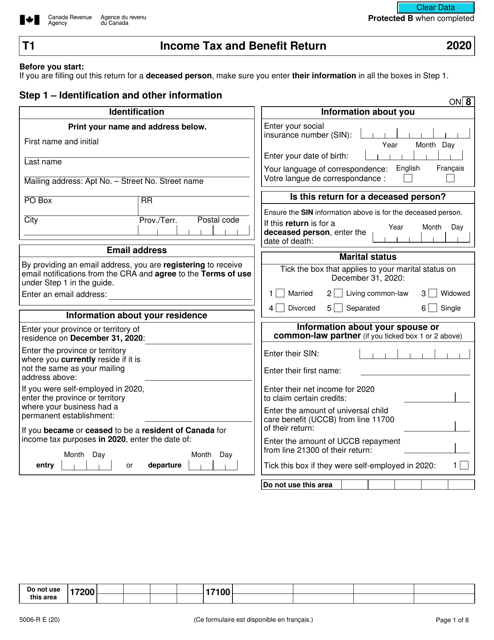

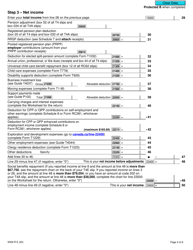

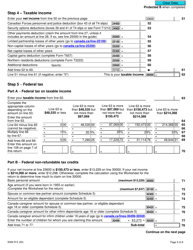

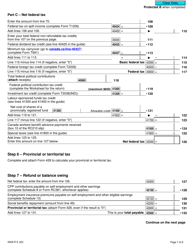

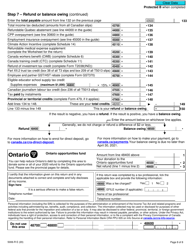

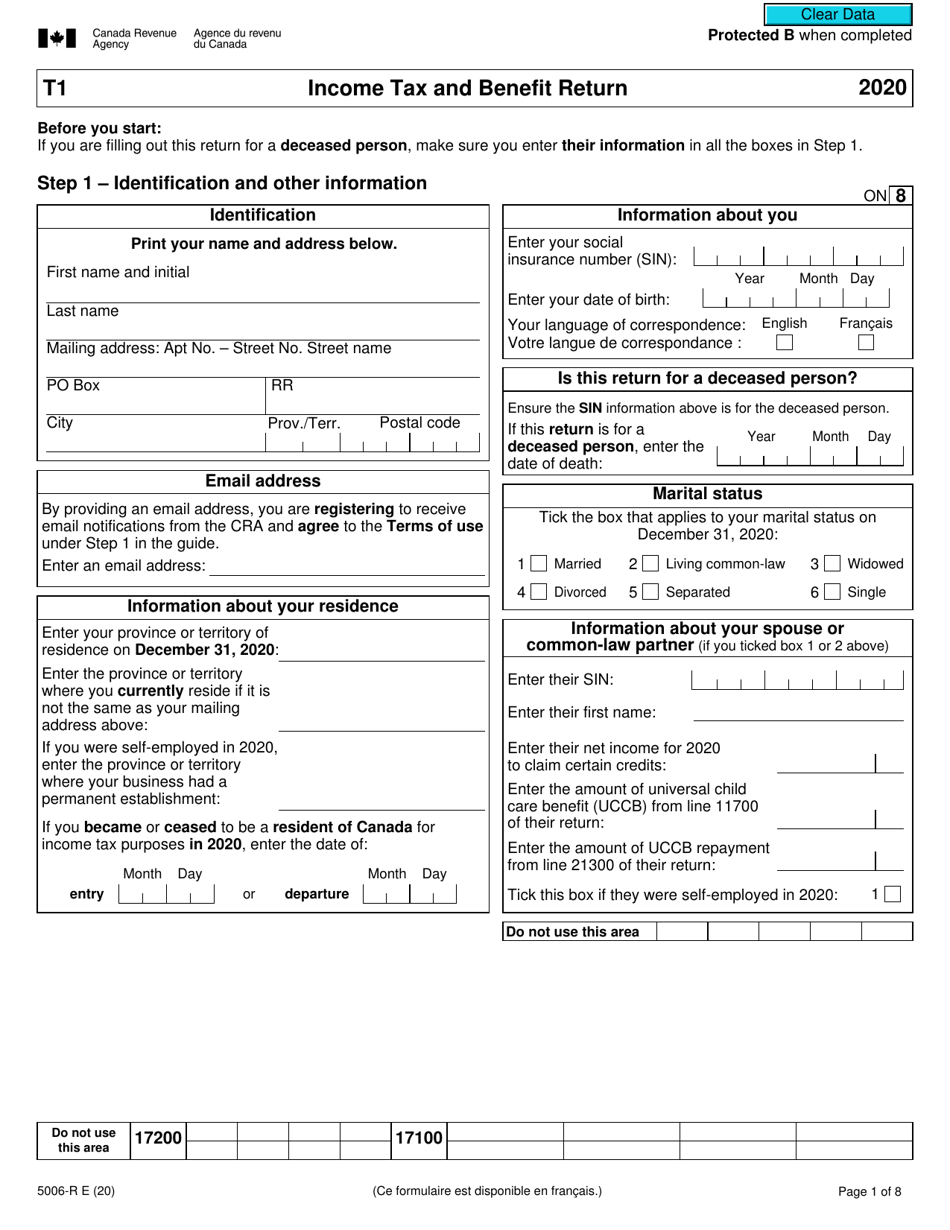

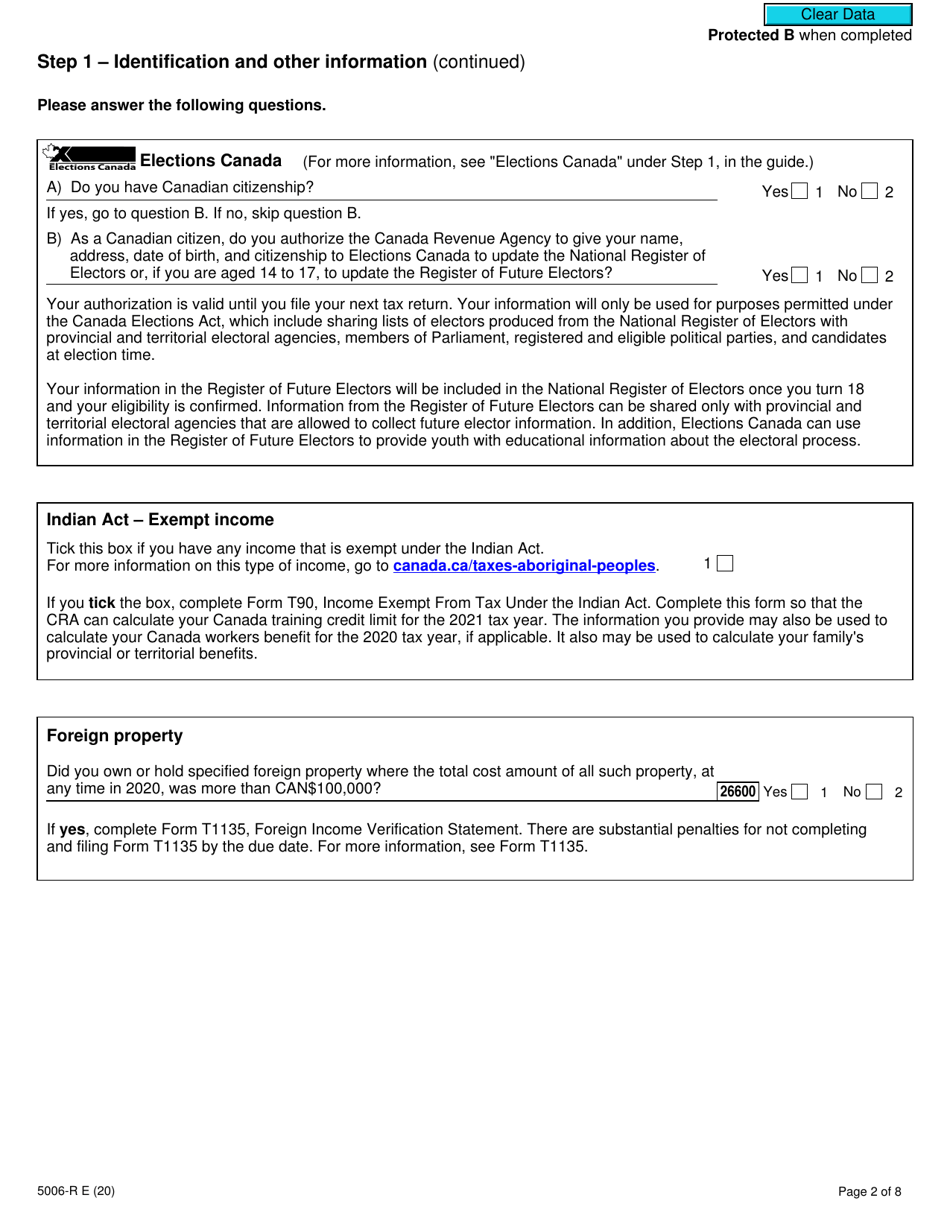

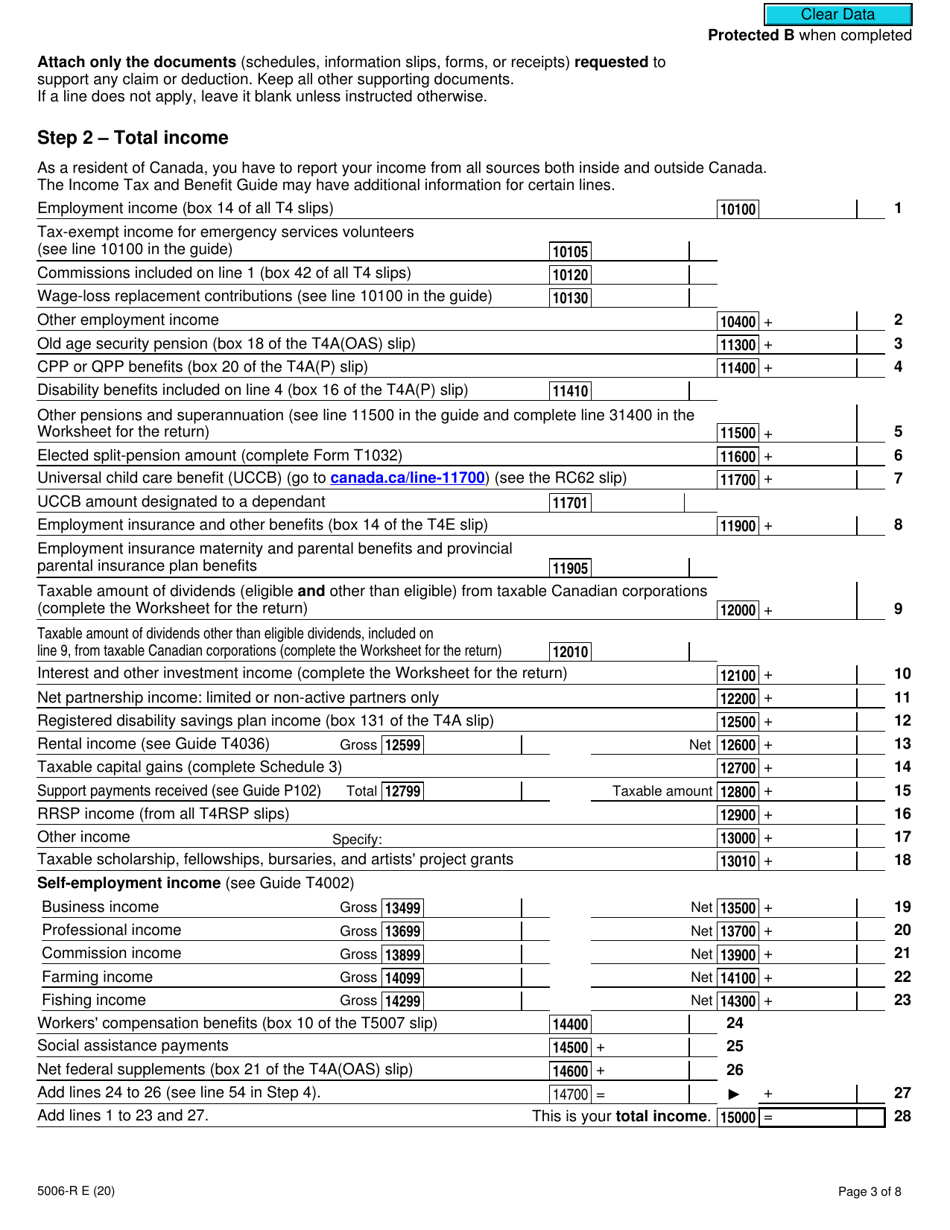

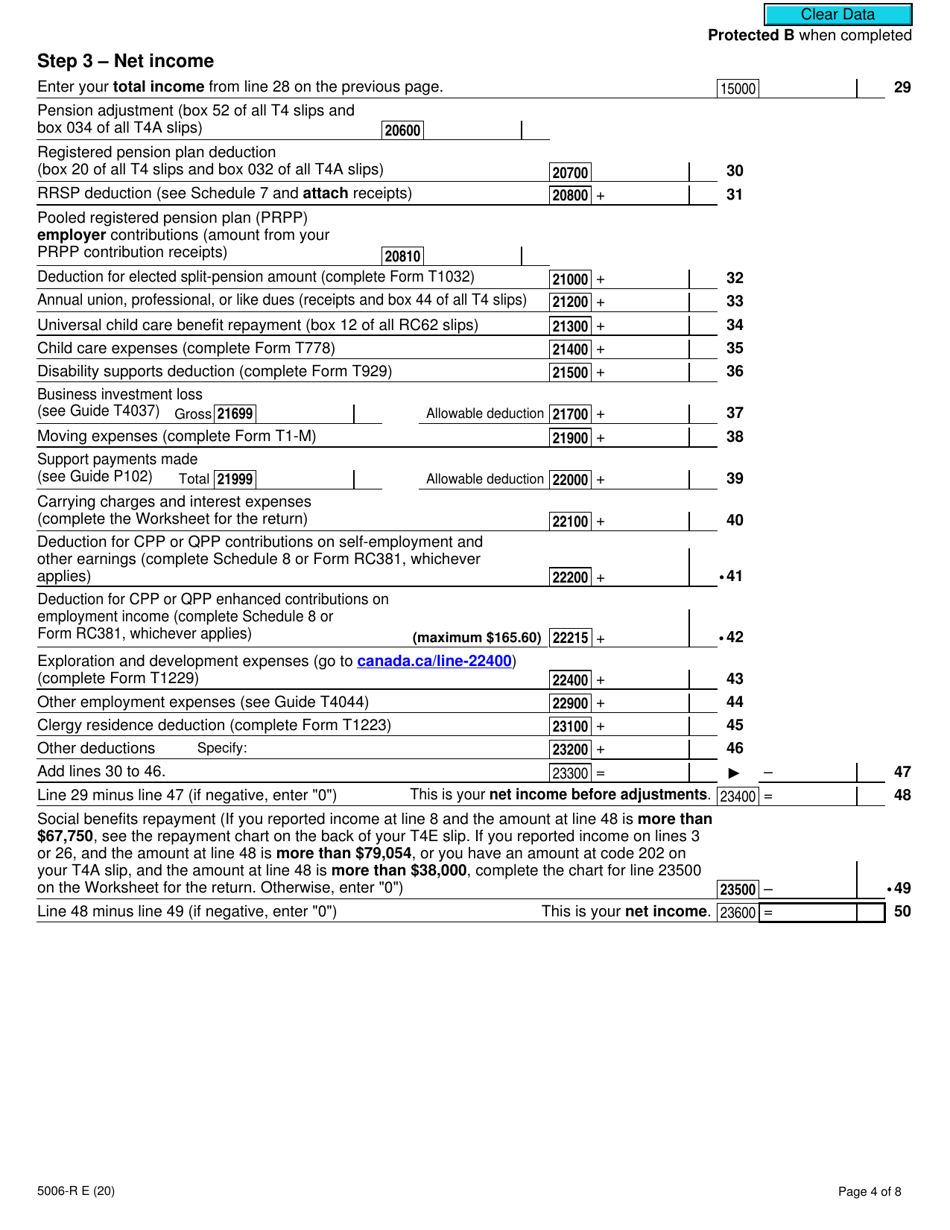

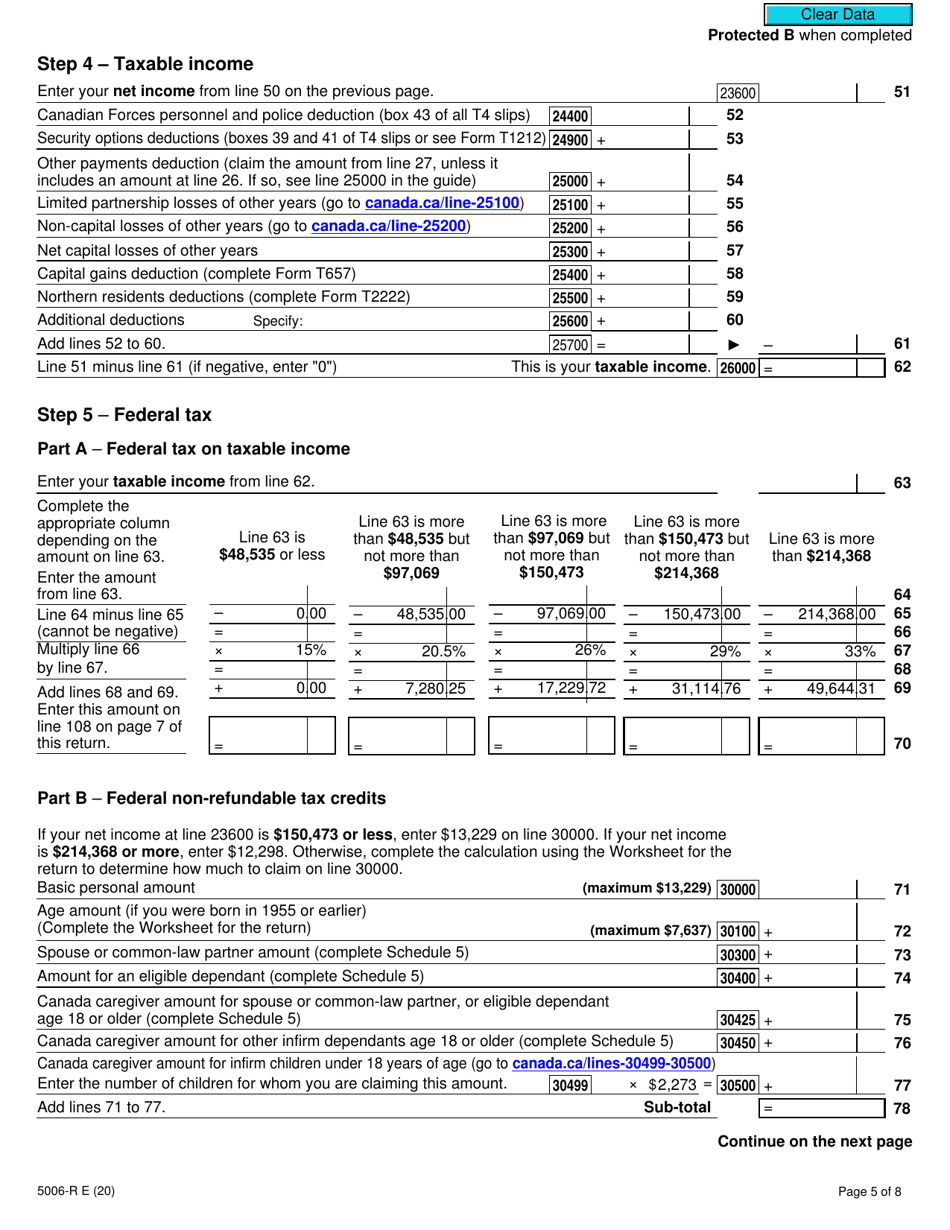

