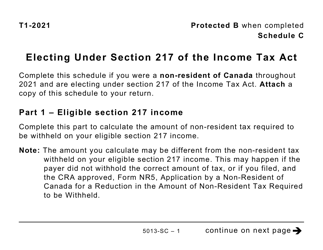

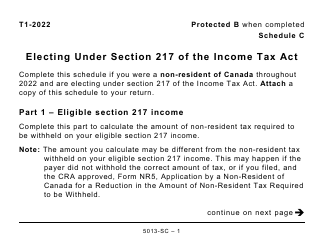

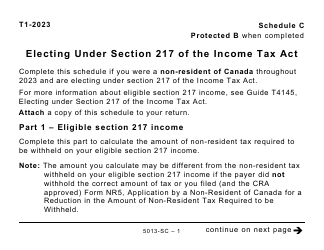

This version of the form is not currently in use and is provided for reference only. Download this version of

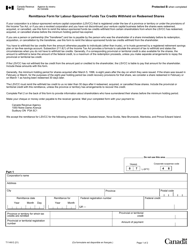

Form 5013-SC Schedule C

for the current year.

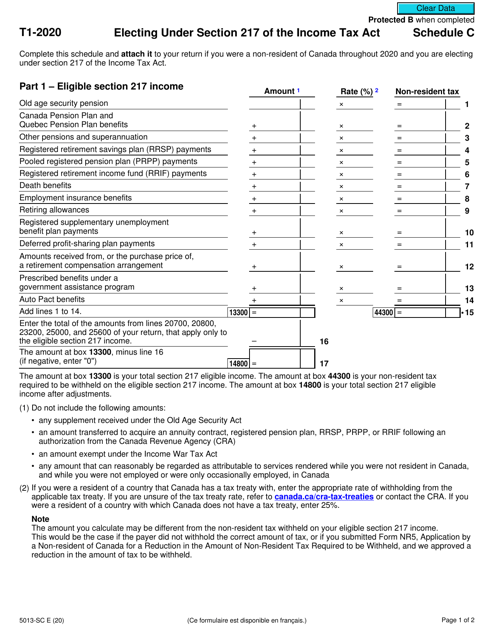

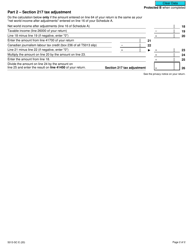

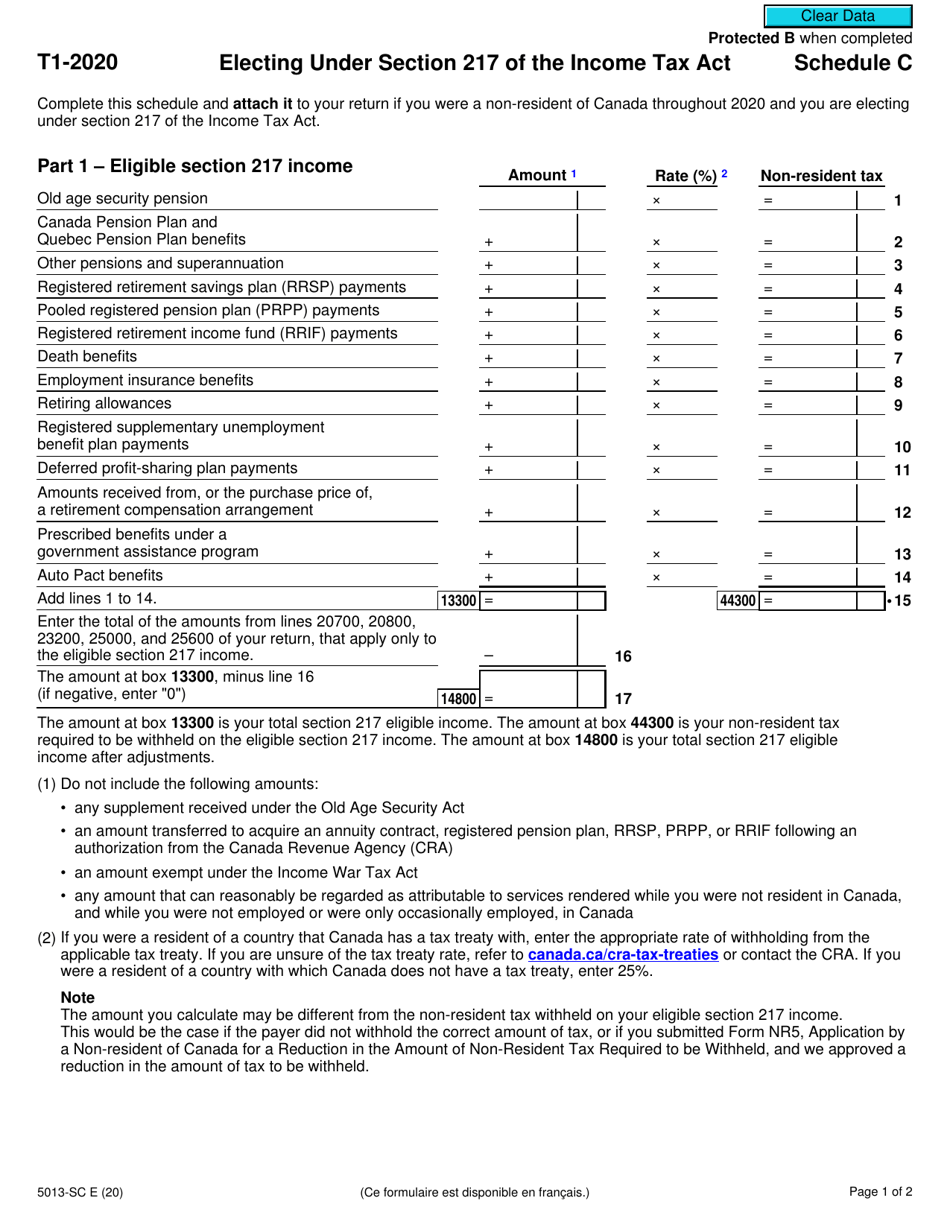

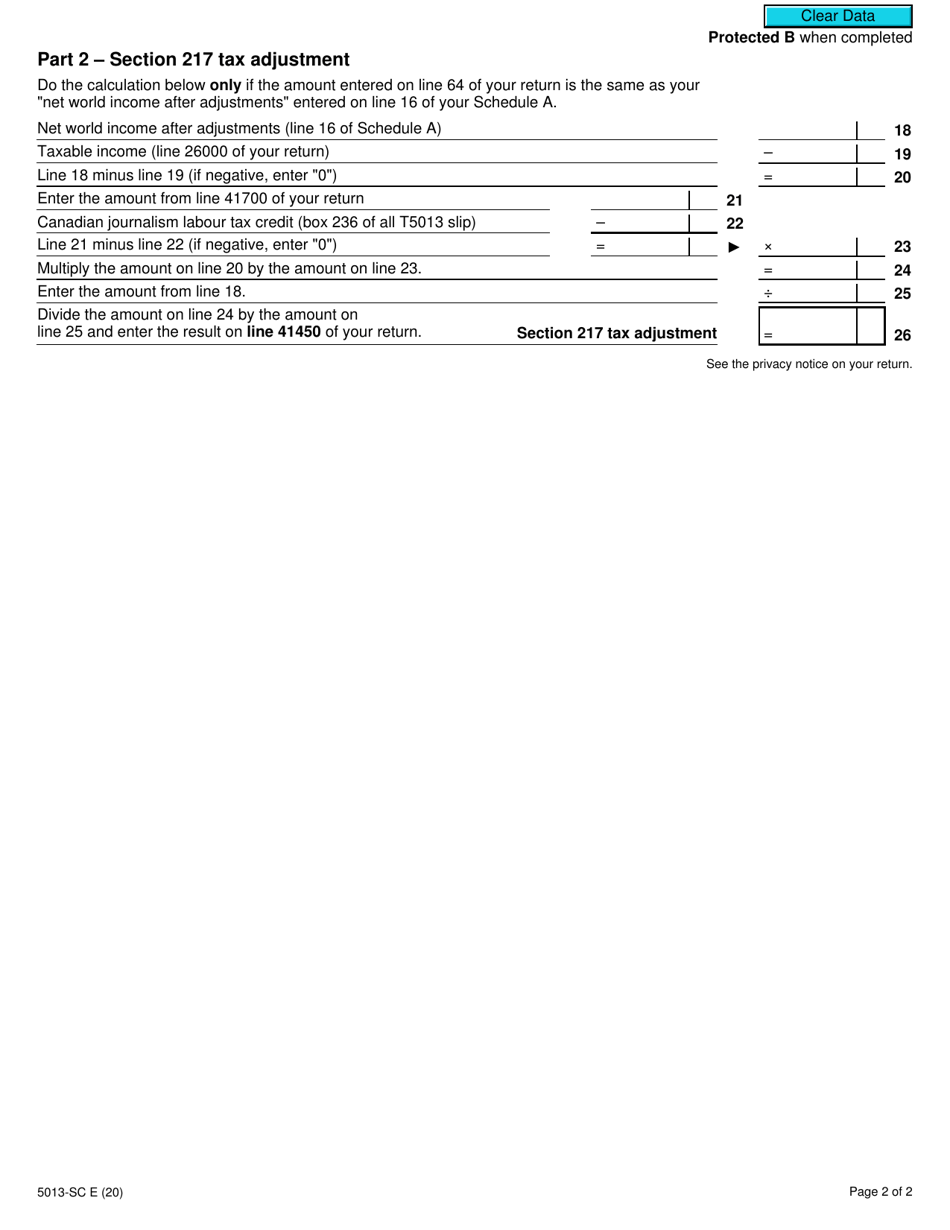

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Canada

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act is used in Canada for individuals who wish to claim foreign tax credits for income earned outside of Canada.

FAQ

Q: What is Form 5013-SC?

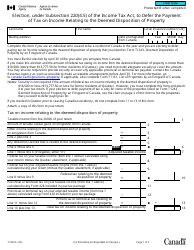

A: Form 5013-SC is a specific form used in Canada for reporting income and expenses related to section 217 of the Income Tax Act.

