This version of the form is not currently in use and is provided for reference only. Download this version of

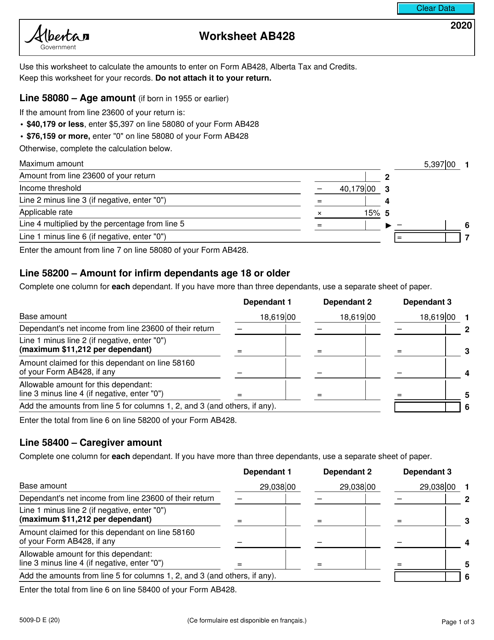

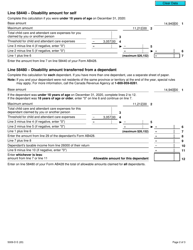

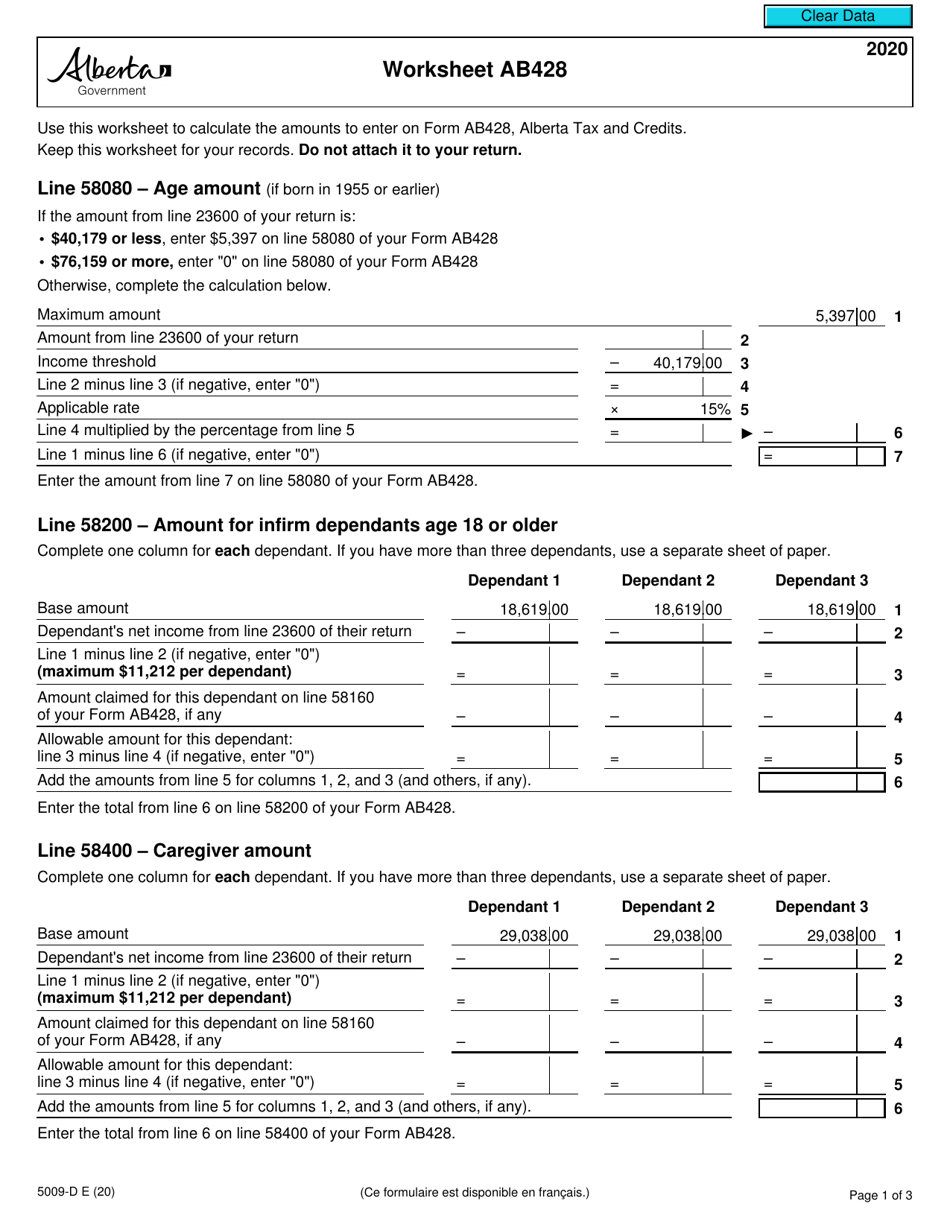

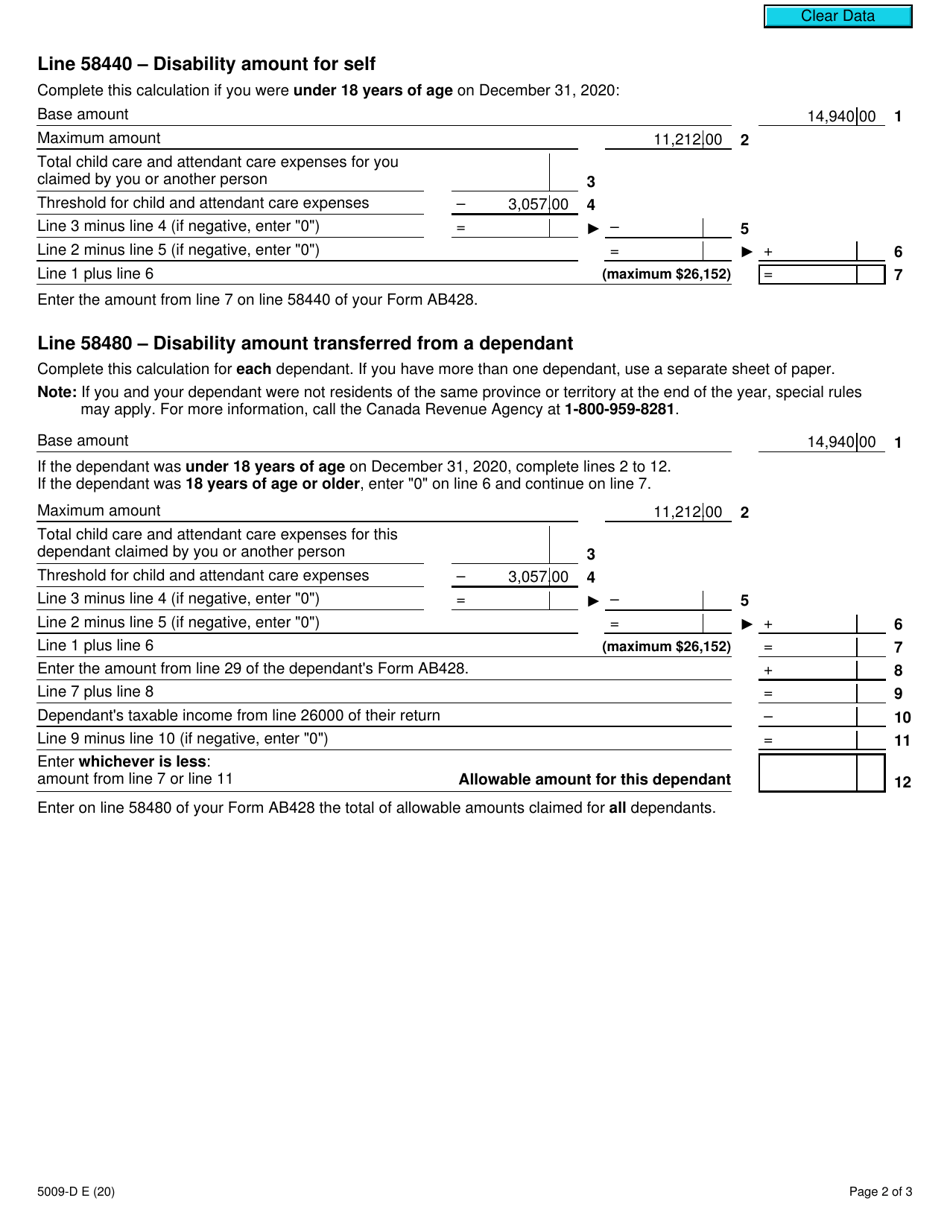

Form 5009-D Worksheet AB428

for the current year.

