This version of the form is not currently in use and is provided for reference only. Download this version of

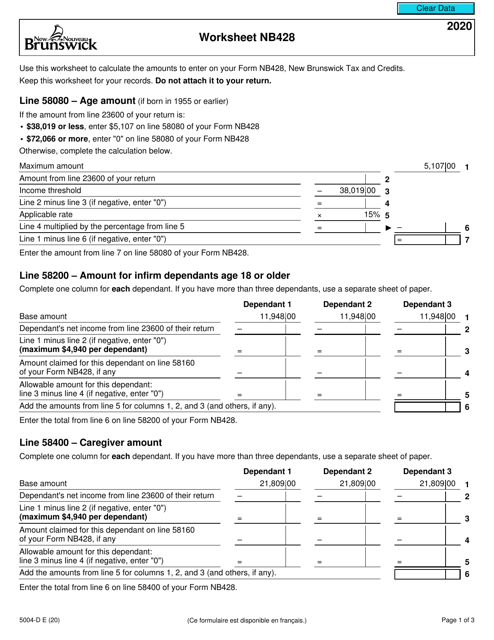

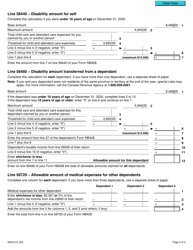

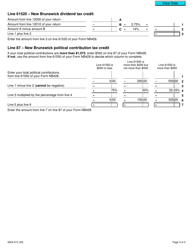

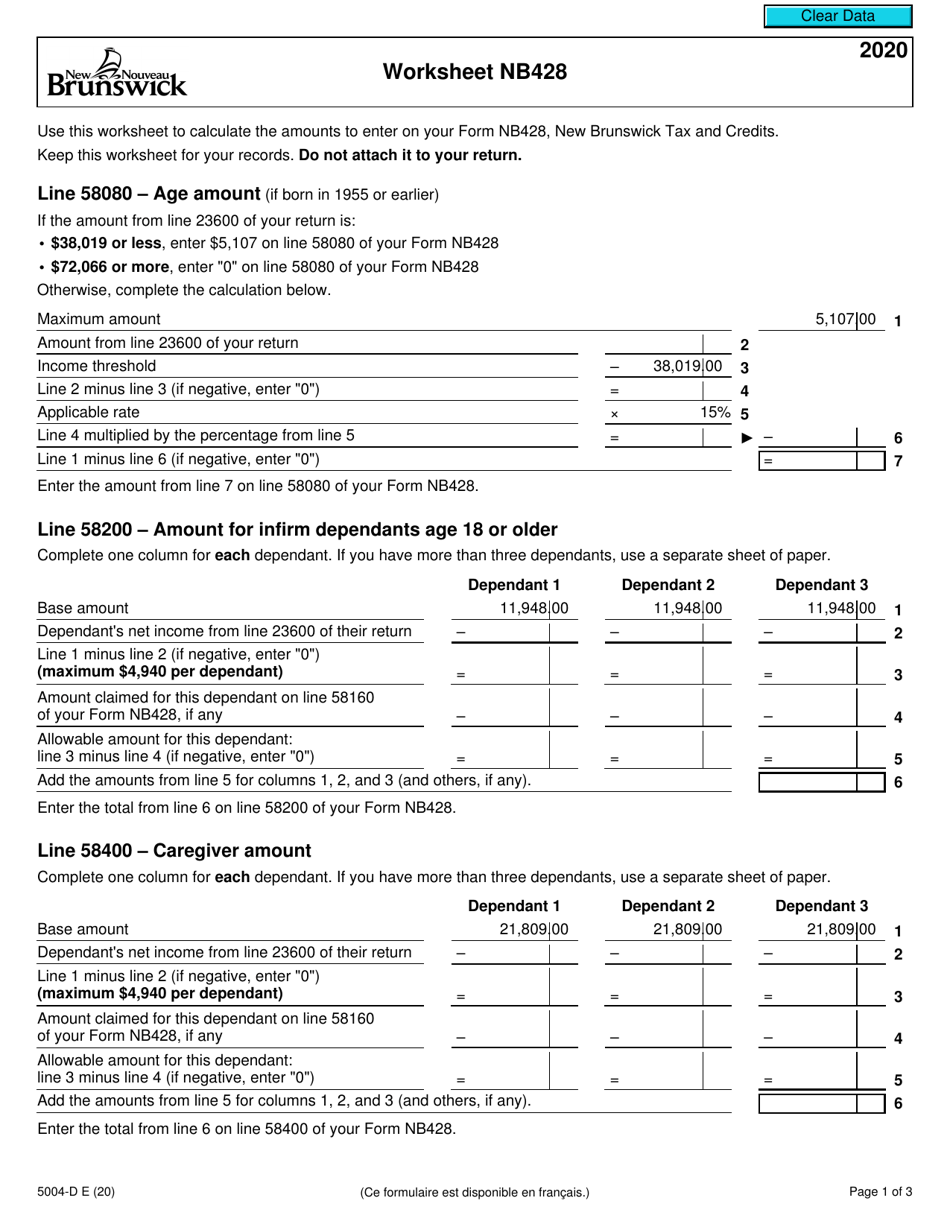

Form 5004-D Worksheet NB428

for the current year.