Q: What is Schedule C?

A: Schedule C is a part of Form 5013-SC used to elect the benefits available under section 217 of the Income Tax Act.

Q: What is section 217 of the Income Tax Act?

A: Section 217 of the Income Tax Act allows individuals who are residents of Canada but working in another country to choose to be taxed on their foreign employment income in Canada.

Q: Who can use Form 5013-SC Schedule C?

A: Form 5013-SC Schedule C can be used by Canadian residents working in another country and electing to be taxed on their foreign employment income in Canada.

Q: What information is required in Form 5013-SC Schedule C?

A: Form 5013-SC Schedule C requires information about the individual's foreign employment income, taxes paid in the foreign country, and any applicable deductions.

Q: When is Form 5013-SC Schedule C due?

A: Form 5013-SC Schedule C is generally due on or before the individual's tax filing deadline, which is usually April 30th for most taxpayers in Canada.

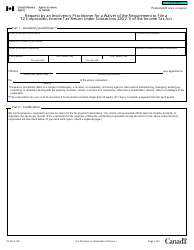

Q: Do I need to attach additional documentation with Form 5013-SC Schedule C?

A: Yes, individuals filing Form 5013-SC Schedule C may need to attach supporting documentation such as foreign tax slips and proof of foreign employment.

Q: Can I e-file Form 5013-SC Schedule C?

A: No, Form 5013-SC Schedule C cannot be electronically filed and must be submitted by mail or in person to the Canada Revenue Agency.

Q: What happens after I submit Form 5013-SC Schedule C?

A: After submitting Form 5013-SC Schedule C, the Canada Revenue Agency will review the information provided and assess the individual's tax liability based on section 217 of the Income Tax Act.