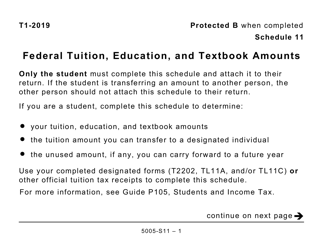

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-S11 Schedule YT(S11)

for the current year.

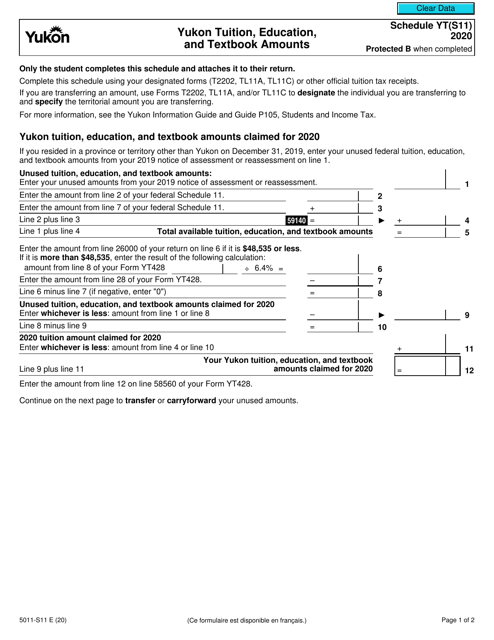

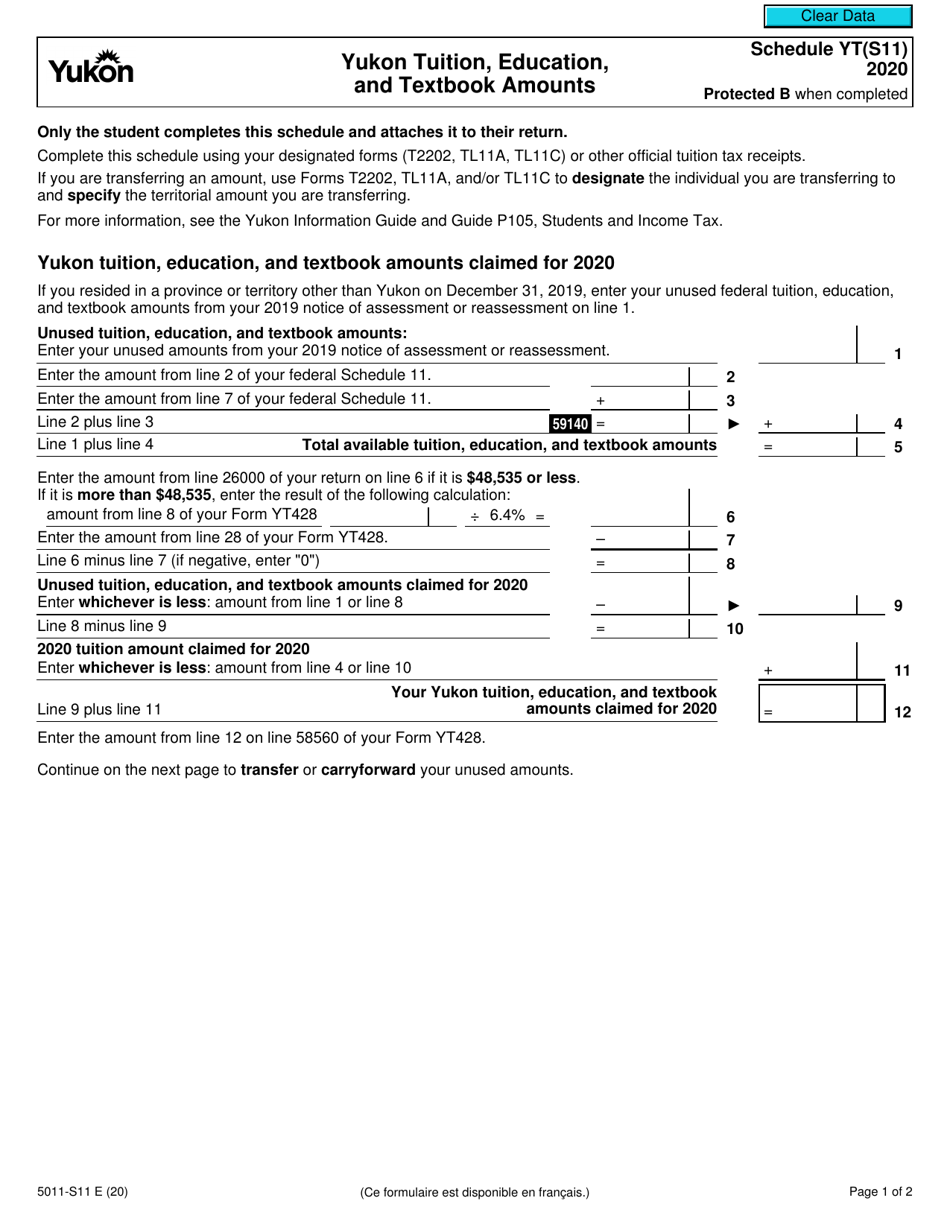

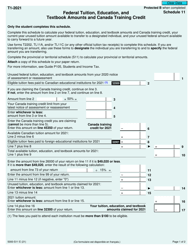

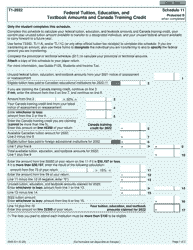

Form 5011-S11 Schedule YT(S11) Yukon Tuition, Education, and Textbook Amounts - Canada

Form 5011-S11 Schedule YT (S11) Yukon Tuition, Education, and Textbook Amounts in Canada is used to claim tuition, education, and textbook amounts for individuals in the Yukon Territory.

