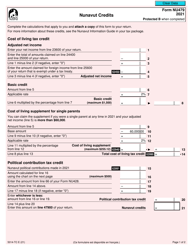

This version of the form is not currently in use and is provided for reference only. Download this version of

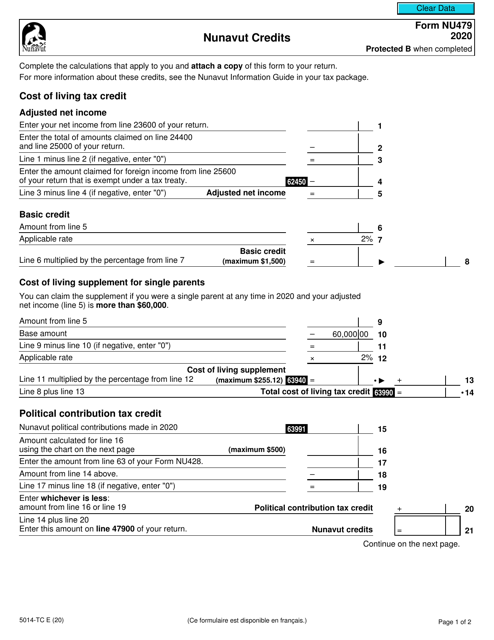

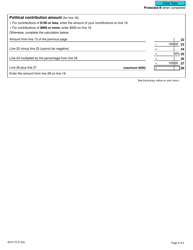

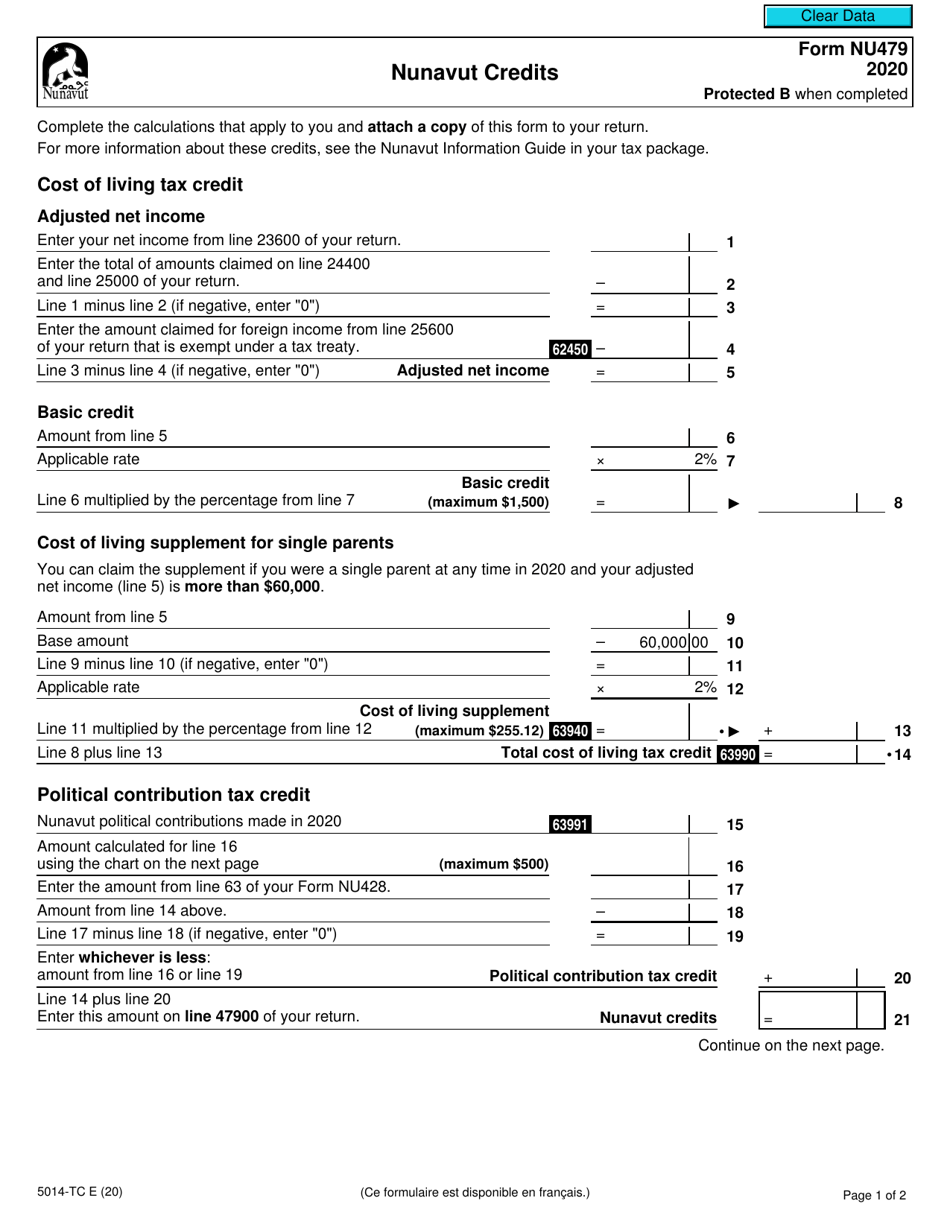

Form 5014-TC (NU479)

for the current year.

