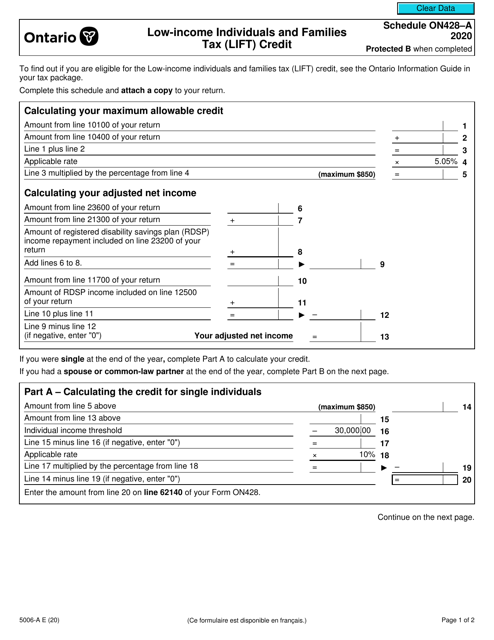

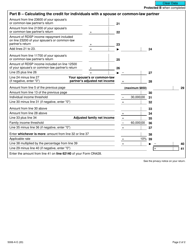

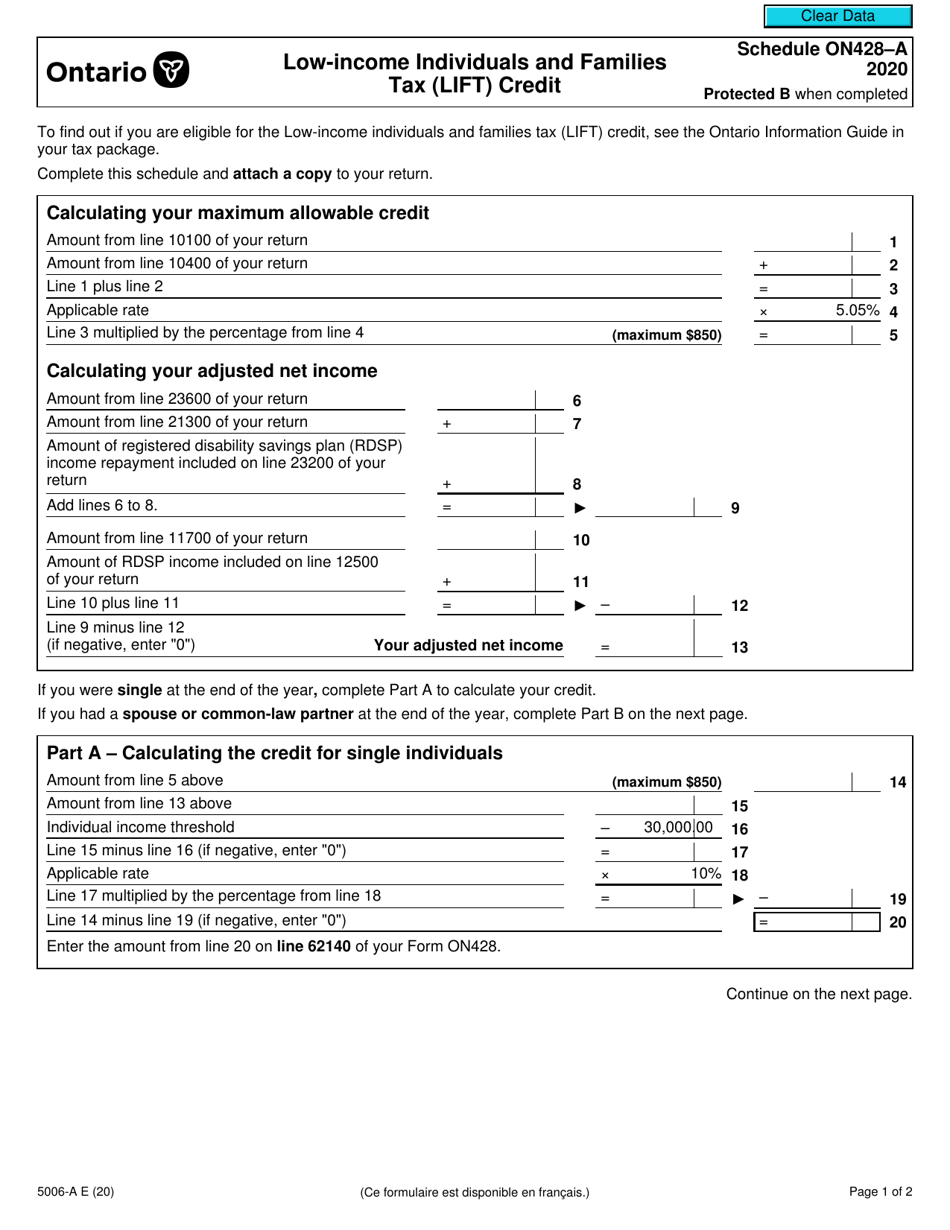

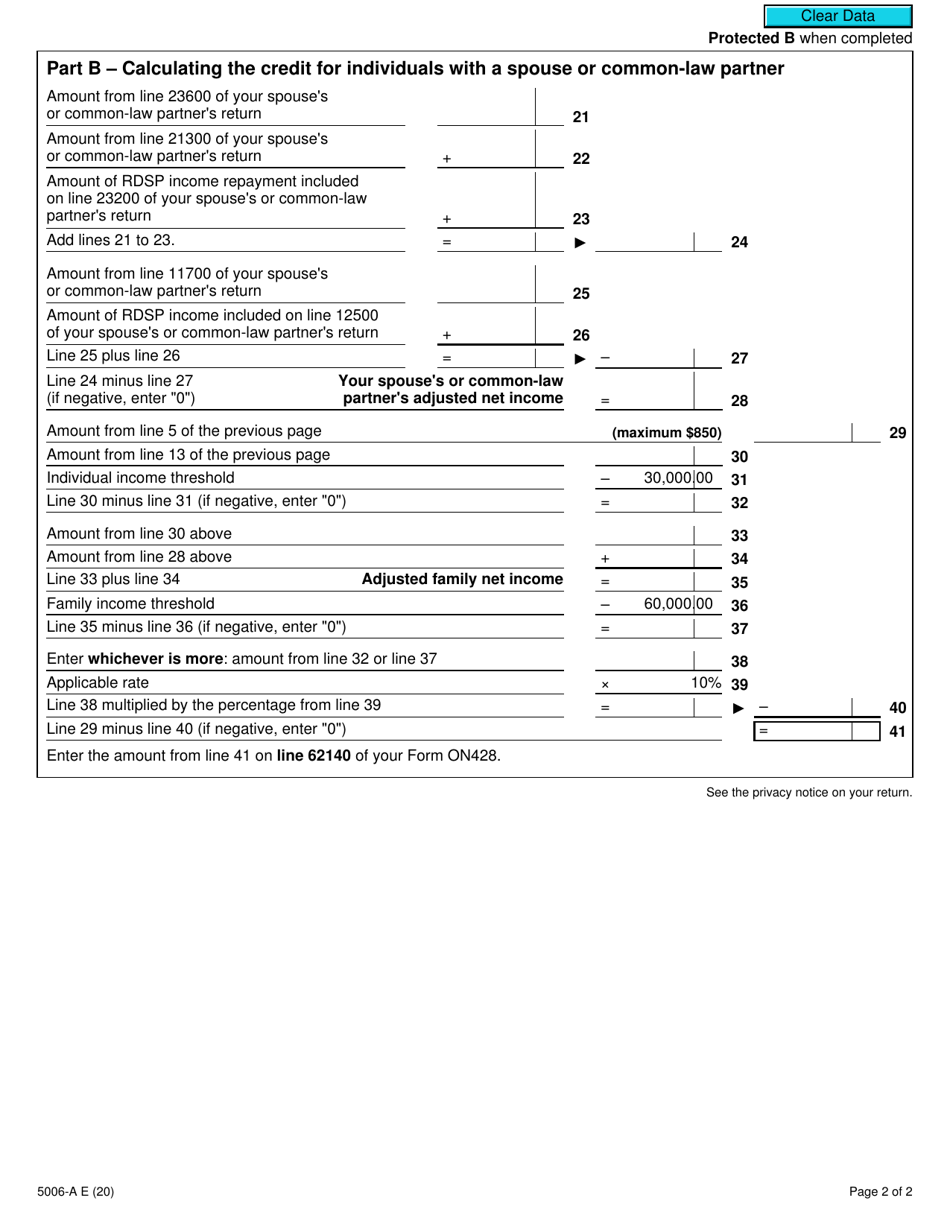

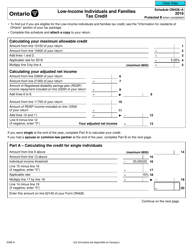

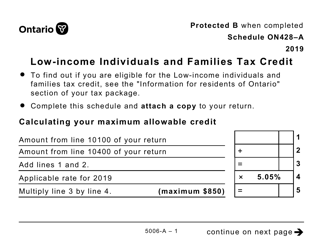

Form 5006-A Schedule ON428-A Low-Income Individuals and Families Tax (Lift) Credit - Canada

Form 5006-A Schedule ON428-A is used in Canada to claim the Low-Income Individuals and Families Tax (Lift) Credit. This credit is intended to provide tax relief for low-income individuals and families.

FAQ

Q: What is Form 5006-A Schedule ON428-A?

A: Form 5006-A Schedule ON428-A is a tax form in Canada.

Q: What is the Low-Income Individuals and Families Tax (Lift) Credit?

A: The Low-Income Individuals and Families Tax (Lift) Credit is a credit designed to provide tax relief for low-income individuals and families in Canada.

Q: Who is eligible for the Low-Income Individuals and Families Tax (Lift) Credit?

A: Eligibility for the Low-Income Individuals and Families Tax (Lift) Credit is based on several factors, including income, family size, and province of residence.

Q: How do I claim the Low-Income Individuals and Families Tax (Lift) Credit?

A: To claim the Low-Income Individuals and Families Tax (Lift) Credit, you need to complete and submit Form 5006-A Schedule ON428-A along with your annual tax return.

Q: What information do I need to complete Form 5006-A Schedule ON428-A?

A: To complete Form 5006-A Schedule ON428-A, you will need information such as your income, family size, and province of residence.

Q: Is the Low-Income Individuals and Families Tax (Lift) Credit refundable?

A: Yes, the Low-Income Individuals and Families Tax (Lift) Credit is refundable, which means you may receive a refund if the credit exceeds your tax liability.

Q: When is the deadline to claim the Low-Income Individuals and Families Tax (Lift) Credit?

A: The deadline to claim the Low-Income Individuals and Families Tax (Lift) Credit is the same as the deadline to file your annual tax return, which is generally April 30th of the following year.

Q: Can I claim the Low-Income Individuals and Families Tax (Lift) Credit if I live in a different province?

A: No, the Low-Income Individuals and Families Tax (Lift) Credit is specific to Ontario residents only.

Q: What other tax credits are available for low-income individuals and families in Canada?

A: There are several other tax credits available for low-income individuals and families in Canada, including the GST/HST credit, Canada Child Benefit, and the Working Income Tax Benefit.