FAQ

Q: What is Form 5011-S11 Schedule YT(S11)?

A: Form 5011-S11 Schedule YT(S11) is a Canadian tax form used to claim tuition, education, and textbook amounts in Yukon.

Q: Who can use Form 5011-S11 Schedule YT(S11)?

A: Residents of Yukon who paid tuition fees or bought textbook materials for post-secondary education can use this form.

Q: What can be claimed on Form 5011-S11 Schedule YT(S11)?

A: You can claim a deduction for the eligible tuition fees and the cost of eligible textbooks.

Q: What are the eligibility criteria for claiming the tuition, education, and textbook amounts?

A: You must have attended a post-secondary educational institution in Yukon, and the tuition fees and textbook expenses must meet the specified criteria.

Q: When do I need to submit Form 5011-S11 Schedule YT(S11)?

A: You should complete and submit this form along with your annual tax return.

Q: Are there any deadlines for claiming the tuition, education, and textbook amounts?

A: Yes, you must claim these amounts within four years from the end of the taxation year for which the fees were paid.

Q: Can I carry forward any unused tuition, education, and textbook amounts?

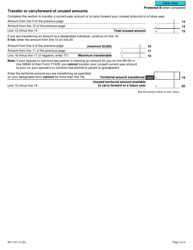

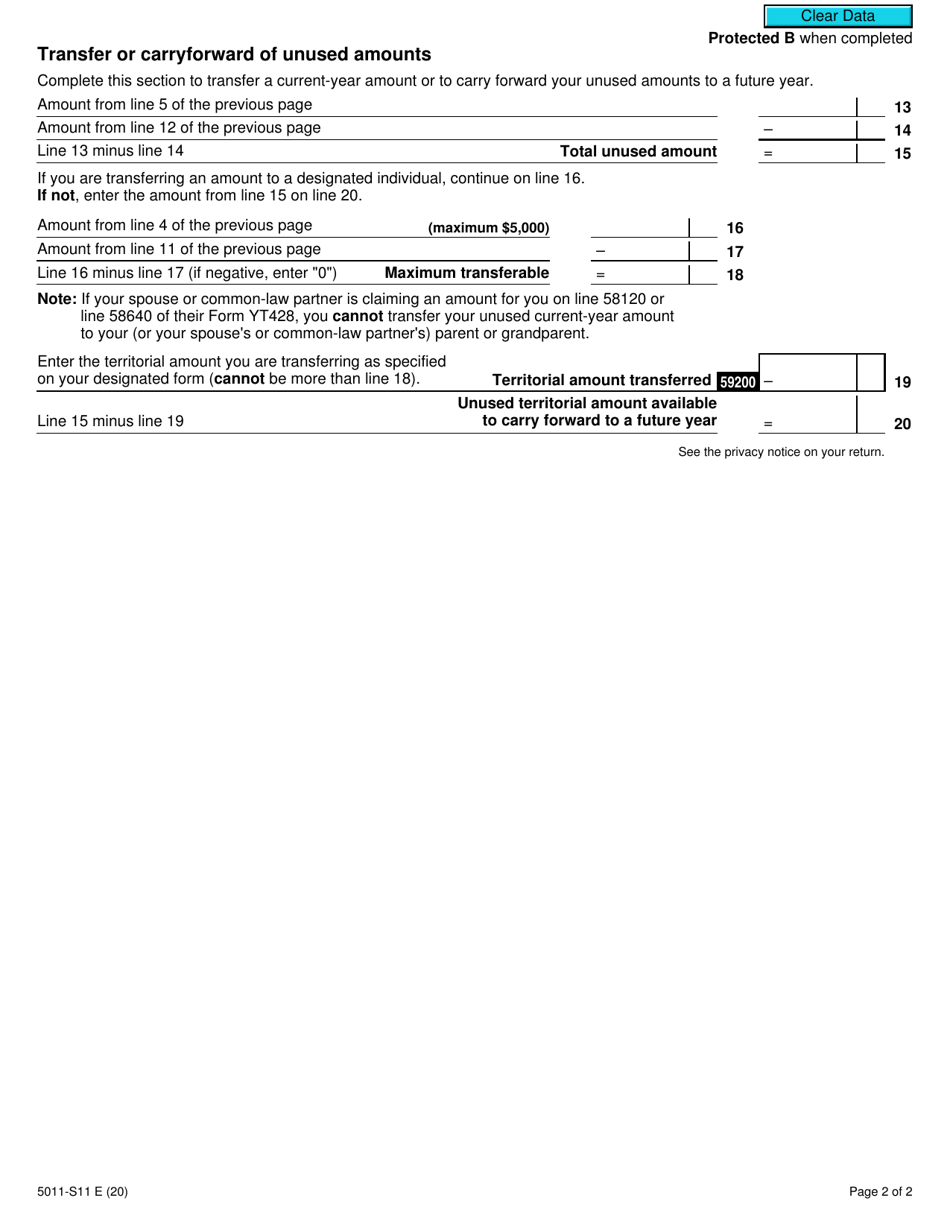

A: Yes, you can carry forward any unused amounts to future years or transfer them to a designated individual.