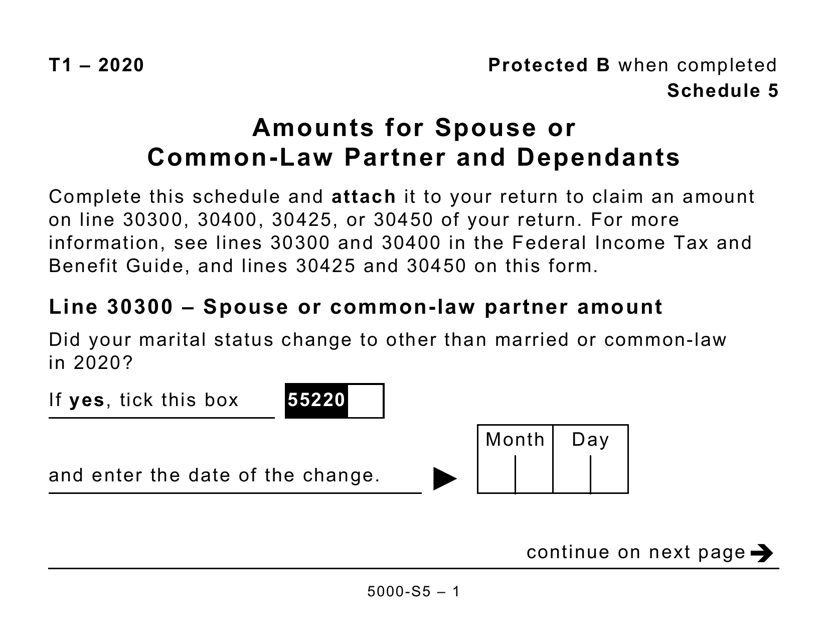

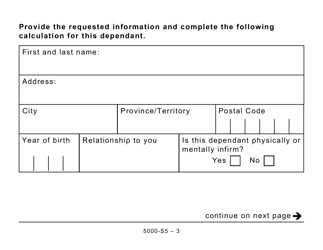

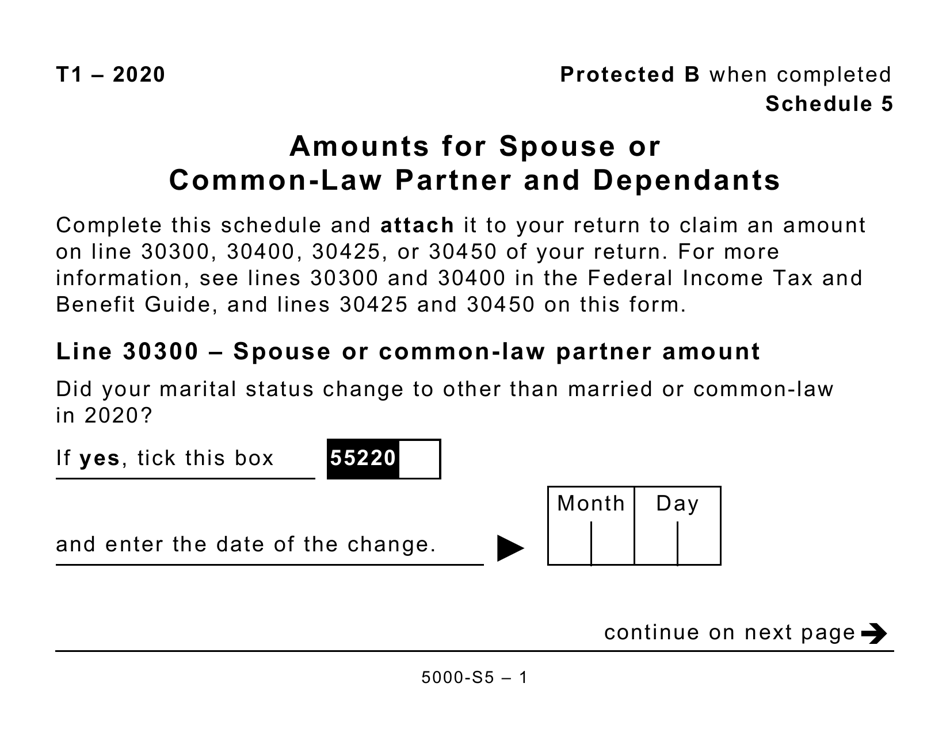

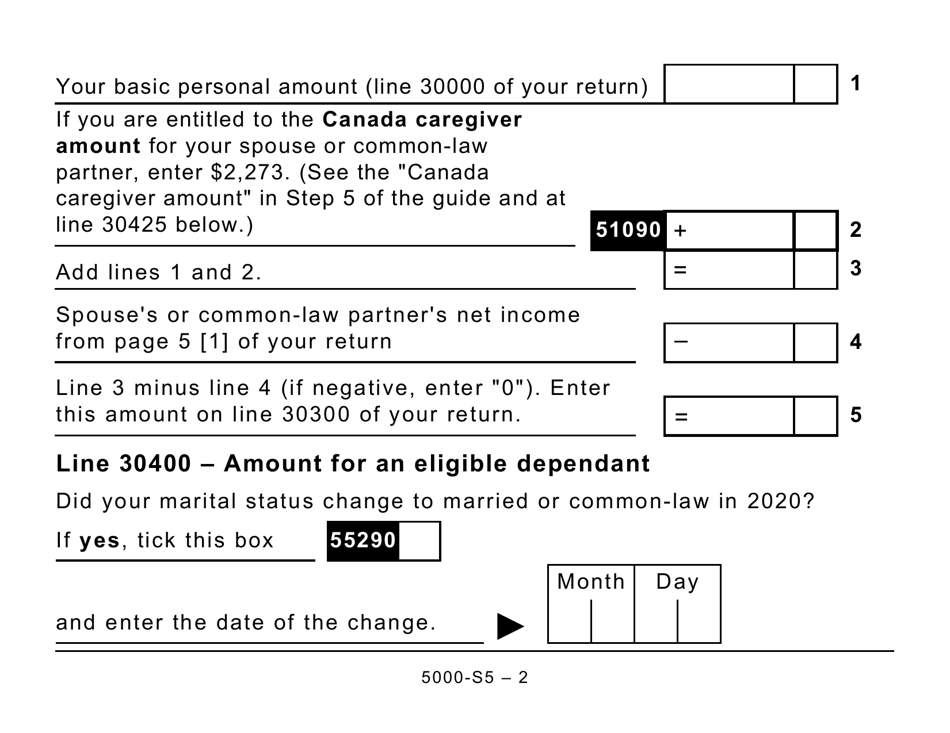

