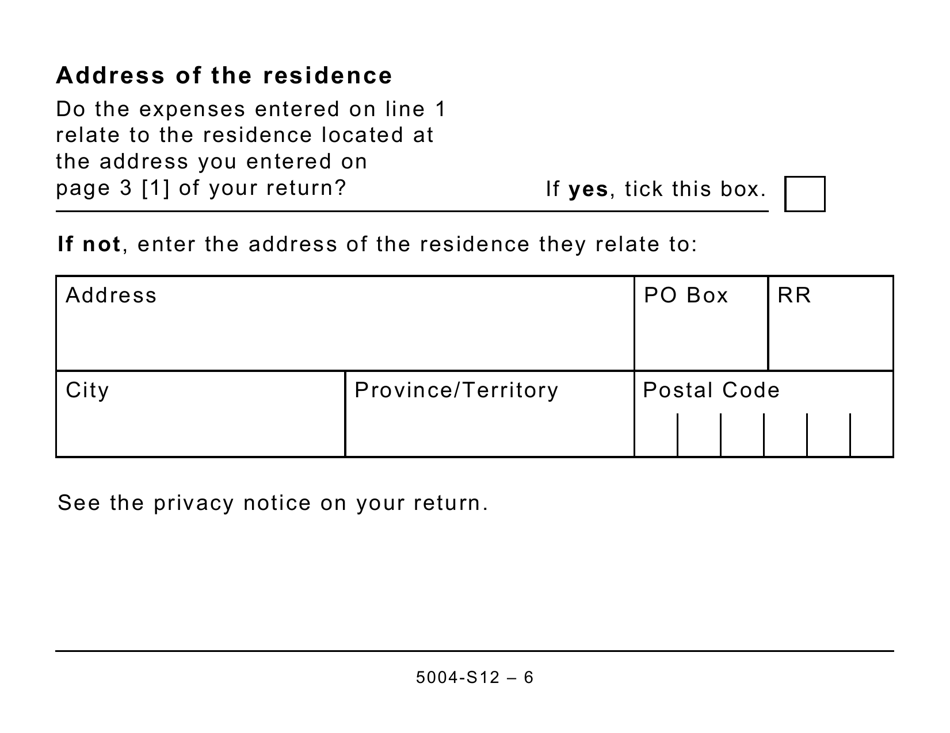

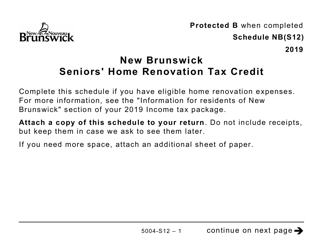

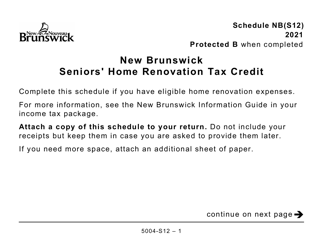

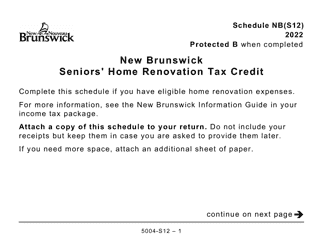

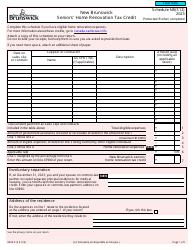

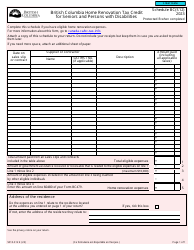

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Large Print - Canada

Form 5004-S12 Schedule NB(S12) is a tax form in Canada specifically for the New Brunswick Seniors' Home Renovation Tax Credit. This credit is aimed at providing financial assistance to seniors in New Brunswick who make renovations to their homes to improve accessibility and safety.

