This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5002-C (PE428)

for the current year.

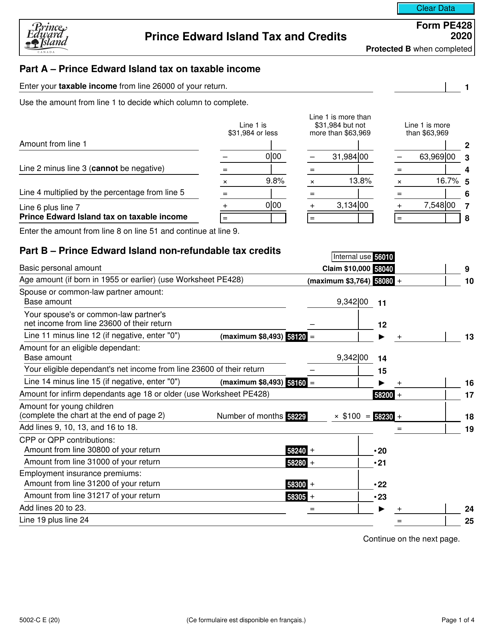

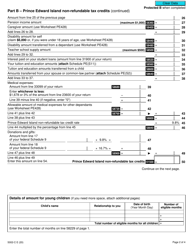

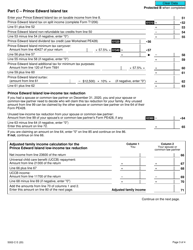

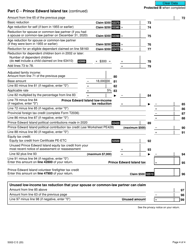

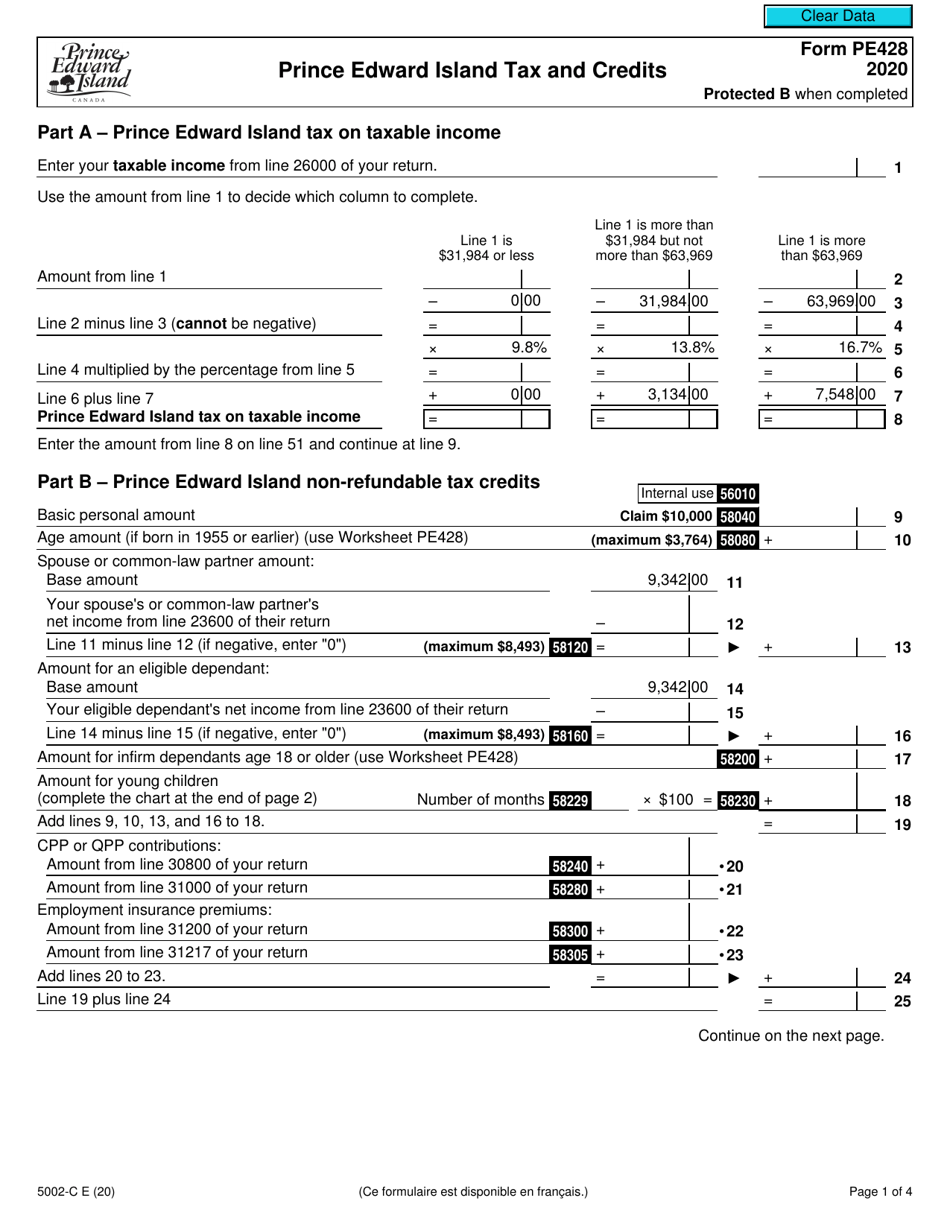

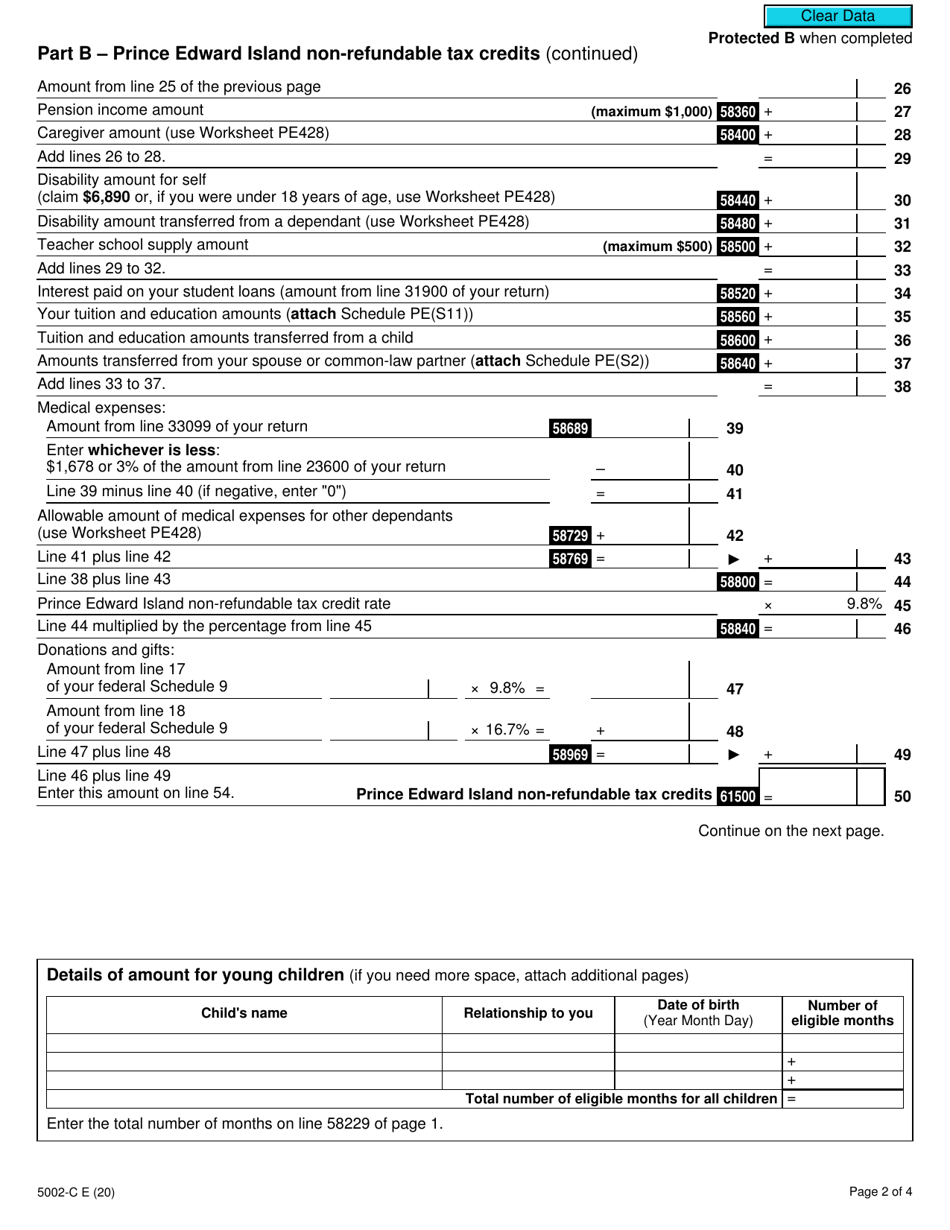

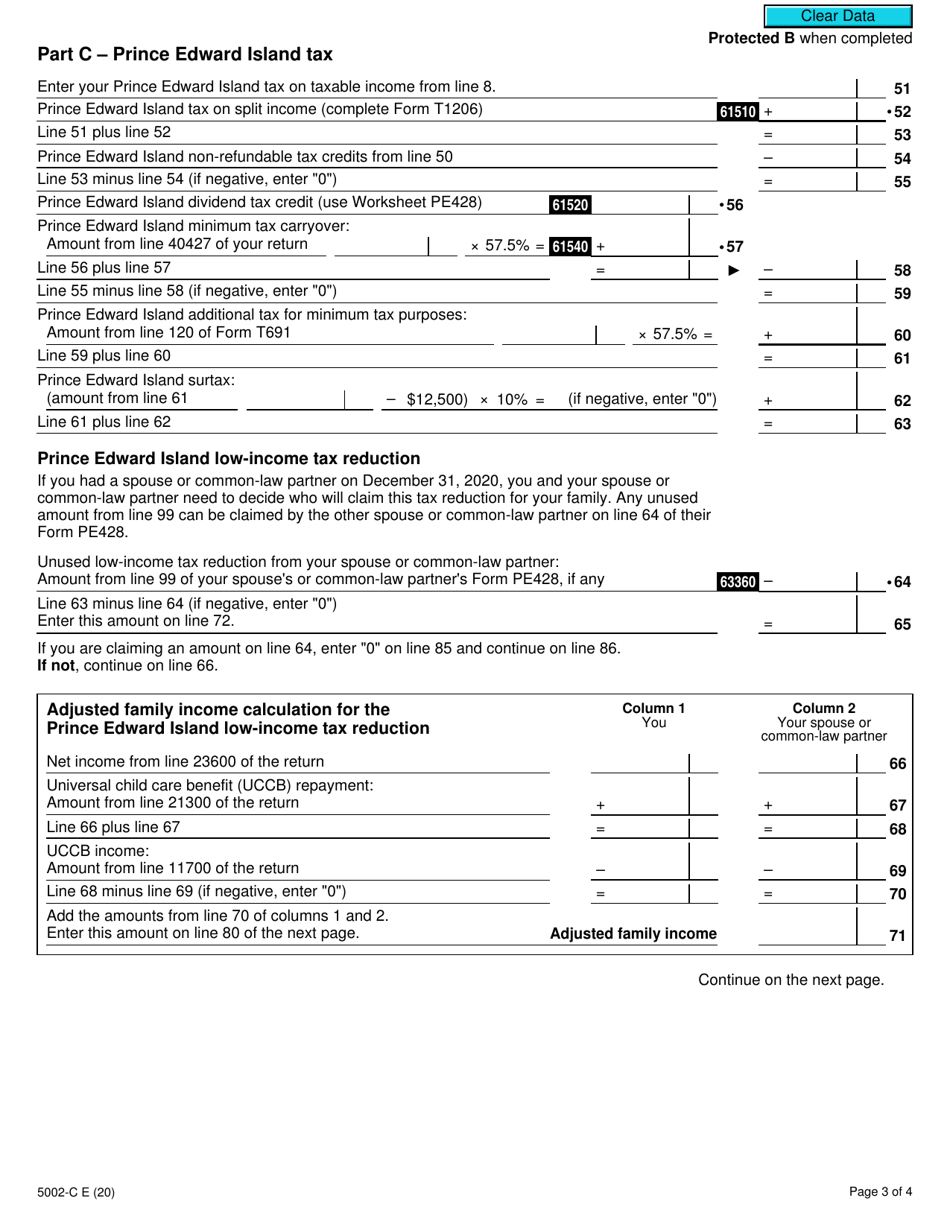

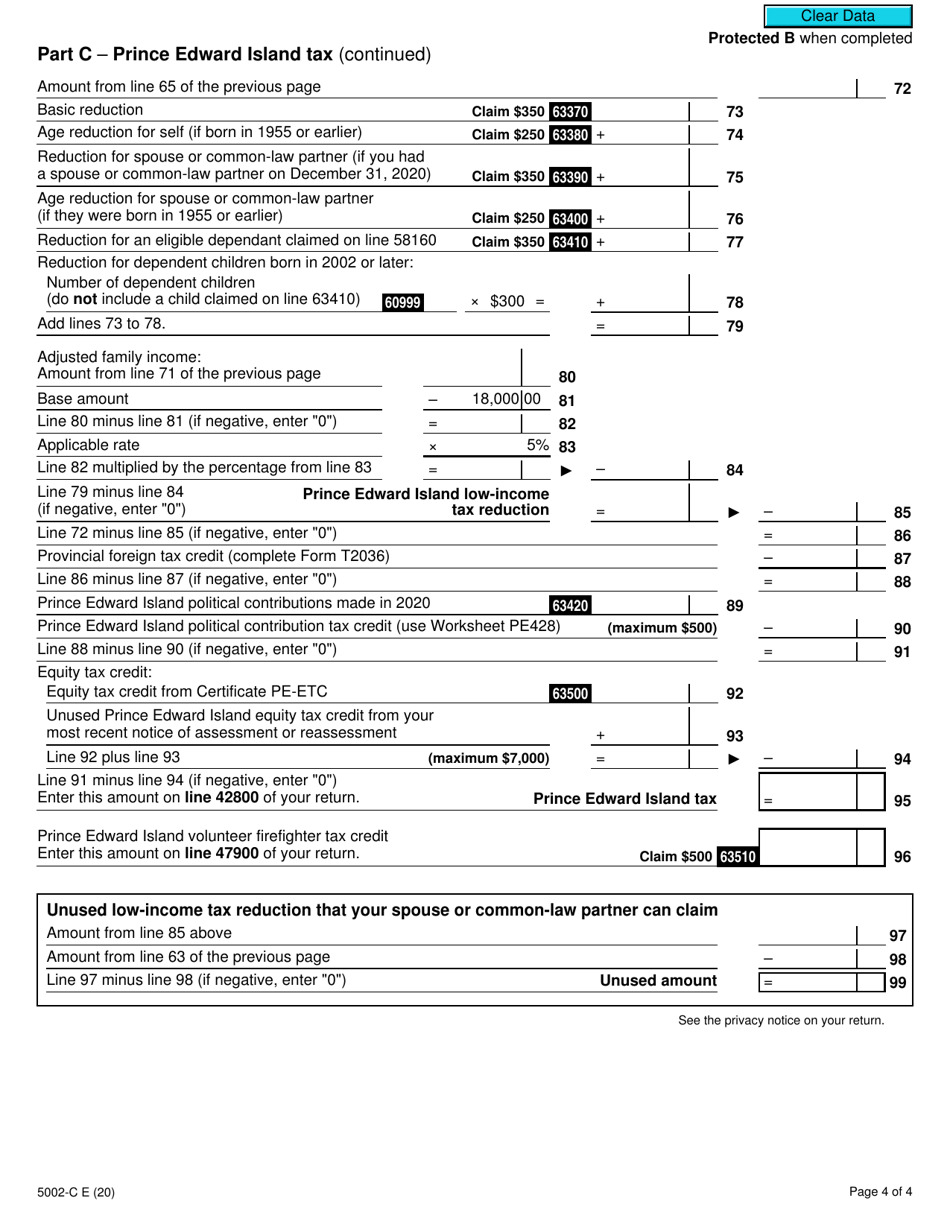

