This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2220

for the current year.

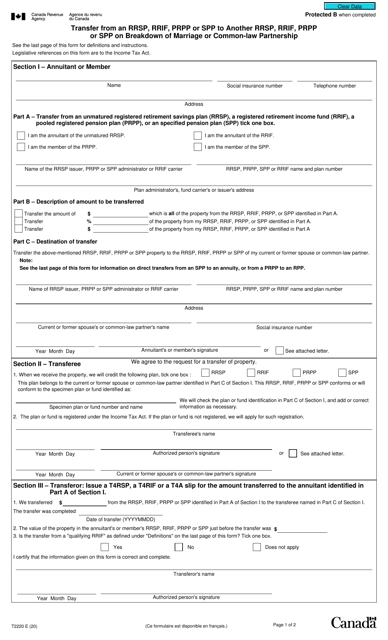

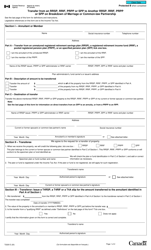

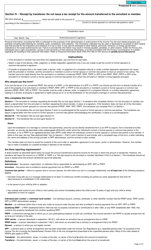

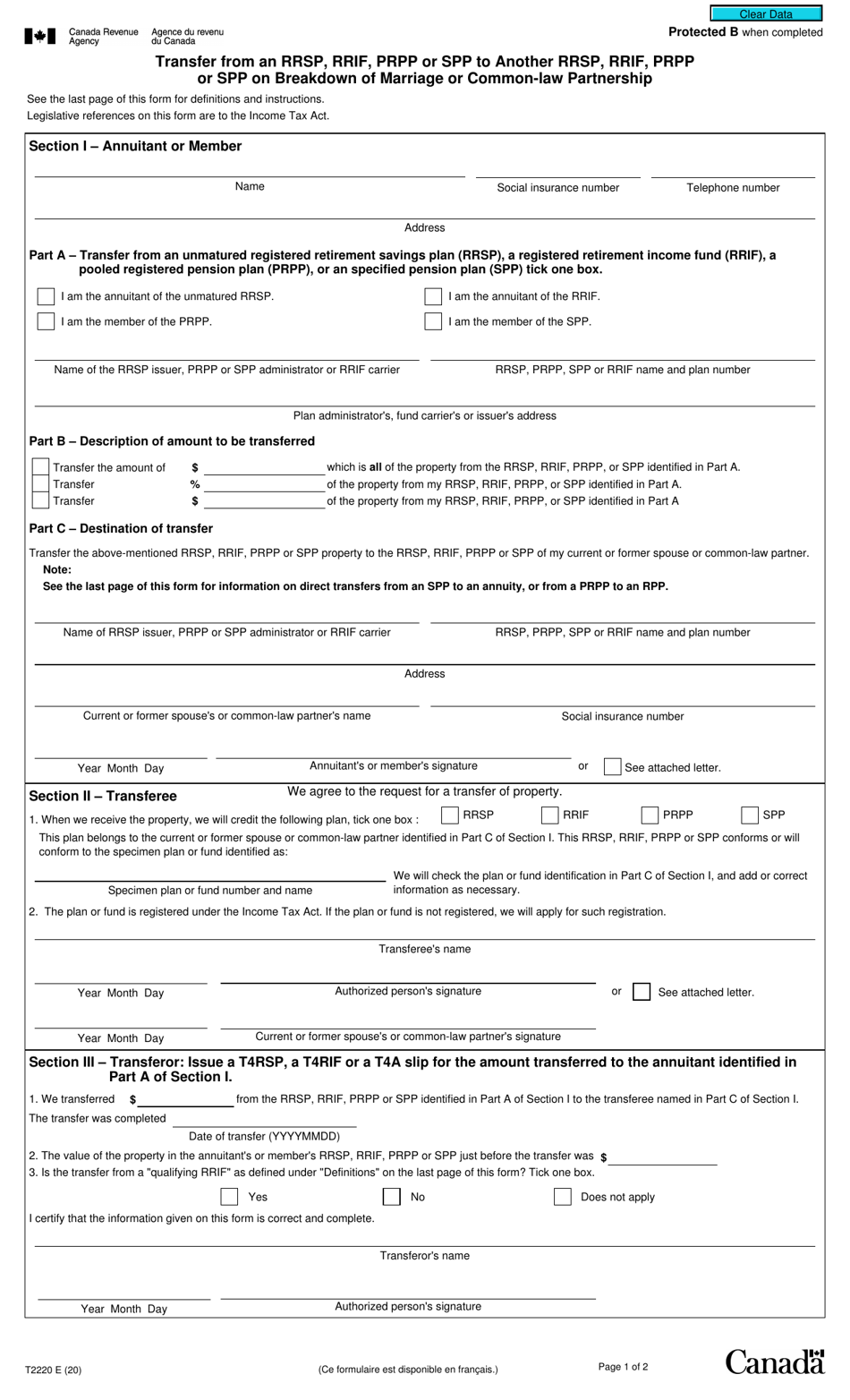

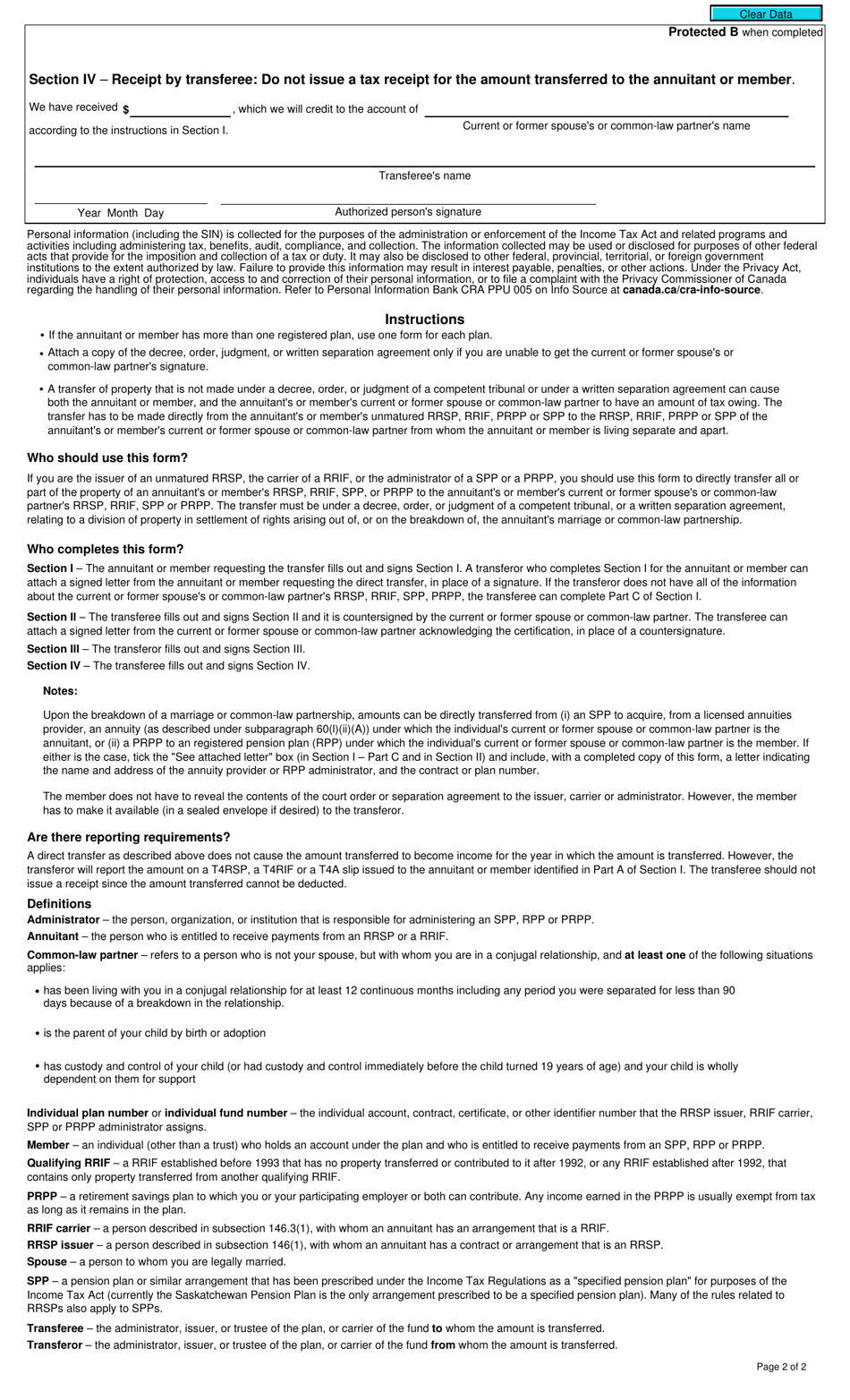

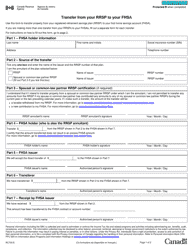

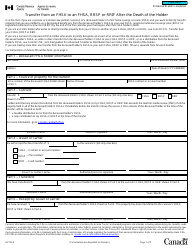

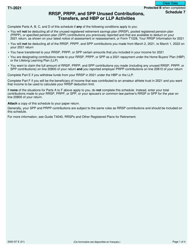

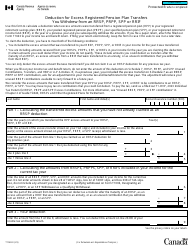

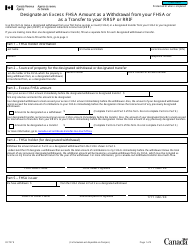

Form T2220 Transfer From an Rrsp, Rrif, Prpp or Spp to Another Rrsp, Rrif, Prpp or Spp on Breakdown of Marriage or Common-Law Partnership - Canada

Form T2220 Transfer From an RRSP, RRIF, PRPP or SPP to Another RRSP, RRIF, PRPP or SPP on Breakdown of Marriage or Common-Law Partnership in Canada is used to transfer funds from one registered retirement savings plan (RRSP), registered retirement income fund (RRIF), pooled registered pension plan (PRPP), or