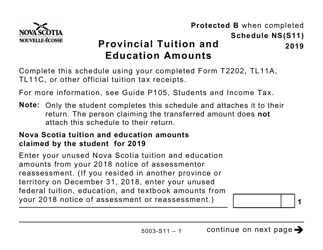

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5003-S11 Schedule NS(S11)

for the current year.

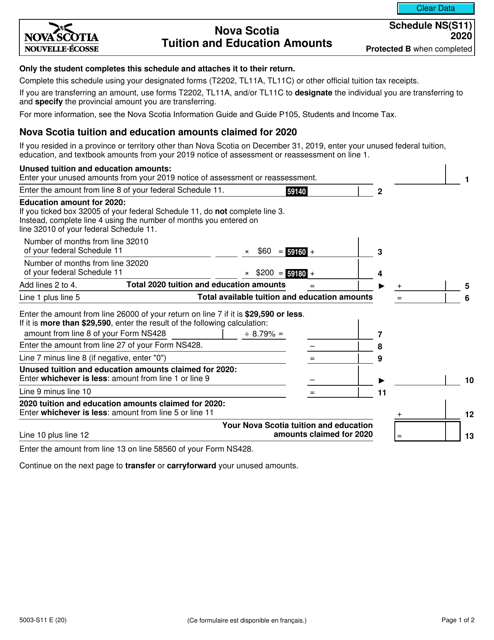

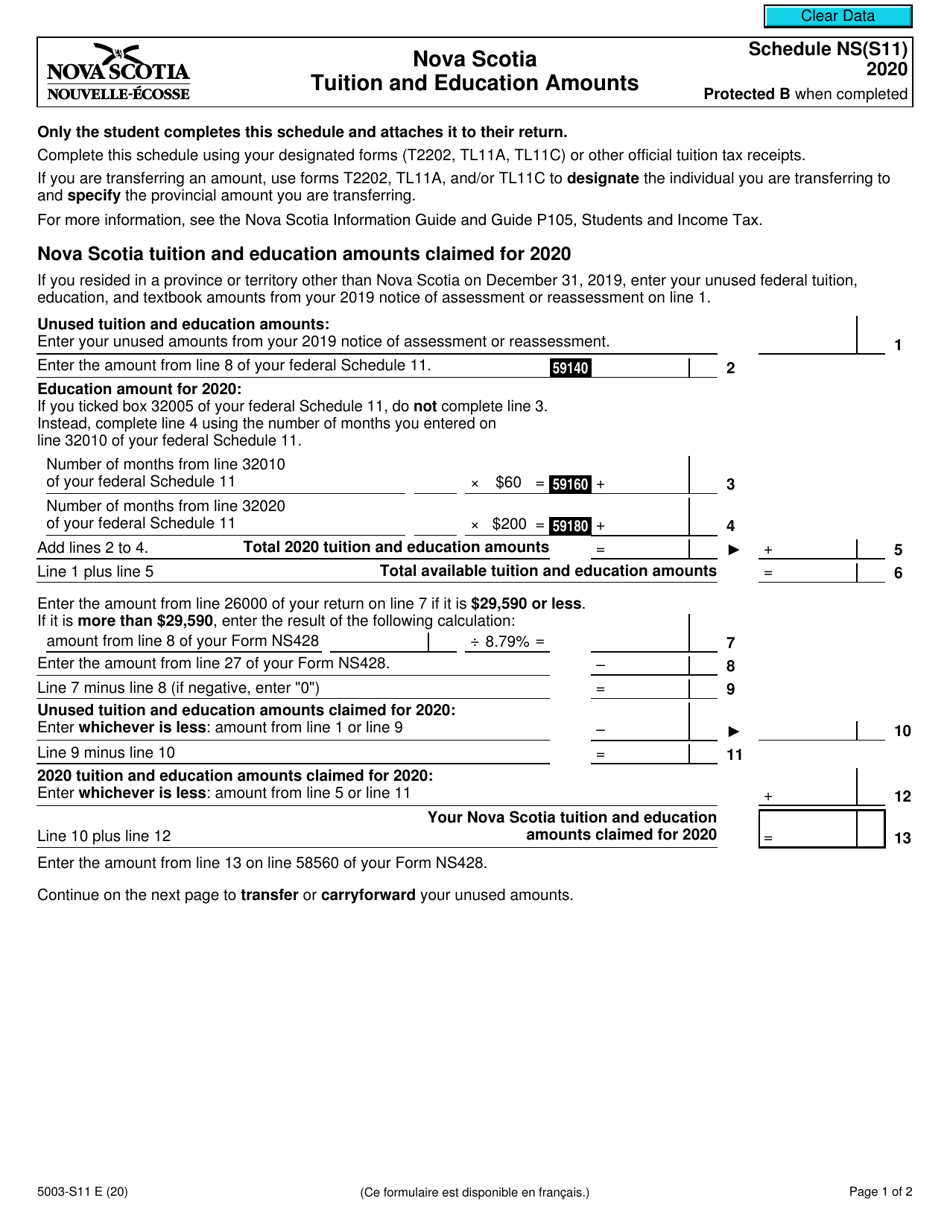

Form 5003-S11 Schedule NS(S11) Nova Scotia Tuition and Education Amounts - Canada

Form 5003-S11 Schedule NS(S11) is used in Canada for claiming the Nova Scotia Tuition and Education Amounts. It is a part of the Canadian tax system and is used to calculate and report tuition and education expenses for residents of Nova Scotia.

The Form 5003-S11 Schedule NS(S11) Nova Scotia Tuition and Education Amounts in Canada is usually filed by residents of Nova Scotia who are claiming the tuition and education amounts for tax purposes.

FAQ

Q: What is Form 5003-S11 Schedule NS(S11)?

A: Form 5003-S11 Schedule NS(S11) is a form used in Canada to claim Nova Scotia Tuition and Education Amounts.

Q: What are Nova Scotia Tuition and Education Amounts?

A: Nova Scotia Tuition and Education Amounts are tax credits offered by the province of Nova Scotia to eligible students.

Q: Who is eligible for Nova Scotia Tuition and Education Amounts?

A: Eligible students include those who attended an eligible institution in Nova Scotia or who moved to Nova Scotia to attend an eligible institution.

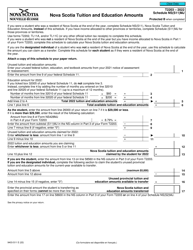

Q: How do I claim Nova Scotia Tuition and Education Amounts?

A: To claim these amounts, you need to complete Form 5003-S11 Schedule NS(S11) and include it with your income tax return.

Q: Are there any deadlines for claiming Nova Scotia Tuition and Education Amounts?

A: Yes, you must claim these amounts on your tax return for the year in which they were incurred.

Q: Can I claim both the federal and Nova Scotia tuition tax credits?

A: Yes, if you are eligible, you can claim both the federal and Nova Scotia tuition tax credits.

Q: What supporting documents do I need to submit with my claim?

A: You may be required to provide supporting documents such as tuition receipts or an official statement from the educational institution.

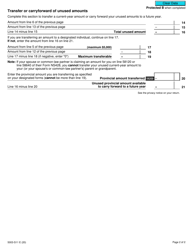

Q: Can I transfer my unused tuition and education amounts to a parent or grandparent?

A: Yes, if you are not able to fully utilize your tuition and education amounts, you may be able to transfer them to a parent or grandparent.

Q: Is there a limit to the amount that can be claimed for Nova Scotia Tuition and Education Amounts?

A: No, there is no specific limit on the amount that can be claimed for Nova Scotia Tuition and Education Amounts.