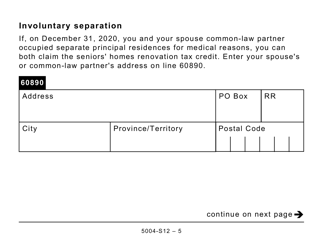

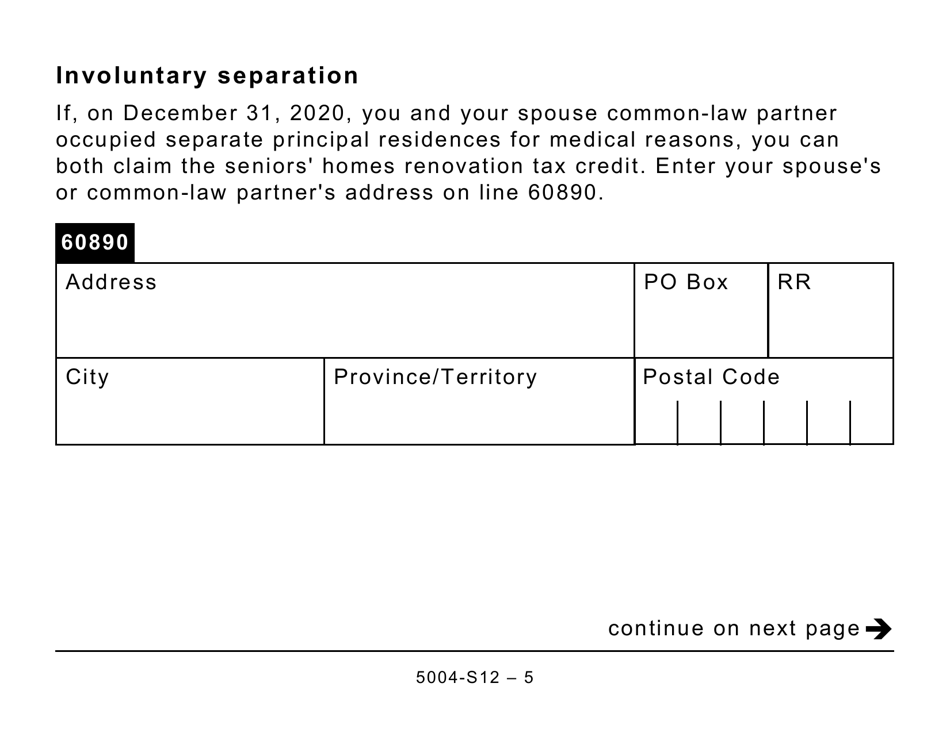

The individual who is eligible and wishes to claim the New Brunswick Seniors' Home RenovationTax Credit would file the Form 5004-S12 Schedule NB(S12) in Canada.

FAQ

Q: What is Form 5004-S12?

A: Form 5004-S12 is the schedule for claiming the New Brunswick Seniors' Home Renovation Tax Credit.

Q: What is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a tax credit available to eligible seniors in New Brunswick for home renovations.

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Eligible seniors in New Brunswick are those who are 65 years of age or older and who have incurred eligible expenses for home renovations.