specified pension plan (SPP) to another following the breakdown of a marriage or common-law partnership. This form helps individuals resolve the financial aspects related to the separation or divorce.

In Canada, the individual who is transferring funds from one registered retirement savings plan (RRSP), registered retirement income fund (RRIF), pooled registered pension plan (PRPP), or specified pension plan (SPP) to another one due to a breakdown of marriage or common-law partnership would file the Form T2220.

FAQ

Q: What is Form T2220?

A: Form T2220 is a form used in Canada to transfer funds from an RRSP, RRIF, PRPP, or SPP to another RRSP, RRIF, PRPP, or SPP on the breakdown of marriage or common-law partnership.

Q: When is Form T2220 used?

A: Form T2220 is used when there is a breakdown of marriage or common-law partnership and funds need to be transferred from one registered retirement savings plan (RRSP), registered retirement income fund (RRIF), pooled registered pension plan (PRPP), or specified pension plan (SPP) to another.

Q: What is the purpose of transferring funds using Form T2220?

A: The purpose of transferring funds using Form T2220 is to allow individuals to move their retirement savings from one registered plan to another without incurring tax consequences.

Q: Who can use Form T2220?

A: Form T2220 can be used by individuals who are going through a breakdown of marriage or common-law partnership and need to transfer funds from their RRSP, RRIF, PRPP, or SPP to another registered plan.

Q: Are there any conditions or requirements for using Form T2220?

A: Yes, there are certain conditions and requirements that must be met in order to use Form T2220. These include providing information about the breakdown of marriage or common-law partnership, obtaining written consent from both parties involved, and ensuring that the receiving plan allows for the transfer of funds.