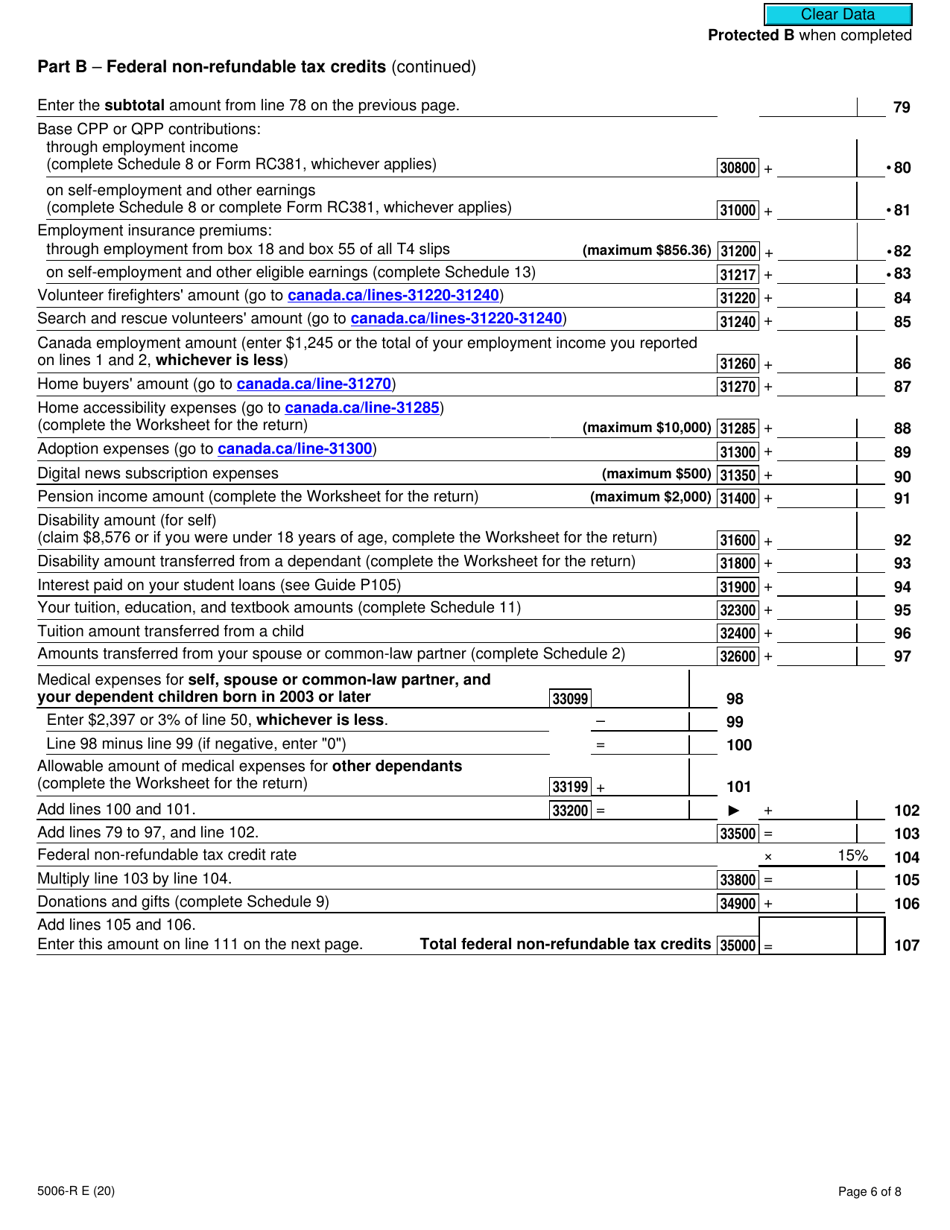

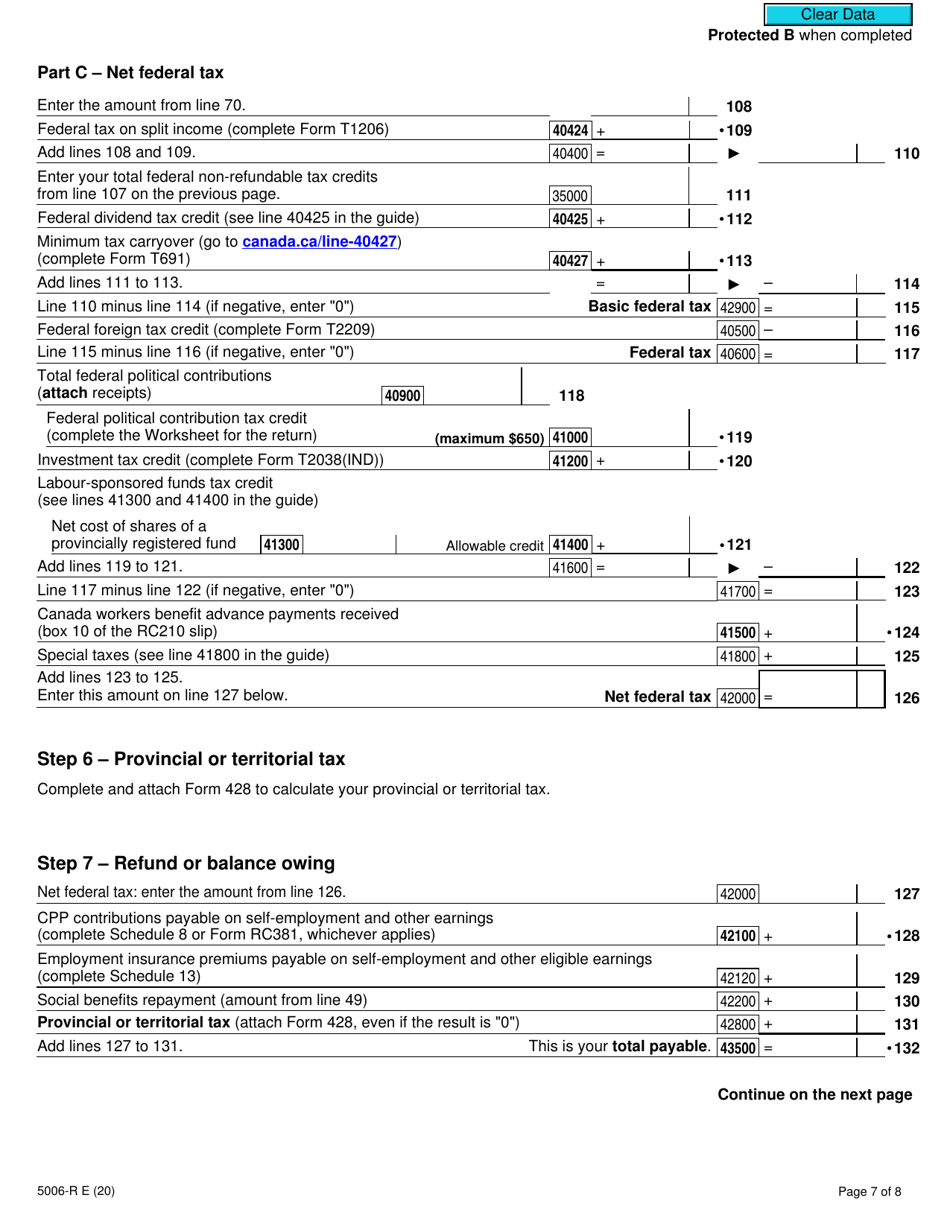

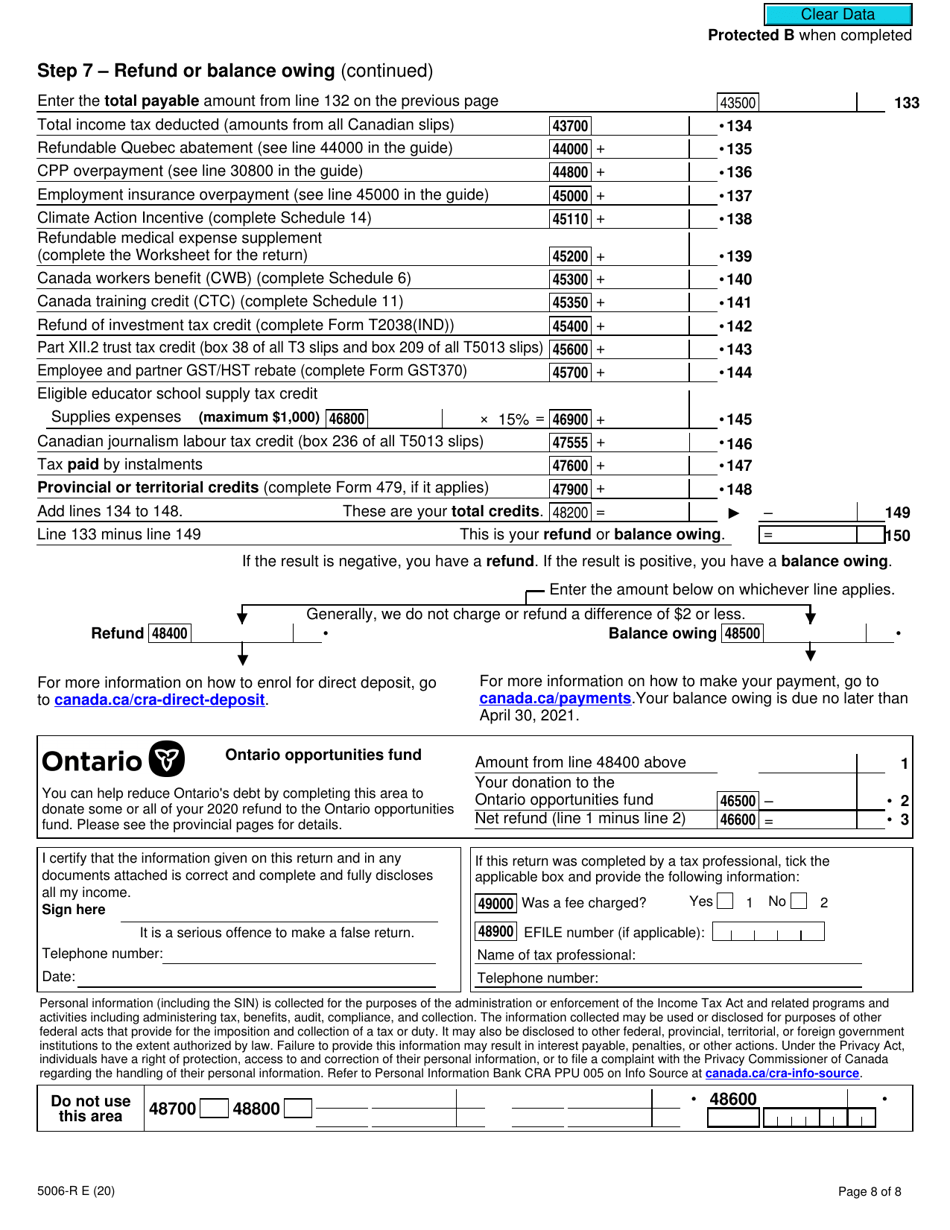

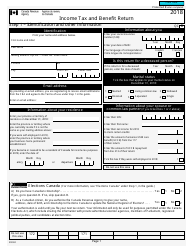

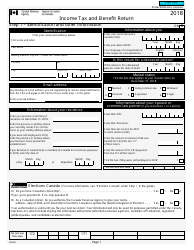

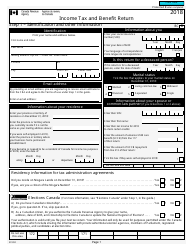

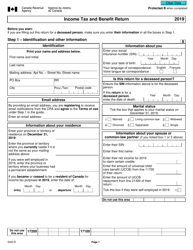

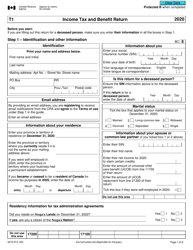

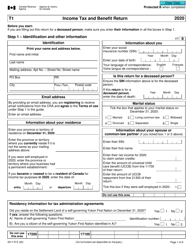

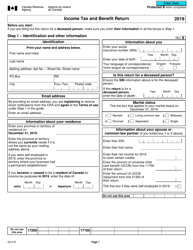

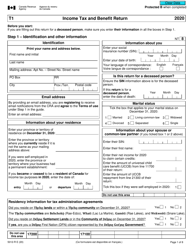