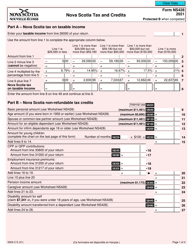

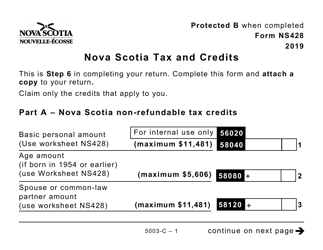

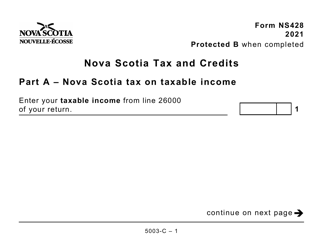

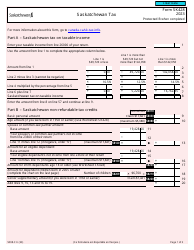

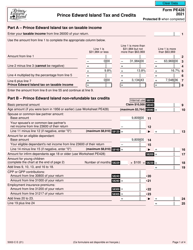

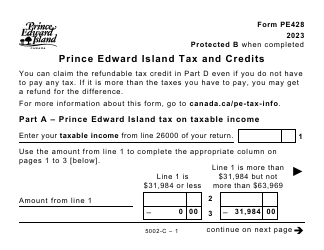

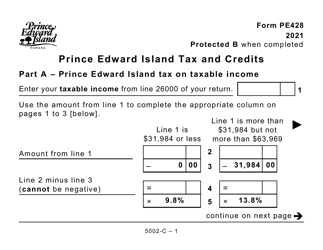

Form 5002-C (PE428) Prince Edward Island Tax and Credits - Canada

Form 5002-C (PE428) is a tax form used in Prince Edward Island, Canada. It is used to report your income and calculate any applicable tax credits for residents of Prince Edward Island.

The Form 5002-C (PE428) Prince Edward Island Tax and Credits in Canada is filed by individuals who are residents of Prince Edward Island and have income to report and claim tax credits.

FAQ

Q: What is Form 5002-C (PE428)?

A: Form 5002-C (PE428) is the tax form for Prince Edward Island, Canada.

Q: What is it used for?

A: It is used to report your income, claim tax credits, and calculate your provincial tax.

Q: Who needs to file this form?

A: Residents of Prince Edward Island who need to report their income and claim provincial tax credits.

Q: How do I fill out this form?

A: You need to provide your personal information, report your income, claim tax credits, and calculate your provincial tax.

Q: When is the deadline to file this form?

A: The deadline to file Form 5002-C (PE428) is usually April 30th of each year.

Q: What happens if I don't file this form?

A: If you don't file this form, you may face penalties or miss out on potential tax credits and refunds.

Q: Can I e-file this form?

A: Yes, you can e-file Form 5002-C (PE428) if you are eligible and have the necessary software.

Q: Are there any other forms I need to file along with this?

A: Depending on your situation, you may need to file additional federal tax forms along with Form 5002-C (PE428).