This version of the form is not currently in use and is provided for reference only. Download this version of

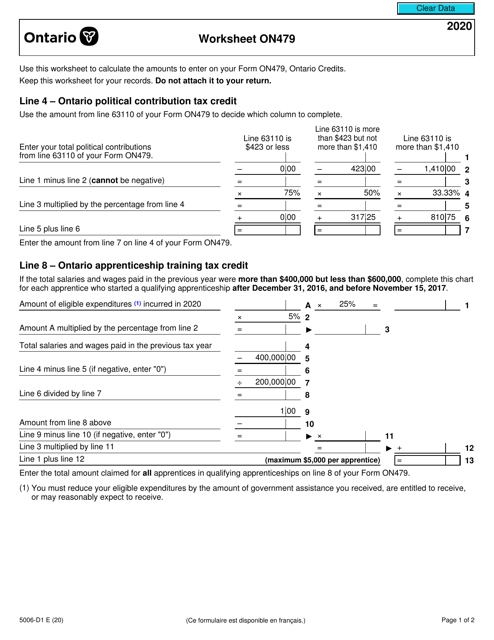

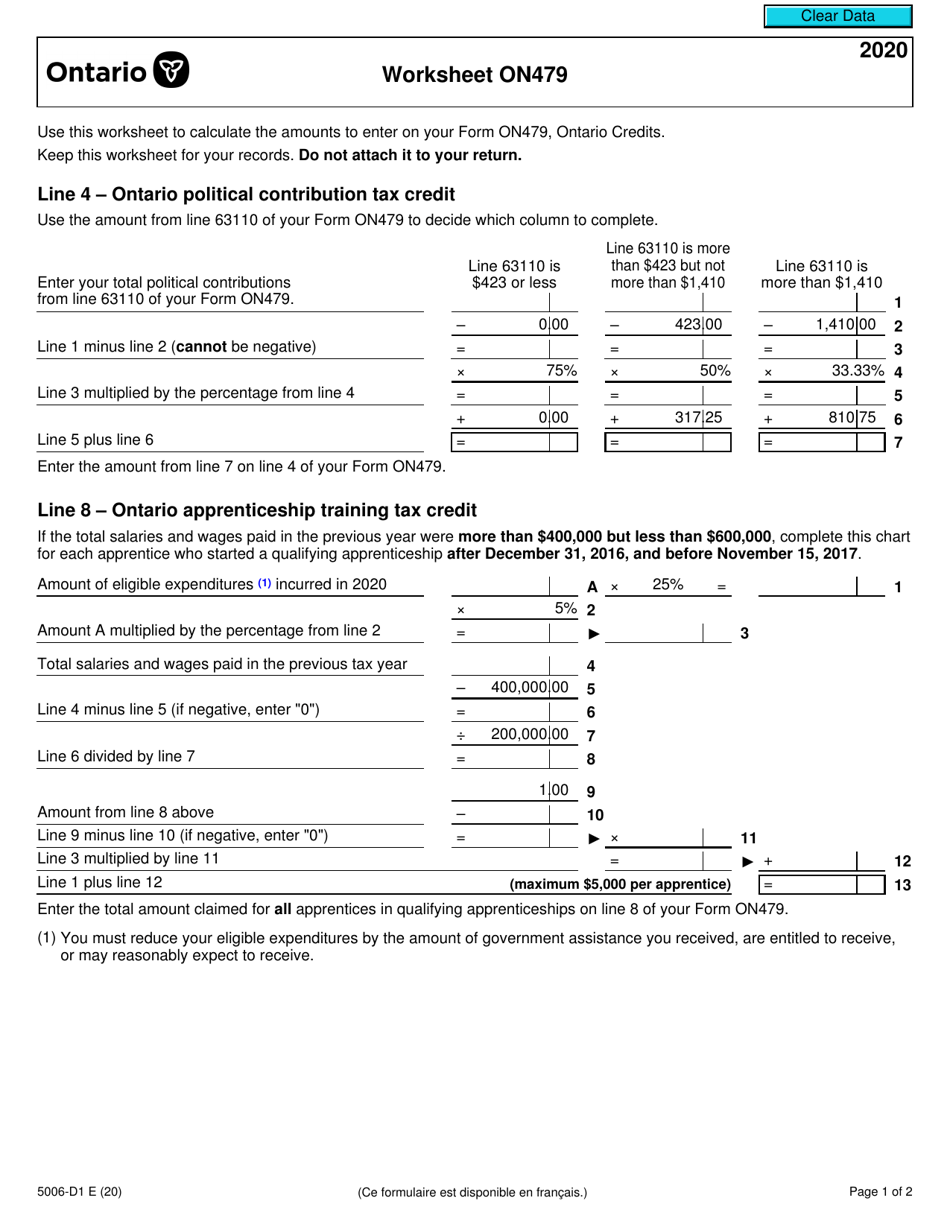

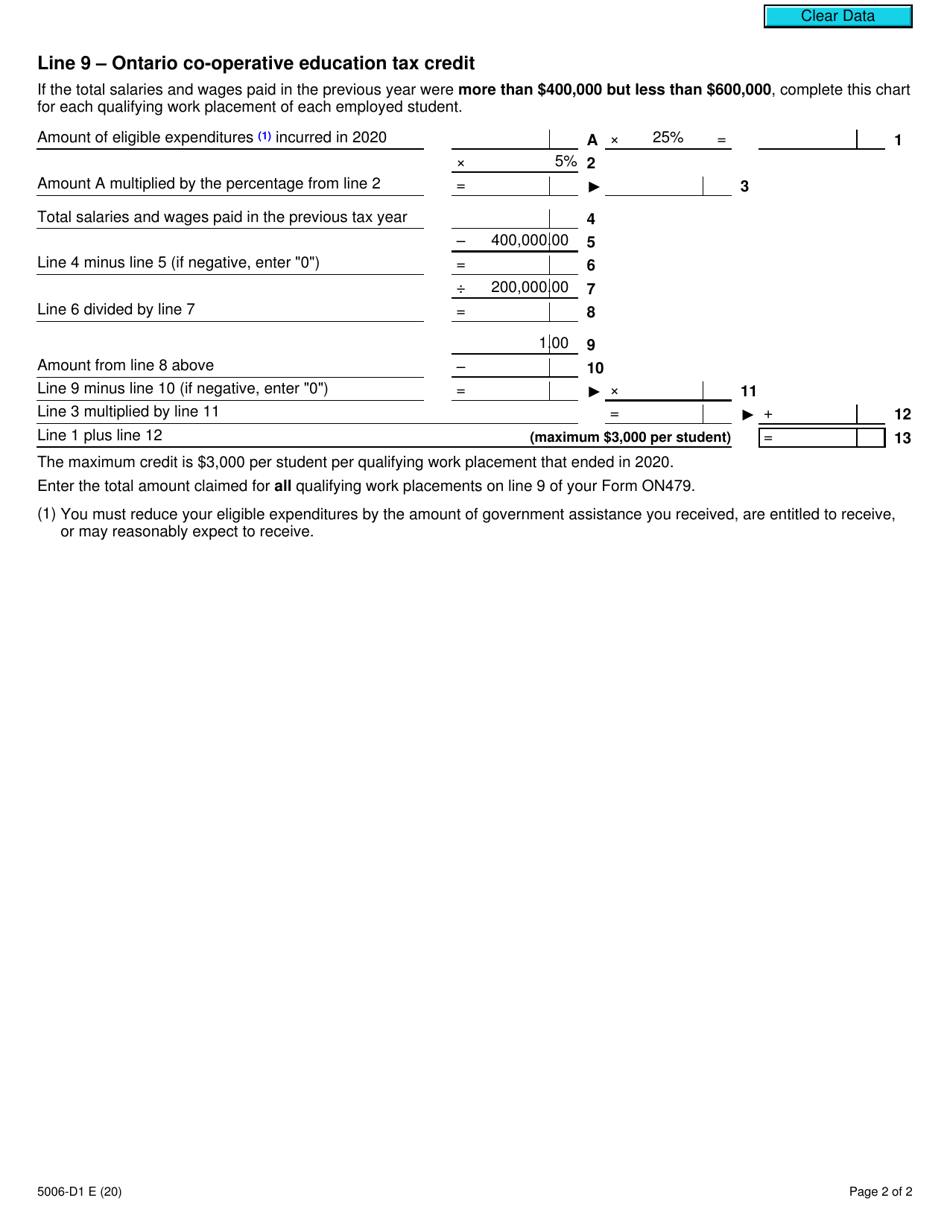

Form 5006-D1 Worksheet ON479

for the current year.

Form 5006-D1 Worksheet ON479 Ontario - Canada

Form 5006-D1 Worksheet ON479 Ontario - Canada is for calculating the Ontario tax credits and benefits, including the Ontario Child Benefit and the Ontario Senior Homeowners' Property Tax Grant.

The Form 5006-D1 Worksheet ON479 Ontario - Canada must be filed by individuals who are residents of Ontario, Canada for tax purposes.

FAQ

Q: What is Form 5006-D1?

A: Form 5006-D1 is a worksheet used for completing the ON479 form in Ontario, Canada.

Q: What is the ON479 form?

A: The ON479 form is a tax form used in Ontario, Canada to claim various tax credits.

Q: What is the purpose of the worksheet?

A: The worksheet (Form 5006-D1) helps you calculate the amounts to enter on the ON479 form.

Q: Who needs to use Form 5006-D1?

A: Residents of Ontario, Canada who are claiming tax credits on the ON479 form would use Form 5006-D1.

Q: What are some examples of tax credits that can be claimed on the ON479 form?

A: Examples of tax credits that can be claimed on the ON479 form include the Ontario energy and property tax credit, the Ontario sales tax credit, and the Northern Ontario energy credit.

Q: Do I need to submit Form 5006-D1 with my tax return?

A: No, you do not need to submit Form 5006-D1 with your tax return. However, you should keep it for your records in case the Canada Revenue Agency requests it.

Q: What should I do if I need help completing Form 5006-D1?

A: If you need help completing Form 5006-D1 or have questions about the ON479 form, you can contact the Canada Revenue Agency or consult a tax professional.

Q: Are there any deadlines for filing the ON479 form?

A: Yes, the deadlines for filing the ON479 form are the same as the deadlines for filing your income tax return, which are typically April 30th or June 15th for self-employed individuals.

Q: Can I make changes to my ON479 form after it has been filed?

A: Yes, if you discover an error or omission on your ON479 form after it has been filed, you can request a T1-ADJ form from the Canada Revenue Agency to make the necessary changes.