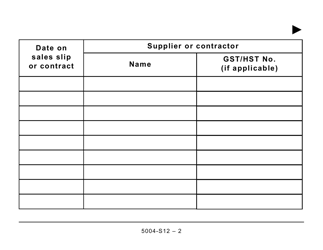

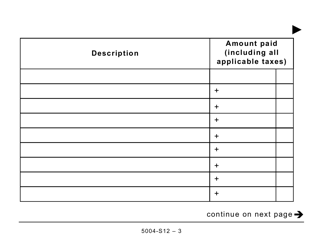

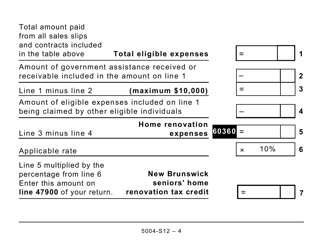

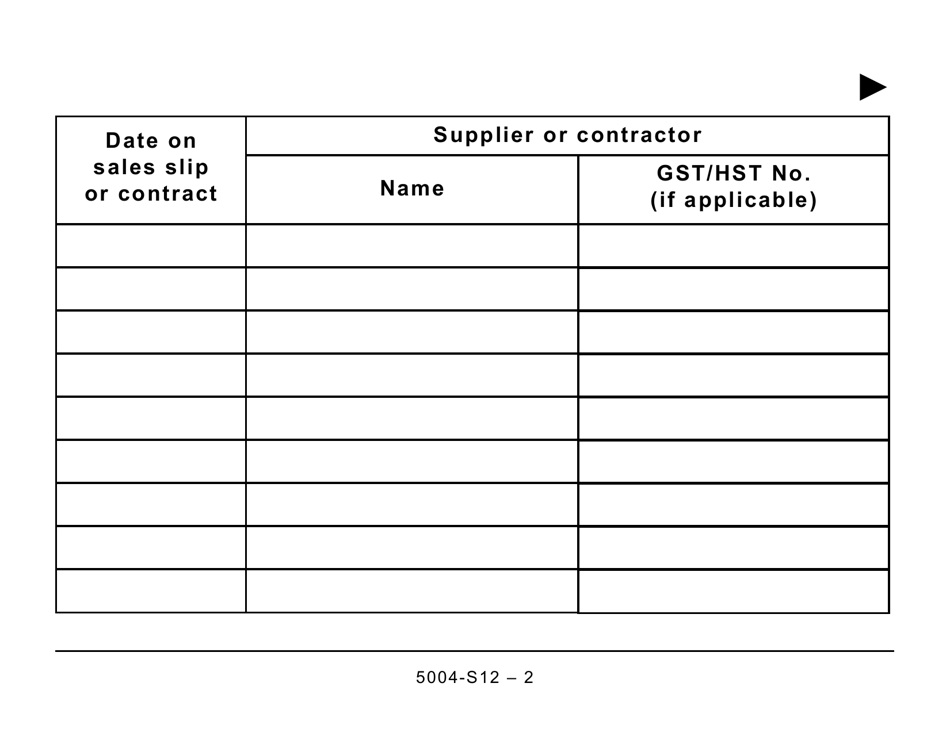

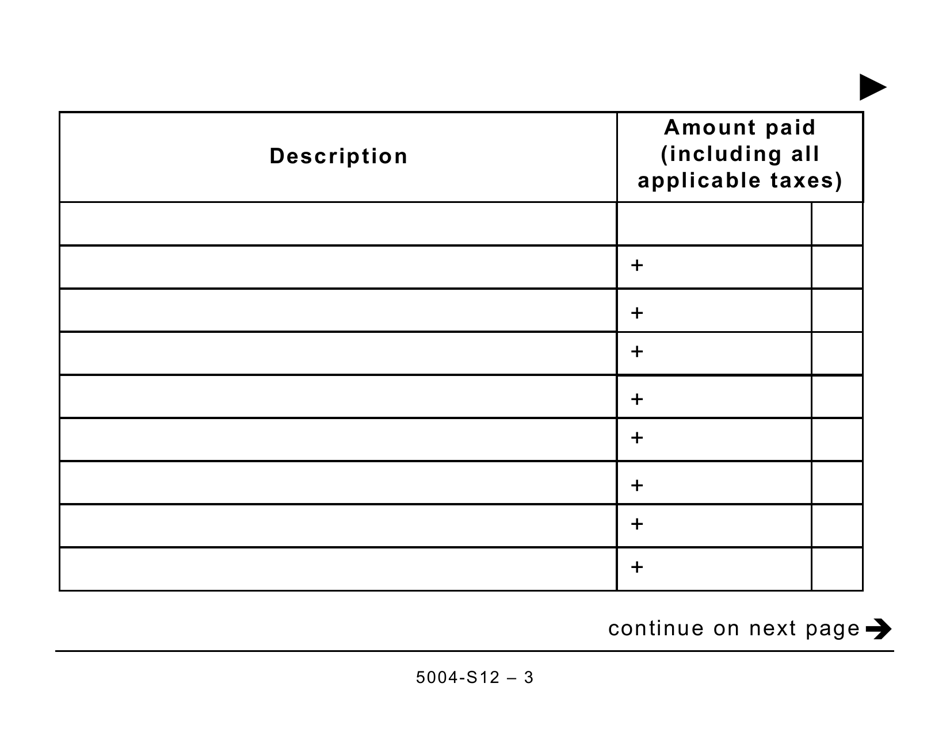

Q: What expenses are eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Eligible expenses for the tax credit include costs related to renovations that improve accessibility, safety, or mobility in the senior's home.

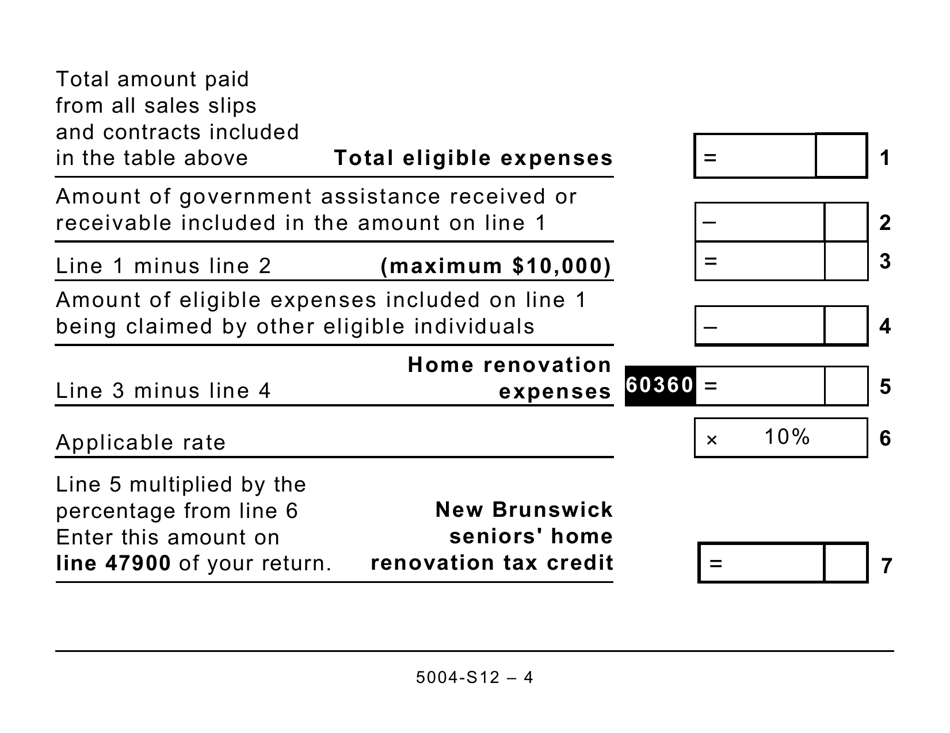

Q: How much is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The tax credit is equal to 10% of eligible expenses, up to a maximum of $10,000.

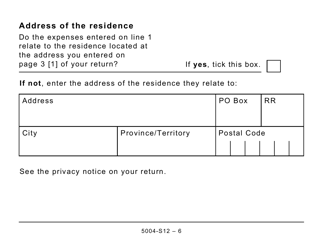

Q: How do I claim the New Brunswick Seniors' Home Renovation Tax Credit?

A: To claim the tax credit, you need to complete Form 5004-S12 and include it with your income tax return.

Q: Is the New Brunswick Seniors' Home Renovation Tax Credit available in the United States?

A: No, the New Brunswick Seniors' Home Renovation Tax Credit is only available to eligible seniors in New Brunswick, Canada.

Q: Is the New Brunswick Seniors' Home Renovation Tax Credit taxable?

A: No, the tax credit is non-taxable and does not need to be included as income on your tax return.