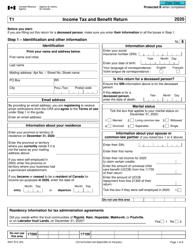

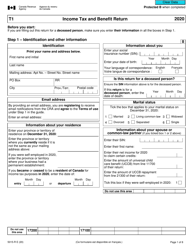

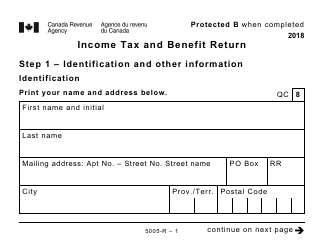

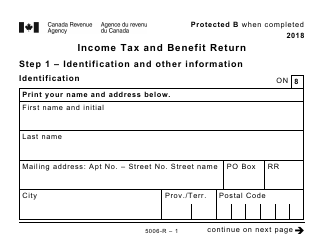

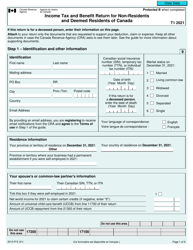

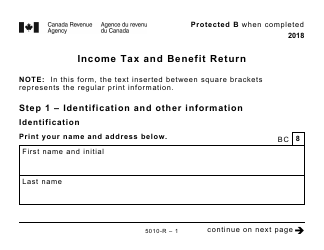

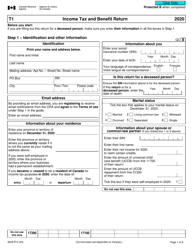

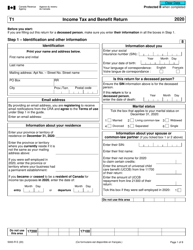

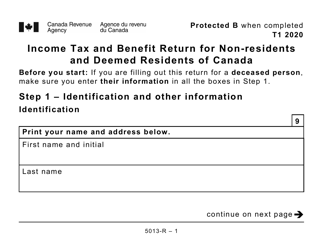

Form 5006-R Income Tax and Benefit Return - Canada

