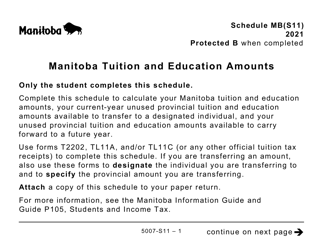

This version of the form is not currently in use and is provided for reference only. Download this version of

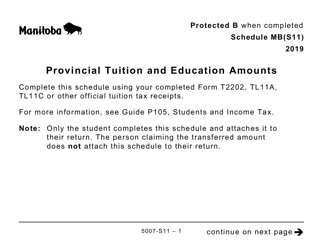

Form 5007-S11 Schedule MB(S11)

for the current year.

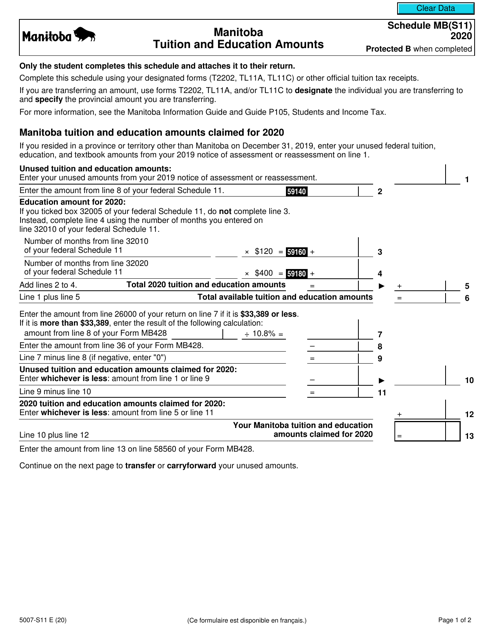

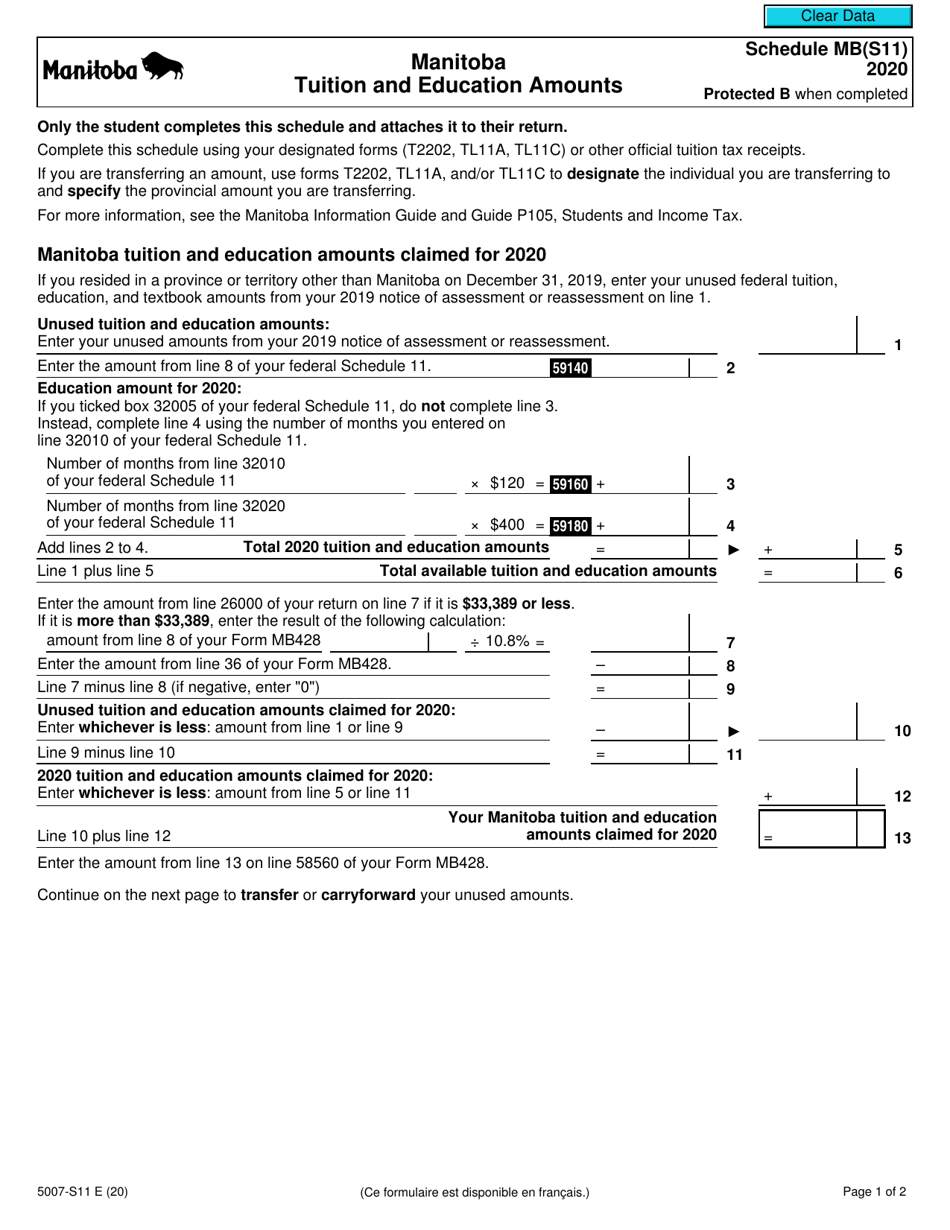

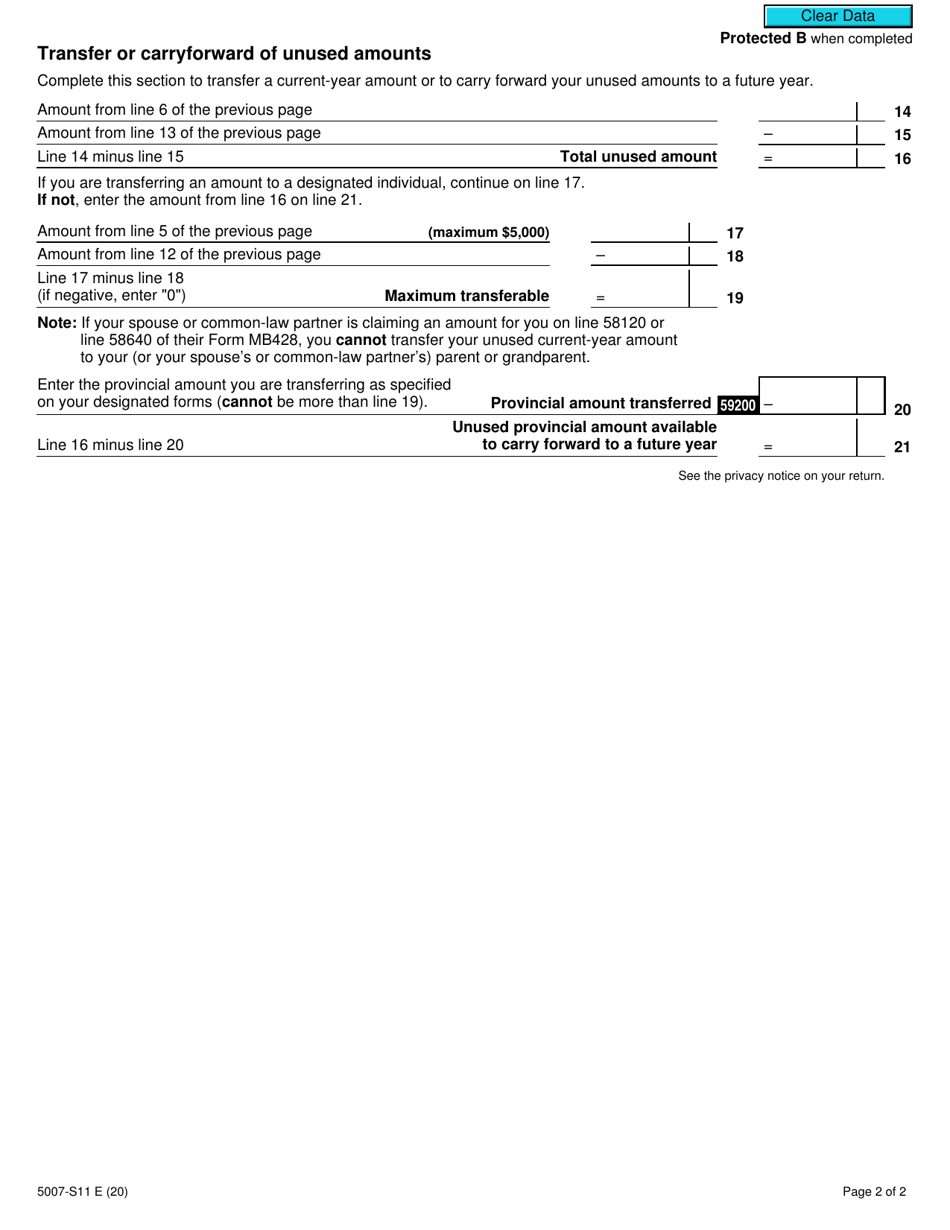

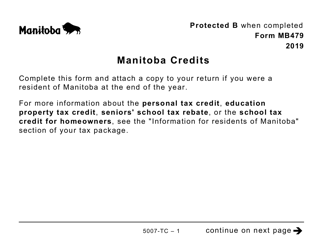

Form 5007-S11 Schedule MB(S11) Manitoba Tuition and Education Amounts - Canada

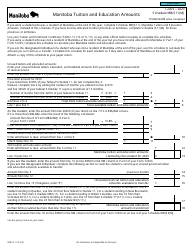

Form 5007-S11 Schedule MB(S11) is used in Canada for reporting Manitoba Tuition and Education Amounts. It is used to claim tax credits for tuition and education expenses incurred in Manitoba.

The student who claims the Manitoba Tuition and Education Amounts would file the Form 5007-S11 Schedule MB(S11) in Canada.

FAQ

Q: What is Form 5007-S11 Schedule MB?

A: Form 5007-S11 Schedule MB is a tax form used in Canada.

Q: What is the purpose of Form 5007-S11 Schedule MB?

A: The purpose of Form 5007-S11 Schedule MB is to claim tuition and education amounts in the province of Manitoba.

Q: Who can use Form 5007-S11 Schedule MB?

A: Residents of Manitoba who have incurred eligible tuition and education expenses can use Form 5007-S11 Schedule MB.

Q: What are tuition and education amounts?

A: Tuition and education amounts are credits that can be claimed to reduce the amount of tax owed.

Q: How do I fill out Form 5007-S11 Schedule MB?

A: You need to provide your personal information and details about your tuition and education expenses.

Q: Is there a deadline to submit Form 5007-S11 Schedule MB?

A: The deadline to submit Form 5007-S11 Schedule MB is typically April 30th of the year following the tax year.

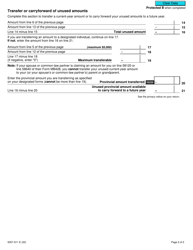

Q: Can I claim tuition and education amounts from previous years?

A: Yes, it is possible to carry forward and claim unused tuition and education amounts from previous years.