This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3A

for the current year.

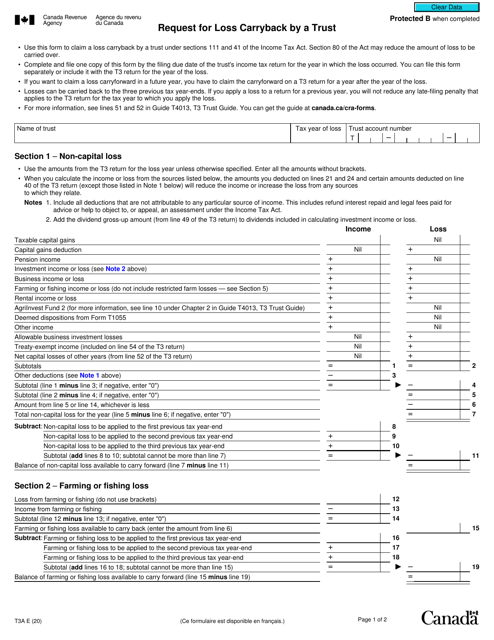

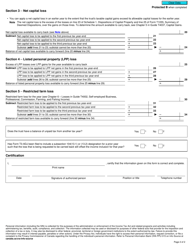

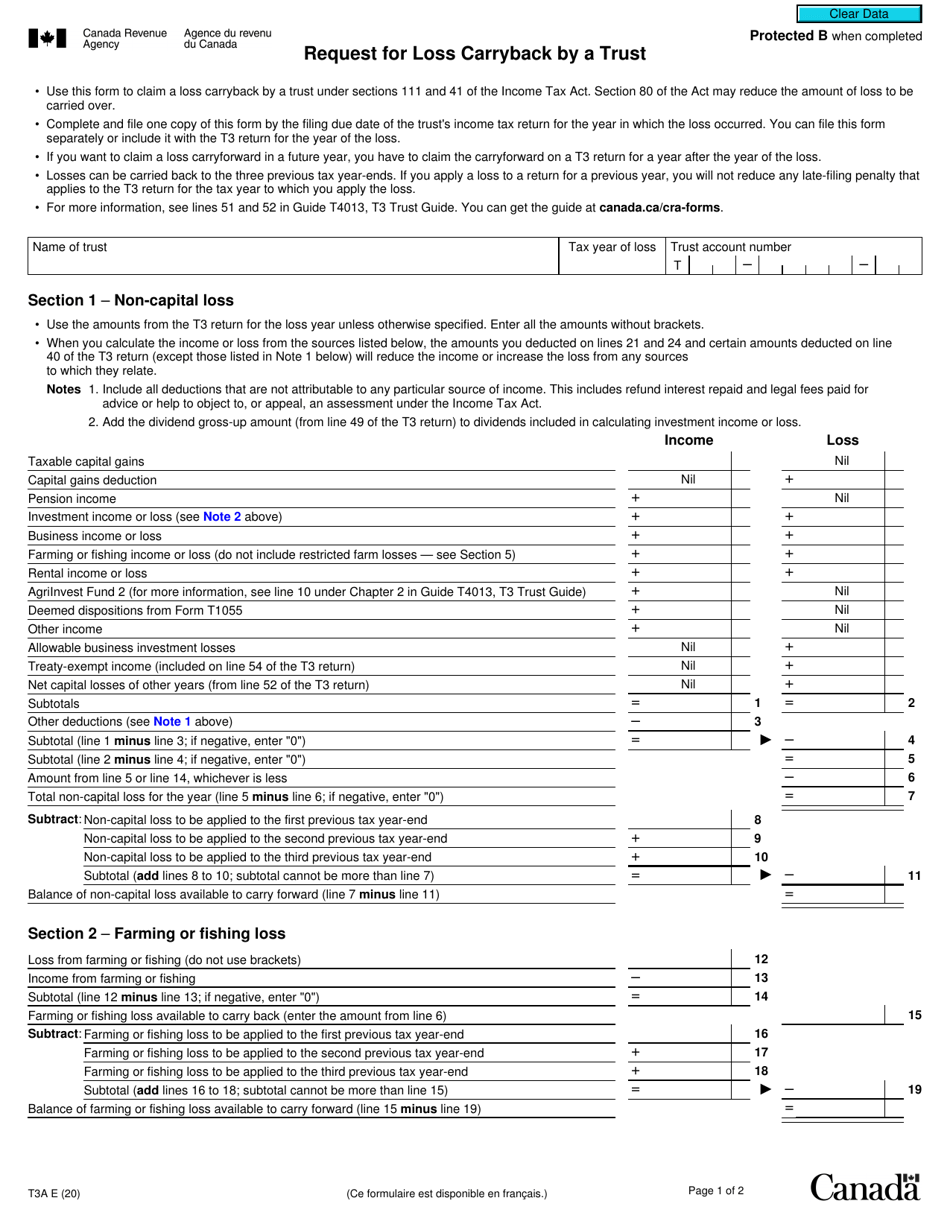

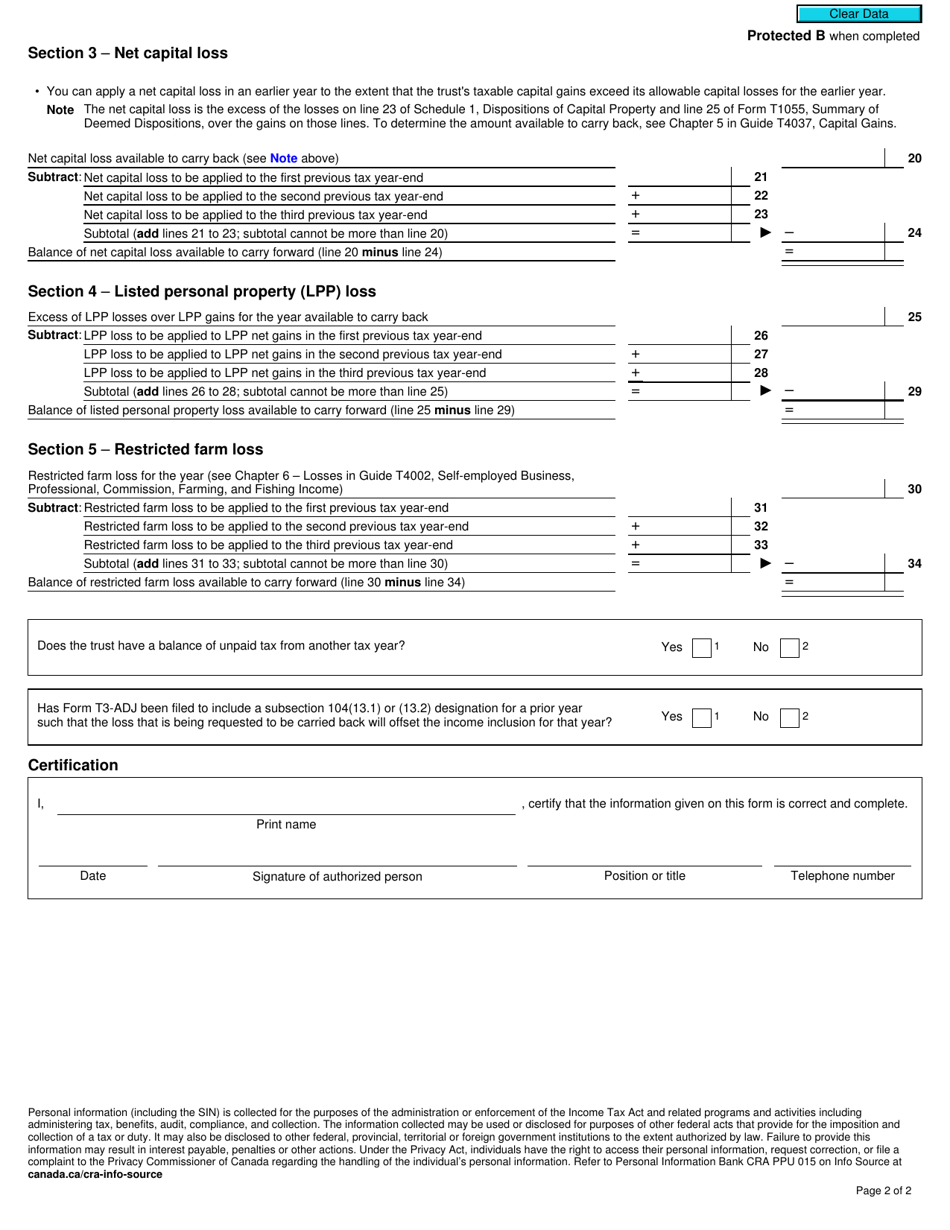

Form T3A Request for Loss Carryback by a Trust - Canada

Form T3A Request forLoss Carryback by a Trust - Canada is used by trusts in Canada to request the carryback of a loss from a future tax year to a prior tax year to reduce the amount of tax payable.

In Canada, the Form T3A - Request for Loss Carryback by a Trust is filed by trusts that have experienced a loss and wish to carry it back to a previous tax year to offset income.

FAQ

Q: What is Form T3A?

A: Form T3A is a request for loss carryback by a trust in Canada.

Q: Why would a trust use Form T3A?

A: A trust would use Form T3A to carry back losses from the current year to a previous year in order to reduce its tax liability.

Q: What information is required on Form T3A?

A: Form T3A requires information such as the trust's name, address, tax year information, details of the loss being carried back, and previous year tax calculations.

Q: Is there a deadline for filing Form T3A?

A: Yes, Form T3A must be filed within three years from the end of the tax year in which the loss occurred.

Q: Are there any fees associated with filing Form T3A?

A: No, there are no fees associated with filing Form T3A.

Q: What happens after filing Form T3A?

A: After filing Form T3A, the CRA will review the request and determine the amount of the loss that can be carried back.

Q: Is professional assistance necessary to complete Form T3A?

A: While professional assistance is not mandatory, it may be beneficial to consult with a tax professional or accountant to ensure the form is completed accurately.

Q: Can the CRA deny a request for loss carryback?

A: Yes, the CRA has the authority to deny a request for loss carryback if the information provided is incomplete or inaccurate.

Q: Can a trust carry forward losses instead of carrying them back?

A: Yes, if a trust is unable to use the loss carryback provision, it can choose to carry the losses forward to offset future income.