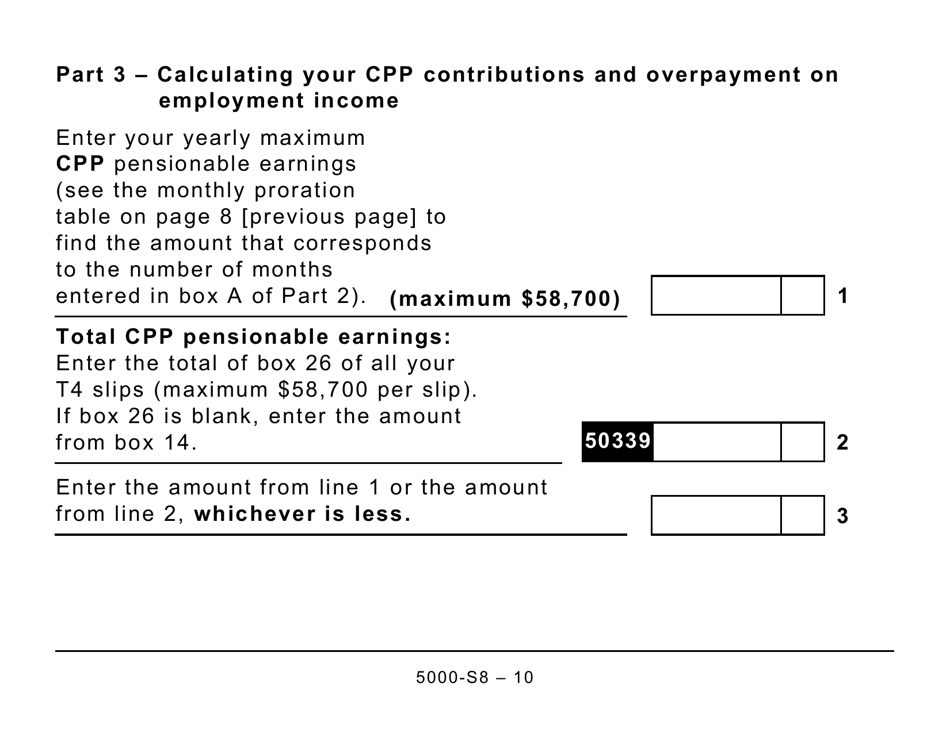

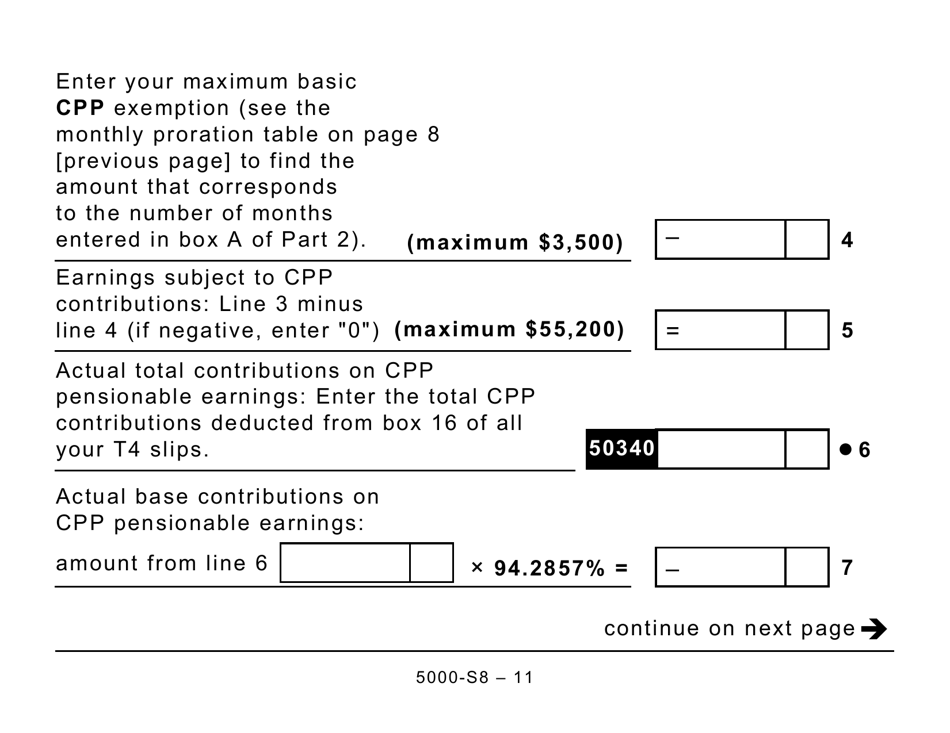

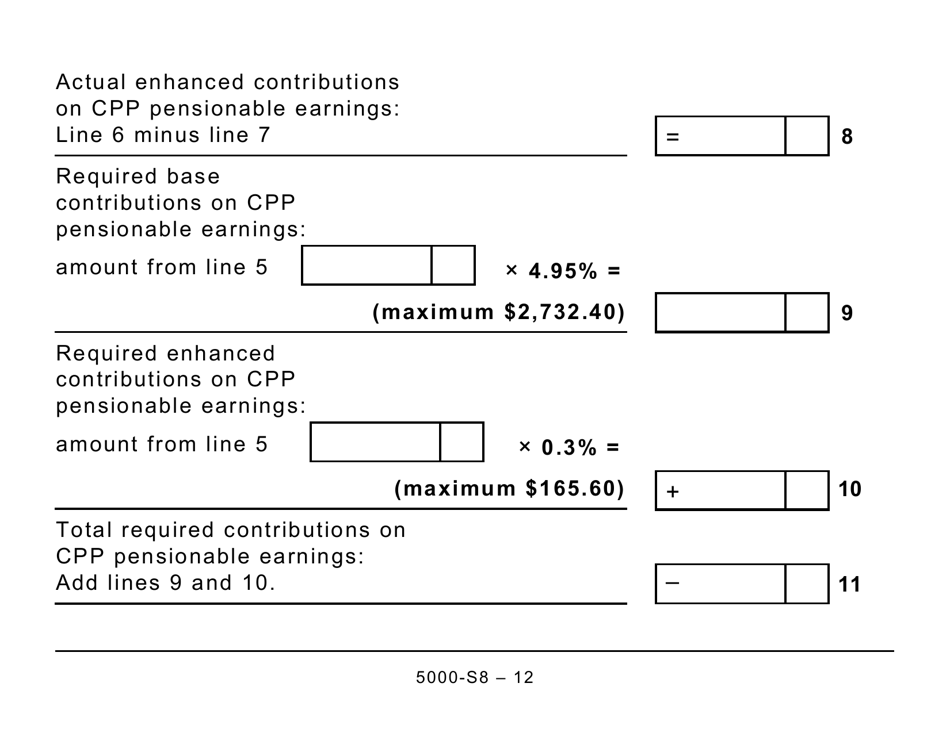

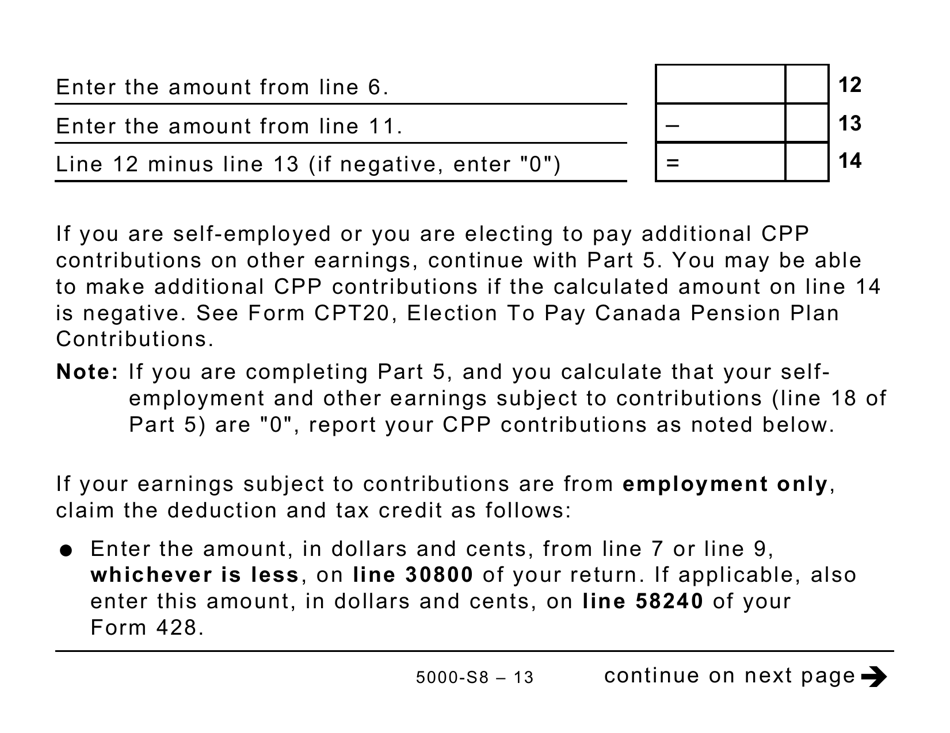

