This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-S2 Schedule YT(S2)

for the current year.

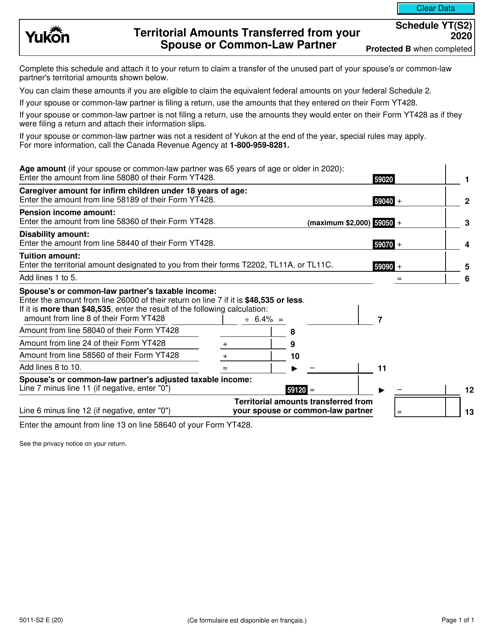

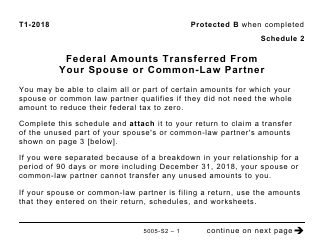

Form 5011-S2 Schedule YT(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5011-S2 Schedule YT(S2) is used in Canada to report the transfer of territorial amounts from your spouse or common-law partner. It is part of the tax filing process and helps determine the amount of tax credits or deductions that can be claimed.

FAQ

Q: What is Form 5011-S2?

A: Form 5011-S2 is a schedule used in Canada for reporting territorial amounts transferred from your spouse or common-law partner.

Q: What is Schedule YT(S2)?

A: Schedule YT(S2) is a specific schedule within Form 5011-S2 used for reporting territorial amounts transferred from your spouse or common-law partner in Canada.

Q: When is Form 5011-S2 used?

A: Form 5011-S2 is used when you want to report territorial amounts transferred from your spouse or common-law partner on your taxes in Canada.

Q: What are territorial amounts transferred?

A: Territorial amounts transferred are certain deductions, credits, and other tax-related amounts that can be transferred from your spouse or common-law partner to reduce your tax liability in Canada.

Q: Who can transfer territorial amounts?

A: Only spouses or common-law partners who are residents of Canada can transfer territorial amounts.

Q: Why would someone transfer territorial amounts?

A: Transferring territorial amounts can help lower the overall tax burden for a couple if one spouse or common-law partner has more tax credits and deductions than they can use themselves.

Q: Do I need to file Form 5011-S2?

A: You only need to file Form 5011-S2 if you want to report territorial amounts transferred from your spouse or common-law partner on your taxes in Canada.

Q: Can I transfer territorial amounts to my spouse or common-law partner?

A: No, only territorial amounts can be transferred from your spouse or common-law partner to you. You cannot transfer territorial amounts to them.

Q: Are there any restrictions on transferring territorial amounts?

A: Yes, there are certain restrictions and limitations on transferring territorial amounts, such as maximum limits on the amounts that can be transferred and specific criteria that must be met.