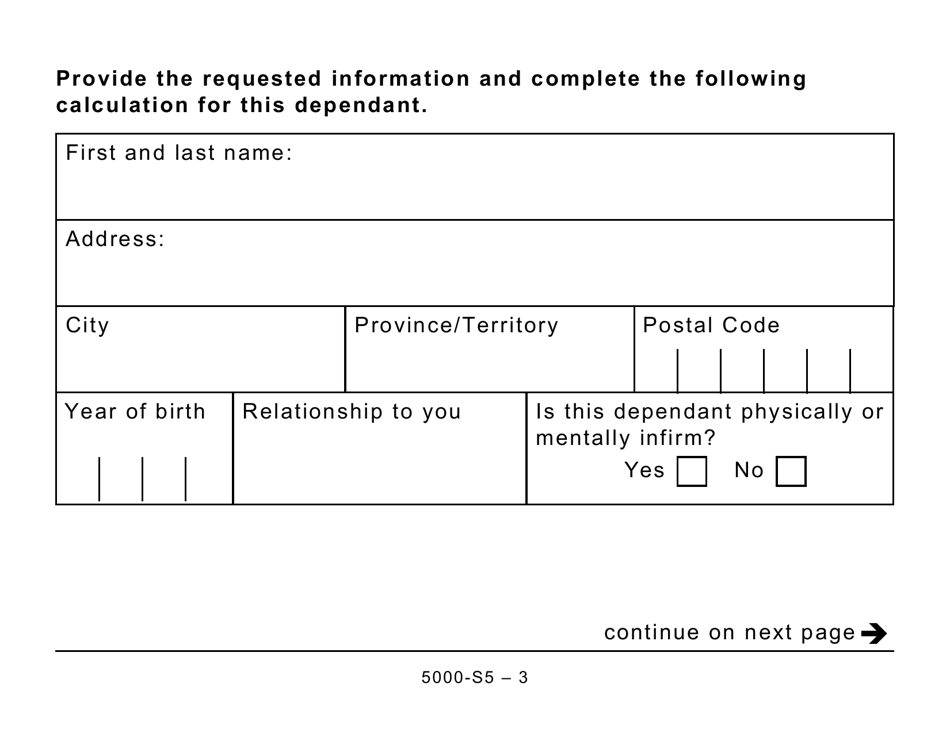

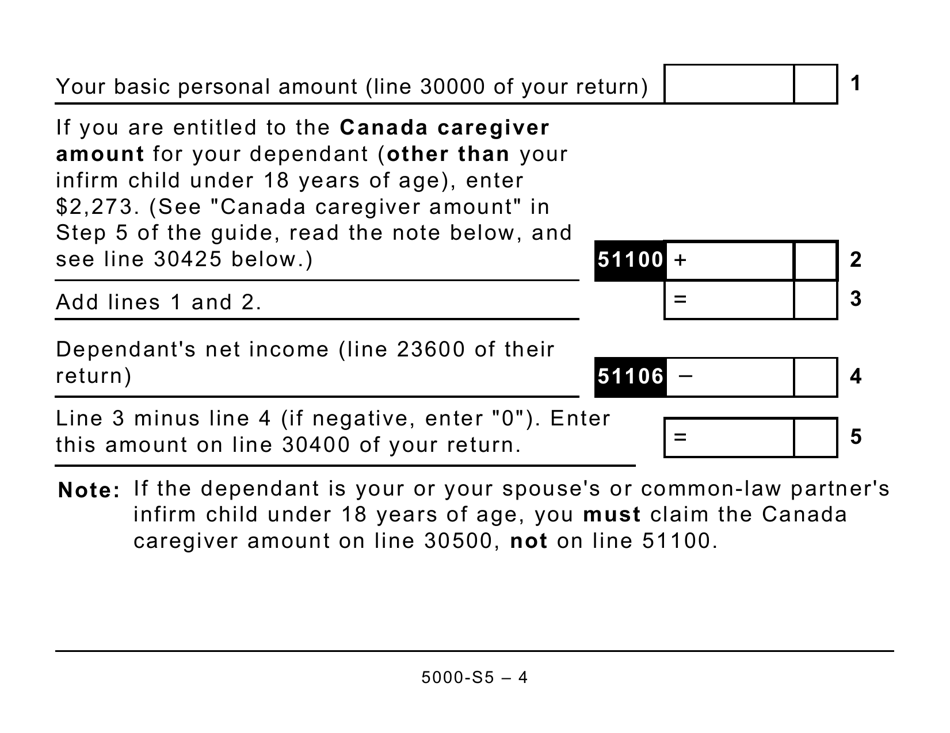

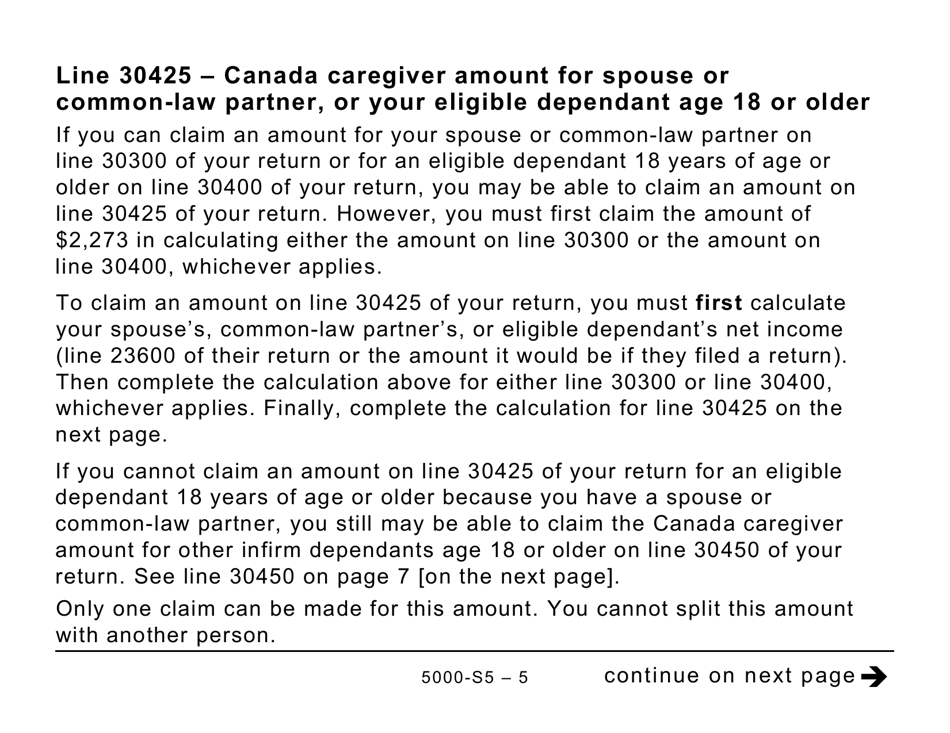

