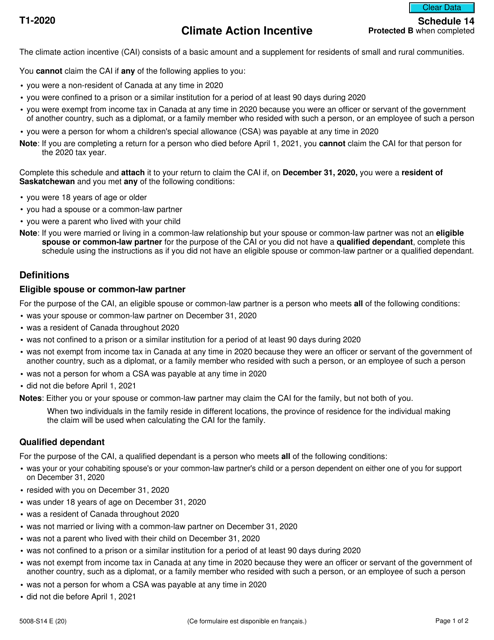

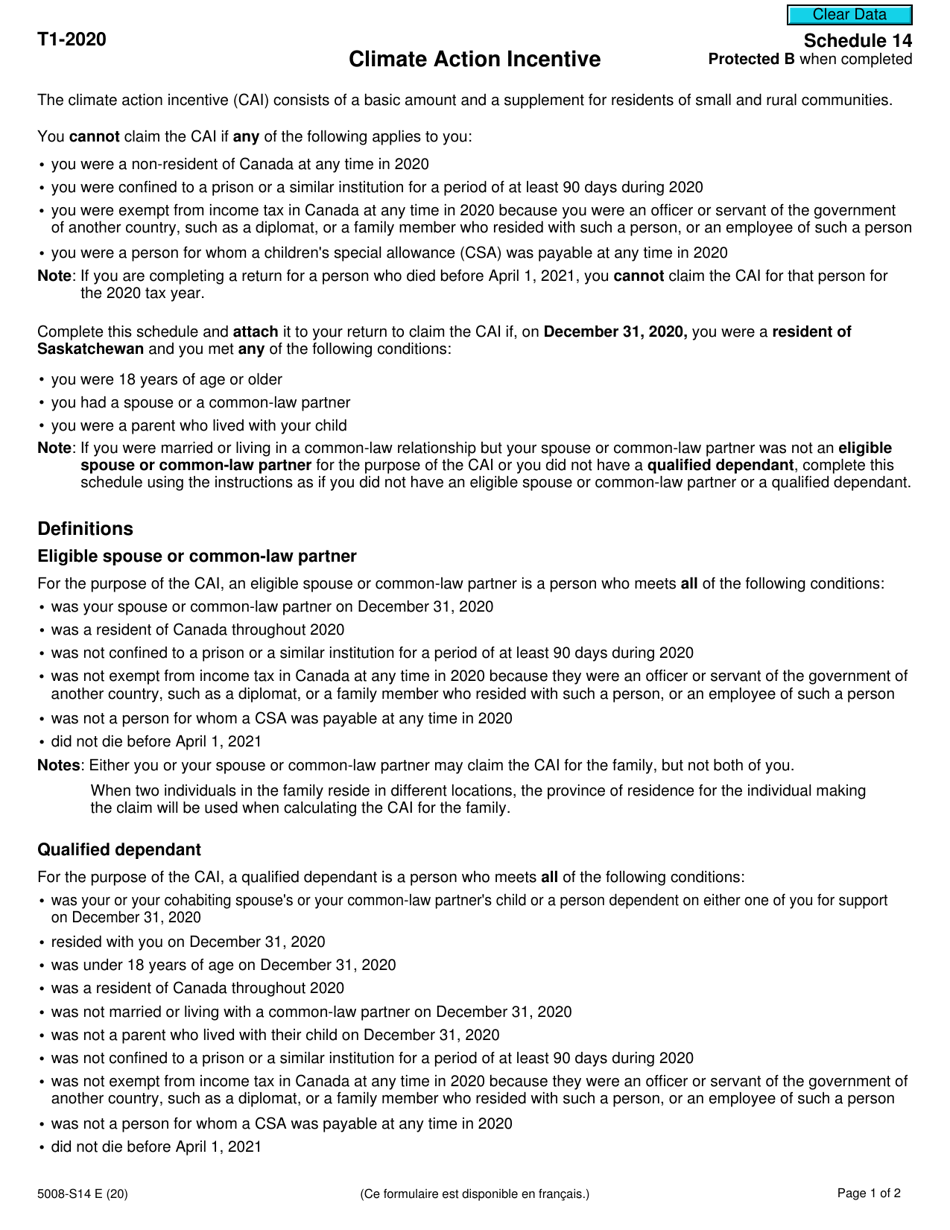

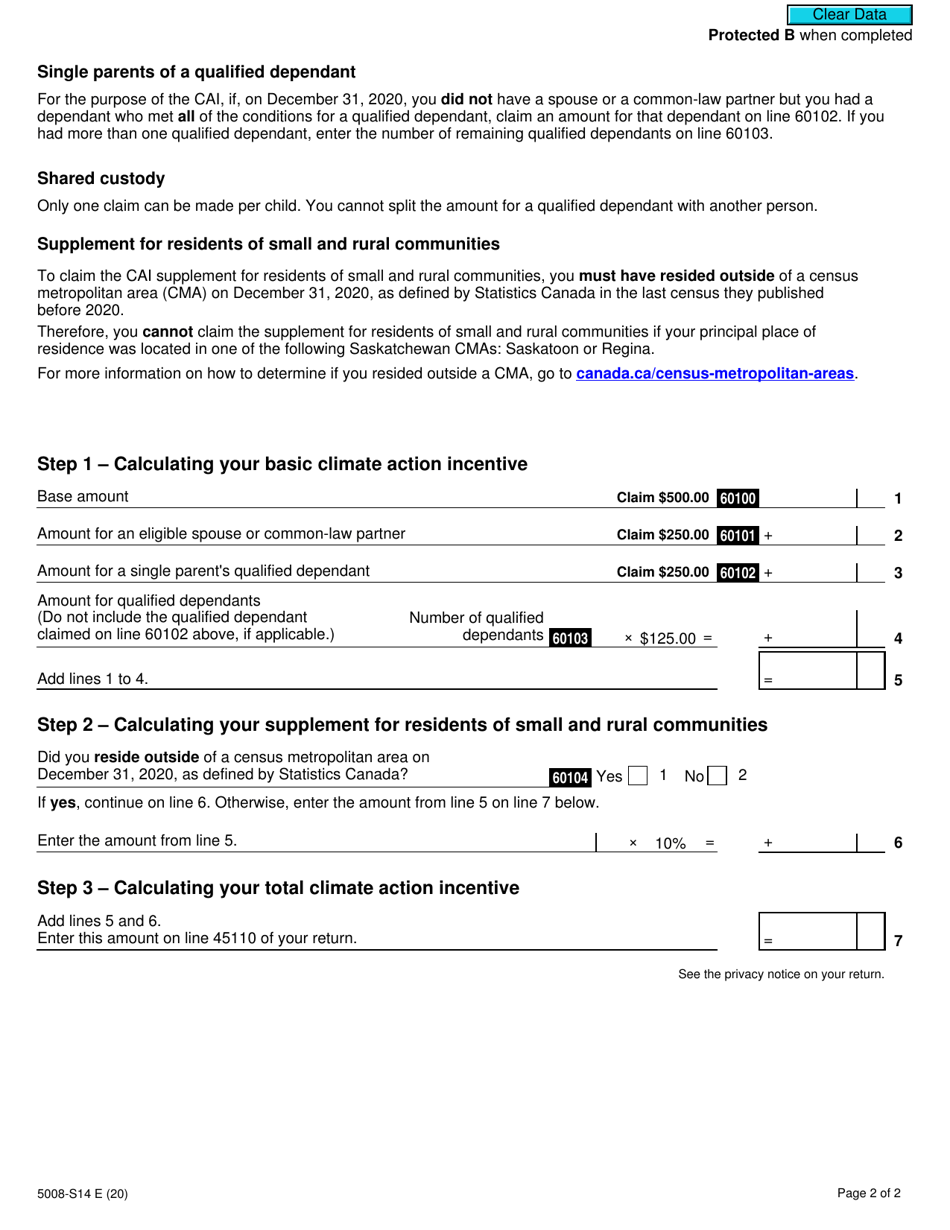

Form 5008-S14 Schedule 14 Climate Action Incentive - Canada

Form 5008-S14 Schedule 14 Climate Action Incentive is used in Canada to claim the Climate Action Incentive tax credit. This credit is provided to individuals residing in provinces that do not have their own carbon pricing system.

Individuals who are residents of the provinces or territories of Canada that have opted to implement the federal carbon pricing system (Alberta, Ontario, Manitoba, and Saskatchewan) will need to file the Form 5008-S14 Schedule 14 Climate Action Incentive as part of their Canadian tax return.

FAQ

Q: What is Form 5008-S14 Schedule 14?

A: Form 5008-S14 Schedule 14 is a form used in Canada for reporting Climate Action Incentive payments.

Q: What is Climate Action Incentive?

A: Climate Action Incentive is a program in Canada that provides financial assistance to individuals and families in provinces that have not implemented a carbon pricing system.

Q: Who is eligible for Climate Action Incentive?

A: Eligibility for Climate Action Incentive depends on the province of residence and household size. Generally, individuals and families with lower income levels are eligible.

Q: What is the purpose of Form 5008-S14 Schedule 14?

A: The purpose of Form 5008-S14 Schedule 14 is to report the Climate Action Incentive payment received and provide the necessary information for claiming the incentive.

Q: Do I need to file Form 5008-S14 Schedule 14?

A: Whether or not you need to file Form 5008-S14 Schedule 14 depends on your individual circumstances. It is recommended to consult the CRA or a tax professional for guidance.

Q: When is the deadline to file Form 5008-S14 Schedule 14?

A: The deadline to file Form 5008-S14 Schedule 14 depends on the tax year. It is generally due when filing your income tax return for the corresponding year.

Q: What happens if I don't file Form 5008-S14 Schedule 14?

A: Failing to file Form 5008-S14 Schedule 14 may result in a delay or denial of the Climate Action Incentive payment.

Q: Can I claim the Climate Action Incentive on my taxes?

A: Yes, you can claim the Climate Action Incentive on your taxes by completing Form 5008-S14 Schedule 14 and including it with your tax return.

Q: Is the Climate Action Incentive taxable?

A: No, the Climate Action Incentive payment is not taxable. It is considered to be a government benefit and is not included in your taxable income.