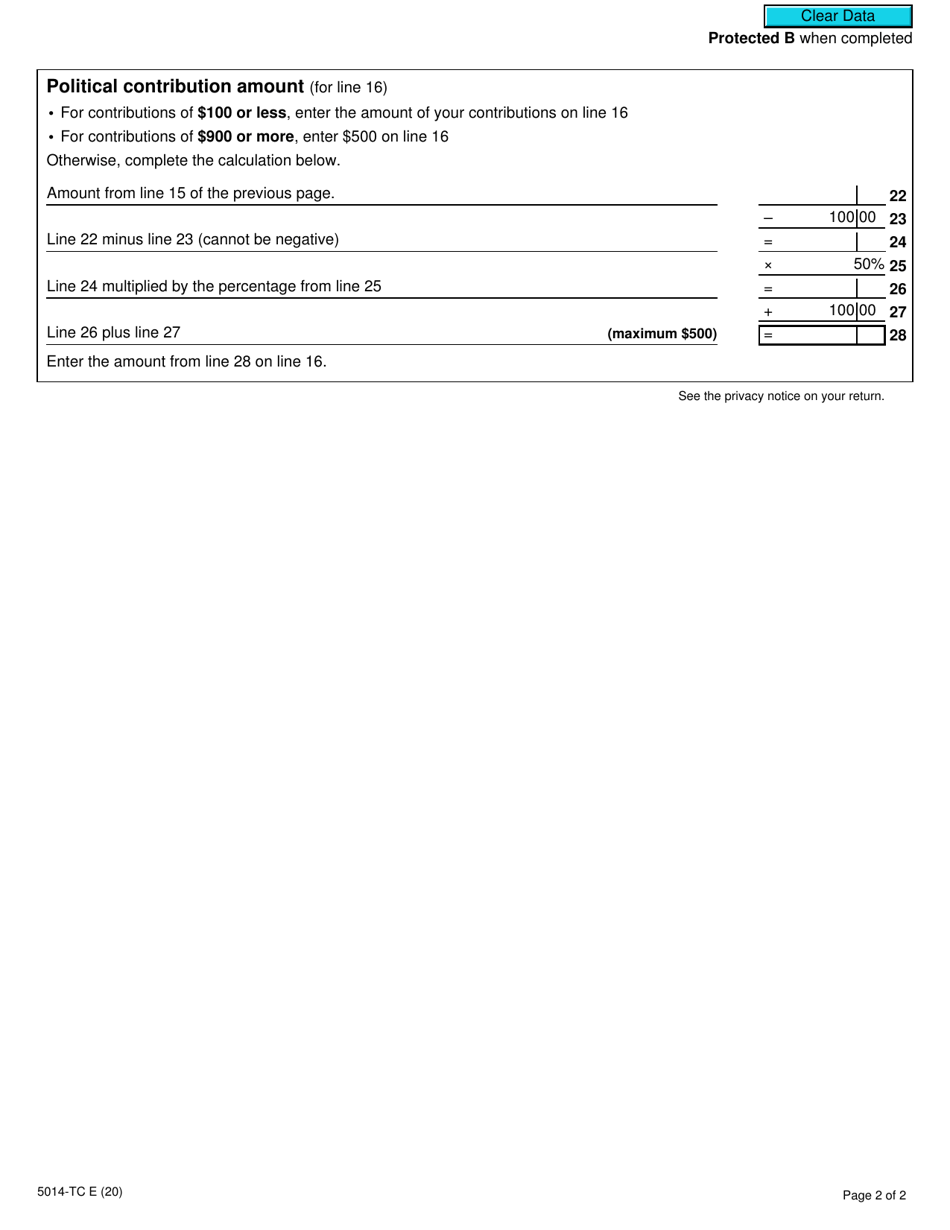

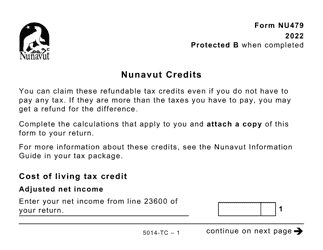

Form 5014-TC (NU479) Nunavut Credits - Canada

Form 5014-TC (NU479) is used for claiming Nunavut credits in Canada. It allows individuals to report and claim tax credits specific to Nunavut, a territory in Canada.

The Form 5014-TC (NU479) Nunavut Credits in Canada is typically filed by individuals who are claiming the Nunavut tax credits.

FAQ

Q: What is Form 5014-TC (NU479)?

A: Form 5014-TC (NU479) is a tax form used to claim Nunavut credits in Canada.

Q: What are Nunavut credits?

A: Nunavut credits are tax credits specific to the Nunavut territory in Canada.

Q: Who can claim Nunavut credits?

A: Residents of Nunavut who meet the eligibility criteria can claim Nunavut credits.

Q: What can be claimed as Nunavut credits?

A: Some common examples of Nunavut credits include the Nunavut cost of living credit and the Nunavut property tax credit.

Q: When is the deadline to file Form 5014-TC (NU479)?

A: The deadline to file Form 5014-TC (NU479) is generally the same as the deadline for submitting your income tax return, which is usually April 30th.

Q: Can I claim Nunavut credits if I don't live in Nunavut?

A: No, Nunavut credits are specifically for residents of Nunavut only.

Q: Are Nunavut credits refundable?

A: Some Nunavut credits may be refundable, meaning you can receive money back if the credit exceeds your tax liability.

Q: Do I need to include supporting documentation with Form 5014-TC (NU479)?

A: It is recommended to keep supporting documentation such as receipts and proof of eligibility in case the Canada Revenue Agency requests it.

Q: Can I claim other tax credits in addition to Nunavut credits?

A: Yes, you can claim other tax credits in addition to Nunavut credits, as long as you meet the eligibility criteria for each credit.