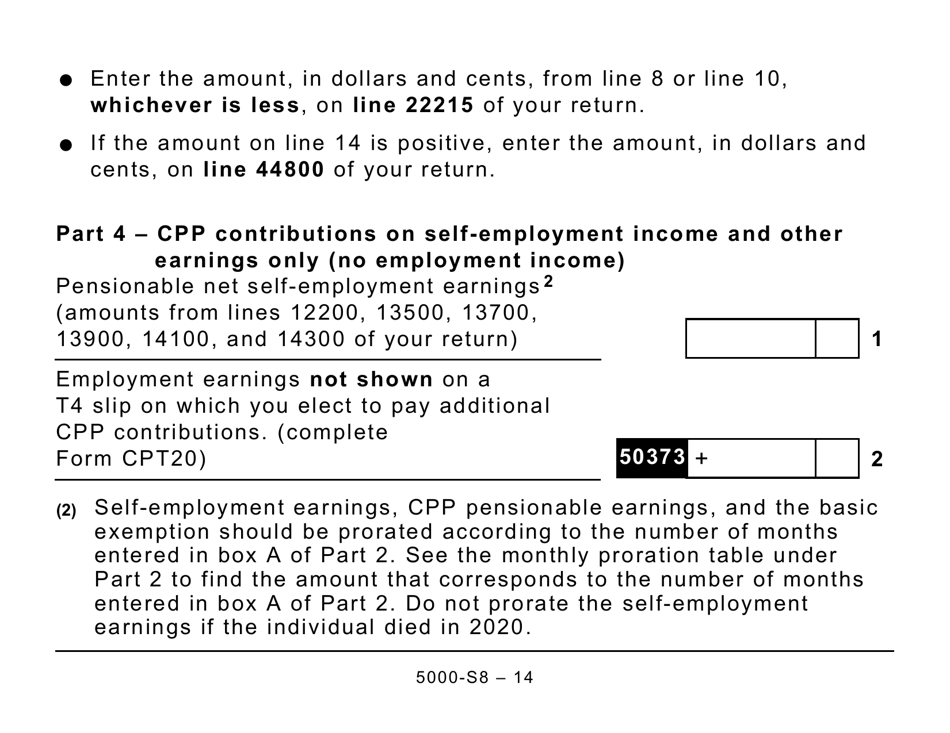

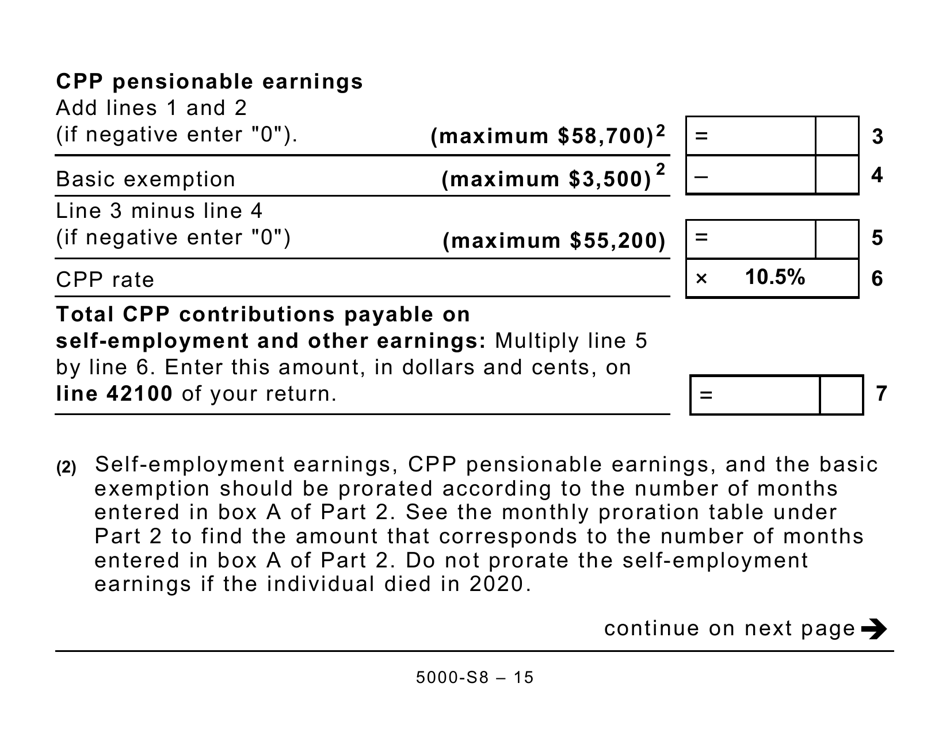

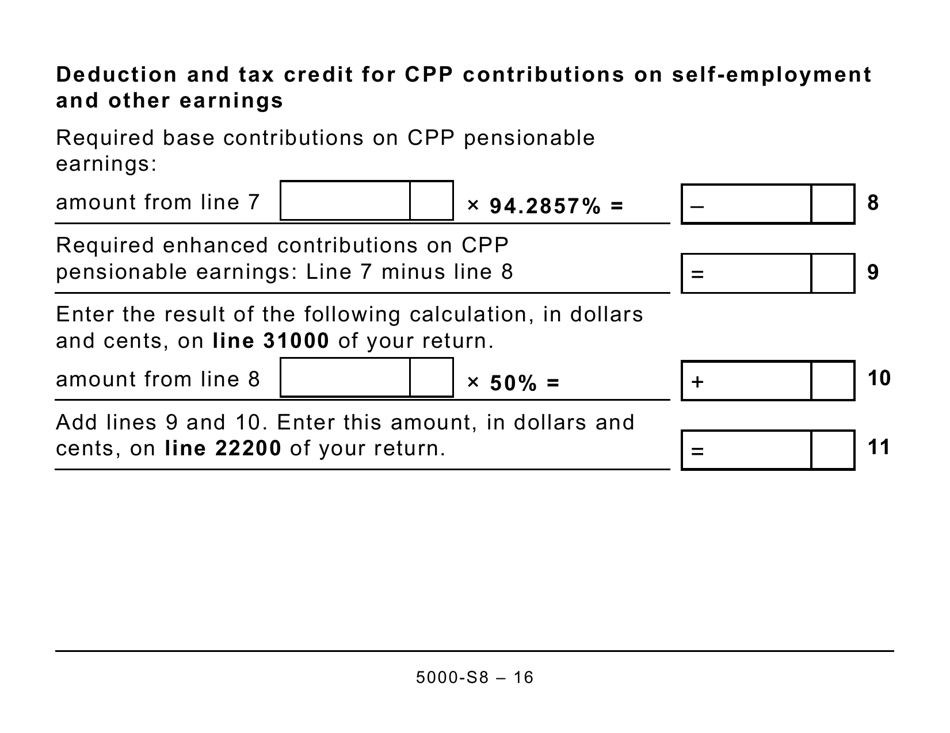

Form 5000-S8 Schedule 8 is used in Canada for reporting contributions and overpayments made to the Canada Pension Plan. It is specifically designed in large print format for individuals with visual impairments.

Individuals or businesses in Canada who have made contributions to the Canada Pension Plan and have overpaid can file the Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment (Large Print).

FAQ

Q: What is Form 5000-S8?