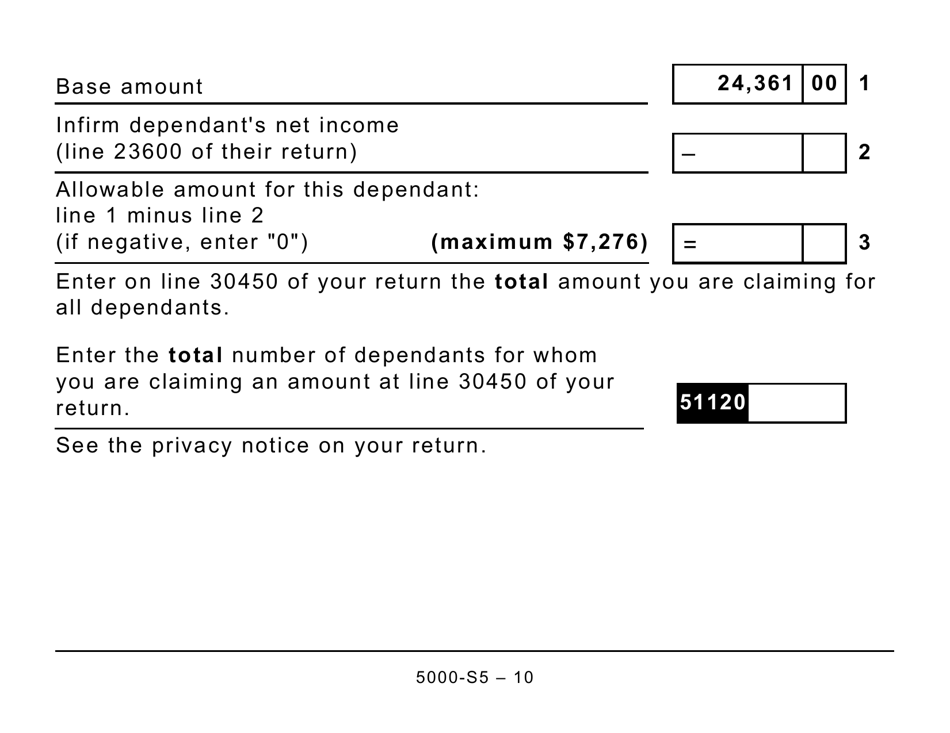

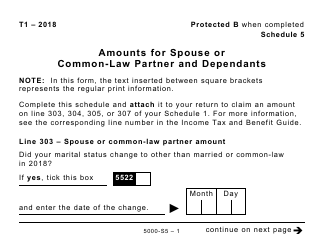

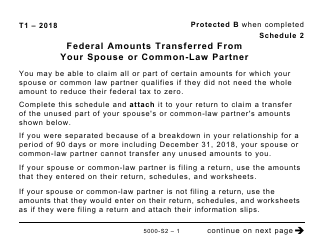

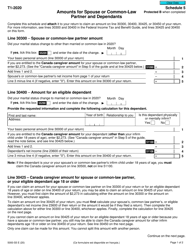

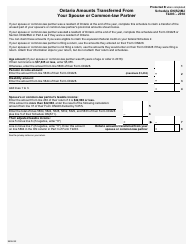

Form 5000-S5 Schedule 5 Amounts for Spouse or Common-Law Partner and Dependants - Large Print - Canada