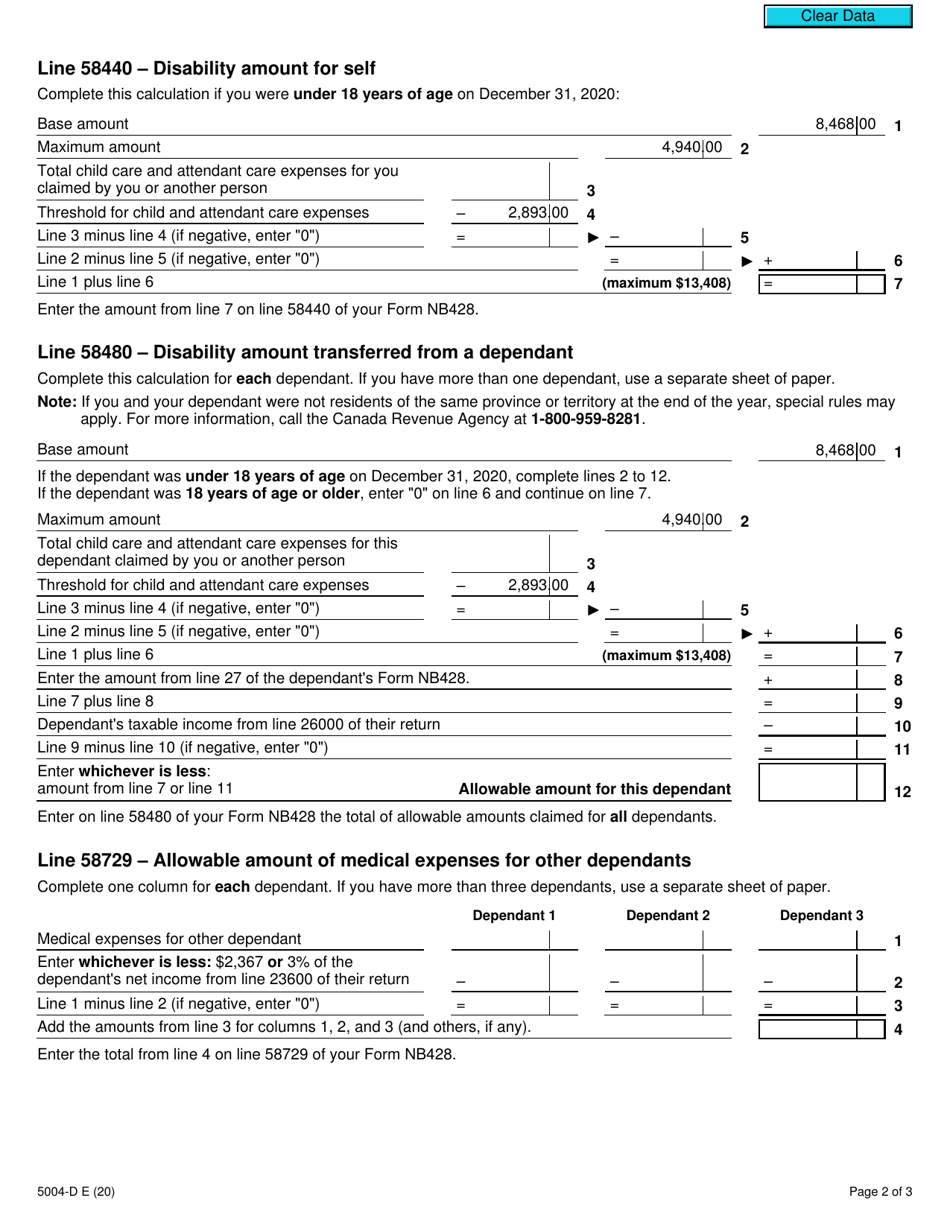

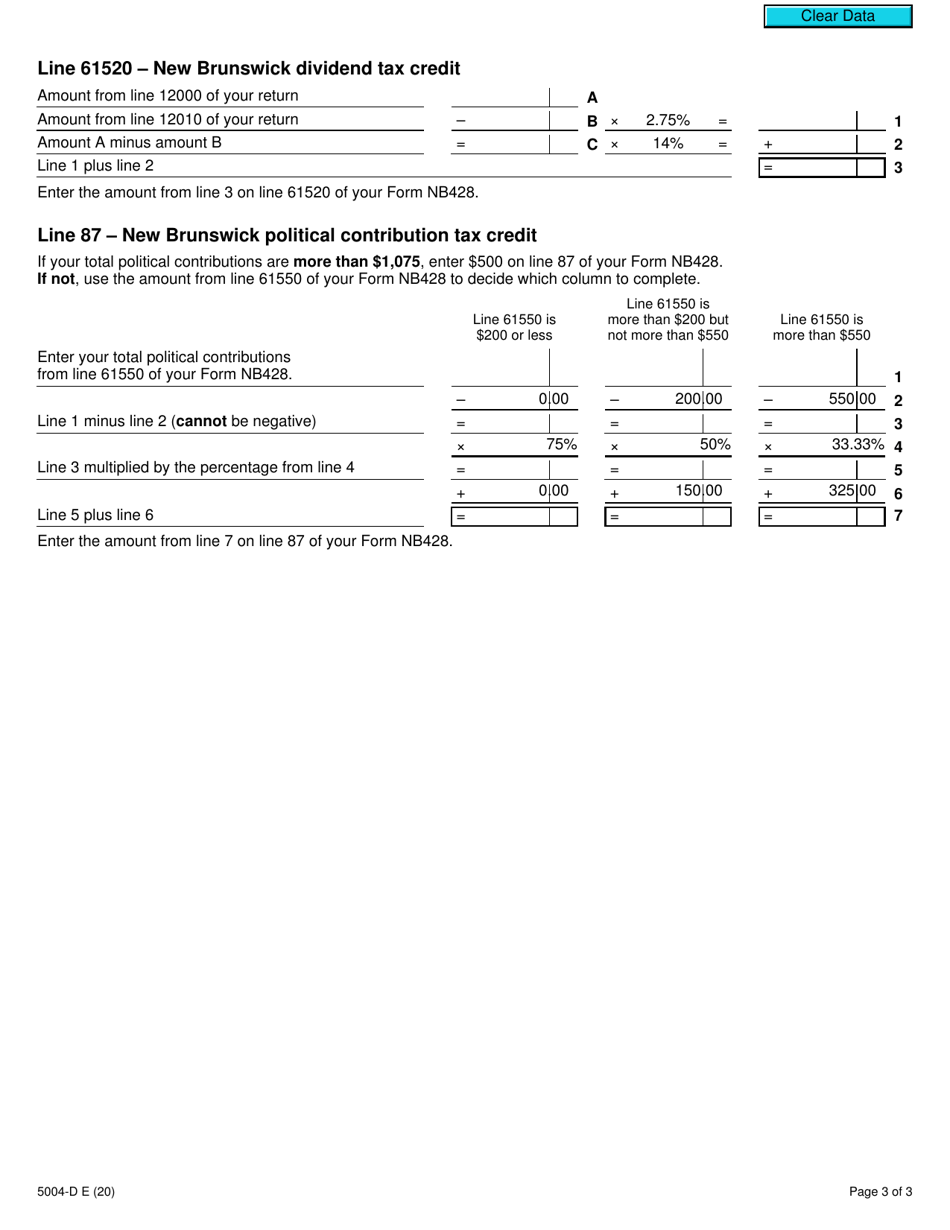

Form 5004-D Worksheet NB428 New Brunswick - Canada

The Form 5004-D Worksheet NB428 in New Brunswick, Canada is used for calculating the provincial tax credits and deductions on your personal income tax return.

The Form 5004-D Worksheet NB428 in New Brunswick, Canada is typically filed by individuals who are residents of New Brunswick and need to calculate their provincial tax credits and deductions.

FAQ

Q: What is Form 5004-D?

A: Form 5004-D is a worksheet used in New Brunswick, Canada.

Q: What is the purpose of Form 5004-D?

A: The purpose of Form 5004-D is to calculate your provincial tax credits in New Brunswick.

Q: Who needs to fill out Form 5004-D?

A: Residents of New Brunswick who want to claim provincial tax credits need to fill out Form 5004-D.

Q: How do I fill out Form 5004-D?

A: You need to enter your personal information, income details, and expenses in the appropriate sections of Form 5004-D.

Q: What are the tax credits that can be claimed using Form 5004-D?

A: Form 5004-D allows you to claim tax credits for dependents, medical expenses, donations, tuition fees, and more.

Q: When is the deadline to submit Form 5004-D?

A: The deadline to submit Form 5004-D is usually April 30th of the following year.

Q: What happens if I don't file Form 5004-D?

A: If you don't file Form 5004-D, you may miss out on potential tax credits and deductions.