This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 141

for the current year.

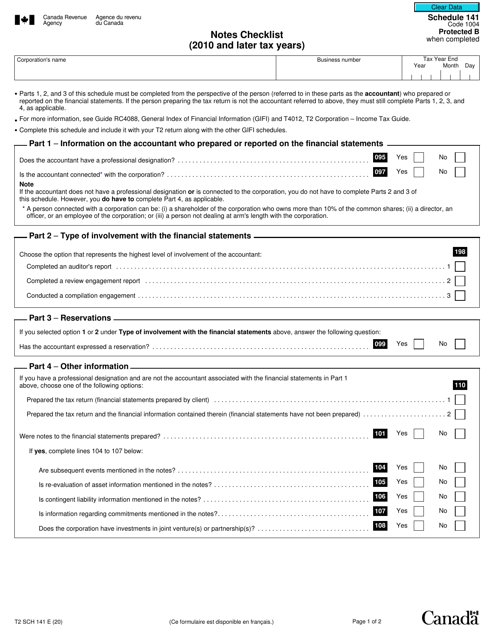

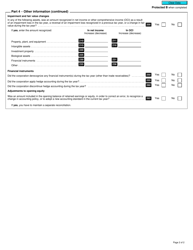

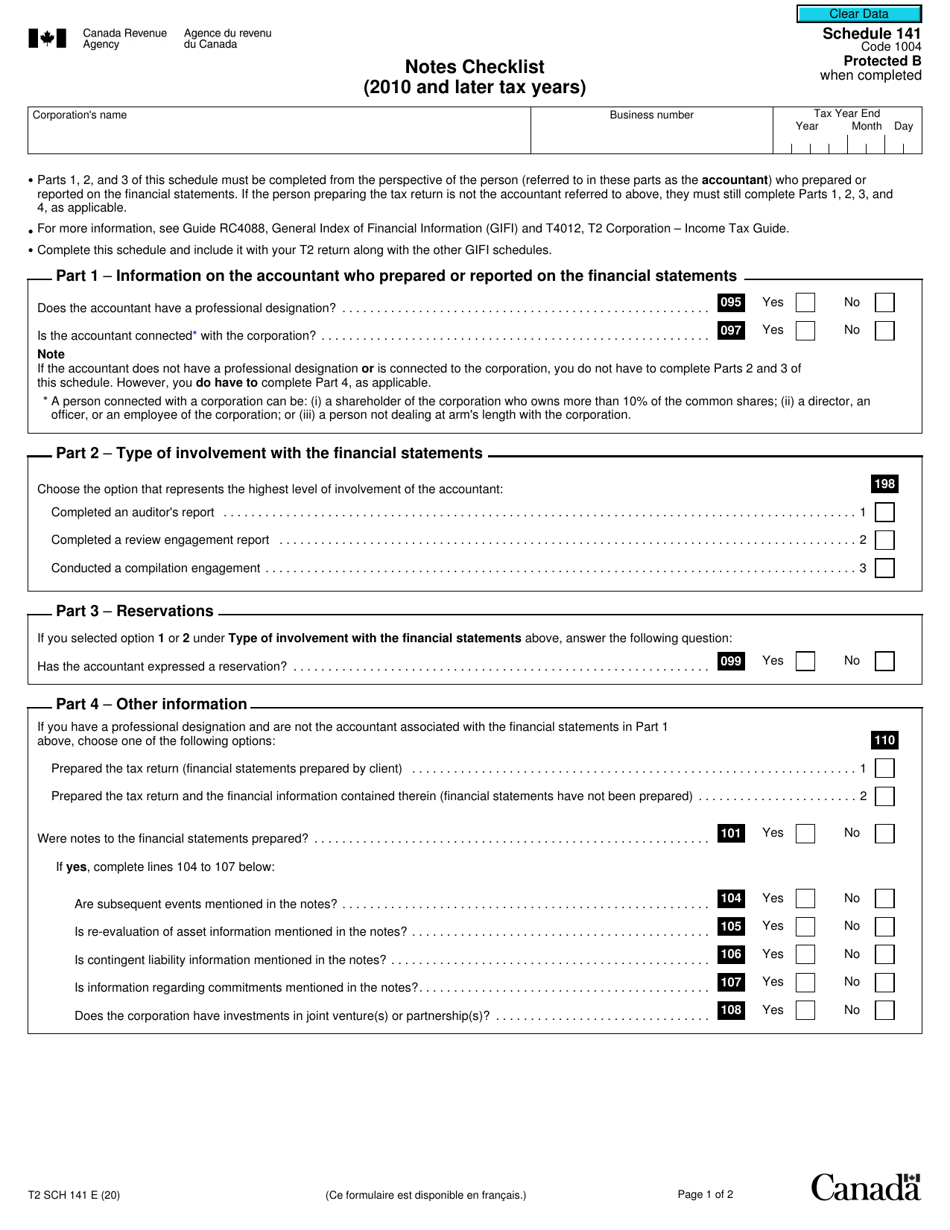

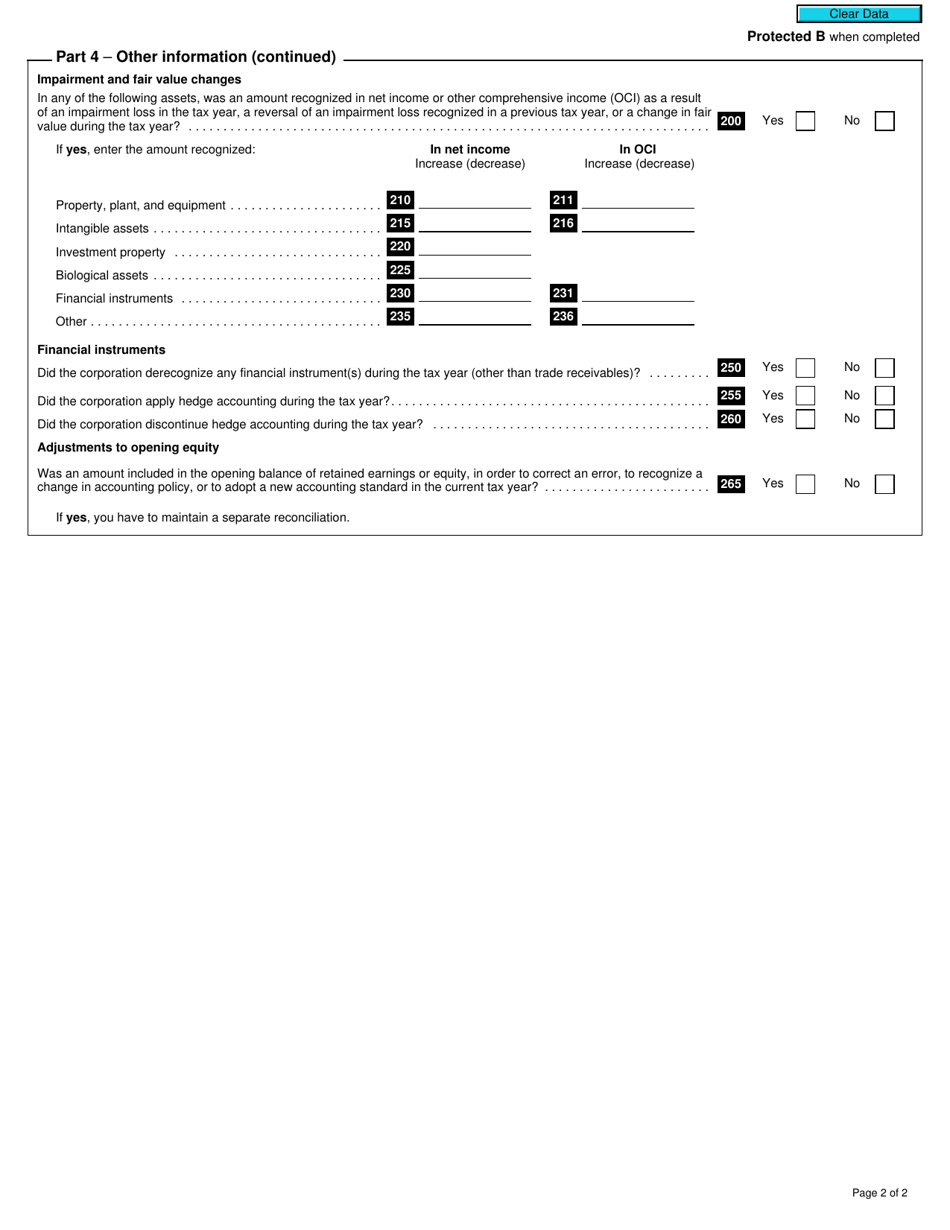

Form T2 Schedule 141 Notes Checklist - Canada

Form T2 Schedule 141 Notes Checklist is a document used in Canada for providing notes and explanations for specific items on the T2 Corporation Income Tax Return. It helps taxpayers and tax preparers ensure that all required notes and explanations are included with the tax return.

The Form T2 Schedule 141 Notes Checklist in Canada is typically filed by corporations and non-resident corporations.

FAQ

Q: What is Form T2 Schedule 141?

A: Form T2 Schedule 141 is a document used in Canada by corporations to provide information related to their foreign affiliates.

Q: What is the purpose of Form T2 Schedule 141?

A: The purpose of Form T2 Schedule 141 is to disclose certain details about a corporation's foreign affiliates, such as their names, countries of residence, and income.

Q: Who needs to fill out Form T2 Schedule 141?

A: Corporations in Canada that have foreign affiliates need to fill out Form T2 Schedule 141.

Q: What information is required on Form T2 Schedule 141?

A: Some of the information required on Form T2 Schedule 141 includes the name and country of residence of each foreign affiliate, and details about their income.

Q: Is there a deadline for filing Form T2 Schedule 141?

A: Yes, there is a deadline for filing Form T2 Schedule 141. The deadline is typically the same as the corporation's tax return filing deadline.

Q: What happens if I don't file Form T2 Schedule 141?

A: Failure to file Form T2 Schedule 141 or providing inaccurate information can result in penalties and interest charges.

Q: Are there any other related forms or schedules?

A: Yes, there are other related forms and schedules, depending on the specific circumstances of the corporation and its foreign affiliates. These may include Form T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates, and Schedule 41, Calculation of Foreign Accrual Property Income (FAPI).