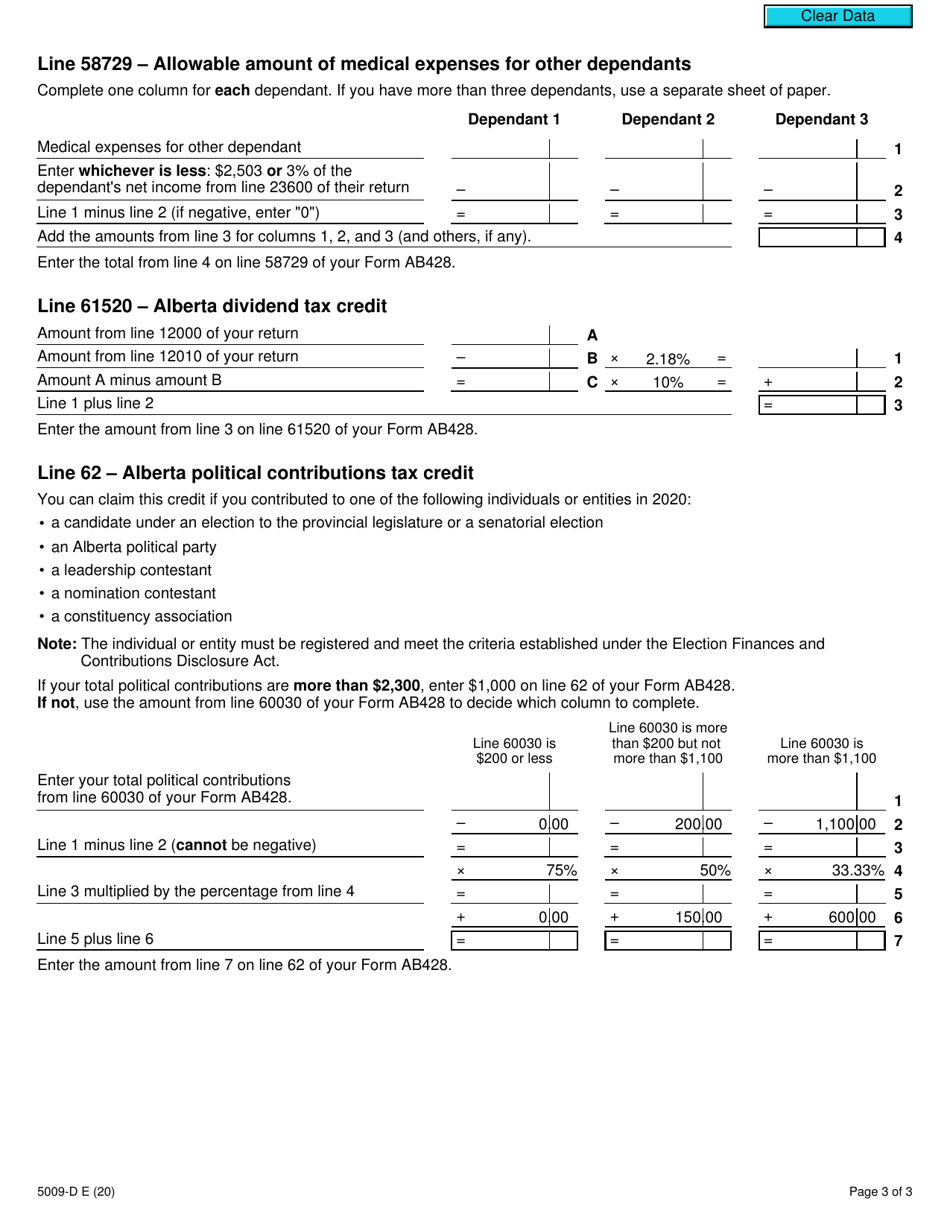

Form 5009-D Worksheet AB428 Alberta - Canada

Form 5009-D Worksheet AB428 Alberta is used by residents of Alberta, Canada to calculate provincial tax credits and deductions. Its purpose is to help individuals or families determine the amount they can claim on their provincial income tax return.

The form 5009-D Worksheet AB428 in Alberta, Canada is filed by individuals who are claiming the Alberta Family Employment Tax Credit.

FAQ

Q: What is Form 5009-D?

A: Form 5009-D is a worksheet used for AB428 in Alberta, Canada.

Q: What is AB428?

A: AB428 is a tax form used in Alberta, Canada.

Q: What is the purpose of Form 5009-D?

A: Form 5009-D serves as a worksheet to help complete the AB428 tax form.

Q: Who needs to fill out Form 5009-D?

A: This form is typically filled out by residents of Alberta, Canada.

Q: What information is required on Form 5009-D?

A: Form 5009-D requires information related to your income, deductions, and credits.

Q: Is Form 5009-D mandatory?

A: Form 5009-D is not mandatory, but it is recommended to complete it to ensure accurate completion of the AB428 tax form.

Q: When is Form 5009-D due?

A: The due date for Form 5009-D is usually the same as the filing deadline for the AB428 tax form, which is April 30th of each year.

Q: Can I file Form 5009-D electronically?

A: As of now, Form 5009-D cannot be filed electronically. It must be printed, filled out, and mailed to the Canada Revenue Agency.