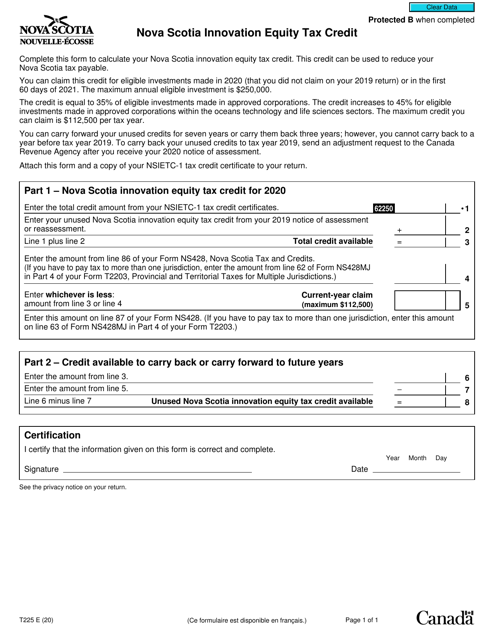

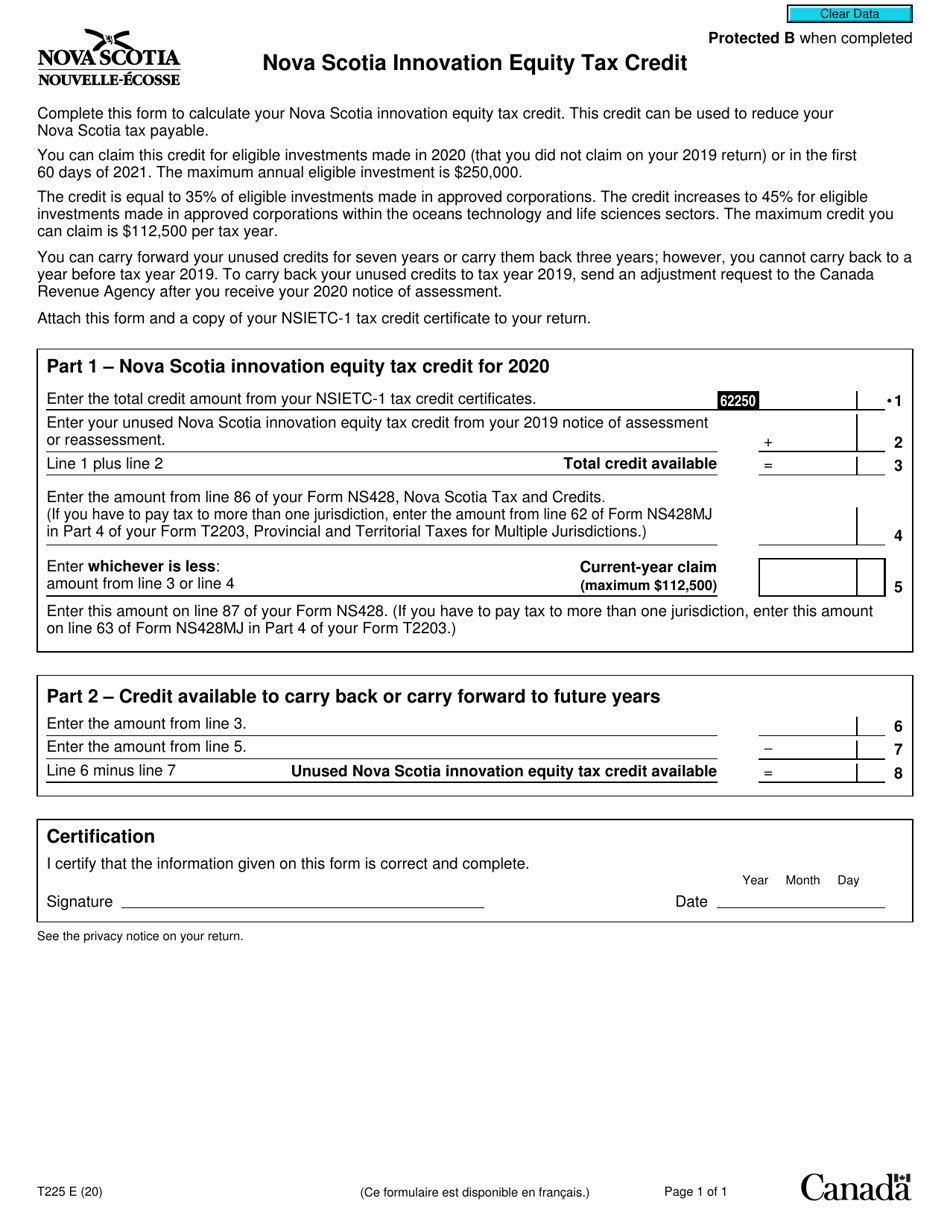

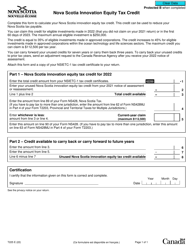

Form T225 Nova Scotia Innovation Equity Tax Credit - Canada

Form T225 Nova Scotia Innovation Equity Tax Credit is used in Canada to claim a tax credit related to investments made in eligible small businesses in Nova Scotia. This tax credit encourages investment in innovative companies and stimulates economic growth in the province.

The Form T225 Nova Scotia Innovation Equity Tax Credit is filed by individuals or corporations who are eligible for the tax credit in Nova Scotia, Canada.

FAQ

Q: What is the Form T225 Nova Scotia Innovation Equity Tax Credit?

A: The Form T225 Nova Scotia Innovation Equity Tax Credit is a tax credit offered by the province of Nova Scotia in Canada.

Q: Who is eligible for the Nova Scotia Innovation Equity Tax Credit?

A: To be eligible for the Nova Scotia Innovation Equity Tax Credit, you must be a resident of Nova Scotia and have invested in an eligible Nova Scotia business.

Q: What is the purpose of the Nova Scotia Innovation Equity Tax Credit?

A: The purpose of the Nova Scotia Innovation Equity Tax Credit is to encourage individuals to invest in innovative businesses in Nova Scotia.

Q: How much is the tax credit?

A: The tax credit is equal to 35% of your investment in an eligible Nova Scotia business.

Q: Are there any limits to the tax credit?

A: Yes, there is a maximum tax credit of $75,000 per year, per individual.

Q: How do I claim the tax credit?

A: You can claim the tax credit by completing and filing the Form T225 with your annual income tax return.