This version of the form is not currently in use and is provided for reference only. Download this version of

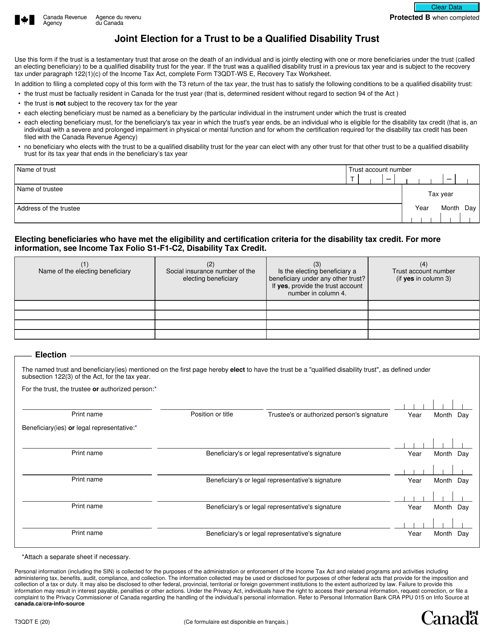

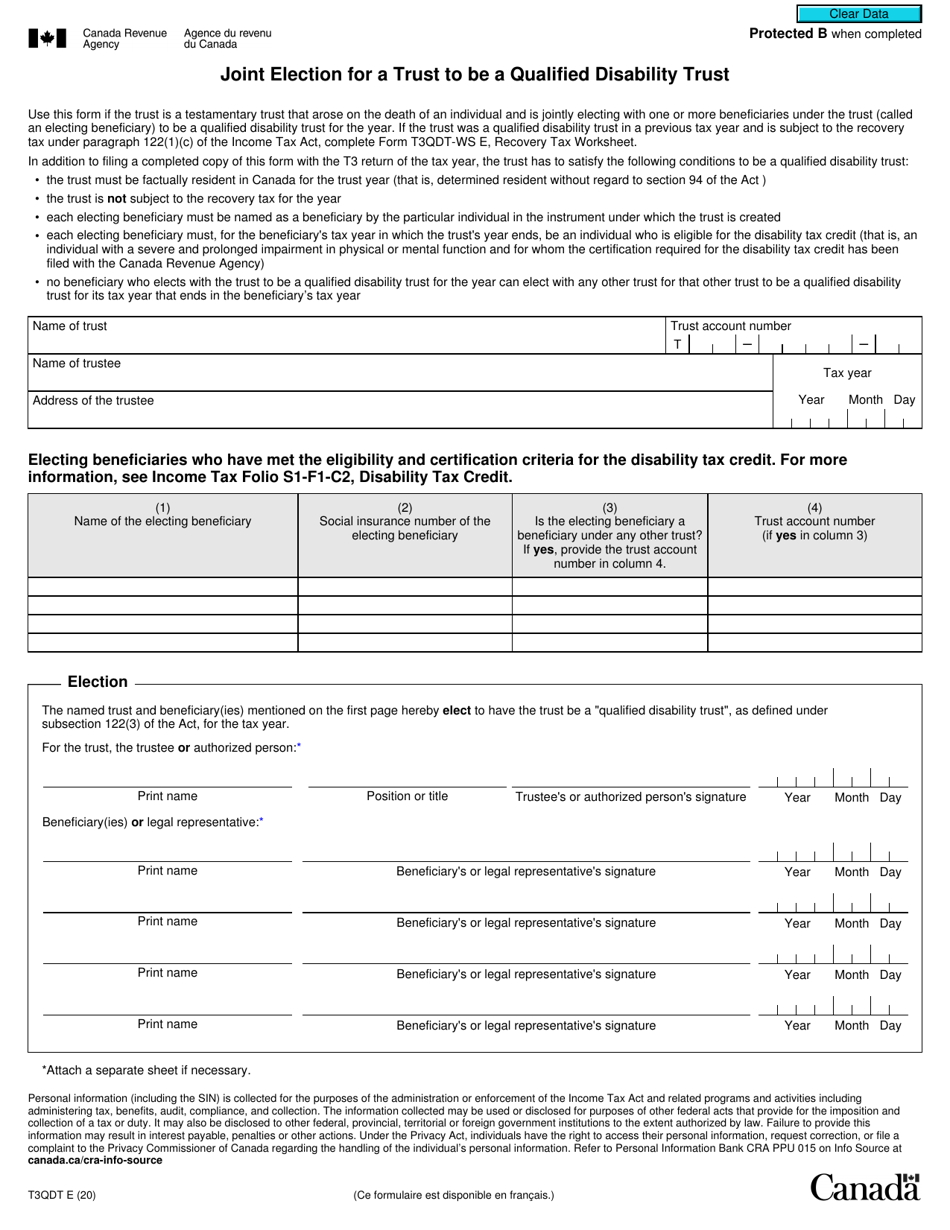

Form T3QDT

for the current year.

Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust - Canada

Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust in Canada is used to elect a trust as a Qualified Disability Trust (QDT). A QDT is a type of trust that allows certain tax benefits for individuals with disabilities.

The form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust in Canada is filed by the trust itself.

FAQ

Q: What is Form T3QDT?

A: Form T3QDT is used to make a joint election for a trust to be considered a qualified disability trust in Canada.

Q: What is a qualified disability trust?

A: A qualified disability trust is a type of trust that may be eligible for certain tax benefits if it meets certain criteria related to supporting a beneficiary with a disability.

Q: Who should use Form T3QDT?

A: Trusts that wish to be classified as qualified disability trusts should use Form T3QDT to make a joint election with the beneficiary with a disability.

Q: What are the tax benefits of being a qualified disability trust?

A: Qualified disability trusts may be eligible for tax advantages such as the ability to claim the Disability Tax Credit, the ability to claim certain deductions and credits, and the ability to benefit from certain tax treatment on distributions to the beneficiary.