This version of the form is not currently in use and is provided for reference only. Download this version of

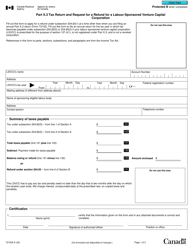

Form T224

for the current year.

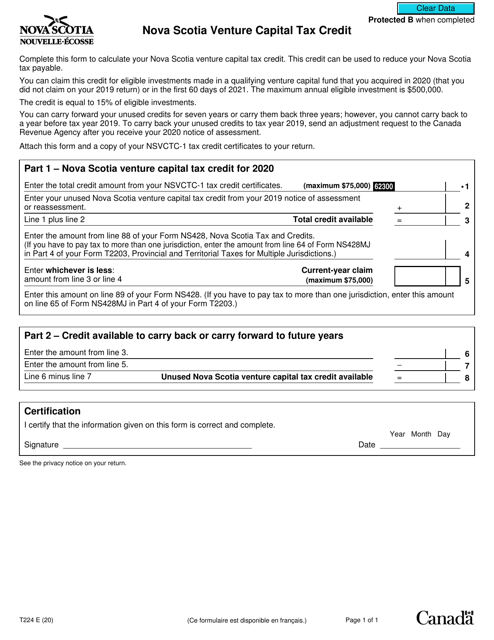

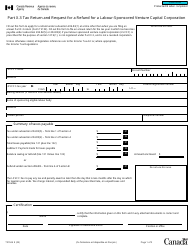

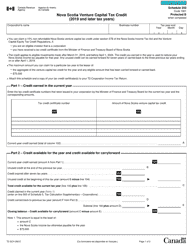

Form T224 Nova Scotia Venture Capital Tax Credit - Canada

Form T224 Nova Scotia Venture Capital Tax Credit is used by individuals or corporations in Nova Scotia, Canada, to claim a tax credit when they invest in eligible Nova Scotia venture capital funds. This tax credit encourages investment in local businesses and helps support economic growth in the province.

The business that is seeking the Nova Scotia Venture Capital Tax Credit files the Form T224.

FAQ

Q: What is Form T224?

A: Form T224 is a tax form used in Nova Scotia, Canada.

Q: What is the Nova Scotia Venture Capital Tax Credit?

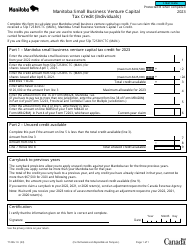

A: The Nova Scotia Venture Capital Tax Credit is a tax credit program designed to encourage investments in eligible small and medium-sized businesses in Nova Scotia.

Q: Who is eligible for the Nova Scotia Venture Capital Tax Credit?

A: Individuals, corporations, and partnerships that invest in eligible small and medium-sized businesses in Nova Scotia are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 35% of the amount invested in an eligible business.

Q: What is the maximum tax credit that can be claimed?

A: The maximum tax credit that can be claimed is $75,000 per individual investor and $150,000 per corporation or partnership.

Q: How is the tax credit claimed?

A: To claim the tax credit, investors must complete Form T224 and include it with their personal or corporate income tax return.

Q: Are there any restrictions on the tax credit?

A: Yes, there are certain restrictions and conditions that must be met in order to qualify for the tax credit. These include a minimum investment threshold and a maximum annual limit on the total amount of tax credits that can be claimed.