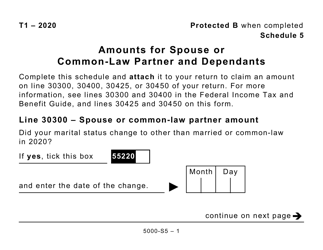

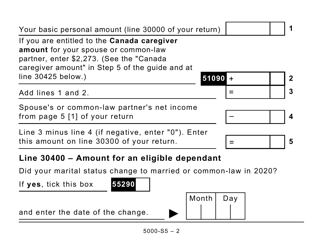

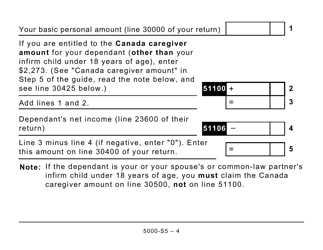

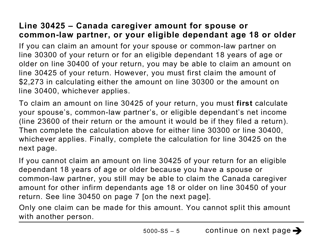

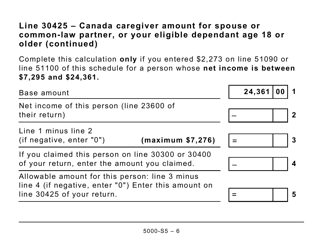

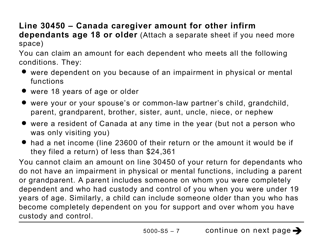

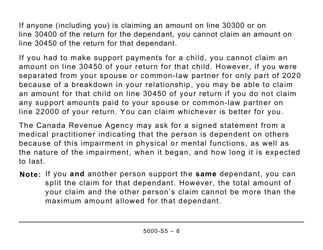

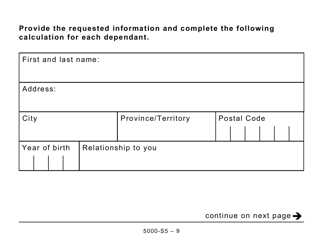

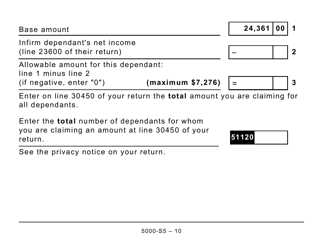

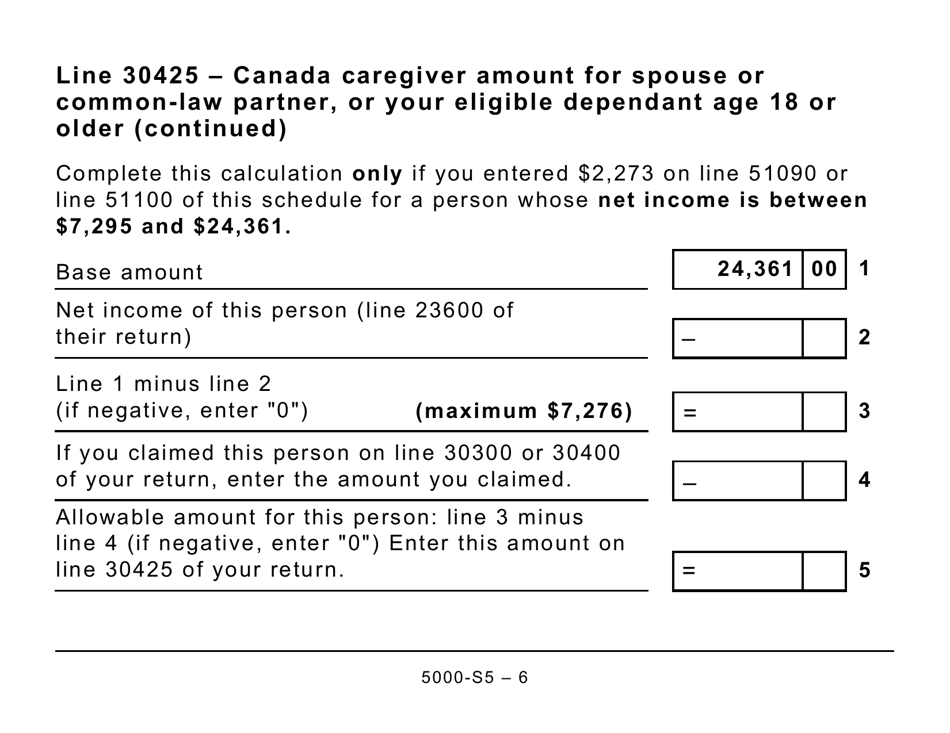

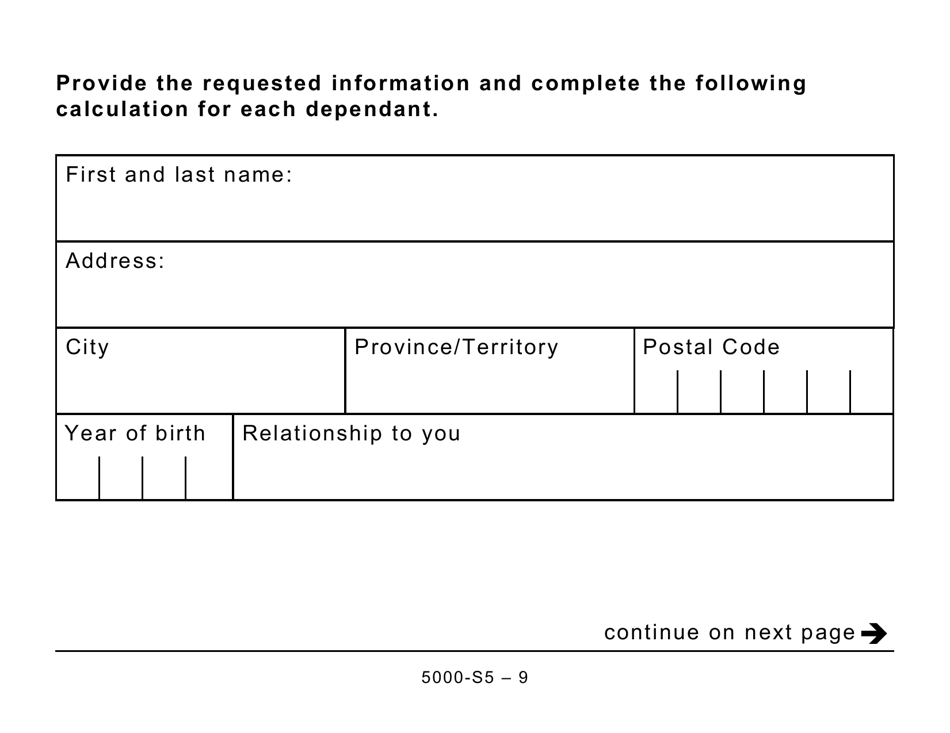

Form 5000-S5 Schedule 5 in Canada is used to report the amounts related to your spouse or common-law partner, as well as any dependents, in a large print format. It provides a breakdown of the deductions and credits for these individuals.

The Form 5000-S5 Schedule 5 - Amounts for Spouse or Common-Law Partner and Dependents - Large Print in Canada is filed by individuals who are claiming various tax credits for their spouse or common-law partner and dependents.

FAQ

Q: What is Form 5000-S5 Schedule 5?

A: Form 5000-S5 Schedule 5 is a tax form used in Canada.

Q: What is the purpose of Form 5000-S5 Schedule 5?

A: The purpose of Form 5000-S5 Schedule 5 is to report amounts for your spouse or common-law partner and dependants.

Q: Is Form 5000-S5 Schedule 5 specifically for large print?

A: Yes, Form 5000-S5 Schedule 5 is specifically for large print.

Q: Who can use Form 5000-S5 Schedule 5?

A: Any taxpayer in Canada who has a spouse or common-law partner and dependants can use Form 5000-S5 Schedule 5.

Q: Is Form 5000-S5 Schedule 5 mandatory?

A: No, Form 5000-S5 Schedule 5 is not mandatory for all taxpayers. It depends on your specific tax situation.