This version of the form is not currently in use and is provided for reference only. Download this version of

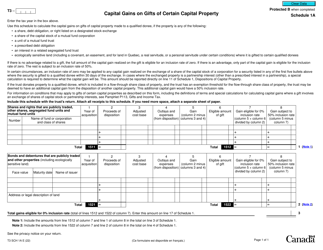

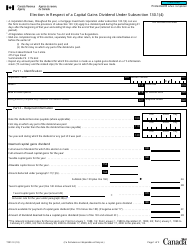

Form 5000-S3 Schedule 3

for the current year.

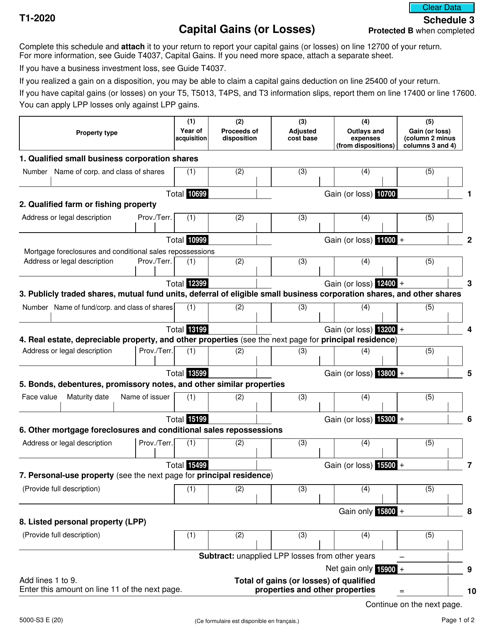

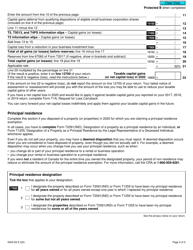

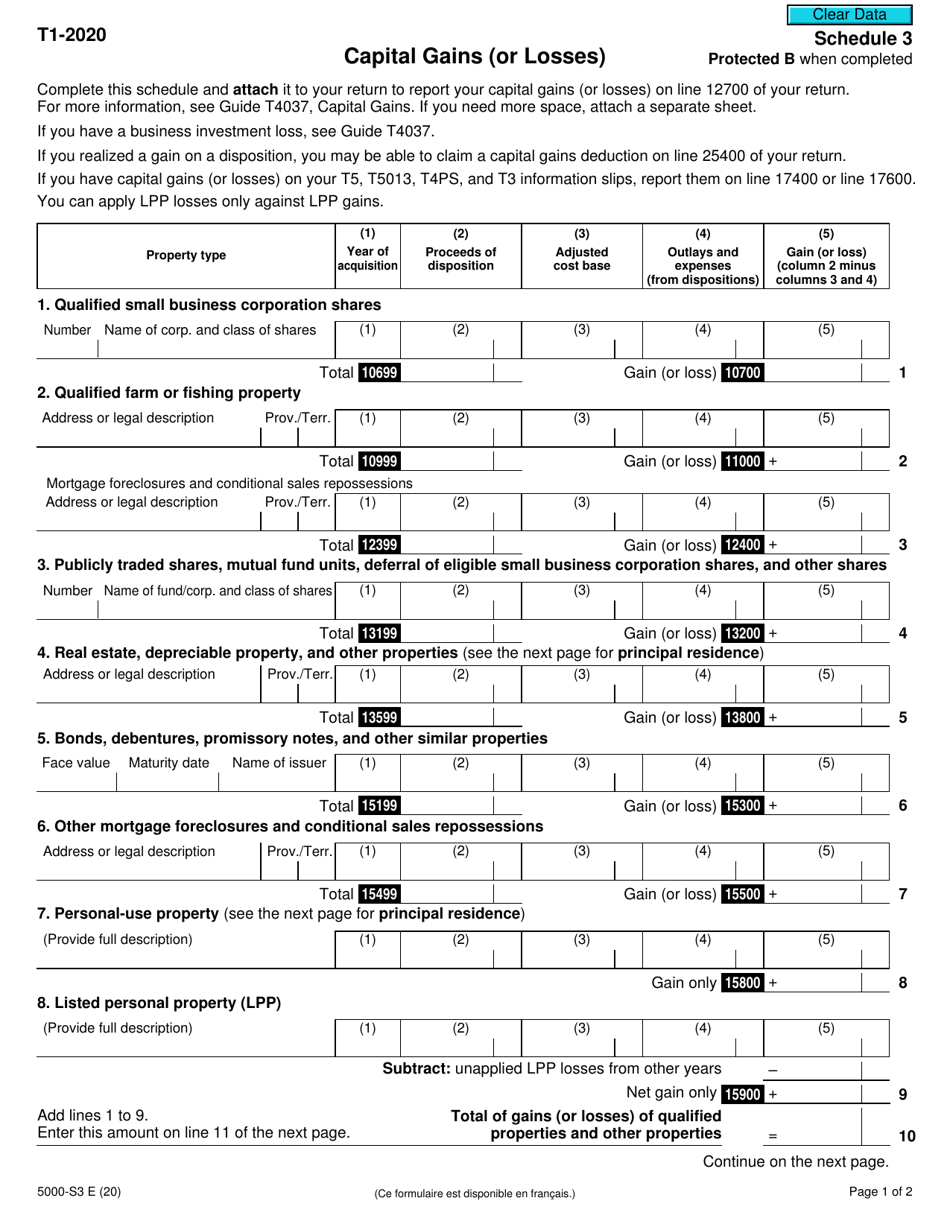

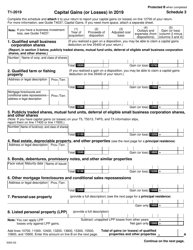

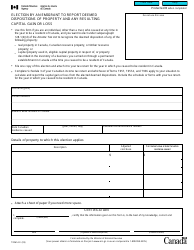

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Canada

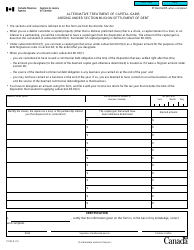

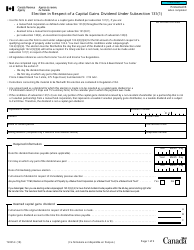

Form 5000-S3 Schedule 3 Capital Gains (or Losses) in Canada is used to report any capital gains or losses incurred during the tax year. It is part of the Canadian tax returnfiling process.

Individuals or businesses in Canada who have realized capital gains or losses during the tax year would file the Form 5000-S3 Schedule 3 Capital Gains (Or Losses).

FAQ

Q: What is Form 5000-S3?

A: Form 5000-S3 is the Schedule 3 form used in Canada to report capital gains or losses.

Q: What are capital gains?

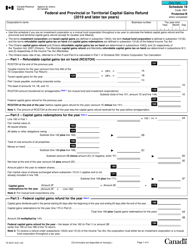

A: Capital gains are the profits made from selling or disposing of certain assets, such as real estate or stocks.

Q: What are capital losses?

A: Capital losses occur when the value of certain assets decreases and you sell them for less than you paid.

Q: When is Form 5000-S3 used?

A: This form is used when you need to report any capital gains or losses for the tax year.

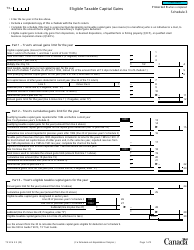

Q: What information do I have to provide on Form 5000-S3?

A: You need to provide details about the assets you sold, their cost, and the proceeds from the sale.

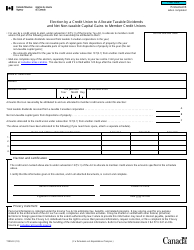

Q: Do I have to report all capital gains and losses?

A: Yes, you are required to report all capital gains and losses on your tax return.

Q: When is the deadline for filing Form 5000-S3?

A: The deadline for filing Form 5000-S3 is the same as the deadline for your tax return, typically April 30th.