This version of the form is not currently in use and is provided for reference only. Download this version of

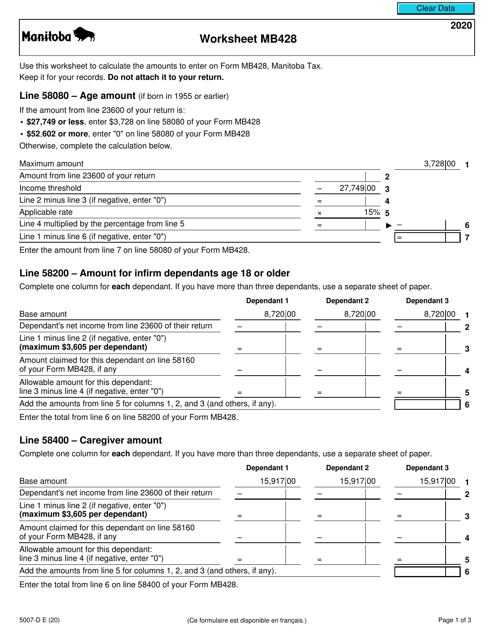

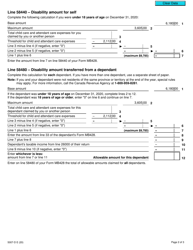

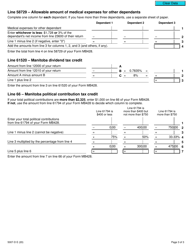

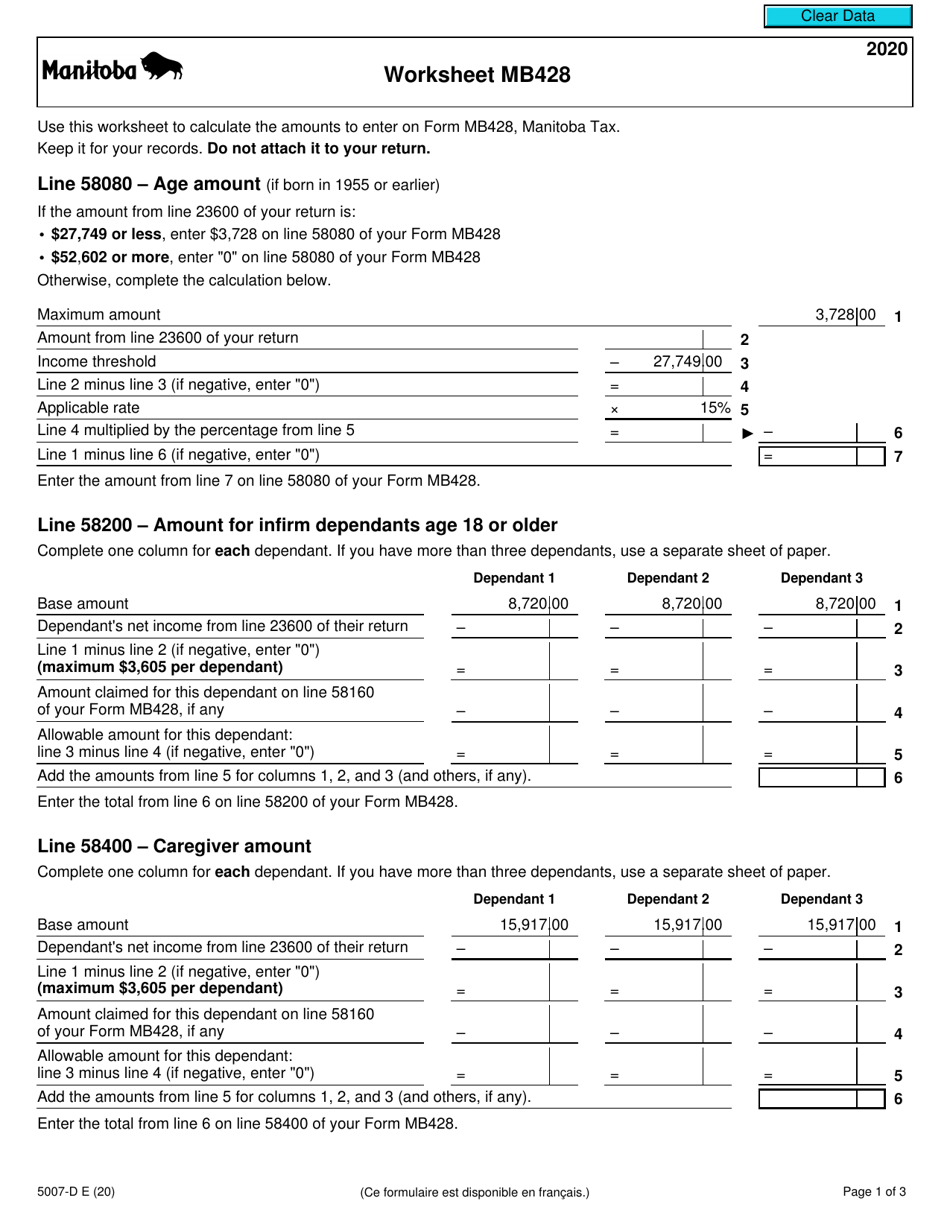

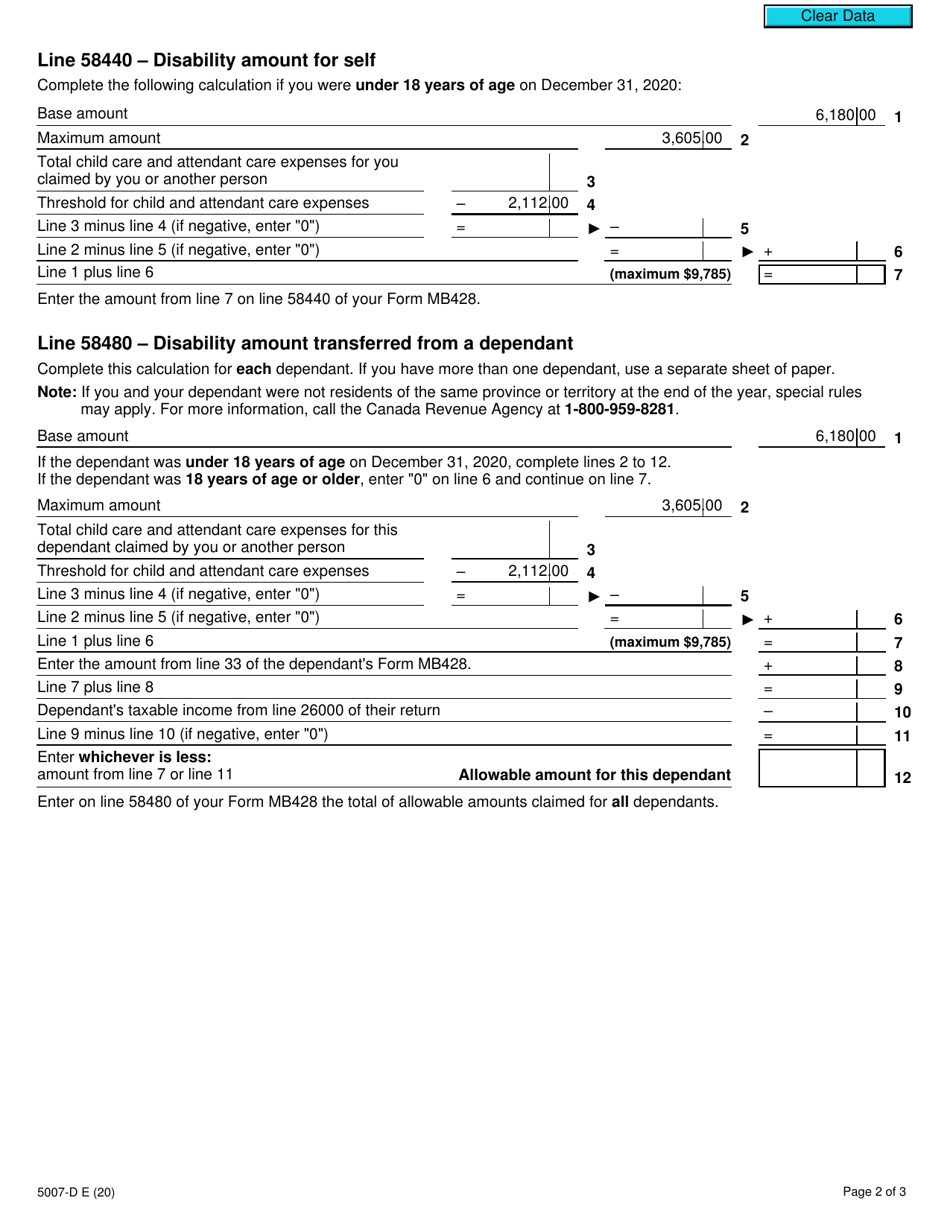

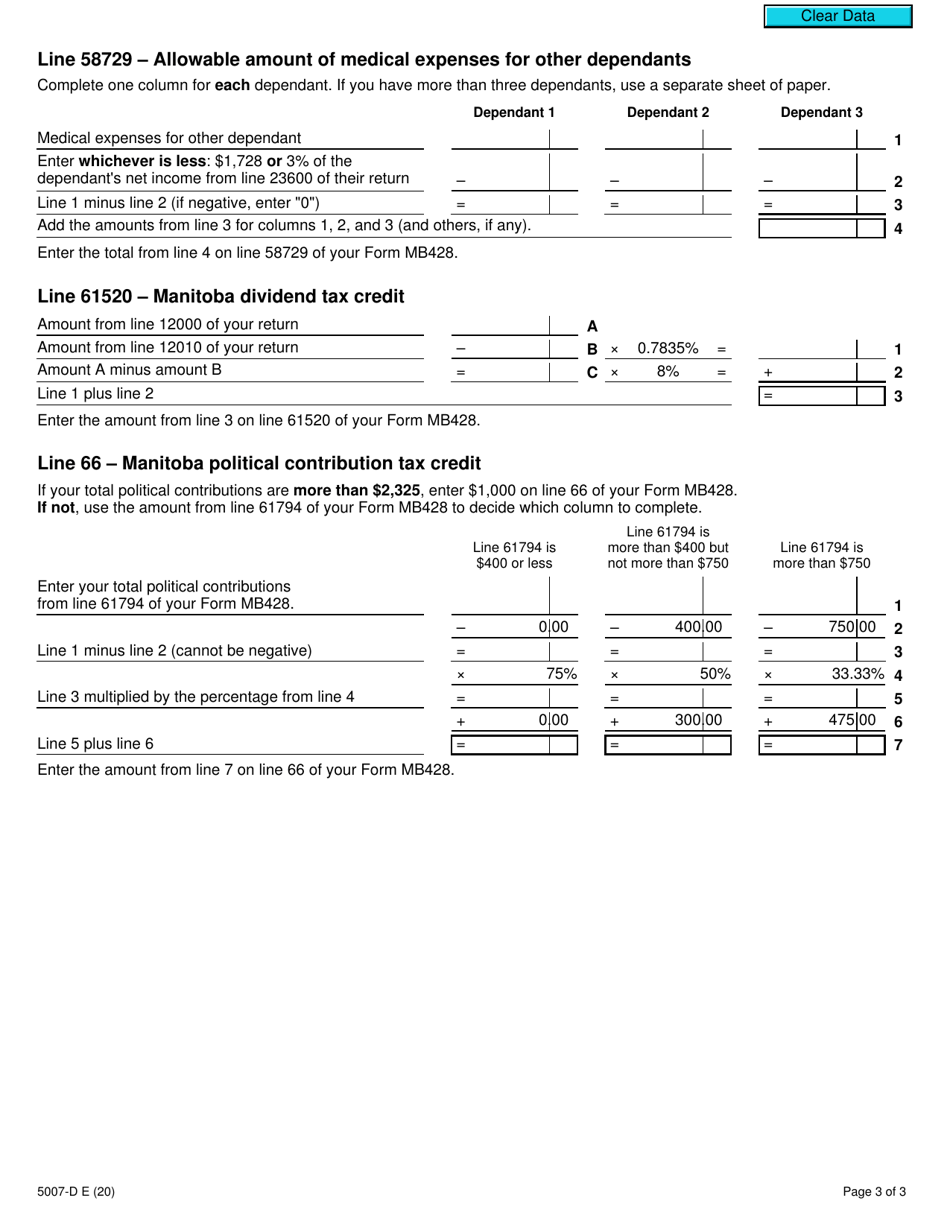

Form 5007-D Worksheet MB428

for the current year.

Form 5007-D Worksheet MB428 Manitoba - Canada

Form 5007-D Worksheet MB428 is used to calculate the Manitoba personal tax credits for individuals. It helps determine the amount of tax credits that can be claimed on the Manitoba tax return.

The Form 5007-D Worksheet MB428 in Manitoba, Canada is typically filed by individuals who are residents of Manitoba.

FAQ

Q: What is Form 5007-D?

A: Form 5007-D is a worksheet used for filing taxes in Manitoba, Canada.

Q: Who needs to file Form 5007-D?

A: Residents of Manitoba, Canada who are filing their taxes.

Q: What is the purpose of Form 5007-D?

A: Form 5007-D is used to calculate certain tax credits and deductions specific to Manitoba.

Q: Do I need to attach Form 5007-D to my tax return?

A: Typically, you do not need to attach Form 5007-D to your tax return. However, keep it for your records in case of an audit.

Q: Are there any deadlines for filing Form 5007-D?

A: The deadline for filing Form 5007-D is usually the same as the deadline for filing your tax return, which is April 30th.

Q: What if I made a mistake on my Form 5007-D?

A: If you made a mistake on your Form 5007-D, you can correct it by submitting an amended return or contacting the tax authority for assistance.

Q: What should I do if I have questions about Form 5007-D?

A: If you have questions about Form 5007-D, you can contact the tax authority or seek assistance from a tax professional.