This version of the form is not currently in use and is provided for reference only. Download this version of

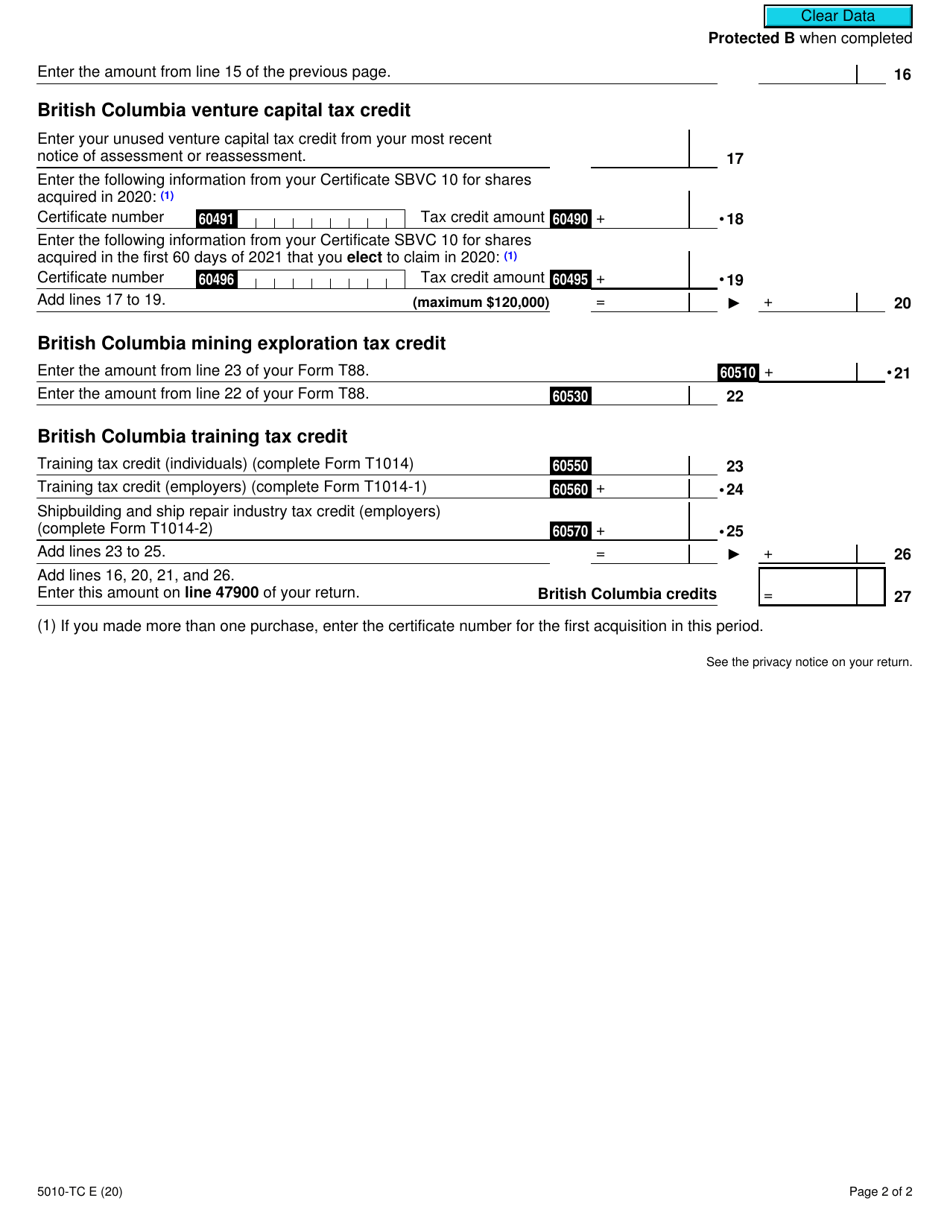

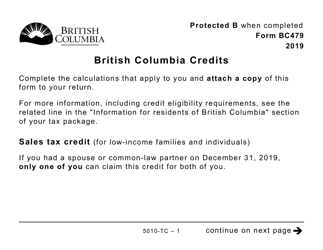

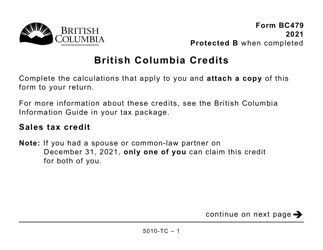

Form 5010-TC (BC479)

for the current year.

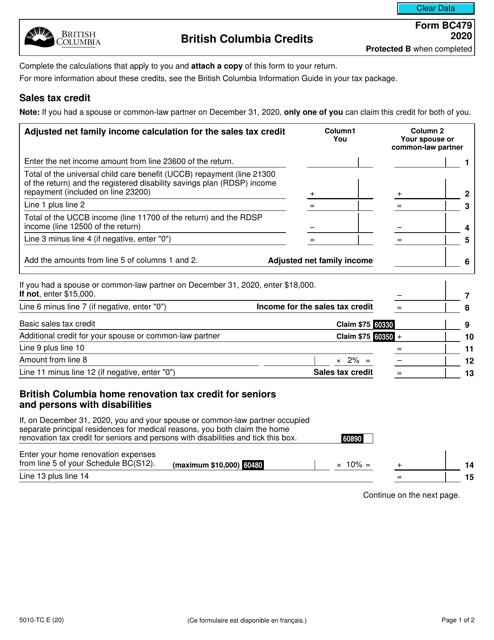

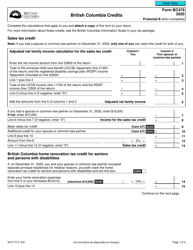

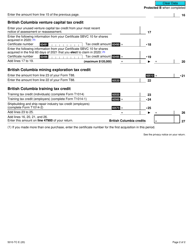

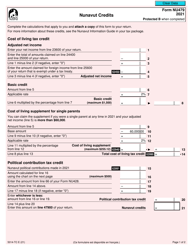

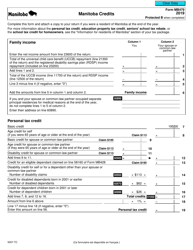

Form 5010-TC (BC479) British Columbia Credits - Canada

Form 5010-TC (BC479) is used to claim British Columbia credits in Canada.

The Form 5010-TC (BC479) is filed by the residents of British Columbia, Canada.

FAQ

Q: What is Form 5010-TC?

A: Form 5010-TC is a tax form used in British Columbia, Canada.

Q: What does BC479 mean?

A: BC479 is the unique identifier for this specific version of Form 5010-TC.

Q: What are British Columbia credits?

A: British Columbia credits refer to tax benefits and deductions available to residents of British Columbia.

Q: Who can use Form 5010-TC?

A: Residents of British Columbia who are eligible for specific tax credits can use Form 5010-TC.

Q: What information is required on Form 5010-TC?

A: Form 5010-TC requires personal information, income details, and specific details related to the tax credits being claimed.

Q: When is the deadline to file Form 5010-TC?

A: The deadline to file Form 5010-TC is typically April 30th of each year.

Q: Can I claim British Columbia credits on my federal tax return?

A: No, British Columbia credits can only be claimed on the provincial tax return.

Q: Are there any specific eligibility criteria for British Columbia credits?

A: Yes, there are specific eligibility criteria for each tax credit. You need to review the guidelines provided by the Canada Revenue Agency (CRA).