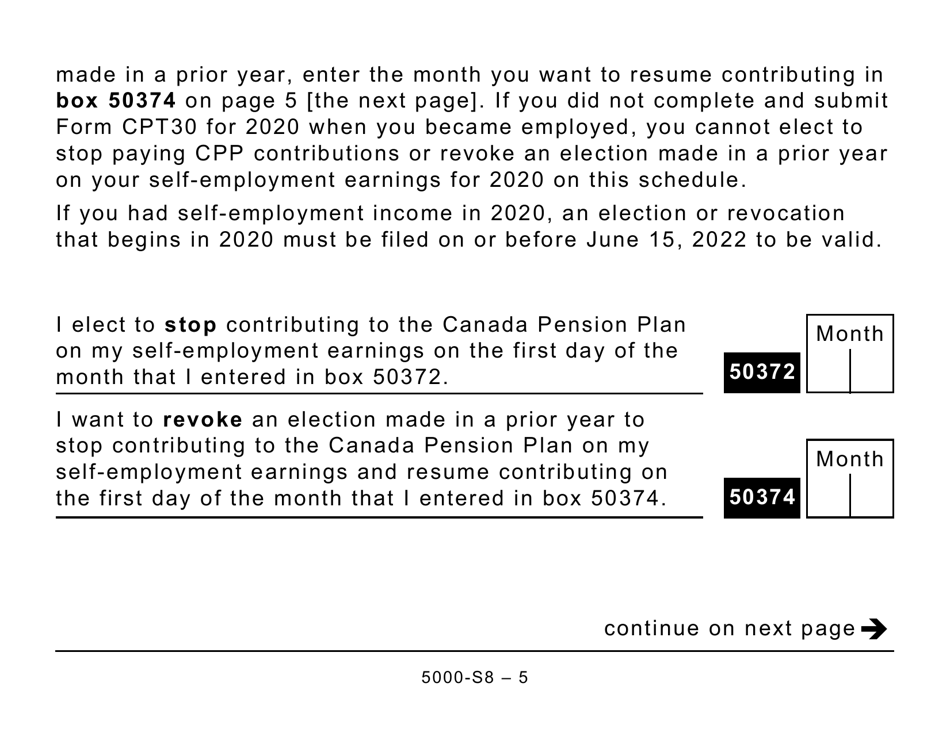

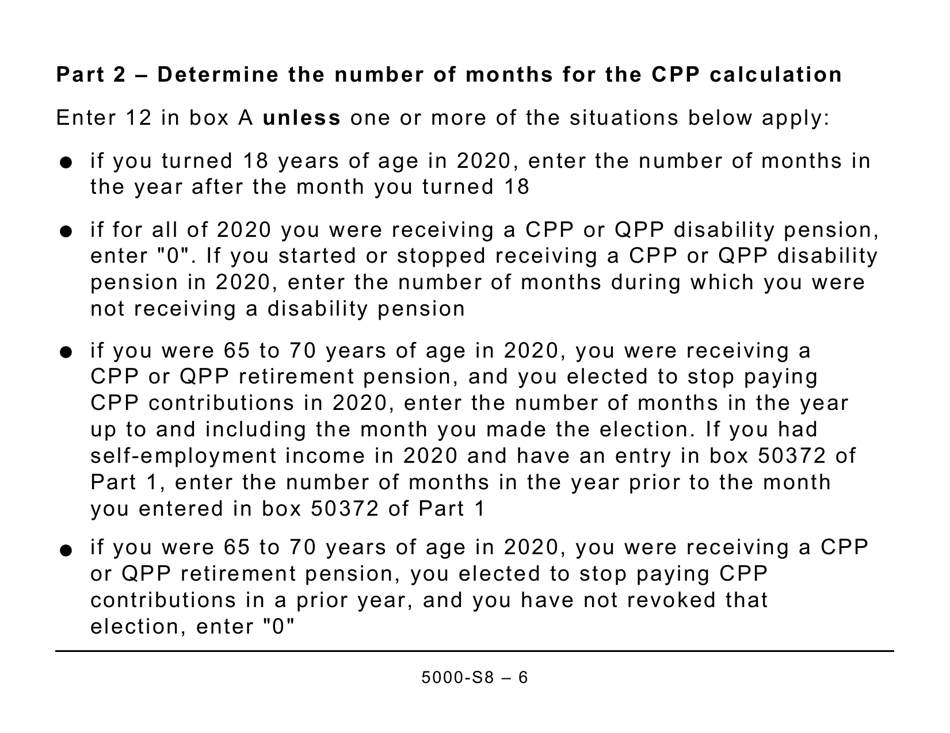

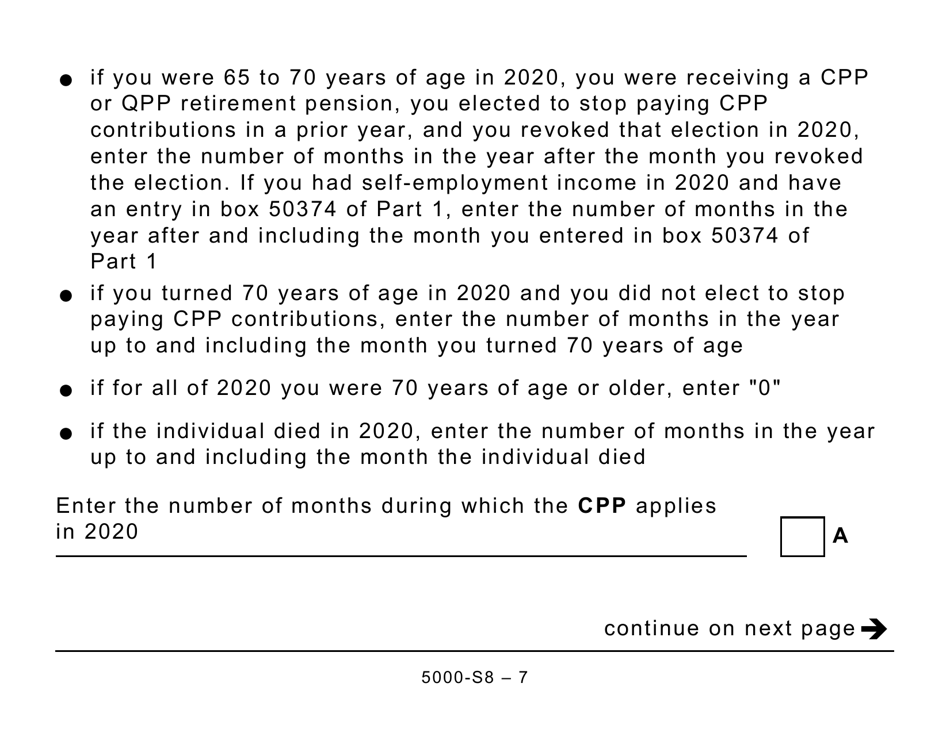

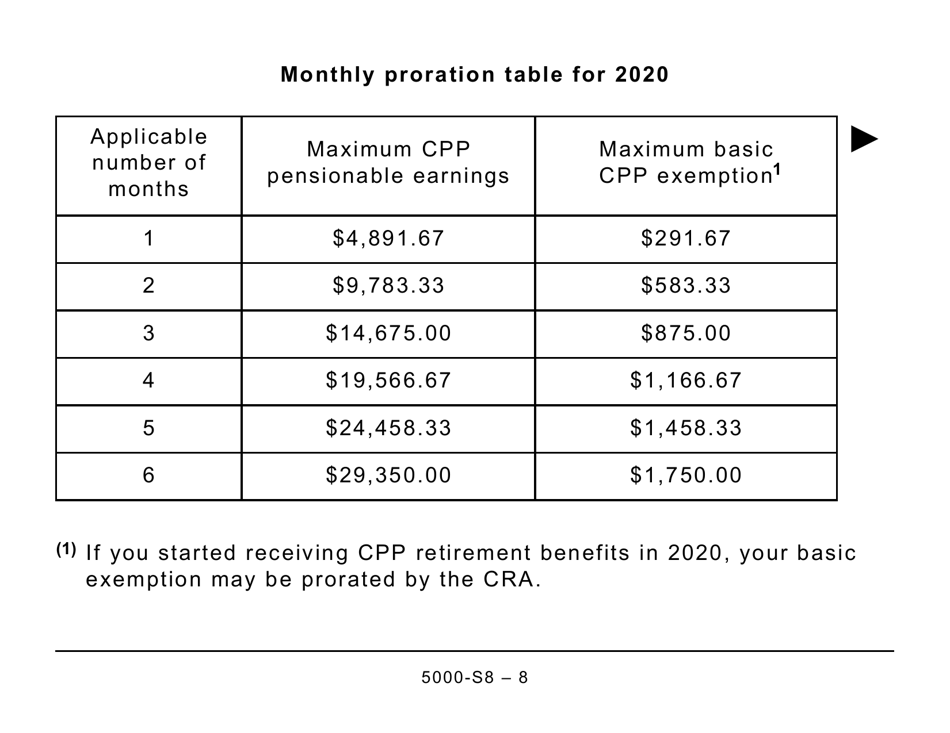

A: Form 5000-S8 is a schedule used for reporting Canada Pension Plan (CPP) contributions and overpayments.

Q: Who uses Form 5000-S8?

A: Form 5000-S8 is used by individuals in Canada who need to report their CPP contributions and overpayments.

Q: What is the purpose of Form 5000-S8?

A: The purpose of Form 5000-S8 is to provide a detailed breakdown of an individual's CPP contributions and any overpayments made.

Q: Do I need to fill out Form 5000-S8?

A: You only need to fill out Form 5000-S8 if you have made CPP contributions or have overpaid your CPP.

Q: Are there any eligibility criteria for using Form 5000-S8?

A: There are no specific eligibility criteria for using Form 5000-S8; however, it is only applicable to individuals who have made CPP contributions or have overpaid their CPP.

Q: Is Form 5000-S8 available in large print?

A: Yes, Form 5000-S8 is available in a large print format for individuals who require visual assistance.

Q: Can I electronically file Form 5000-S8?

A: No, Form 5000-S8 cannot be electronically filed. You must fill out a printed copy and mail it to the CRA.

Q: What should I do if I have questions about Form 5000-S8?

A: If you have any questions about Form 5000-S8, you can contact the Canada Revenue Agency (CRA) for assistance.