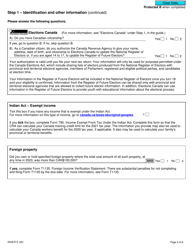

Form 5006-R, Income Tax and Benefit Return, is used by individuals in Canada to report their income and claim various tax credits and deductions.

The Form 5006-R Income Tax and Benefit Return in Canada is typically filed by individual taxpayers.

FAQ

Q: What is Form 5006-R?

A: Form 5006-R is the Income Tax and Benefit Return form used in Canada to report income and claim various deductions and credits.

Q: Who needs to file Form 5006-R?

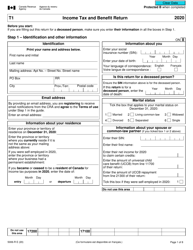

A: Any individual who is a resident of Canada and has income to report or has claims for deductions and credits needs to file Form 5006-R.

Q: When is the deadline to file Form 5006-R?

A: The deadline to file Form 5006-R is April 30th of the following year. However, if you or your spouse or common-law partner is self-employed, the deadline is June 15th.

Q: Can Form 5006-R be filed electronically?

A: Yes, Form 5006-R can be filed electronically using NETFILE, Telefile, or through certified tax software.

Q: Are there any penalties for filing Form 5006-R late?

A: Yes, if you have a balance owing, there may be penalties and interest charges for filing Form 5006-R late. It's important to file on time to avoid these penalties.

Q: What should I include with Form 5006-R?

A: You should include all relevant forms, schedules, and supporting documents with Form 5006-R, such as T4 slips, receipts for deductions, and any other necessary documentation.

Q: Can I make changes to Form 5006-R after I've filed it?

A: Yes, if you realize you made a mistake or need to make changes to your Form 5006-R after filing, you can submit a T1 Adjustment Request to the CRA.

Q: What happens if I don't file Form 5006-R?

A: If you don't file Form 5006-R, you may face penalties, interest charges, and delays in receiving any tax refunds or benefits you are entitled to.

Q: Can I file Form 5006-R if I have no income?

A: Yes, even if you have no income to report, you should still file Form 5006-R if you want to claim certain credits or benefits, such as the Goods and Services Tax (GST) credit or the Canada Child Benefit (CCB).