Form 5007-S14 Schedule 14 Climate Action Incentive - Canada

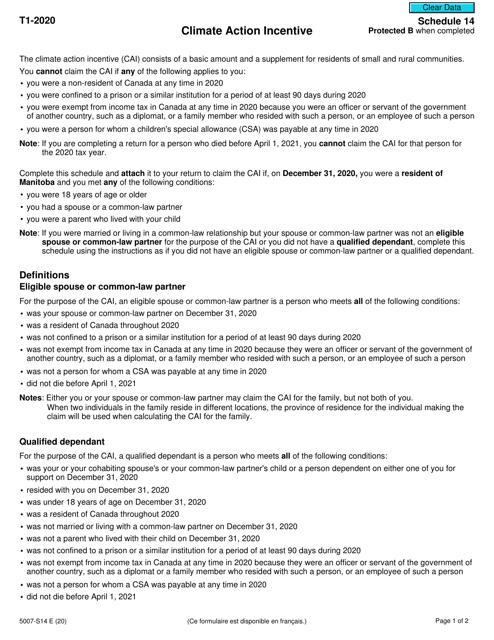

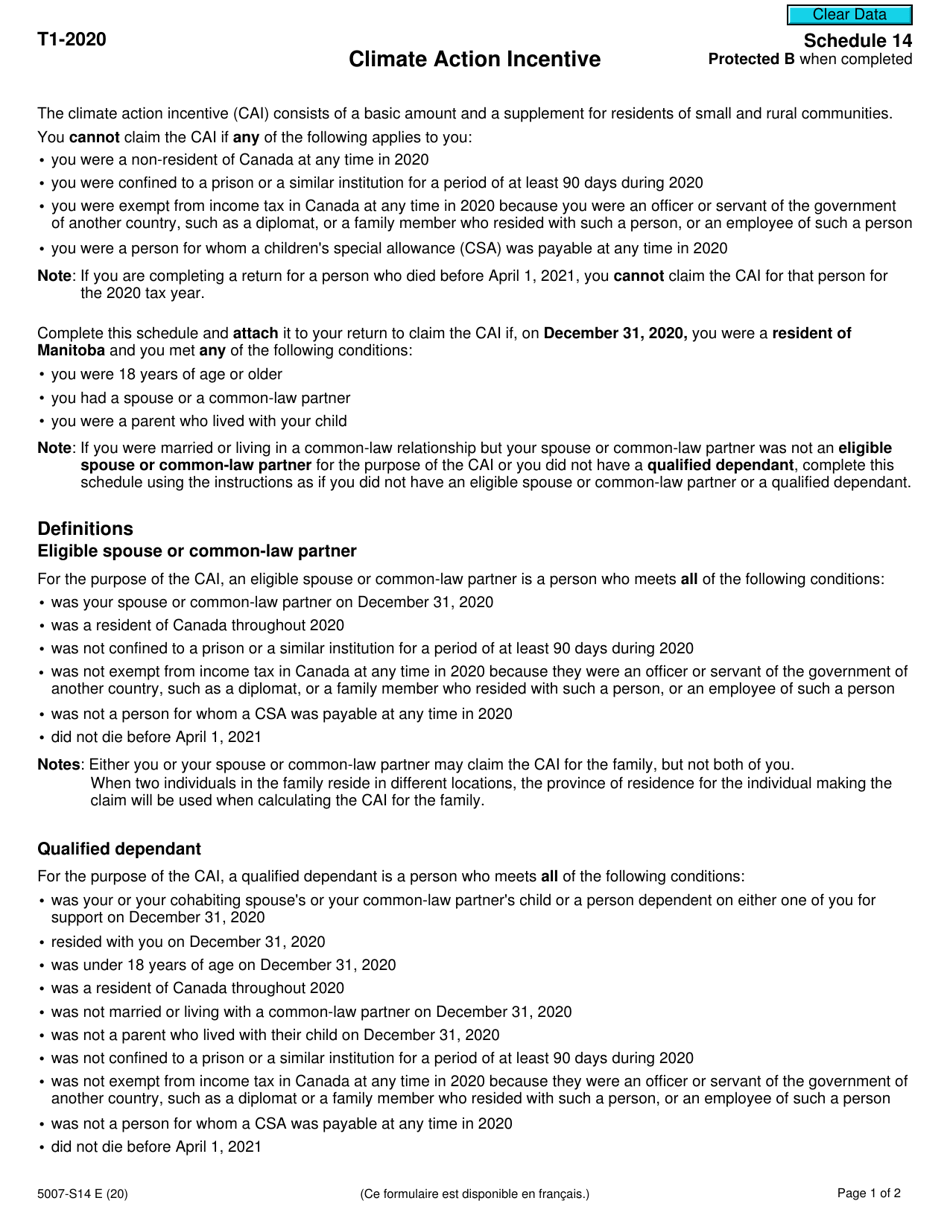

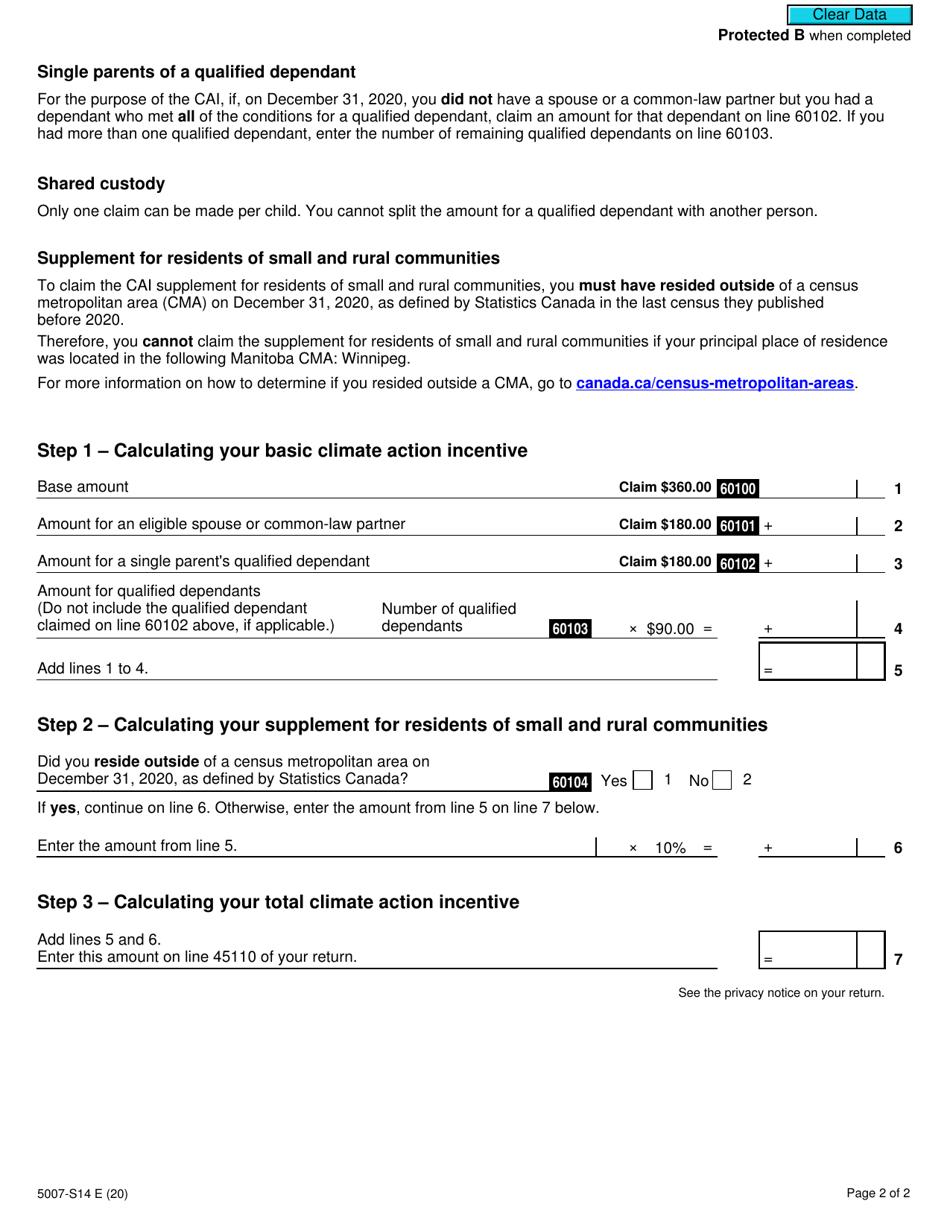

Form 5007-S14 Schedule 14 Climate Action Incentive in Canada is used to claim the Climate Action Incentive, which is a tax credit provided to residents of certain provinces as a part of the federal government's effort to reduce greenhouse gas emissions and combat climate change.

In Canada, individuals who are residents of provinces or territories that have a carbon pricing system, such as British Columbia, Alberta, Saskatchewan, Manitoba, or Ontario, may be required to file the Form 5007-S14 Schedule 14 Climate Action Incentive. This form is filed by individuals who are eligible to claim the Climate Action Incentive on their tax return.

FAQ

Q: What is Form 5007-S14?

A: Form 5007-S14 is a Schedule 14 Climate Action Incentive form for Canada.

Q: What is the purpose of Form 5007-S14?

A: The purpose of Form 5007-S14 is to claim the Climate Action Incentive.

Q: Who needs to fill out Form 5007-S14?

A: Residents of Canada who are eligible for the Climate Action Incentive need to fill out Form 5007-S14.

Q: What is the Climate Action Incentive?

A: The Climate Action Incentive is a refundable tax credit available to residents of provinces that have not implemented a carbon pricing system.

Q: How do I claim the Climate Action Incentive?

A: To claim the Climate Action Incentive, you need to fill out Form 5007-S14 and include it with your income tax return.

Q: Are there any eligibility requirements for the Climate Action Incentive?

A: Yes, there are eligibility requirements based on residency and the province you live in. Please refer to the instructions on Form 5007-S14.

Q: What provinces are eligible for the Climate Action Incentive?

A: Currently, the provinces eligible for the Climate Action Incentive are Ontario, Manitoba, Saskatchewan, and Alberta.

Q: When is the deadline to submit Form 5007-S14?

A: The deadline to submit Form 5007-S14 is the same as the deadline for filing your income tax return, which is usually April 30th of each year.

Q: Can I claim the Climate Action Incentive retroactively?

A: No, the Climate Action Incentive can only be claimed for the current tax year and cannot be claimed retroactively.